PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851232

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851232

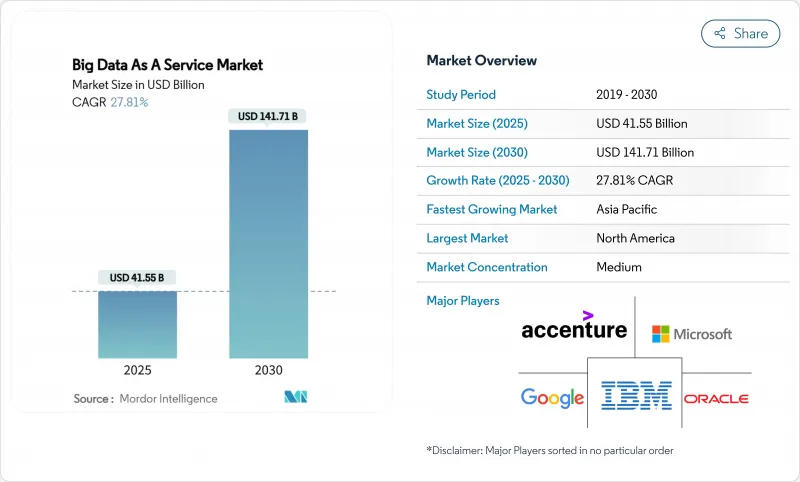

Big Data As A Service - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Big Data As A Service Market size is estimated at USD 41.55 billion in 2025, and is expected to reach USD 141.71 billion by 2030, at a CAGR of 27.81% during the forecast period (2025-2030).

The big data as a service market reached USD 41.55 billion in 2025 and is forecast to climb to USD 141.71 billion by 2030, reflecting a compound annual growth rate of 27.81%. Demand escalates as enterprises replace capital-intensive on-premises systems with usage-based cloud analytics that flex with artificial-intelligence workloads. A surge in generative-AI pilots, wider industrial IoT rollouts, and a global shift toward pay-as-you-go pricing have narrowed adoption barriers. Hyperscale providers have therefore invested more than USD 105 billion each year in new capacity to meet elastic data-processing needs. North America retains leadership, yet Asia-Pacific shows the steepest trajectory as manufacturers and financial institutions accelerate cloud migrations. Together, these forces uphold a strong outlook for the big data as a service market through the decade.

Global Big Data As A Service Market Trends and Insights

Cloud Adoption and Exploding Data Volumes

Organizations now generate 2.5 quintillion bytes each day, volumes that exceed the practical limits of on-premises clusters.Manufacturers such as 3M cut anomaly-detection time by 40% after installing Azure SQL Edge on production lines, showing the operational impact of elastic processing. Annual global cloud spending topped USD 825 billion in 2025, and 85% of enterprises use multi-cloud environments to support analytics projects. Savings are evident: maintaining local Hadoop farms can cost USD 2-5 million per year, while usage-based BDaaS scales strictly with workload size. At the network edge, IoT sensors produce more data than traditional pipes can carry, forcing firms to adopt distributed architectures that keep compute near the source while synchronizing to cloud analytics platforms.

Generative-AI-Ready Analytics Demand

Large language models now sit beside SQL engines in most enterprise road maps. Banking institutions estimate USD 200-340 billion in new annual profit once GenAI is fully operational, driving heavy BDaaS investments for unstructured-data processing. Snowflake attributes 38% of its USD 2.67 billion fiscal-2024 revenue to AI workloads and has partnered with Anthropic, NVIDIA, and Microsoft to embed AI training directly in its data cloud. AWS already reports multi-billion-dollar AI run rates, underscoring the momentum toward platforms that can ingest, transform and serve data to ML pipelines in a single tenancy. Retrieval-augmented generation further monetizes enterprise documents, creating new revenue streams from dormant content libraries.

Data Privacy and Cybersecurity Risks

Seventy-five percent of countries enforce localization mandates that fragment cloud architectures and inflate operating expenses. Overlapping rules from GDPR, China's CSL and the US CLOUD Act force multinational firms to build complex data-governance layers, lifting total ownership cost by up to 25%. Financial institutions must further store transactional data onshore, restricting vendor options and raising procurement cycles. These hurdles slow some migrations but rarely reverse them; providers increasingly offer region-specific clusters and contract clauses that address legal variance, tempering the headwind but not eliminating it.

Other drivers and restraints analyzed in the detailed report include:

- Edge-to-Cloud Data Fabrics for IoT-Rich Verticals

- FinOps-Linked Consumption Pricing Models

- Talent Gap in FinOps and Data Engineering

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Hadoop-as-a-Service retained 42% of the big data as a service market in 2024, indicating that batch processing and data-lake architectures still hold value for established enterprises. However, Analytics-as-a-Service is forecast to grow at 30.61% CAGR, the quickest pace among offerings, as firms favor managed environments that merge BI dashboards, ML notebooks and vector search without cluster maintenance. In 2025, the analytics segment captured 50% share of the big data as a service market size for incremental spending and is projected to widen its lead through 2030. Data Platform-as-a-Service remains relevant in regulated scenarios that need custom governance controls, occupying a middle ground between raw infrastructure and end-to-end analytics suites.

Clients increasingly measure success by time-to-insight rather than hardware utilization. Snowflake's launch of Cortex AISQL signals a future where an analyst can query LLMs with plain language and receive governed answers from the same pane of glass that stores transactional data. This convergence blurs the historical divide between ETL, warehousing and analytics, pushing vendors to consolidate features. Over the forecast period, the big data as a service market will therefore pivot from infrastructure-first branding to value propositions built around immediacy of decision support.

Public cloud commanded 63% of revenue in 2024, driven by hyperscaler pricing, but hybrid cloud will rise fastest at 29.51% CAGR. Organizations seek the flexibility to keep sensitive records in private zones while bursting analytics to the public edge during demand spikes. Hybrid options also mitigate vendor lock-in and support compliance when 75% of jurisdictions impose data-residency rules. As a result, the big data as a service market size for hybrid solutions is projected to more than triple between 2025 and 2030.

Multi-cloud architectures are now mainstream: 85% of enterprises employ at least two providers for big-data tasks. Snowflake's recent integration with Apache Iceberg files across AWS, Azure and Google Cloud enables identical queries on any venue, encouraging workload portability. For plants with IoT gateways, hybrid layouts process anomaly scores on local hardware, then forward aggregates to cloud models for historical trend building. Such patterns will entrench hybrid deployments as the backbone of next-generation analytics.

The Big Data As A Service Market Report is Segmented by Service Model (Hadoop-As-A-Service (HaaS), Analytics-As-A-Service (AaaS), and More), Deployment (Public Cloud, Private Cloud, and More), End User Industry (BFSI, Manufacturing, IT and Telecom, and More), and Geography.

Geography Analysis

North America controlled 39% of the big data as a service market in 2024, buoyed by entrenched cloud providers, venture funding and data-driven business cultures. Enterprises in the United States and Canada were early adopters and now focus on refining FinOps practices to tame runaway AI compute bills. Europe follows, propelled by GDPR obligations that favor managed services able to guarantee auditability. Despite stringent privacy rules, the region still grows in mid-teens percentages because providers certify regional clusters and encryption-key sovereignty.

Asia-Pacific is the pacesetter, projected to expand at a 27.85% CAGR. Governments in China, India and Southeast Asia champion national cloud programs while manufacturing digitalization piles new data into BDaaS pipelines. Local hyperscalers such as Alibaba Cloud and Tencent Cloud invest in cross-regional availability zones, removing latency penalties once tied to global providers. Japan and South Korea, early IoT adopters, now experiment with enterprise-grade GenAI built on regional data guardianship frameworks.

Latin America and the Middle East and Africa are earlier in the curve yet show promising absolute growth. Brazilian fintech firms and Mexican retailers shift workloads to BDaaS because capital budgets cannot support large self-hosted clusters. Gulf oil producers run hybrid BDaaS edge nodes on rigs for predictive maintenance, while African telecoms leverage consumption pricing to launch customer-analytics programs without front-loading capital. Collectively, these emerging markets contribute incremental revenue that broadens the global footprint of the big data as a service market.

- Amazon Web Services

- Microsoft

- Google Cloud

- IBM

- Oracle

- SAP

- Hewlett Packard Enterprise

- SAS Institute

- Accenture

- Teradata

- Cloudera

- Snowflake

- Databricks

- Dell Technologies

- Splunk

- Palantir

- Informatica

- Huawei Cloud

- Alibaba Cloud

- Tencent Cloud

- Wipro

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY AND KEY FINDINGS

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Cloud adoption and exploding data volumes

- 4.2.2 Cost-effective alternatives to on-prem big-data stacks

- 4.2.3 Generative-AI-ready analytics demand

- 4.2.4 Edge-to-cloud data fabrics for IoT-rich verticals

- 4.2.5 Data-localization rules fueling regional BDaaS nodes

- 4.2.6 FinOps-linked consumption pricing models

- 4.3 Market Restraints

- 4.3.1 Data privacy and cybersecurity risks

- 4.3.2 Legacy integration complexity

- 4.3.3 Carbon-footprint scrutiny on hyperscale DCs

- 4.3.4 Talent gap in FinOps and data engineering

- 4.4 Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Service Model

- 5.1.1 Hadoop-as-a-Service (HaaS)

- 5.1.2 Analytics-as-a-Service (AaaS)

- 5.1.3 Data Platform-as-a-Service (DPaaS)

- 5.2 By Deployment

- 5.2.1 Public Cloud

- 5.2.2 Private Cloud

- 5.2.3 Hybrid Cloud

- 5.3 By End User Industry

- 5.3.1 BFSI

- 5.3.2 IT and Telecom

- 5.3.3 Healthcare and Life Sciences

- 5.3.4 Retail and E-commerce

- 5.3.5 Manufacturing

- 5.3.6 Energy and Power

- 5.3.7 Government and Public Sector

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 South America

- 5.4.2.1 Brazil

- 5.4.2.2 Argentina

- 5.4.2.3 Rest of South America

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Russia

- 5.4.3.5 Rest of Europe

- 5.4.4 Asia Pacific

- 5.4.4.1 China

- 5.4.4.2 India

- 5.4.4.3 Japan

- 5.4.4.4 South Korea

- 5.4.4.5 ASEAN

- 5.4.4.6 Rest of Asia Pacific

- 5.4.5 Middle East

- 5.4.5.1 GCC

- 5.4.5.2 Turkey

- 5.4.5.3 Rest of Middle East

- 5.4.6 Africa

- 5.4.6.1 South Africa

- 5.4.6.2 Nigeria

- 5.4.6.3 Rest of Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, Recent Developments)

- 6.4.1 Amazon Web Services

- 6.4.2 Microsoft

- 6.4.3 Google Cloud

- 6.4.4 IBM

- 6.4.5 Oracle

- 6.4.6 SAP

- 6.4.7 Hewlett Packard Enterprise

- 6.4.8 SAS Institute

- 6.4.9 Accenture

- 6.4.10 Teradata

- 6.4.11 Cloudera

- 6.4.12 Snowflake

- 6.4.13 Databricks

- 6.4.14 Dell Technologies

- 6.4.15 Splunk

- 6.4.16 Palantir

- 6.4.17 Informatica

- 6.4.18 Huawei Cloud

- 6.4.19 Alibaba Cloud

- 6.4.20 Tencent Cloud

- 6.4.21 Wipro

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment