PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851254

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851254

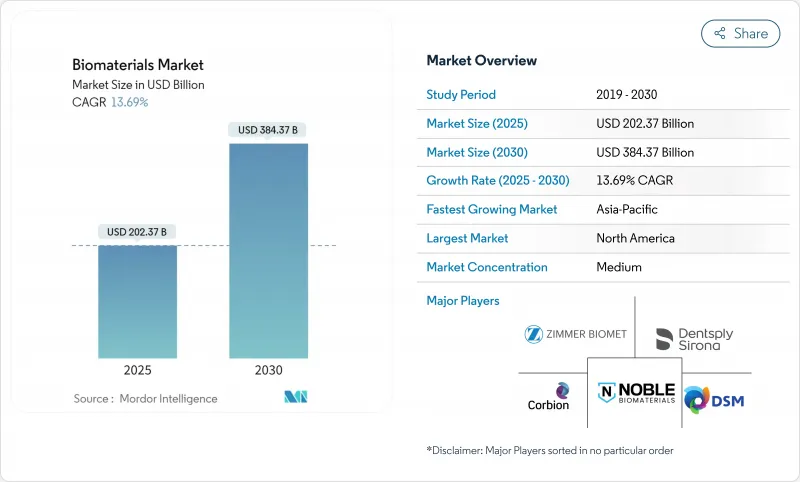

Biomaterials - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The biomaterials market size stands at USD 202.37 billion in 2025 and is forecast to reach USD 384.37 billion by 2030, advancing at a 13.69% CAGR throughout the period.

Growth gathers momentum from aging-driven procedure volumes, rapid regenerative medicine breakthroughs, and streamlined regulatory pathways. Polymeric materials keep demand buoyant thanks to their adaptability in cardiovascular stents and orthopedic inserts, while waste-derived natural materials expand quickly as circular-economy mandates intensify. North America benefits from 1,041 FDA breakthrough device designations that de-risk commercialization, yet Asia-Pacific outpaces with double-digit growth backed by China's fivefold rise in knee replacements and Japan's induced-pluripotent-stem-cell (iPSC) innovations. Strategic acquisitions-such as Enovis' EUR 800 million purchase of LimaCorporate-underscore vertical-integration moves aimed at buffering raw-material shortages and EU MDR compliance bottlenecks.

Global Biomaterials Market Trends and Insights

Aging population-led surge in joint-replacement volumes

Primary knee arthroplasty volumes in the United States alone are projected to climb 673% by 2030, and Germany anticipates a 55% rise in knee arthroplasties by 2040. Younger and more active patients now represent a majority of candidates, forcing implant developers to prioritize wear resistance and osseointegration longevity. Colombia projects 39,270 lower-limb arthroplasties by 2050, 52.7% of which will involve women, spurring gender-specific biomaterial formulations. The sustained procedure pipeline cushions the biomaterials market against traditional healthcare spending cycles.

Rapid advances in regenerative medicine & 3-D bioprinting

The Canadian government's CAD 72.75 million grant to Aspect Biosystems signals policy confidence in bioprinted tissues, while machine-learning-driven modelling achieves R2 > 0.999 for shape predictions in 4D scaffolds. FDA clearance of Symvess, the first acellular tissue-engineered vessel, establishes precedent and accelerates clinical translation. As regulatory clarity improves, venture activity spreads to Asia-Pacific, where Japan's iPSC-based corneal epithelial transplants underscore regional competitiveness.

High production & surgical costs of next-gen biomaterials

Inflation and supply chain shocks inflated contract manufacturing costs during 2024, while polytetrafluoroethylene shortages forced insourcing and inventory stockpiling, impairing cash flow for small device makers. Tantalum prices climbed to USD 5,190 per kg in 2023, tightening margins for specialty implant suppliers. EU MDR compliance adds 18-24 months and significant certification costs, prompting 50% of surveyed European firms to trim portfolios.

Other drivers and restraints analyzed in the detailed report include:

- Expansion of cardiovascular interventions using bio-stents

- Government R&D grants and fast-track approvals for breakthrough implants

- Lengthy multi-phase regulatory & clinical validation timelines

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Polymeric materials retained a 40.15% share of the biomaterials market in 2024, dominating cardiovascular and orthopedic uses. Fish-waste collagen and insect-derived chitosan speed natural-material uptake, driving a 14.67% CAGR that challenges polymeric supremacy. Composite hybrids marry metallic strength with polymeric elasticity, meeting load-bearing preferences in younger arthroplasty patients. Shape-memory polymers produced via 4D printing enable scaffolds that conform in vivo, a differentiator for tissue-engineering firms seeking reimbursement premiums.

Natural candidates also benefit from EU circular-economy incentives, accelerating collagen extraction from sardine scales and upcycling crustacean waste. Metallic biomaterials, though vulnerable to tantalum-and-niobium supply risks, remain indispensable in hip prostheses demanding high fatigue resistance. The biomaterials market continues to reward suppliers able to hedge raw-material volatility through recycling and dual-sourcing strategies.

The Biomaterials Market Report is Segmented by Material Type (Metals, Polymeric, Ceramic, Composite, Natural), Origin (Synthetic, Natural), Application (Orthopedic, Cardiovascular, Dental, Wound Healing, Neurology, Plastic Surgery, Tissue Engineering & Regeneration, Others), and Geography (North America, Europe, Asia-Pacific, South America, Middle East and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America held 42.23% of biomaterials market share in 2024, buoyed by 1,041 FDA breakthrough designations and heavy corporate R&D. Established reimbursement and robust surgeon training programs encourage rapid adoption of premium implants signals federal backing for bioprinting ventures.

Europe grapples with MDR bottlenecks-only 4,873 certificates were issued from 14,539 applications in 2023-delaying launches and prompting some manufacturers to withdraw legacy devices. Despite this, Germany expects knee-replacement incidence to climb 55% by 2040, guaranteeing demand once compliance hurdles ease. EU circular-bioeconomy grants also fast-track insect-derived chitosan plants, giving natural materials an early-mover edge.

Asia-Pacific charts the fastest 15.19% CAGR, propelled by China's fivefold jump in knee replacements and Japan's first-in-human iPSC corneal transplants. Even with venture funding down 22% from 2021 highs, the region's medtech sector still targets USD 225 billion in 2030 revenue, encouraging global OEMs to localize manufacturing. South Korea and Australia add capacity through advanced composite printing hubs, while India's growing middle class amplifies volume demand for cost-efficient implants.

- Johnson & Johnson

- Stryker

- Medtronic

- Evonik Industries

- Corbion NV (Purac)

- Zimmer Biomet

- Covestro

- BASF

- Celanese Corporation

- Invibio (Victrex plc)

- DSM Biomedical

- Berkeley Advanced Biomaterials

- Dentsply Sirona

- Carpenter Technology

- Collagen Solutions plc

- Straumann Group

- Organogenesis

- Precision Biomaterials Inc.

- Wright Medical (now Stryker)

- 3M Health Care

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Aging population-led surge in joint-replacement volumes

- 4.2.2 Rapid advances in regenerative medicine & 3-D bioprinting

- 4.2.3 Expansion of cardiovascular interventions using bio-stents

- 4.2.4 Government R&D grants and fast-track approvals for breakthrough implants

- 4.2.5 Emergence of 4-D stimuli-responsive biomaterials

- 4.2.6 Circular-bioeconomy push for waste-derived natural biomaterials

- 4.3 Market Restraints

- 4.3.1 High production & surgical costs of next-gen biomaterials

- 4.3.2 Lengthy multi-phase regulatory & clinical validation timelines

- 4.3.3 Supply-chain volatility for specialty alloying elements (e.g., Nb, Ta)

- 4.3.4 Environmental scrutiny over synthetic-polymer leachables

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Bargaining Power of Buyers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value, 2024-2030)

- 5.1 By Material Type

- 5.1.1 Metals

- 5.1.2 Polymeric

- 5.1.3 Ceramic

- 5.1.4 Composite

- 5.1.5 Natural

- 5.2 By Origin

- 5.2.1 Synthetic

- 5.2.2 Natural

- 5.3 By Application

- 5.3.1 Orthopedic

- 5.3.2 Cardiovascular

- 5.3.3 Dental

- 5.3.4 Wound Healing

- 5.3.5 Neurology

- 5.3.6 Plastic Surgery

- 5.3.7 Tissue Engineering & Regeneration

- 5.3.8 Others

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 India

- 5.4.3.3 Japan

- 5.4.3.4 Australia

- 5.4.3.5 South Korea

- 5.4.3.6 Rest of Asia-Pacific

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 GCC

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle East and Africa

- 5.4.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level Overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 Johnson & Johnson (DePuy Synthes)

- 6.3.2 Stryker Corporation

- 6.3.3 Medtronic plc

- 6.3.4 Evonik Industries AG

- 6.3.5 Corbion NV (Purac)

- 6.3.6 Zimmer Biomet Holdings Inc.

- 6.3.7 Covestro AG

- 6.3.8 BASF SE

- 6.3.9 Celanese Corporation

- 6.3.10 Invibio (Victrex plc)

- 6.3.11 DSM Biomedical

- 6.3.12 Berkeley Advanced Biomaterials

- 6.3.13 Dentsply Sirona

- 6.3.14 Carpenter Technology Corporation

- 6.3.15 Collagen Solutions plc

- 6.3.16 Straumann Holding AG

- 6.3.17 Organogenesis Inc.

- 6.3.18 Precision Biomaterials Inc.

- 6.3.19 Wright Medical (now Stryker)

- 6.3.20 3M Health Care

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment