PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851241

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851241

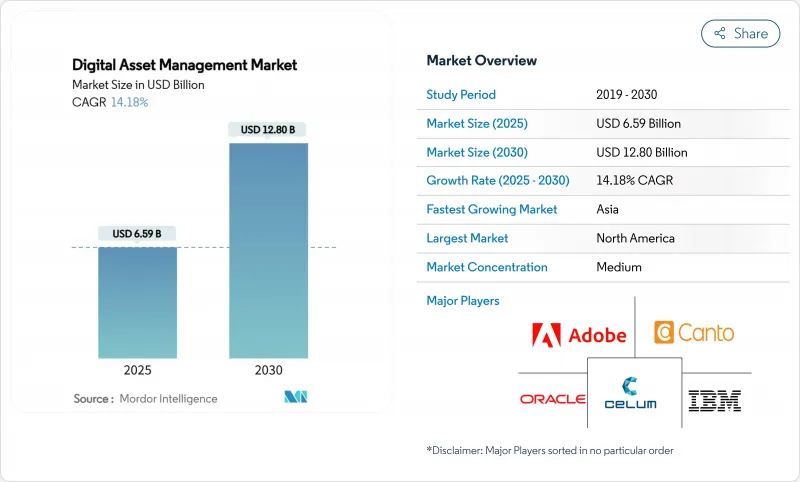

Digital Asset Management - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Digital Asset Management market is valued at USD 6.59 billion in 2025 and is forecast to reach USD 12.80 billion by 2030, advancing at a 14.18% CAGR.

Demand is accelerating as enterprises reposition DAM from a cost center to a core pillar of omnichannel content strategy. Solution providers now embed AI for auto-tagging, rights management, and dynamic delivery, helping brands cut asset search time by up to 40% . Generative AI pilots are already under way at 66% of large organizations, boosting personalization at scale. Regulatory change is another growth catalyst: Europe's Accessibility Act effective June 2025 requires richer metadata and alt-text, pushing companies to upgrade legacy systems. North America leads adoption thanks to cloud-native architectures, while Asia-Pacific posts the fastest expansion as mobile video streaming surges. At the same time, high total cost of ownership and tightening data-sovereignty rules restrain smaller firms and heavily regulated sectors.

Global Digital Asset Management Market Trends and Insights

Growing Volume and Velocity of Rich Media Assets in Omnichannel Commerce

Marketing teams now devote 39% of budgets to content creation, much of it short-form video and interactive formats that require sophisticated metadata, rights tracking, and rendition management. Organizations that integrate Product Information Management with DAM repurpose assets across storefronts, social commerce, and marketplaces, maximizing ROI while protecting brand integrity. Coca-Cola links SKU-level data with creative files to drive real-time personalization across e-commerce sites. Companies without a robust DAM struggle with duplicate production and inconsistent messaging, eroding campaign effectiveness.

Rapid Shift to Cloud-Native AI-Enhanced DAM Platforms in North America

Enterprises such as T-Mobile decreased creative cycle times after moving from on-premise repositories to Adobe Experience Manager Assets, which uses AI for bulk tagging and rendition generation . SaaS delivery eliminates costly upgrades and supports distributed teams that need instant access. Early adopters report measurable OPEX savings and faster campaign launches, prompting competitors to accelerate migrations.

High Total Cost of Ownership for Enterprise-Grade DAM Suites in SMEs

Licensing fees, integration work, and the need for DAM specialists deter many smaller firms from enterprise platforms. Departments often adopt lightweight tools, creating silos that inflate support overhead and complicate consolidation efforts. Service providers now bundle change-management workshops and migration accelerators to close this adoption gap.

Other drivers and restraints analyzed in the detailed report include:

- Surging Demand for Personalised Video Streaming Assets in Asia

- Integration of DAM with Headless CMS for Real-Time Content Syndication

- Data-Sovereignty and Residency Mandates Limiting Cross-Border Asset Storage

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The Solutions segment captured a 72.3% share, establishing a baseline for enterprise adoption. Platforms now bundle AI transcription, color correction, and rights clearance, making the Digital Asset Management market integral to broader digital-experience stacks. Large brands use orchestration rules to assemble campaign kits automatically, ensuring regulatory-ready content sets. Meanwhile, Services revenue is forecast to outpace software at a 17.9% CAGR as firms rely on partners for taxonomy design, migration from fragmented archives, and user-training programs. Managed-service engagements that wrap governance dashboards and KPI tracking are becoming standard. Implementations supported by specialists demonstrate a 196% ROI through faster retrieval and compliance savings

Cloud installations represent 64% of 2024 revenue because updates flow seamlessly and total cost per asset drops as storage tiers auto-scale clients integrate AI Video Intelligence entirely through SaaS APIs and expand their digital presence across new channels without downtime MediaValet. On-premise installations persist in defense, government, and healthcare, but hybrid patterns are gaining traction where sensitive master files stay behind the firewall while derivatives stream from regional clouds. Continuous delivery of features such as semantic search keeps the cloud model ahead, fueling a 15.8% CAGR and reinforcing the primacy of the Digital Asset Management market in modern tech stacks.

The Digital Asset Management Market is Segmented by Component (Solutions, Services), Deployment (On-Premise, Cloud), Organization Size (SMEs, Large Enterprises), Application (Sales and Marketing Enablement and More), End-User (Media and Entertainment, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America led with 38.2% share in 2024 as enterprises embraced AI-rich cloud suites and as hyperscale providers strengthened compliance certifications. DeFi Technologies projected USD 201.07 million revenue from Solana-based products, illustrating deep regional expertise in tokenized asset management The region's mature ad-tech ecosystem drives higher per-user content spend, solidifying its leadership in the Digital Asset Management market.

Asia-Pacific is forecast to post a 17.4% CAGR through 2030. The DAM Sydney 2025 conference underscored rising demand across FMCG, healthcare, and government programs seeking multilingual asset orchestration. Rising smartphone penetration and social commerce expand use cases for instant video personalization at scale. Government smart-city initiatives also encourage unified content hubs to power public-service apps.

Europe's growth is anchored in accessibility mandates and strict privacy frameworks. The Digital Asset Management market size for compliance-ready solutions expands as firms retrofit heritage collections with alt-text and granular consent tracking. Vendors differentiate on advanced metadata, versioning, and anonymization features to satisfy GDPR and regional localization laws.advises that early conformance with the European Accessibility Act enhances brand reputation and mitigates legal risk

- Adobe Inc.

- OpenText Corp.

- Bynder BV

- Aprimo LLC

- Oracle Corp.

- Cloudinary Ltd.

- IBM Corp.

- Canto Inc.

- Widen Enterprises (Acquia)

- CELUM GmbH

- MediaBeacon Inc.

- Nuxeo (Hyland)

- Extensis

- Digizuite A/S

- MediaValet Inc.

- Brandfolder (Smartsheet)

- Sitecore

- Northplains Systems

- Tenovos

- Amplifi.io

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing Volume and Velocity of Rich Media Assets in Omnichannel Commerce

- 4.2.2 Rapid Shift to Cloud-Native AI-Enhanced DAM Platforms in North America

- 4.2.3 Surging Demand for Personalised Video Streaming Assets in Asia

- 4.2.4 Integration of DAM with Headless CMS for Real-Time Content Syndication

- 4.2.5 Regulatory Push for Accessibility (WCAG-2.2) Elevating Metadata Standards in Europe

- 4.2.6 Emergence of Generative-AI-Powered Auto-Tagging Reducing TTM for Brand Launches

- 4.3 Market Restraints

- 4.3.1 High Total Cost of Ownership for Enterprise-Grade DAM Suites in SMEs

- 4.3.2 Data-Sovereignty & Residency Mandates Limiting Cross-Border Asset Storage

- 4.3.3 Fragmented Legacy Repositories Hindering Seamless Migration

- 4.3.4 Limited Skilled Workforce for AI-based Metadata Governance

- 4.4 Technological Outlook

- 4.5 Macroeconomic Factors Impact Assessment

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

- 4.7 Investment Analysis (Funding, M&A, VC Activity)

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Component

- 5.1.1 Solutions

- 5.1.2 Services

- 5.2 By Deployment Mode

- 5.2.1 On-Premise

- 5.2.2 Cloud (SaaS)

- 5.3 By Organisation Size

- 5.3.1 SMEs

- 5.3.2 Large Enterprises

- 5.4 By Application

- 5.4.1 Sales and Marketing Enablement

- 5.4.2 Broadcast and Publishing Workflows

- 5.4.3 Product and E-commerce Management

- 5.4.4 Photography, Graphics and Design Repositories

- 5.4.5 Document and Knowledge Management

- 5.5 By End-User Industry

- 5.5.1 Media and Entertainment

- 5.5.2 BFSI

- 5.5.3 Government and Public Sector

- 5.5.4 Healthcareand Life Sciences

- 5.5.5 Retail and CPG

- 5.5.6 Manufacturing

- 5.5.7 IT and Telecom

- 5.5.8 Others (Education, Non-Profit)

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 South America

- 5.6.2.1 Brazil

- 5.6.2.2 Argentina

- 5.6.2.3 Chile

- 5.6.2.4 Peru

- 5.6.2.5 Rest of South America

- 5.6.3 Europe

- 5.6.3.1 Germany

- 5.6.3.2 United Kingdom

- 5.6.3.3 France

- 5.6.3.4 Italy

- 5.6.3.5 Spain

- 5.6.3.6 Rest of Europe

- 5.6.4 Asia-Pacific

- 5.6.4.1 China

- 5.6.4.2 Japan

- 5.6.4.3 South Korea

- 5.6.4.4 India

- 5.6.4.5 Australia

- 5.6.4.6 New Zealand

- 5.6.4.7 Rest of Asia-Pacific

- 5.6.5 Middle East and Africa

- 5.6.5.1 United Arab Emirates

- 5.6.5.2 Saudi Arabia

- 5.6.5.3 Turkey

- 5.6.5.4 South Africa

- 5.6.5.5 Rest of Middle East and Africa

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Strategic Developments

- 6.2 Vendor Positioning Analysis

- 6.3 Company ProfilesCompany Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments) : this is correct

- 6.3.1 Adobe Inc.

- 6.3.2 OpenText Corp.

- 6.3.3 Bynder BV

- 6.3.4 Aprimo LLC

- 6.3.5 Oracle Corp.

- 6.3.6 Cloudinary Ltd.

- 6.3.7 IBM Corp.

- 6.3.8 Canto Inc.

- 6.3.9 Widen Enterprises (Acquia)

- 6.3.10 CELUM GmbH

- 6.3.11 MediaBeacon Inc.

- 6.3.12 Nuxeo (Hyland)

- 6.3.13 Extensis

- 6.3.14 Digizuite A/S

- 6.3.15 MediaValet Inc.

- 6.3.16 Brandfolder (Smartsheet)

- 6.3.17 Sitecore

- 6.3.18 Northplains Systems

- 6.3.19 Tenovos

- 6.3.20 Amplifi.io

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-Space and Unmet-Need Assessment