PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851226

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851226

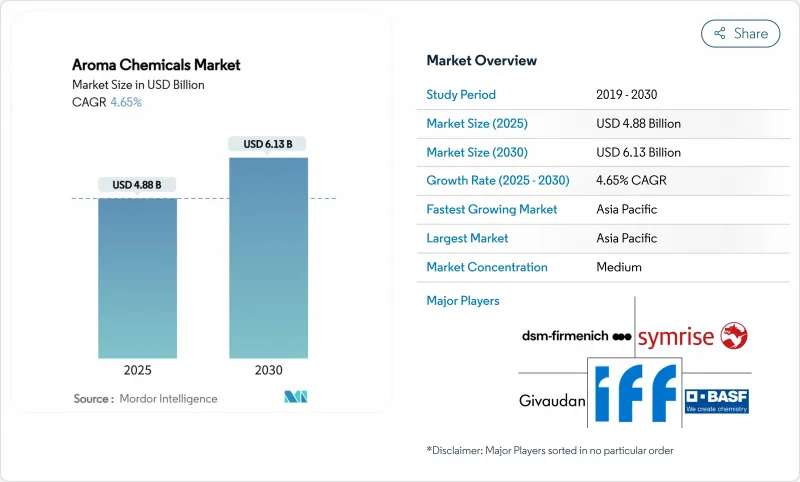

Aroma Chemicals - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Aroma Chemicals Market size is estimated at USD 4.88 billion in 2025, and is expected to reach USD 6.13 billion by 2030, at a CAGR of 4.65% during the forecast period (2025-2030).

Tightening safety regulations and the rapid commercialization of fermentation-based production methods are reshaping cost structures while answering the consumer push for sustainable, nature-identical ingredients. Terpenes keep their lead because microbial platforms can now deliver limonene, santalene, and related molecules at a competitive scale, anchoring 38.40% of 2024 revenue. Musk chemicals, buoyed by fourth-generation alicyclic variants, post the fastest trajectory at 5.05% CAGR as perfumers seek high-performance and readily biodegradable fixatives. On the demand side, cosmetics and toiletries absorb 34.56% of global volumes, while fine fragrances grow the quickest at 5.23% CAGR owing to premiumization and niche-brand proliferation. Asia Pacific captures the largest regional slice at 38.95% and advances at 5.76% CAGR, helped by China's double-digit fragrance uptake and India's specialty-chemicals investments.

Global Aroma Chemicals Market Trends and Insights

Rising Demand from Fine-Fragrance Formulators

Premium fragrance houses are raising performance specifications, prompting a shift from commodity notes to complex molecules that deliver long-lasting sillage and distinctive olfactory signatures. Compounds such as Helvetolide and Romandolide underpin this evolution by combining strong blooming properties with improved biodegradability. As luxury brands widen bespoke collections, formulators require differentiated musks and specialty aldehydes, amplifying order volumes per launch. Suppliers able to co-create accords through rapid prototyping hold a competitive edge, further stimulating the aroma chemicals market.

Rapid Growth of Natural & Clean-Label Personal-Care Brands

Seventy percent of Swedish consumers actively look for ecolabels when purchasing cosmetics, signaling a broader appetite for transparency. Brands respond by reformulating toward fermentation-derived terpenes and bio-vanillin, reducing reliance on petro-based inputs. L'Oreal's pledge to secure 95% sustainable ingredients by 2030 epitomizes corporate commitments that are cascading throughout supplier networks. The result is brisk procurement of certified-natural aroma molecules, bolstering long-term demand.

Volatile Petrochemical Feedstock Prices

Rapid swings in naphtha and natural-gas liquids prices compress margins for producers dependent on petro baselines. Firms lacking dual-feedstock flexibility face squeezed spreads and unplanned downtime, heightening short-term cost variability. Scale operators cushion volatility through strategic hedging and balanced cracker configurations, yet sustained turbulence nudges buyers toward bio-based alternatives, marginally trimming the aroma chemicals market CAGR.

Other drivers and restraints analyzed in the detailed report include:

- Expansion of Multifunctional Home-Care Product Lines

- Biotechnological Production Lowering Unit Costs

- Tightened Allergen-Labeling Rules in Europe & North America

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Terpenes accounted for a 38.40% aroma chemicals market share in 2024, translating into the single largest contributor to revenue. Producers capitalize on fermentation routes that convert sugars into limonene, santalene, and related frameworks, cutting extraction losses and stabilizing supply. The aroma chemicals market size for terpenes is projected to widen steadily alongside cost declines and the broad applicability of these backbones across fine fragrance, cosmetics, and household care. Musk chemicals remain the fastest-growing cohort, advancing at 5.05% CAGR through 2030 as alicyclic innovations deliver low-bioaccumulation profiles desirable under new safety regimes. Benzenoids and specialty aldehydes maintain relevance for their structural roles in sophisticated accords, even though their growth tempo is less pronounced.

Second-tier types such as specialty ketones cater to niche effects like metallic freshness or marine nuances. Their premium positioning protects average selling prices, helping suppliers diversify margin mix. The technological race is concentrated on route efficiency: enzymatic cascades coupled with solvent-free isolation lower energy draws and reinforce environmental credentials. Such advances ensure terpenes retain primacy, while leaving white-space pockets for agile producers willing to scale novel molecules.

The Aroma Chemicals Report is Segmented by Type (Terpenes, Benzenoids, Musk Chemicals, Other Types), Application (Soaps and Detergents, Cosmetics and Toiletries, Fine Fragrances, Household Products, Food and Beverage, Other Applications), and Geography (Asia Pacific, North America, Europe, South America, Middle East and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia Pacific's 38.95% revenue grip in 2024 positions the region as both the largest consumer and the primary production hub for the aroma chemicals market. Rising disposable incomes in China, Indonesia, and Vietnam nurture fragrance adoption that remains well below Western saturation, leaving sizeable headroom. Governments support bio-manufacturing parks, lowering entry barriers for fermentation-driven start-ups. These forces underpin the forecast 5.76% regional CAGR to 2030.

North America leverages advantaged ethane feedstock and deep R&D ecosystems. Producers concentrate on high-purity specialties and controlled-release systems, serving premium segments that demand tight specification control. Regulatory clarity under MOCRA drives proactive portfolio audits, ensuring steady but measured expansion. Europe continues to exert regulatory leadership, with stringent allergen thresholds shaping global formulation norms. Premium luxury brand clusters in France and Italy secure demand for captive aroma ingredients, offsetting relative market maturity.

Latin America benefits from urbanization and premiumization trends in Brazil and Mexico, though currency fluctuations occasionally temper import appetite. The Middle East & Africa see gradual uptake, with the Gulf Cooperation Council advancing fragrance-focused retail and local contract manufacturing. Although these two regions contribute a relatively small share of global sales, investors focus on them for long-term diversification, recognizing the growing middle class and retail channels linked to tourism. Overall, regional dynamics sustain growth breadth, moderating exposure to single-market shocks.

- BASF SE

- Bedoukian Research Inc.

- Bell Flavors & Fragrances

- DSM-Firmenich (Nutritional aroma ingredients)

- Eternis Fine Chemicals

- Firmenich International SA

- Givaudan SA

- Hindustan Mint & Agro Products

- International Flavors & Fragrances (IFF)

- Kalpsutra Chemicals Pvt Ltd

- Kao Corporation

- Robertet Group

- Silverline Chemicals

- Solvay SA

- Symrise AG

- Takasago International Corporation

- Treatt Plc

- Zhejiang NHU Co. Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising demand from fine-fragrance formulators

- 4.2.2 Rapid growth of natural and "clean-label" personal-care brands

- 4.2.3 Expansion of multifunctional home-care product lines

- 4.2.4 Biotechnological production lowering unit costs

- 4.2.5 Growing adoption of aroma chemicals in functional foods and beverages

- 4.3 Market Restraints

- 4.3.1 Volatile petrochemical feedstock prices

- 4.3.2 Tightened allergen-labeling rules in Europe and North America

- 4.3.3 Supply-chain risk for natural precursors

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

5 Market Size and Growth Forecasts (Value)

- 5.1 By Type

- 5.1.1 Terpenes

- 5.1.2 Benzenoids

- 5.1.3 Musk Chemicals

- 5.1.4 Other Types

- 5.2 By Application

- 5.2.1 Soaps and Detergents

- 5.2.2 Cosmetics and Toiletries

- 5.2.3 Fine Fragrances

- 5.2.4 Household Products (Air-care, Surface-care)

- 5.2.5 Food and Beverage

- 5.2.6 Other Applications

- 5.3 By Geography

- 5.3.1 Asia Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 ASEAN Countries

- 5.3.1.6 Australia and New Zealand

- 5.3.1.7 Rest of Asia Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Spain

- 5.3.3.6 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 GCC

- 5.3.5.2 Turkey

- 5.3.5.3 South Africa

- 5.3.5.4 Rest of Middle East and Africa

- 5.3.1 Asia Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 BASF SE

- 6.4.2 Bedoukian Research Inc.

- 6.4.3 Bell Flavors & Fragrances

- 6.4.4 DSM-Firmenich (Nutritional aroma ingredients)

- 6.4.5 Eternis Fine Chemicals

- 6.4.6 Firmenich International SA

- 6.4.7 Givaudan SA

- 6.4.8 Hindustan Mint & Agro Products

- 6.4.9 International Flavors & Fragrances (IFF)

- 6.4.10 Kalpsutra Chemicals Pvt Ltd

- 6.4.11 Kao Corporation

- 6.4.12 Robertet Group

- 6.4.13 Silverline Chemicals

- 6.4.14 Solvay SA

- 6.4.15 Symrise AG

- 6.4.16 Takasago International Corporation

- 6.4.17 Treatt Plc

- 6.4.18 Zhejiang NHU Co. Ltd.

7 Market Opportunities and Future Outlook

- 7.1 White-Space and Unmet-Need Assessment

- 7.2 Technological Advancement in Aroma Chemicals Industry