PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851228

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851228

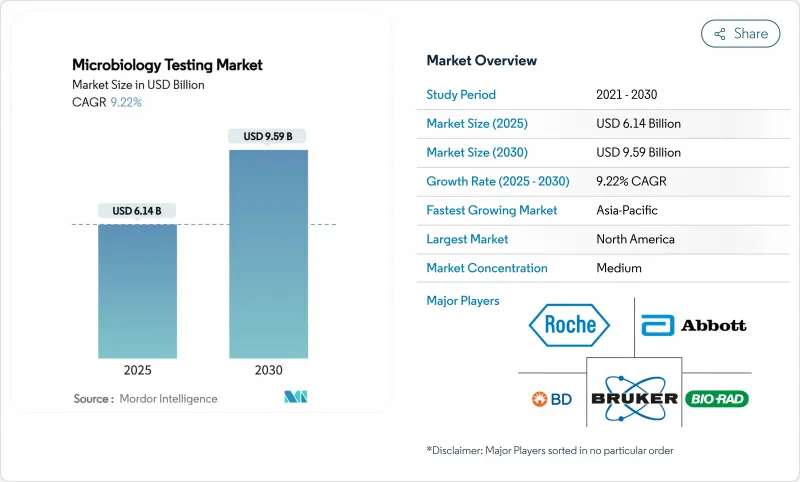

Microbiology Testing - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The microbiology testing market size reached USD 6.14 billion in 2025 and is forecast to register a CAGR of 9.22%, lifting revenue to USD 9.59 billion by 2030.

Clinical demand for faster pathogen identification, the spread of antimicrobial resistance, and accelerating laboratory automation are the strongest growth catalysts. Governments have tightened regulatory oversight of pharmaceutical, food, and personal-care supply chains, which raises the frequency and scope of routine microbial quality control. At the same time, AI-enabled mass-spectrometry and molecular platforms shorten turnaround times, allowing hospitals to start targeted therapy within hours instead of days. Laboratories facing double-digit vacancy rates view total laboratory automation as the most practical remedy for chronic staffing shortages. Manufacturers that can combine rapid diagnostics with connectivity, analytics, and remote-support features will capture a disproportionate share of future tenders in the microbiology testing market.

Global Microbiology Testing Market Trends and Insights

Advancements in Diagnostic Technologies and Automation

Laboratory automation reshapes microbiology workflows by pairing robotics with AI-guided imaging systems that cut plating and reading times by around 40%, a clear benefit when vacancy rates in clinical labs hover near 25%. Mass-spectrometry platforms such as MALDI-TOF now integrate machine-learning models capable of species-level identification in minutes, replacing manual techniques that once required up to two days. Fully automated "dark labs" operate lights-out shifts to keep essential testing running during staffing shortages or crises like COVID-19. Interoperability with hospital information systems enables seamless data flow that supports infection-control dashboards and antimicrobial-stewardship alerts. Vendors that bundle hardware, reagents, and cloud-based analytics under service contracts improve uptime while lowering ownership costs, enhancing the attractiveness of their offers in the microbiology testing market.

Growing Incidence of Infectious Diseases and Antimicrobial Resistance

Rising drug-resistant pathogens push clinicians to adopt culture-independent tests that can deliver identification and resistance markers inside the first critical hours of patient admission. Healthcare-associated infections in the United States alone cost more than USD 20 billion annually, intensifying pressure on hospitals to deploy rapid diagnostics that prevent broad-spectrum antibiotic overuse. Climate-driven expansion of mosquito-borne diseases increases the baseline demand for molecular panels that can differentiate co-circulating arboviruses. Evidence that targeted therapy lowers mortality and length of stay amplifies interest in one-hour multiplex PCR assays. Policy makers channel funding toward surveillance networks that rely on timely microbiology data, which in turn enlarges the installed base of advanced systems across the microbiology testing market.

High Capital Investment and Operational Costs

Total laboratory automation systems require upfront outlays of USD 2-5 million per site, a hurdle that smaller community hospitals and independent labs struggle to clear. MALDI-TOF instruments cut per-test costs but still demand more than USD 500,000 for hardware plus annual database licensing fees. Molecular reagent packs priced at USD 100-200 per panel dwarf the USD 10-20 consumable spend of culture methods, limiting routine use in low-volume settings. Facilities must also budget for controlled-environment rooms, redundant power, and specialized IT infrastructure. Without volume-based discounts, many emerging-market labs remain locked out of next-generation platforms, constraining the reachable segment of the microbiology testing market.

Other drivers and restraints analyzed in the detailed report include:

- Expansion of Public and Private Healthcare Funding

- Rising Demand for Rapid and Point-of-Care Testing Solutions

- Shortage of Skilled Laboratory Personnel

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Clinical diagnostics delivered 31.34% of 2024 revenue, reflecting hospitals' priority to curtail healthcare-associated infections with same-day pathogen confirmation. Pharmaceutical-quality control ranked second in value because cGMP rules obligate batch release only after sterile assurance testing. Food and beverage processors adopted Hazard Analysis and Critical Control Point standards that mandate pathogen screening at multiple checkpoints. Environmental monitoring tract steadily due to stricter wastewater and remediation rules.

Cosmetic testing posts the quickest expansion at an 11.45% CAGR as EU Regulation 1223/2009 compels safety dossiers, and the shift toward preservative-light "clean label" formulas raises contamination risk. As brands promote plant-based ingredients, microbial hurdles climb, driving demand for challenge testing and preservative-efficacy studies. Contract labs specializing in personal-care microbiology capture new outsourcing contracts, enlarging their footprint within the microbiology testing market size.

Reagents and consumables controlled 73.56% of 2024 spending because every culture or molecular run consumes media, panels, discs, or cartridges, ensuring steady replenishment cycles. Stock-out scares during the COVID-19 crisis convinced procurement teams to diversify suppliers and build inventory buffers. Multi-plex respiratory panels, chromogenic media, and AST cards remain staple revenue generators, anchoring the cash-flow base for manufacturers in the microbiology testing market.

Instrumentation revenue rises at an 11.89% CAGR as laboratories upgrade to high-throughput streakers, incubators, and mass-spectrometry analyzers that compress workflow times. More than 550 VITEK MS PRIME systems were installed in 2024 alone, reflecting demand for faster identification without sacrificing accuracy. Automated susceptibility platforms that pair with LIS middleware unlock real-time reporting and antimicrobial-stewardship notifications. Service contracts and software licenses add an annuity layer to hardware sales, enhancing lifetime customer value.

The Microbiology Testing Market Report is Segmented by Application (Clinical Diagnostics, and More), Product (Instruments & Equipment, and More), Technology (Culture-Based Testing, and More), End User (Hospitals & Diagnostic Laboratories, Pharmaceutical & Biotech Companies, and More), and Geography (North America, Europe, Asia-Pacific, Middle East & Africa, South America). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America generated 42.43% of 2024 revenue, underpinned by advanced hospital infrastructure, mandatory infection-control guidelines, and a clear regulatory pathway for novel diagnostics. The Food Safety Modernization Act obliges extensive pathogen monitoring, stimulating demand from food processors and reference labs. Federal programs that reimburse rapid diagnostics strengthen the business case for premium molecular panels, reinforcing leadership of the microbiology testing market in the region.

Europe ranks second and upholds stringent standards under Regulation 2073/2005 for foodstuffs and the well-enforced cGMP framework for pharmaceuticals. Germany, France, and the Nordics account for the bulk of installed automation lines, and Regulation 1223/2009 keeps cosmetic-testing laboratories busy across the bloc. Collaborative surveillance through the European Centre for Disease Prevention and Control harmonizes outbreak response, indirectly encouraging pan-regional adoption of advanced testing systems.

Asia-Pacific is the fastest-growing territory with a 10.54% CAGR as China, India, and Southeast Asian countries pour capital into laboratory networks that underpin public-health resilience. Massive expansions in biologics and vaccine manufacturing create steady need for environmental monitoring and sterility testing. Japanese hospitals, early adopters of point-of-care molecular devices, showcase the operational gains of rapid diagnostics, prompting regional peer institutions to follow suit. As infrastructure improves, previously underserved rural markets open, enlarging the total addressable microbiology testing market size across the region.

- Bio-Rad Laboratories

- Abbott Laboratories

- Beckton Dickinson

- Roche

- Bruker

- Hologic

- Danaher Corp (Cepheid)

- bioMerieux

- Thermo Fisher Scientific

- Agilent Technologies

- Merck

- Shimadzu

- Neogen

- Charles River Laboratories Intl. Inc.

- QIAGEN

- Siemens Healthineers

- Lonza Group

- QuidelOrtho

- 3M

- Luminex Corp (DiaSorin)

- Eurofins

- Beckman Coulter MicroScan

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Advancements in Diagnostic Technologies and Automation

- 4.2.2 Growing Incidence of Infectious Diseases and Antimicrobial Resistance

- 4.2.3 Expansion of Public and Private Healthcare Funding

- 4.2.4 Rising Demand for Rapid and Point-of-Care Testing Solutions

- 4.2.5 Stringent Regulatory Standards for Product Safety and Quality

- 4.2.6 Diversifying Applications in Pharmaceutical, Food, and Environmental Testing

- 4.3 Market Restraints

- 4.3.1 High Capital Investment and Operational Costs

- 4.3.2 Reimbursement and Pricing Challenges For Novel Tests

- 4.3.3 Shortage of Skilled Laboratory Personnel

- 4.3.4 Supply Chain Disruptions for Critical Reagents and Consumables

- 4.4 Regulatory Landscape

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitutes

- 4.5.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Application

- 5.1.1 Clinical Diagnostics

- 5.1.2 Pharmaceutical Manufacturing QC

- 5.1.3 Food & Beverage Testing

- 5.1.4 Environmental Monitoring

- 5.1.5 Cosmetic Testing

- 5.1.6 Industrial Quality Control

- 5.2 By Product

- 5.2.1 Instruments & Equipment

- 5.2.2 Reagents & Consumables

- 5.2.3 Software & Services

- 5.3 By Technology

- 5.3.1 Culture-based Testing

- 5.3.2 Molecular Diagnostics (PCR/NAAT)

- 5.3.3 Mass Spectrometry (MALDI-TOF)

- 5.3.4 Rapid/Automated Methods

- 5.3.5 Biosensors & Nano-based Assays

- 5.4 By End User

- 5.4.1 Hospitals & Diagnostic Laboratories

- 5.4.2 Pharmaceutical & Biotech Companies

- 5.4.3 Food & Beverage Companies

- 5.4.4 CROs & CMOs

- 5.4.5 Academic & Research Institutes

- 5.4.6 Environmental Testing Labs

- 5.4.7 Cosmetics & Personal-Care Labs

- 5.5 Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 Australia

- 5.5.3.5 South Korea

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 Middle East & Africa

- 5.5.4.1 GCC

- 5.5.4.2 South Africa

- 5.5.4.3 Rest of Middle East & Africa

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Argentina

- 5.5.5.3 Rest of South America

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and analysis of Recent Developments)

- 6.3.1 Bio-Rad Laboratories Inc.

- 6.3.2 Abbott Laboratories

- 6.3.3 Becton Dickinson & Company

- 6.3.4 F. Hoffmann-La Roche Ltd

- 6.3.5 Bruker Corporation

- 6.3.6 Hologic Inc.

- 6.3.7 Danaher Corp (Cepheid)

- 6.3.8 bioMerieux SA

- 6.3.9 Thermo Fisher Scientific Inc.

- 6.3.10 Agilent Technologies Inc.

- 6.3.11 Merck KGaA

- 6.3.12 Shimadzu Corporation

- 6.3.13 NEOGEN Corporation

- 6.3.14 Charles River Laboratories Intl. Inc.

- 6.3.15 QIAGEN N.V.

- 6.3.16 Siemens Healthineers AG

- 6.3.17 Lonza Group AG

- 6.3.18 QuidelOrtho Corporation

- 6.3.19 3M Company

- 6.3.20 Luminex Corp (DiaSorin)

- 6.3.21 Eurofins Scientific

- 6.3.22 Beckman Coulter MicroScan

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment