PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851235

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851235

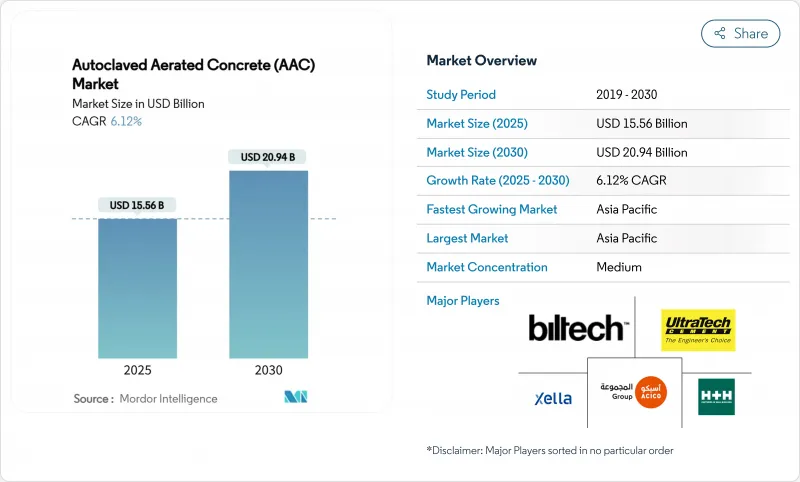

Autoclaved Aerated Concrete (AAC) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Autoclaved Aerated Concrete Market size is estimated at USD 15.56 billion in 2025, and is expected to reach USD 20.94 billion by 2030, at a CAGR of 6.12% during the forecast period (2025-2030).

Growth is fueled by tightening green-building mandates, rising demand for seismic-resilient structures, and the rapid adoption of modular construction, all of which highlight AAC's lightweight, energy-efficient profile. Blocks continue to dominate traditional masonry, yet panels are gaining momentum as prefabrication revamps project timelines. Asia-Pacific commands nearly half of global demand on the back of urbanization and infrastructure outlays, while North America and Europe capitalize on strict energy and seismic codes. Manufacturers are scaling capacity and automating plants to match demand spikes, improve cost structures, and strengthen regional supply chains.

Global Autoclaved Aerated Concrete (AAC) Market Trends and Insights

Growing Demand from New-Build & Renovation Construction

Surging residential and commercial starts in emerging economies have made lightweight materials indispensable because they lower foundation loads and shorten project cycles. AAC cuts dead weight by 30-40%, enabling slimmer foundations and quicker floor-to-floor progress, which is vital in dense city cores. India's housing drive illustrates the trend; domestic producer BigBloc Construction is expanding capacity to keep pace with elevated urban housing approvals. Renovation schemes also prefer AAC because its precision blocks streamline retrofits without reforging structure lines. Four-hour fire ratings boost compliance in commercial refurbishments, and its mold-proof matrix appeals in humid climates. Together, these factors underpin sustained Autoclaved Aerated Concrete market growth.

Stringent Green-Building Codes & LEED Adoption

Policies aimed at curbing embodied carbon are reshaping material selection worldwide. The US government's USD 160 million funding for sustainable-materials benchmarking explicitly encourages AAC uptake. EPA's 2024 low-carbon label gives manufacturers a clear route to quantify climate advantages, enhancing bid scores on public projects. Europe mirrors the shift; H+H UK is targeting net-zero operations by 2050, in line with EU decarbonization goals. With an R-value of 1.43 for 200 mm thickness, AAC delivers 10-20% operational energy savings and incorporates recycled fly ash, satisfying circular-economy criteria.

High Upfront Cost vs. Clay & Concrete Blocks

Perceptions of premium pricing hinder AAC's penetration where contractors prioritize purchase price over life-cycle savings. However, traditional red bricks recently became roughly 20% more expensive than AAC in key Indian metros, nudging buyers toward the lighter alternative. Material-price volatility is reshaping comparisons; 2025 tariffs elevated steel by 10-25% and concrete by 3-7%, eroding AAC's cost differential. Limited local plants in some regions still inflate delivered prices by 15-20%. Education campaigns stressing 30% energy-bill reductions and lower labor needs are gradually reframing procurement decisions around total cost of ownership.

Other drivers and restraints analyzed in the detailed report include:

- Government Incentives for Low-Carbon Materials

- Modular Off-Site Construction Uptake

- Volatile Supply & Price of Aluminum Powder Foaming Agent

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Blocks held 54.78% of 2024 revenue, reflecting decades of contractor familiarity and broad distribution networks. In parallel, panels are charting a 7.81% CAGR through 2030 as builders pivot toward prefabricated envelopes. The panel boom embodies the construction industry's industrialization push: factory-cut modules arrive field-ready, reducing waste and compressing schedules. Developers favor panels in tall residential towers because fewer joints mean tighter thermal envelopes and lower infiltration losses.

The blocks segment remains central to low-rise housing, especially in markets where labor is abundant and on-site techniques dominate. Yet panel innovation is relentless. Reinforced wall panels now handle load-bearing duties, and roof modules with thermal conductivity of 0.11 W/mK meet zero-energy-building targets. Automated saw lines and robotic handling have cut panel-fabrication costs, underpinning an Autoclaved Aerated Concrete market shift from craft-based block laying to industrial panel assembly.

The Autoclaved Aerated Concrete Market Report is Segmented by Product Type (Block, Panel, Lintel, Tile, Others), Construction Method (On-Site Masonry, Prefabricated/Modular), Application (Residential, Commercial, Industrial, Other Applications), and Geography (Asia-Pacific, North America, Europe, South America, Middle East and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific held 46.78% of global revenue in 2024 and is accelerating at 7.28% CAGR to 2030. China and India anchor demand, driven by housing mega-projects and state infrastructure pipelines. Government incentives for low-carbon building methods further tip specifications toward AAC. Japan and South Korea adopt AAC for seismic safety, while Australia's home-energy codes sustain steady uptake. High regional self-sufficiency in raw materials and rising automation keep unit costs competitive, cementing Asia-Pacific's dominance.

North America is experiencing a renaissance in AAC usage, propelled by wildfire resilience requirements in the western United States and stricter building envelopes across climate zones. The EPA's low-embodied-carbon label is catalyzing public procurement, and Canada's national energy code revision amplifies momentum. Mexico's housing stimulus complements the regional picture, leading to a robust Autoclaved Aerated Concrete market trajectory.

Europe's mature landscape benefits from stringent carbon targets: Germany and the UK aggressively retrofit buildings, while Nordic markets edge toward near-zero-energy codes. EU Green Deal financing supports plant upgrades and new lines. Central and Eastern Europe provide white-space growth as booming logistics and data-center construction seek fire-safe, thermally efficient shells.

- ACICO Group

- AERCON AAC

- Asahi Kasei Corporation

- Bauroc AS

- Biltech Building Elements Limited

- BirlaNu Limited

- Eastland Building Materials Co., Ltd

- Eco Green

- Ecostone AAC

- H+H UK Limited

- JK Lakshmi Cement Ltd.

- Renacon

- SOLBET

- Starken AAC Sdn Bhd

- STT Turk Gazbeton

- Thomas Armstrong (Concrete Blocks) Ltd

- UAL Industries Limited

- UltraTech Cement Ltd.

- Xella International

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing demand from new-build & renovation construction

- 4.2.2 Stringent green-building codes & LEED adoption

- 4.2.3 Government incentives for low-carbon materials

- 4.2.4 Modular off-site construction uptake

- 4.2.5 Demand for seismic-resilient lightweight blocks

- 4.3 Market Restraints

- 4.3.1 High upfront cost vs. clay & concrete blocks

- 4.3.2 Structural limitations in load-bearing applications

- 4.3.3 Volatile supply & price of aluminum powder foaming agent

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

5 Market Size & Growth Forecasts (Value)

- 5.1 By Product Type

- 5.1.1 Block

- 5.1.2 Panel

- 5.1.3 Lintel

- 5.1.4 Tile

- 5.1.5 Others (U-blocks, floor/roof elements)

- 5.2 By Construction Method

- 5.2.1 On-site masonry

- 5.2.2 Prefabricated/modular

- 5.3 By Application

- 5.3.1 Residential

- 5.3.2 Commercial

- 5.3.3 Industrial

- 5.3.4 Other Applications (roads, utility enclosures, noise-barrier walls)

- 5.4 By Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 Australia and New Zealand

- 5.4.1.6 ASEAN

- 5.4.1.7 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Spain

- 5.4.3.6 Nordic Countries

- 5.4.3.7 Poland

- 5.4.3.8 Netherlands

- 5.4.3.9 Romania

- 5.4.3.10 Czech Republic

- 5.4.3.11 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Colombia

- 5.4.4.4 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 Israel

- 5.4.5.3 Qatar

- 5.4.5.4 South Africa

- 5.4.5.5 Rest of Middle East and Africa

- 5.4.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.4.1 ACICO Group

- 6.4.2 AERCON AAC

- 6.4.3 Asahi Kasei Corporation

- 6.4.4 Bauroc AS

- 6.4.5 Biltech Building Elements Limited

- 6.4.6 BirlaNu Limited

- 6.4.7 Eastland Building Materials Co., Ltd

- 6.4.8 Eco Green

- 6.4.9 Ecostone AAC

- 6.4.10 H+H UK Limited

- 6.4.11 JK Lakshmi Cement Ltd.

- 6.4.12 Renacon

- 6.4.13 SOLBET

- 6.4.14 Starken AAC Sdn Bhd

- 6.4.15 STT Turk Gazbeton

- 6.4.16 Thomas Armstrong (Concrete Blocks) Ltd

- 6.4.17 UAL Industries Limited

- 6.4.18 UltraTech Cement Ltd.

- 6.4.19 Xella International

7 Market Opportunities & Future Outlook

- 7.1 White-space & unmet-need assessment