PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851243

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851243

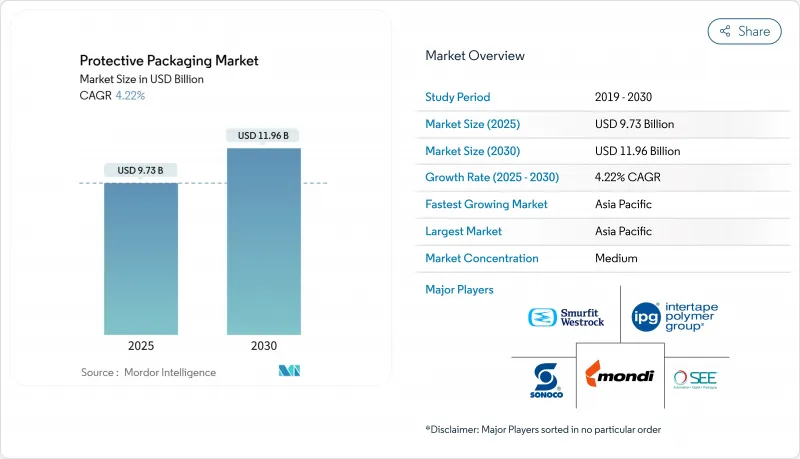

Protective Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The protective packaging market size reached USD 9.73 billion in 2025 and is projected to advance at a 4.22% CAGR, touching USD 11.96 billion by 2030.

Rising e-commerce volumes, intensifying sustainability regulations, and the search for premium unboxing experiences are recasting protective solutions from a back-end expense into a brand value lever. Demand patterns now reward lightweight materials that curb dimensional-weight fees, and regulatory certainty is prompting rapid shifts toward paper and fiber alternatives that can demonstrate recyclability. Accelerating mergers aim to unlock scale economies in sustainable technology, while automation platforms help converters contain labor and waste costs. Asia-Pacific remains the strategic fulcrum, supplying both manufacturing density and the world's fastest e-commerce growth, yet Europe wields outsized regulatory influence that shapes global investment roadmaps.

Global Protective Packaging Market Trends and Insights

Surging E-commerce Shipping Volumes

Exponential parcel growth is redefining protective packaging market logistics, compelling brands to shrink cube sizes and pivot toward fiber formats that meet carrier dimensional weight thresholds. HP's redesign of its All-in-One PC packaging eliminated 98% of expanded polyethylene, reduced volume by up to 67%, and raised pallet density for the 27-inch model, trimming freight spend and carbon load. Logitech completed a portfolio-wide switch to paper in 2025, removing 660 tons of plastic and 6,000 tons of CO2 each year, while 61% of surveyed buyers favored recyclable packs . Brands thus regard the protective packaging market not only as a cost line but as a retention lever in a doorstep economy.

Regulatory Push for Product Safety and Damage Reduction

New statutes go beyond recyclability to treat packaging as intrinsic to consumer safety. Europe's General Product Safety Regulation obliges manufacturers to validate that pack integrity prevents contamination or tampering.Thermo Fisher's carton with built-in tamper evidence withstands -80 °C, discards glue, and scales across vial sizes. In the United States, serialization laws link tracking codes with cushioning layers, catalyzing smart-label demand. Compliance timetables push producers to confirm protective packaging market readiness years ahead of enforcement.

Stringent Environmental Rules on Plastics and EPS

Europe mandates reusable targets climbing to 15% by 2040 and bans certain PFAS, triggering immediate material substitutions and extended-producer fees that squeeze converters' margins. The United Kingdom's October 2025 EPR rollout shifts full disposal costs onto brands, while California restricts the recycling symbol unless curbside acceptance is documented. These moves inflate compliance costs and lengthen payback periods for foam installations, dragging on the protective packaging market growth curve.

Other drivers and restraints analyzed in the detailed report include:

- Growing Consumer Electronics Demand

- Preference for Lightweight Flexible Protective Formats

- Raw-material Price Volatility

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Flexible formats generated 65.34% of 2024 sales within the protective packaging market, reflecting their ability to serve high-volume parcels with minimal cube and lower freight spend. Foam categories, though smaller, are accelerating at 6.75% CAGR toward 2030 as electronics and biologics rely on custom molds with electrostatic discharge yields. The protective packaging market size for foam is projected to widen in tandem with cold-chain expansion, positioning foam makers for premium pricing aligned with higher barrier performance.

Sealed Air's KORRVU suspension format illustrates how paper and corrugate can mimic foam resilience, offering curbside recyclability and shipping flat to cut inbound freight. Rigid corrugated, meanwhile, remains relevant for large white-goods and machinery where stacking strength matters. The product mix signals a divide: flexibles satisfy cost-down mandates in e-commerce, whereas technical foams win where precision cushioning and thermal insulation command a price premium.

Plastics still supplied 58.23% of 2024 tonnage, yet foam polymers log the quickest 7.34% CAGR, tracking growth in high-value electronics and life sciences. Barley-based bioplastics and recycled polyethylene films are scaling pilot lines, proving viability for mass adoption. Protective packaging market share for biocomposites remains modest but expands as food and pharma buyers seek compostable or bio-based seals.

Paper and board converters upgrade barrier coatings so that fiber wraps repel moisture and grease. Virginia Tech's low-pressure cellulose treatment strengthens paper while preserving transparency, unlocking shelf-ready appeal for perishables. Producers bundle such advances with carbon footprint disclosures, translating material innovation into procurement gains within the protective packaging market.

The Protective Packaging Market Report is Segmented by Product Type (Rigid, Flexible, Foam), Materials (Paper, Plastics, Foam Polymers, Biodegradable), Function (Cushioning, Void Fill, Wrapping, Others), End-User Industry (Food & Beverage, Electronics, Pharmaceuticals, E-Commerce), and Geography (North America, Europe, Asia-Pacific, MEA, South America). Market Forecasts are in Value (USD).

Geography Analysis

Asia-Pacific controlled 40.23% revenue in 2024 and is set for 7.76% CAGR, underpinned by dense manufacturing, rapid mobile penetration, and supportive yet tightening policy. China funnels half of global plastic output, offering localized resin access that favors converters, while Japan advances foamed paper research that can satisfy premium electronics exporters. Countries pilot government subsidies for automated packing lines, ensuring the protective packaging market keeps pace with cross-border e-commerce surges.

North America follows through premiumization. United States brands like HP and Amazon test zero-plastic pilots that later migrate worldwide, positioning the region as a trend bellwether. State-level Extended Producer Responsibility rules, beginning with California SB 343, compel recyclability declarations by 2026, rewarding early adopters in the protective packaging market. Canada promotes closed-loop paper recycling, whereas Mexico leverages near-shoring to grow appliance and electronics exports, widening demand for in-plant cushioning.

Europe leads rulemaking. The Packaging and Packaging Waste Regulation locks in recyclability and reuse quotas that benchmark global sourcing policies. Germany's deposit systems and the UK's plastic tax accelerate fiber uptake. Market entrants must navigate complex eco-modulation fees that vary by polymer, so multinationals cluster R&D hubs in the region to future-proof formulations. Compliance mastery therefore becomes a commercial edge across the protective packaging market.

- Sealed Air Corporation

- Pregis LLC

- Intertape Polymer Group Inc.

- Sonoco Products Company

- Smurfit Westrock

- Mondi Group

- International Paper Company

- Storopack Hans Reichenecker GmbH

- Ranpak Holdings Corp.

- Huhtamaki Oyj

- Signode Industrial Group LLC

- Crown Holdings Inc.

- Amcor plc

- Pro-Pac Packaging Ltd.

- ProAmpac Holdings Inc.

- Reflex Packaging LLC

- Pactiv Evergreen Inc.

- AirPack Systems Ltd.

- Polyair Inter Pack Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Surging e-commerce shipping volumes

- 4.2.2 Regulatory push for product safety and damage reduction

- 4.2.3 Growing consumer electronics demand

- 4.2.4 Preference for lightweight flexible protective formats

- 4.2.5 Adoption of on-demand packaging automation

- 4.2.6 Expansion of cold-chain biologics and vaccines

- 4.3 Market Restraints

- 4.3.1 Stringent environmental rules on plastics and EPS

- 4.3.2 Raw-material price volatility

- 4.3.3 Space constraints at urban last-mile hubs

- 4.3.4 Product redesign minimising protective-packaging need

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Product Type

- 5.1.1 Rigid

- 5.1.1.1 Corrugated Paperboard Protectors

- 5.1.1.2 Molded Pulp

- 5.1.1.3 Insulated Shipping Containers

- 5.1.1.4 Other Rigid Types

- 5.1.2 Flexible

- 5.1.2.1 Protective Mailers

- 5.1.2.2 Bubble Wrap

- 5.1.2.3 Air Pillows / Air Bags

- 5.1.2.4 Paper Fill

- 5.1.2.5 Other Flexible Types (Foil Pouches, Stretch and Shrink Films)

- 5.1.3 Foam

- 5.1.3.1 Molded Foam

- 5.1.3.2 Foam-in-Place (FIP)

- 5.1.3.3 Loose Fill

- 5.1.3.4 Foam Rolls / Sheets

- 5.1.3.5 Other Foam Types (Corner Blocks etc.)

- 5.1.1 Rigid

- 5.2 By Materials

- 5.2.1 Paper and Paperboard

- 5.2.2 Plastics

- 5.2.2.1 Polyethylene (PE)

- 5.2.2.2 Polypropylene (PP)

- 5.2.2.3 Polyethylene Terephthalate (PET)

- 5.2.3 Foam Polymers

- 5.2.3.1 Expanded Polystyrene (EPS)

- 5.2.3.2 Expanded Polyethylene (EPE)

- 5.2.3.3 Expanded Polypropylene (EPP)

- 5.2.4 Biodegradable and Compostable

- 5.2.4.1 Molded Fiber

- 5.2.4.2 Starch-based

- 5.2.4.3 Polylactic Acid (PLA)

- 5.2.5 Other Materials

- 5.3 By Function

- 5.3.1 Cushioning

- 5.3.2 Blocking and Bracing

- 5.3.3 Void Fill

- 5.3.4 Insulation and Temperature Control

- 5.3.5 Wrapping

- 5.3.6 Dunnage and Others

- 5.4 By End-user Industry

- 5.4.1 Food and Beverage

- 5.4.2 Industrial Goods

- 5.4.3 Pharmaceuticals and Life Sciences

- 5.4.4 Consumer Electronics

- 5.4.5 Beauty and Home Care

- 5.4.6 Automotive and Aerospace

- 5.4.7 E-commerce and Retail Fulfilment

- 5.4.8 Other End-user Industry

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Russia

- 5.5.2.7 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 South Korea

- 5.5.3.5 Australia and New Zealand

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 Middle East and Africa

- 5.5.4.1 Middle East

- 5.5.4.1.1 Saudi Arabia

- 5.5.4.1.2 United Arab Emirates

- 5.5.4.1.3 Turkey

- 5.5.4.1.4 Rest of Middle East

- 5.5.4.2 Africa

- 5.5.4.2.1 South Africa

- 5.5.4.2.2 Egypt

- 5.5.4.2.3 Nigeria

- 5.5.4.2.4 Rest of Africa

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Argentina

- 5.5.5.3 Chile

- 5.5.5.4 Rest of South America

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Sealed Air Corporation

- 6.4.2 Pregis LLC

- 6.4.3 Intertape Polymer Group Inc.

- 6.4.4 Sonoco Products Company

- 6.4.5 Smurfit Westrock

- 6.4.6 Mondi Group

- 6.4.7 International Paper Company

- 6.4.8 Storopack Hans Reichenecker GmbH

- 6.4.9 Ranpak Holdings Corp.

- 6.4.10 Huhtamaki Oyj

- 6.4.11 Signode Industrial Group LLC

- 6.4.12 Crown Holdings Inc.

- 6.4.13 Amcor plc

- 6.4.14 Pro-Pac Packaging Ltd.

- 6.4.15 ProAmpac Holdings Inc.

- 6.4.16 Reflex Packaging LLC

- 6.4.17 Pactiv Evergreen Inc.

- 6.4.18 AirPack Systems Ltd.

- 6.4.19 Polyair Inter Pack Inc.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment