PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906865

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906865

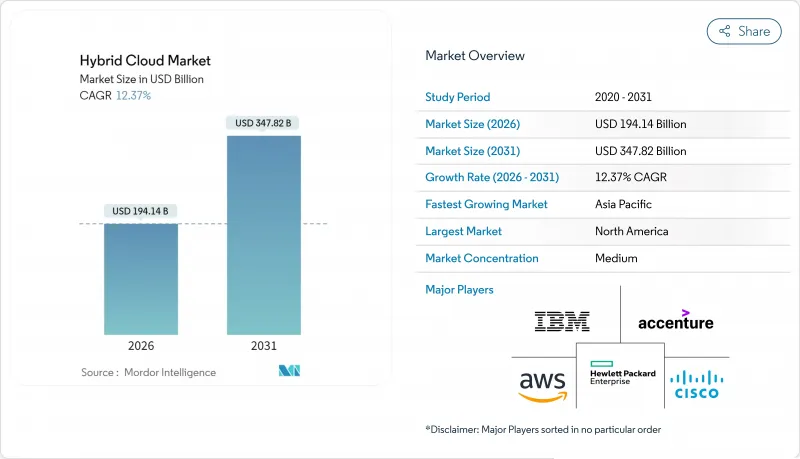

Hybrid Cloud - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The hybrid cloud market was valued at USD 172.77 billion in 2025 and estimated to grow from USD 194.14 billion in 2026 to reach USD 347.82 billion by 2031, at a CAGR of 12.37% during the forecast period (2026-2031).

Enterprises are steering toward distributed architectures that balance operational control with cloud-native speed, especially as generative-AI workloads require tight linkage between edge and centralized compute resources. Growing sovereignty rules, multicloud preferences, and maturing container orchestration frameworks spur demand for hybrid deployment models. Edge computing investments shorten latency for AI inference while retaining on-premises data for compliance. Large data-center operators are aligning infrastructure projects with corporate decarbonization targets, adding sustainability as a procurement criterion. Strategic acquisitions by hyperscalers and specialized edge providers intensify competitive differentiation across the hybrid cloud market.

Global Hybrid Cloud Market Trends and Insights

Surge in Multicloud Adoption Among Large Enterprises

Hybrid environments now underpin deliberate multicloud strategies, with 87% of enterprises operating workloads across more than one provider.Platform teams standardize tooling to curb redundant spend and improve governance consistency. Financial-operations practices are embedded at design stages to cut waste in the hybrid cloud market. Vendors respond by offering unified billing dashboards that map usage to cost centers. As multicloud maturity rises, seamless workload portability becomes a core purchase criterion for the hybrid cloud market.

Rising Demand for Data-Sovereign Architectures

Strict privacy regimes reshuffle workload placement decisions, particularly in Europe where 84% of organizations either use or plan sovereign cloud solutions within 12 months.Australia and parts of Asia adopt similar rules, pressing providers to launch region-specific control planes. Specialized sovereign offerings promise residency, key management, and local operator staffing. Hyperscalers now integrate confidential computing and dedicated EU support models to retain share in the hybrid cloud market. Compliance complexity therefore fuels demand for architecture designs that keep sensitive data in jurisdiction while leveraging global scale for less regulated workloads.

Migration Complexity and Legacy Integration Costs

Modernization projects often reveal undocumented dependencies that inflate timelines and budgets. Large banks report significant overruns when refactoring core payment systems for hybrid environments. Seventy-three percent of enterprises now refactor rather than lift-and-shift, extending schedules yet delivering better resilience. Continuous integration pipelines and API gateways partly mitigate the hurdle, but technical debt remains a near-term drag on the hybrid cloud market.

Other drivers and restraints analyzed in the detailed report include:

- GenAI Workload Acceleration Needs Cloud-Edge Proximity

- Green Datacenter Mandates Push Hybrid Repatriation

- Skills Shortage in Cloud-Native Security and FinOps

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Services revenue is forecast to rise at 14.68% CAGR through 2031, even though solutions retained 64.80% hybrid cloud market share in 2025. The higher growth stems from enterprises requesting expert guidance for multicloud orchestration, sovereignty mapping, and AI stack tuning. Rackspace and AWS launched Rapid Migration Offer programs that bundle tooling with professional services to shorten cut-over durations.

Demand for managed FinOps, container security, and platform operations pushes providers to expand service lines. Nutanix introduced an Enterprise AI platform that blends software with consulting to offset skills shortages. These trends suggest the services segment will account for a larger slice of hybrid cloud market size as organizations outsource complexity.

IaaS is projected to grow at 13.62% CAGR during 2026-2031, while SaaS keeps 54.10% share thanks to entrenched enterprise suites. Generative-AI training needs GPU-rich clusters that customers often build on IaaS for custom tuning. Oracle extended its distributed cloud line with Roving Edge devices that place compute in austere locations, underscoring the versatility of IaaS.

Platform-as-a-Service occupies a strategic bridge, offering abstraction yet permitting custom runtimes. Snowflake linked its platform with Azure OpenAI Service to simplify model usage for analytics developers. The convergence of AI and development workflows will keep all three models interlinked within the hybrid cloud market.

Hybrid Cloud Market is Segmented by Component (Solutions, Services), Service Model (IaaS, Paas, Saas), Organization Size (Large Enterprises, Smes), End-User Industry (Government and Public Sector, Healthcare and Life Sciences, BFSI, and More) and by Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America captured 25.30% revenue share in 2025 and benefits from dense hyperscaler footprints that simplify multicloud adoption. TP ICAP plans to shift 80% of systems to AWS by 2026 while creating AI labs for capital-markets innovation. Federal privacy rules remain manageable, allowing firms to optimize workload placement freely across the hybrid cloud market.

Asia-Pacific exhibits the steepest 12.89% CAGR through 2031, driven by capacity additions and rising digital-service demand. Microsoft pledged USD 2.9 billion for new AI and cloud zones in Japan to address growing inference requirements. China's providers pursue overseas expansion as domestic growth moderates. Regional data-center capacity now totals 12,206 MW in operation with 14,338 MW under build, underpinning future hybrid cloud market growth.

Europe advances at a steady clip as 84% of firms either deploy or plan sovereign cloud framework adoption. Microsoft rolled out a layered sovereignty solution spanning logical isolation, local key control, and EU-native support teams. Stricter data-localization laws in Russia and Saudi Arabia add complexity but also create opportunities for regional specialists. Emerging markets across MEA and South America accelerate investment as submarine cable routes and renewable energy projects reduce barriers, expanding the hybrid cloud market.

- Amazon Web Services Inc.

- Microsoft Corporation

- Google LLC

- IBM Corporation

- Cisco Systems Inc.

- Hewlett Packard Enterprise Company

- VMware Inc.

- Oracle Corporation

- Alibaba Cloud

- Dell Technologies Inc.

- Rackspace Technology Inc.

- Accenture PLC

- Equinix Inc.

- Fujitsu Ltd.

- NTT Communications Corporation

- DXC Technology Company

- Lumen Technologies Inc.

- Panzura Inc.

- Flexera Software LLC

- Intel Corporation

- Nutanix Inc.

- Red Hat (IBM)

- NetApp Inc.

- Citrix Systems (Cloud Software Group)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Surge in multicloud adoption among large enterprises

- 4.2.2 Rising demand for data-sovereign architectures

- 4.2.3 GenAI workload acceleration needs cloud-edge proximity

- 4.2.4 Edge-native container orchestration frameworks mature

- 4.2.5 Rising enterprise focus on cost optimization and FinOps capabilities

- 4.2.6 Green datacenter mandates push hybrid repatriation

- 4.3 Market Restraints

- 4.3.1 Migration complexity and legacy integration costs

- 4.3.2 Skills shortage in cloud-native security and FinOps

- 4.3.3 Hidden egress-fee economics limit workload portability

- 4.3.4 Geo-political data localization rules fragment architectures

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Assesment of Macroeconomic Factors on the market

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Component

- 5.1.1 Solutions

- 5.1.2 Services

- 5.2 By Service Model

- 5.2.1 Infrastructure as a Service (IaaS)

- 5.2.2 Platform as a Service (PaaS)

- 5.2.3 Software as a Service (SaaS)

- 5.3 By Organization Size

- 5.3.1 Large Enterprises

- 5.3.2 Small and Medium Enterprises (SMEs)

- 5.4 By End-user Industry

- 5.4.1 Government and Public Sector

- 5.4.2 Healthcare and Life Sciences

- 5.4.3 Banking, Financial Services and Insurance (BFSI)

- 5.4.4 Retail and E-Commerce

- 5.4.5 Information and Communication Technology and Telecom

- 5.4.6 Manufacturing

- 5.4.7 Media and Entertainment

- 5.4.8 Others

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 United Kingdom

- 5.5.3.2 Germany

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 Japan

- 5.5.4.3 South Korea

- 5.5.4.4 India

- 5.5.4.5 Australia

- 5.5.4.6 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 Saudi Arabia

- 5.5.5.1.2 United Arab Emirates

- 5.5.5.1.3 Turkey

- 5.5.5.1.4 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Nigeria

- 5.5.5.2.3 Egypt

- 5.5.5.2.4 Rest of Africa

- 5.5.5.1 Middle East

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Amazon Web Services Inc.

- 6.4.2 Microsoft Corporation

- 6.4.3 Google LLC

- 6.4.4 IBM Corporation

- 6.4.5 Cisco Systems Inc.

- 6.4.6 Hewlett Packard Enterprise Company

- 6.4.7 VMware Inc.

- 6.4.8 Oracle Corporation

- 6.4.9 Alibaba Cloud

- 6.4.10 Dell Technologies Inc.

- 6.4.11 Rackspace Technology Inc.

- 6.4.12 Accenture PLC

- 6.4.13 Equinix Inc.

- 6.4.14 Fujitsu Ltd.

- 6.4.15 NTT Communications Corporation

- 6.4.16 DXC Technology Company

- 6.4.17 Lumen Technologies Inc.

- 6.4.18 Panzura Inc.

- 6.4.19 Flexera Software LLC

- 6.4.20 Intel Corporation

- 6.4.21 Nutanix Inc.

- 6.4.22 Red Hat (IBM)

- 6.4.23 NetApp Inc.

- 6.4.24 Citrix Systems (Cloud Software Group)

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment