PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851222

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851222

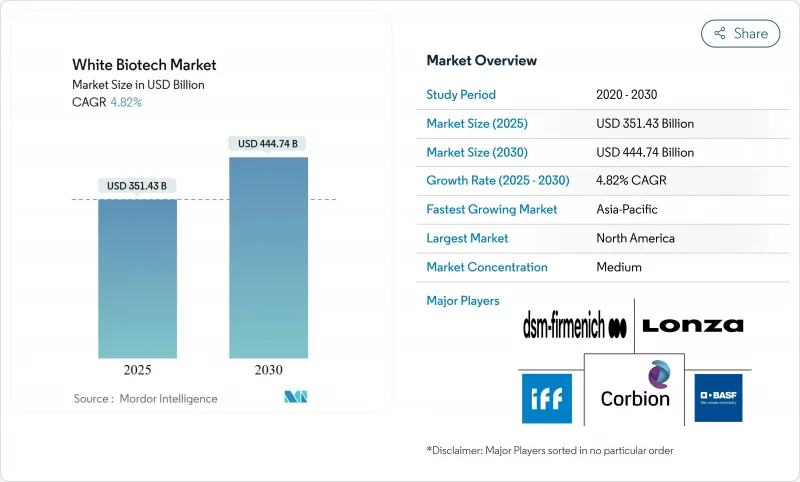

White Biotech - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The white biotech market size is expected to grow from USD 351.43 billion in 2025 to USD 444.74 billion by 2030, at a CAGR of 4.82%.

Industrial biotechnology serves as a key component in transitioning from fossil-based to bio-based manufacturing processes for chemicals, materials, and fuels production. This shift represents a significant advancement in sustainable manufacturing practices, as bio-based processes typically consume less energy, produce fewer emissions, and utilize renewable resources. The integration of white biotechnology across various industrial sectors demonstrates its potential to revolutionize traditional manufacturing methods while addressing environmental concerns.

Global White Biotech Market Trends and Insights

Increasing Demand for Sustainable Industrial Processes

The Biden Administration's comprehensive biomanufacturing targets for US chemical demand through sustainable processes have increased the adoption of bio-based manufacturing processes. Companies are implementing these processes not only for environmental compliance but also to mitigate risks from fossil fuel price volatility and supply chain uncertainties. The Defense Advanced Research Projects Agency (DARPA) Switch program combines artificial intelligence with synthetic biology to develop adaptable microorganisms, enabling flexible biomanufacturing that responds to changing market demands and raw material availability. This integration of advanced technologies with biological processes represents a significant shift in manufacturing approaches, offering enhanced production capabilities and improved resource utilization across multiple industrial sectors .

Supportive Regulatory Frameworks and Green Incentives

Regulatory harmonization across major markets is accelerating biotech commercialization. The EU Biotech Act and the coordinated U.S. regulatory framework from the EPA, FDA, and USDA establish streamlined approval processes, reducing investment uncertainty. The Horizon Europe program has allocated EUR 10 million in seed funding for scaling operations, while the UK has invested GBP 100 million across six engineering biology centers. In Asia-Pacific, China's approval of precision-fermented human milk oligosaccharides indicates increasing regional acceptance. The FDA's establishment of a specialized office within CBER aims to process 10-20 cell and gene therapy approvals annually by 2025, demonstrating expanded regulatory capacity for biotech innovations .

Limited Availability of Cost-Effective Feedstocks

Regional differences in lignocellulosic biomass availability and fluctuating agricultural commodity prices limit consistent industry expansion across global markets. Brazil has significant sugarcane bagasse resources available for processing, while European manufacturers continue to face intense competition for feedstock from both the energy and paper industries. The adoption of circular feedstock approaches, including agricultural residues and municipal organic waste, is steadily increasing across regions. However, substantial logistics and pre-treatment costs reduce profit margins throughout the supply chain, impacting the white biotechnology industry's near-term growth potential in established and emerging markets.

Other drivers and restraints analyzed in the detailed report include:

- Advancements in Synthetic Biology and Metabolic Engineering

- Growing Adoption of Biofuels and Bioplastics

- Lack of Infrastructure for Large-Scale Fermentation in Emerging Markets

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Industrial enzymes hold a 38.13% market share in 2024, with applications spanning food processing, textiles, and biofuel production. The biofuels segment is growing at a 5.97% CAGR through 2030. The enzyme segment continues to advance through innovations such as Novozymes' Fortiva(R) Hemi liquefaction enzyme, which improves corn oil and ethanol yields to address the current 40-50% recovery rate limitation in ethanol plants.

The biofuels segment expansion is supported by enzyme discoveries and regulatory frameworks. Brazil's CelOCE enzyme development shows potential to double cellulose conversion efficiency, while India's ethanol production capabilities contribute to regional market growth . The implementation of advanced biofuel technologies, including precision fermentation and gasification processes, enables commercial-scale production from non-food biomass. These developments address sustainability requirements while meeting aviation industry requirements for sustainable fuel adoption .

The White Biotechnology Market Report is Segmented by Type (Biofuels, Biomaterials, Biochemicals, and Industrial Enzymes), Application (Bioenergy, Pharmaceuticals, Food and Beverages, Animal Feed, and Other Applications), and Geography (North America, Europe, Asia-Pacific, South America, and Middle East and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America held 39.88% of global sales in 2024, supported by an established network of pharmaceutical companies, contract manufacturers, and university spinoffs. Canada's precision-fermentation facilities and Mexico's fill-finish operations complete the regional value chain, though fermentation capacity remains limited compared to Europe. The venture capital ecosystems and intellectual property frameworks in the U.S. and Canada support continuous innovation in biomanufacturing. The increasing federal incentives for biomanufacturing aim to enhance domestic production capabilities and decrease import dependence.

Asia-Pacific is experiencing rapid growth at a 6.32% CAGR through 2030. The U.S. BioSecure Act's restrictions on Chinese suppliers have shifted Western outsourcing to Indian Contract Development and Manufacturing Organizations (CDMOs), increasing investment across South Asia. However, variations in regulatory review timelines may favor project placement in North American and European markets. Growing consumer awareness of sustainable products drives demand, creating opportunities across various Asian markets.

South America benefits from Brazil's sugarcane ethanol production and emerging enzyme discoveries. The Middle East and Africa are attracting initial projects through special economic zone incentives. These regional developments continue to shape the white biotechnology market landscape. The Middle East and African countries are offering incentives through special economic zones to attract biotechnology projects. The United Arab Emirates and Saudi Arabia are incorporating white biotechnology into their economic diversification strategies to decrease their reliance on oil revenues.

- Lonza Group Ltd

- International Flavors & Fragrances Inc.

- Corbion NV

- DSM-Firmenich AG

- BASF SE

- Evonik Industries AG

- Laurus Labs

- BioSynth (EUCODIS Bioscience GmbH)

- Novozymes A/S

- Archer-Daniels-Midland Company

- Cargill, Incorporated

- Danimer Scientific

- Shree Renuka Sugars Limited

- Cosan SA

- Chevron (The Renewable Energy Group )

- Henan Alfa Chemical Co., Ltd.

- Amano Enzyme Inc

- Advanced Enzyme Technologies Ltd.

- Lesaffre

- K-Genix Group ( Lumis Biotech pvt ltd)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing Demand for Sustainable Industrial Processes

- 4.2.2 Supportive Regulatory Frameworks and Green Incentives

- 4.2.3 Advancements in Synthetic Biology and Metabolic Engineering

- 4.2.4 Growing Adoption of Biofuels and Bioplastics

- 4.2.5 Expanding Applications of Industrial Enzymes in Food and Beverage

- 4.2.6 Rising Consumer Preference for Bio-Based and Natural Products

- 4.3 Market Restraints

- 4.3.1 Limited availability of cost-effective feedstocks

- 4.3.2 Lack of infrastructure for large-scale fermentation in emerging markets

- 4.3.3 High capital investment and infrastructure requirements

- 4.3.4 Complexity in scaling up bioprocesses

- 4.4 Supply Chain Analysis

- 4.5 Regulatory Outlook

- 4.6 Porters Five Forces

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Type

- 5.1.1 Biofuels

- 5.1.2 Biomaterials

- 5.1.3 Biochemicals

- 5.1.4 Industrial Enzymes

- 5.2 By Application

- 5.2.1 Bioenergy

- 5.2.2 Pharmaceuticals

- 5.2.3 Food and Beverages

- 5.2.4 Animal Feed

- 5.2.5 Other Applications

- 5.3 By Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.1.4 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 France

- 5.3.2.3 United Kingdom

- 5.3.2.4 Spain

- 5.3.2.5 Netherlands

- 5.3.2.6 Italy

- 5.3.2.7 Sweden

- 5.3.2.8 Poland

- 5.3.2.9 Belgium

- 5.3.2.10 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 India

- 5.3.3.3 Japan

- 5.3.3.4 Australia

- 5.3.3.5 South Korea

- 5.3.3.6 Indonesia

- 5.3.3.7 Thailand

- 5.3.3.8 Singapore

- 5.3.3.9 Rest of Asia-Pacific

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Chile

- 5.3.4.4 Colombia

- 5.3.4.5 Peru

- 5.3.4.6 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 United Arab Emirates

- 5.3.5.2 South Africa

- 5.3.5.3 Nigeria

- 5.3.5.4 Saudi Arabia

- 5.3.5.5 Egypt

- 5.3.5.6 Morocco

- 5.3.5.7 Turkey

- 5.3.5.8 Rest of Middle Eastand Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Ranking Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials (if available), Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Lonza Group Ltd

- 6.4.2 International Flavors & Fragrances Inc.

- 6.4.3 Corbion NV

- 6.4.4 DSM-Firmenich AG

- 6.4.5 BASF SE

- 6.4.6 Evonik Industries AG

- 6.4.7 Laurus Labs

- 6.4.8 BioSynth (EUCODIS Bioscience GmbH)

- 6.4.9 Novozymes A/S

- 6.4.10 Archer-Daniels-Midland Company

- 6.4.11 Cargill, Incorporated

- 6.4.12 Danimer Scientific

- 6.4.13 Shree Renuka Sugars Limited

- 6.4.14 Cosan SA

- 6.4.15 Chevron (The Renewable Energy Group )

- 6.4.16 Henan Alfa Chemical Co., Ltd.

- 6.4.17 Amano Enzyme Inc

- 6.4.18 Advanced Enzyme Technologies Ltd.

- 6.4.19 Lesaffre

- 6.4.20 K-Genix Group ( Lumis Biotech pvt ltd)

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK