PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851251

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851251

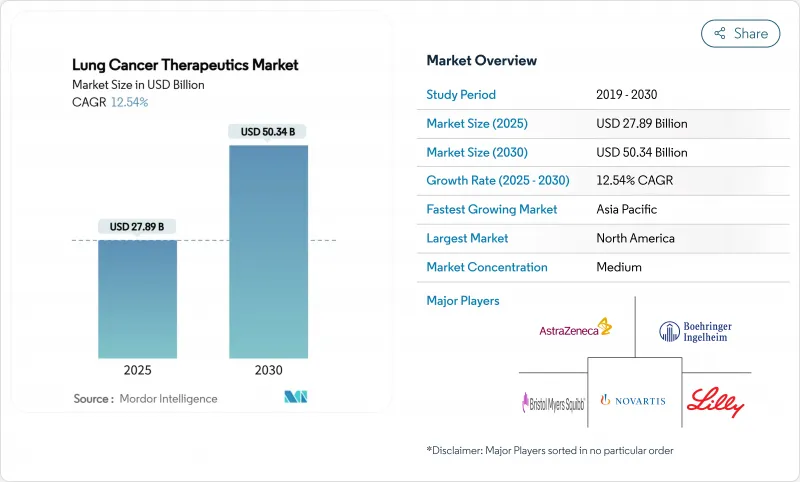

Lung Cancer Therapeutics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The lung cancer therapeutics market size stood at USD 27.89 billion in 2025 and is forecast to reach USD 50.34 billion by 2030, translating into a 12.54% CAGR.

Rapid gains stem from immuno-oncology breakthroughs, bispecific antibodies, and wider global reimbursement adoption that collectively lift treatment volumes. Regulatory agencies expedited 11 new non-small cell approvals after 2024, underscoring an innovation cycle that compresses development timelines and intensifies competition. Precision biomarker testing has moved from specialist to mainstream practice, enabling mutation-matched drug selection and pushing response rates higher for previously hard-to-treat patients. Wider insurance coverage across Asia-Pacific and Latin America improves affordability, while price pressure in mature markets continues to nudge manufacturers toward value-based agreements. Strategic consolidation around combination platforms is accelerating as companies seek to defend positions before major patent cliffs arrive.

Global Lung Cancer Therapeutics Market Trends and Insights

Rapid Adoption of Immuno-Oncology & Targeted Therapies

Checkpoint inhibitors combined with novel targets lift survival beyond legacy chemotherapy. Bispecific T-cell engagers such as tarlatamab post 40% objective responses in heavily pre-treated small-cell cases, while antibody-drug conjugates like datopotamab deruxtecan reach 45% responses in EGFR-mutated non-small-cell disease . Thirteen lung cancer indications cleared the FDA's accelerated pathway during 2024 alone, compressing launch cycles and intensifying rivalry . Combination regimens dominate pipelines as developers marry immune activation with mutation-specific blockade to blunt escape mechanisms. Biomarker-driven selection now guides most first-line decisions, enabling higher response depths and longer progression-free intervals. As new modalities gain first-line status, chemotherapy shifts toward a backbone role within multi-agent protocols rather than standalone therapy.

Precision-Medicine Biomarker Testing Uptake

Comprehensive molecular profiling is replacing histology-based selection. Next-generation sequencing panels, supported by FDA-cleared diagnostics such as the Oncomine Dx Express Test, are becoming standard for community oncologists . Actionable alterations cover EGFR, ALK, ROS1, KRAS, HER2, MET, and BRAF, now informing choices for more than 60% of non-small-cell cases. Liquid biopsy expands real-time resistance monitoring, allowing therapy switches before clinical progression. Declining sequencing costs, along with payer reimbursement, embed biomarker testing into routine care across higher-income Asia-Pacific markets. Wider panels create additional commercial niches for targeted agents, reinforcing a virtuous cycle of test adoption and drug development.

High Therapy Costs & Pricing Pressures

Annual courses often exceed USD 200,000, straining payers and patients. Durvalumab's acquisition price slowed global uptake despite survival benefit, with cost-effectiveness analyses finding unfavorable ratios in resource-constrained regions. Biosimilar pipelines for pembrolizumab and nivolumab are expected to erode pricing power, forcing originators into value-based deals. Combination regimens compound cost, and multi-year therapy durations magnify budget impact. Reference pricing frameworks in Europe and Latin America intensify discount expectations. Manufacturers respond by offering outcome guarantees and tiered pricing, yet access gaps persist in low-income countries.

Other drivers and restraints analyzed in the detailed report include:

- Emerging Cell & RNA-Based Therapy Pipeline

- Expanding Healthcare Reimbursement Coverage

- Looming Patent Cliffs for Blockbuster Drugs

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Non-small cell disease generated 77.23% of 2024 revenue within the lung cancer therapeutics market share, benefiting from broad biomarker-driven options and high incidence. The small-cell segment holds a smaller base yet is forecast to outpace at 13.21% CAGR through 2030, fueled by the first-in-class bispecific tarlatamab and checkpoint additions. The lung cancer therapeutics market size for small-cell therapy is therefore projected to climb swiftly from a low anchor point. Precision approaches in NSCLC, such as EGFR and KRAS inhibitors, keep that segment sizeable, but pipeline momentum is visibly shifting SCLC from neglect to opportunity.

Continued SCLC innovation narrows historic survival gaps. Tarlatamab reached 40% objective responses in heavily pre-treated cohorts, and durvalumab pushed median overall survival to 55.9 months in limited-stage settings. NSCLC pipelines add HER2 and MET inhibitors plus antibody-drug conjugates to re-intercept resistance, keeping volume leadership intact. Together, both segments illustrate a diversification that attracts specialized players while pushing incumbents to broaden portfolios.

Chemotherapy still accounted for 43.21% of 2024 revenue, yet immunotherapy is projected to climb at 13.24% CAGR, eroding monotherapy chemo reliance. Checkpoint inhibitors moved into first-line PD-L1-positive care, and bispecifics headline second-line SCLC protocols. The lung cancer therapeutics market size allocated to immunotherapy is forecast to double over the decade. Targeted agents add steady mid-single-digit growth by focusing on well-defined biomarkers.

Combination regimens are rising. Durvalumab plus chemotherapy extended survival in limited-stage SCLC, while chemo-IO combos dominate non-small cell first-line practice. As pipelines fill with T-cell engagers and antibody-drug conjugates, immunotherapy's reach broadens into biomarker-low populations, enlarging addressable demand while reshaping safety management norms.

The Lung Cancer Therapeutics Market Report is Segmented by Disease Type (Non-Small Cell Lung Cancer, Small Cell Lung Cancer, Others), Treatment Modality (Chemotherapy, and More), Drug Class (Small-Molecule Drugs, Biologics and Biosimilars), Distribution Channel (Hospital Pharmacies, and More), Line of Therapy (First-Line, and More), and Geography (North America, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America generated 39.19% of global revenue in 2024. Advanced trial infrastructure enables rapid translation from study to practice. Insurance systems fund high-cost regimens, though price negotiations tighten as biosimilars loom. Academic centers accelerate guideline updates, keeping adoption curves steep. Canada and Mexico participate through cross-border trials, widening patient access.

Asia-Pacific is the chief growth engine at 13.56% CAGR. China's reimbursement expansion and local innovation double-team to unlock suppressed demand. Japan's accelerated programs shorten review to 6 months for priority therapies, while Australia leverages expedited pathways for unmet-need cancers. India and Southeast Asia scale diagnostic capacity, installing NGS panels in tertiary hospitals. Economic development and urban pollution jointly increase lung burden, sustaining volume growth.

Europe exhibits steady mid-single-digit gains. Centralized EMA approvals speed simultaneous market launches, but reimbursement decisions remain country specific. Health technology assessment bodies focus on value thresholds, nudging manufacturers toward managed-entry agreements. Eastern European markets catch up through EU cohesion funding for oncology infrastructure. Brexit triggered parallel pathways in the United Kingdom, yet mutual recognition maintains most supply routes.

- Roche

- AstraZeneca

- Merck

- Bristol-Myers Squibb

- Pfizer

- Boehringer Ingelheim

- Eli Lilly and Company

- Novartis

- Johnson & Johnson

- Abbvie

- Amgen

- Sanofi

- Takeda Pharmaceuticals

- Daiichi Sankyo

- BeiGene

- Exelixis

- Innovent Biologics

- Clovis Oncology

- Blueprint Medicines

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing prevalence of lung cancer

- 4.2.2 Rising pollution & smoking rates

- 4.2.3 Rapid adoption of immuno-oncology & targeted therapies

- 4.2.4 Expanding healthcare reimbursement coverage

- 4.2.5 Precision-medicine driven biomarker testing uptake

- 4.2.6 Emerging cell & RNA-based therapies pipeline

- 4.3 Market Restraints

- 4.3.1 High therapy costs & pricing pressures

- 4.3.2 Severe immune-related adverse events

- 4.3.3 Looming patent cliffs for blockbuster drugs

- 4.3.4 Limited biopsy access in low-resource settings

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitutes

- 4.6.5 Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Disease Type

- 5.1.1 Non-Small Cell Lung Cancer (NSCLC)

- 5.1.2 Small Cell Lung Cancer (SCLC)

- 5.1.3 Others

- 5.2 By Treatment Modality

- 5.2.1 Chemotherapy

- 5.2.2 Immunotherapy

- 5.2.3 Targeted Therapy

- 5.3 By Drug Class

- 5.3.1 Small-Molecule Drugs

- 5.3.2 Biologics and Biosimilars

- 5.4 By Distribution Channel

- 5.4.1 Hospital Pharmacies

- 5.4.2 Retail Pharmacies

- 5.4.3 Online Pharmacies

- 5.5 By Line of Therapy

- 5.5.1 First-Line

- 5.5.2 Second-Line

- 5.5.3 Third-Line and Beyond

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 Europe

- 5.6.2.1 Germany

- 5.6.2.2 United Kingdom

- 5.6.2.3 France

- 5.6.2.4 Italy

- 5.6.2.5 Spain

- 5.6.2.6 Rest of Europe

- 5.6.3 Asia-Pacific

- 5.6.3.1 China

- 5.6.3.2 Japan

- 5.6.3.3 India

- 5.6.3.4 Australia

- 5.6.3.5 South Korea

- 5.6.3.6 Rest of Asia-Pacific

- 5.6.4 Middle East and Africa

- 5.6.4.1 GCC

- 5.6.4.2 South Africa

- 5.6.4.3 Rest of Middle East and Africa

- 5.6.5 South America

- 5.6.5.1 Brazil

- 5.6.5.2 Argentina

- 5.6.5.3 Rest of South America

- 5.6.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 F. Hoffman La Roche Ltd.

- 6.3.2 AstraZeneca

- 6.3.3 Merck & Co.

- 6.3.4 Bristol-Myers Squibb

- 6.3.5 Pfizer

- 6.3.6 Boehringer Ingelheim

- 6.3.7 Eli Lilly

- 6.3.8 Novartis

- 6.3.9 Johnson & Johnson (Janssen)

- 6.3.10 AbbVie

- 6.3.11 Amgen

- 6.3.12 Sanofi

- 6.3.13 Takeda

- 6.3.14 Daiichi Sankyo

- 6.3.15 BeiGene

- 6.3.16 Exelixis

- 6.3.17 Innovent Biologics

- 6.3.18 Clovis Oncology

- 6.3.19 Blueprint Medicines

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment