PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851263

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851263

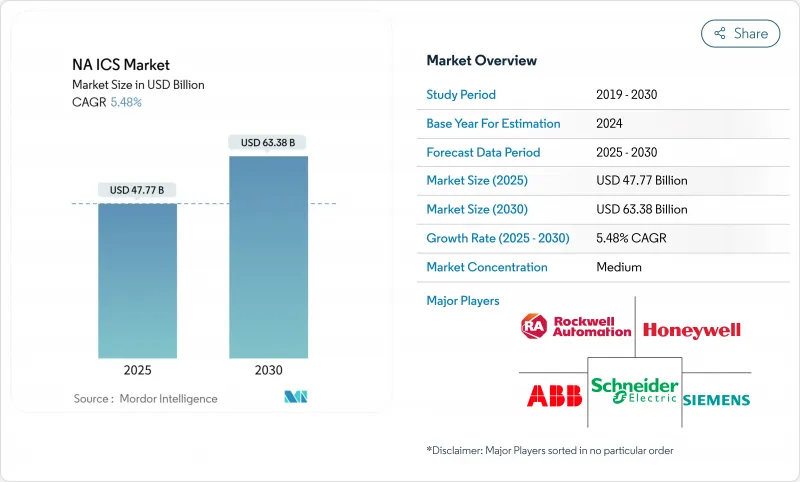

NA ICS - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The North American industrial control systems market size stands at USD 47.77 billion in 2025 and is projected to reach USD 63.38 billion by 2030, reflecting a 5.48% CAGR.

Hardware retains the largest revenue share at 57.2% in 2024, underpinned by steady investment in PLCs, distributed control hardware, and I/O modules. Demand is reinforced by the U.S. CHIPS Act, which has mobilized USD 450 billion of announced semiconductor capacity investments, easing component shortages and spurring new automation roll-outs. Industrial Ethernet accounted for 48.9% of installed communications in 2024, while wireless protocols advanced at a 10.4% CAGR as plants sought flexible connectivity. Although cloud deployments are expanding at 9.31% CAGR, 81% of installations remain on-premise because of latency-sensitive control loops and strict security policies. Automotive producers captured 18.6% of demand, yet pharmaceuticals are the fastest-growing end user at 9.1% CAGR as quality-by-design mandates intensify.

NA ICS Market Trends and Insights

Accelerated brown-field modernization across U.S. automotive plants

Automotive manufacturers are replacing fragmented control layers with unified architectures to boost flexibility and uptime. Audi's U.S. body shop adopted Siemens Simatic S7-1500V virtual controllers connected to its private cloud, merging IT and OT workflows and shortening change-over times. Only 31% of domestic factories have fully automated a function, highlighting large headroom for modernization. Kimberly-Clark's phased PLC-to-DCS migration illustrates the cautious pace: one line per year over a decade to limit downtime while embedding cybersecurity-ready platforms.

Growing cyber-physical safety standards adoption

Ninety-three percent of OT facilities reported an intrusion in the past 12 months, prompting rapid uptake of ISA/IEC 62443 frameworks that define zones, conduits, and continuous monitoring. The February 2025 ANSI/ISA-62443-2-1 update introduced a maturity model, allowing asset owners to tailor controls to risk profiles. Utilities and discrete manufacturers alike are structuring multi-layer defenses, reducing unplanned outages and insurance premiums.

Legacy brown-field systems with proprietary protocol lock-in

Plants built in the 1990s still rely on vendor-specific buses that complicate data acquisition and cloud connectivity. Phoenix Contact advises staged I/O migration to minimise shutdowns, yet integration crews must map thousands of legacy registers to modern object models-an effort that prolongs project timelines and inflates labor costs. Wood PLC notes that process-site lifecycles of 30 years make wholesale replacement impractical, obliging owners to fund dual-stack architectures for years.

Other drivers and restraints analyzed in the detailed report include:

- U.S. CHIPS Act-fuelled semiconductor capacity build-out

- Canada's net-zero grid mandate driving utility automation

- Capital-intensive retrofit costs for OSHA functional-safety

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Hardware contributed 57.2% of 2024 revenue, led by sustained orders for PLC racks, DCS nodes, and motor drives. ABB's Process Automation unit posted USD 6.8 billion of 2024 sales, showing continued appetite for capital equipment. Integration of edge analytics into controllers, such as Honeywell's ControlEdge PLC with embedded OPC UA and MQTT, is boosting sell-through of premium SKUs.

Services, though smaller, are scaling rapidly at 8.9% CAGR as owners outsource lifecycle support. Rockwell Automation's Lifecycle Services backlog reached USD 1.70 billion in September 2024, reflecting demand for outcome-based contracts that tie fees to availability gains. Skills shortages-3.5 million cybersecurity roles lacking by 2025-push maintenance and remote-monitoring agreements higher, elevating recurring revenue in the North American industrial control systems industry.

PLCs held 31.4% of the North American industrial control systems market size in 2024, valued for deterministic control and proven reliability. Rockwell's Logix controller family anchors automotive and food lines across the region. Vendors now ship PLCs with native CIP-Security and TLS encryption, reducing gateway dependencies.

MES platforms are expanding at 7.6% CAGR as manufacturers seek lot-level genealogy and order-to-batch synchronisation. Industry 4.0 roll-outs nearly doubled connected devices to 17 billion globally in 2024, creating data sets that MES converts into actionable production KPIs. Automotive OEMs use MES to coordinate robotic paint, battery assembly, and final inspection, shortening launch cycles and connecting enterprise resource planning.

The North American Industrial Control Systems Market Report is Segmented by Component (Hardware, Software, Services), Type of System (Supervisory Control & Data Acquisition, Distributed Control Systems, and More), Communication Protocol (Fieldbus, Industrial Ethernet, Wireless), Deployment Mode (On-Premise, Cloud, Hybrid), End-User Industry, and Geography. The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- ABB Ltd.

- Emerson Electric Co.

- General Electric Co.

- Honeywell International Inc.

- Johnson Controls International plc

- Mitsubishi Electric Corp.

- Omron Corp.

- Rockwell Automation Inc.

- Schneider Electric SE

- Siemens AG

- Yokogawa Electric Corp.

- Bosch Rexroth AG

- Phoenix Contact GmbH

- Advantech Co. Ltd.

- Eaton Corp. plc

- BandR Industrial Automation GmbH

- Beckhoff Automation GmbH

- FANUC Corp.

- Delta Electronics Inc.

- Hitachi Ltd.

- IDEC Corp.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Accelerated Brown-Field Modernization across U.S. Automotive Plants

- 4.2.2 Growing Cyber-physical Safety Standards (ISA/IEC 62443) Adoption

- 4.2.3 U.S. CHIPS Act-fuelled Semiconductor Capacity Build-out

- 4.2.4 Canada's Net-Zero Grid Mandate Driving Utility Automation

- 4.2.5 Rising Mid-stream LNG Investments in Gulf Coast

- 4.2.6 Edge-enabled Predictive Maintenance Roll-outs in Mexican OEMs

- 4.3 Market Restraints

- 4.3.1 Legacy Brown-field Systems with Proprietary Protocol Lock-in

- 4.3.2 Capital-intensive Retrofit Costs for OSHA Functional-Safety

- 4.3.3 Shortage of ISA-Certified OT-Cybersecurity Workforce

- 4.3.4 North American Supply-Chain Exposure to Rare-earth Magnet Imports

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Outlook

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

- 4.8 Investment Analysis

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Component

- 5.1.1 Hardware

- 5.1.2 Software

- 5.1.3 Services

- 5.2 By Type of System

- 5.2.1 SCADA (Supervisory Control and Data Acquisition)

- 5.2.2 DCS (Distributed Control Systems)

- 5.2.3 PLC (Programmable Logic Controller)

- 5.2.4 MES (Manufacturing Execution Systems)

- 5.2.5 PLM (Product Lifecycle Management)

- 5.2.6 ERP (Enterprise Resource Planning)

- 5.2.7 HMI (Human Machine Interface)

- 5.2.8 Others (OTS, Machine-safety)

- 5.3 By Communication Protocol

- 5.3.1 Fieldbus

- 5.3.2 Industrial Ethernet

- 5.3.3 Wireless

- 5.4 By Deployment Mode

- 5.4.1 On-premise

- 5.4.2 Cloud

- 5.4.3 Hybrid

- 5.5 By End-user Industry

- 5.5.1 Automotive

- 5.5.2 Chemical and Petrochemical

- 5.5.3 Utilities (Power and Water)

- 5.5.4 Pharmaceutical

- 5.5.5 Food and Beverage

- 5.5.6 Oil and Gas

- 5.5.7 Mining and Metals

- 5.5.8 Pulp and Paper

- 5.5.9 Others

- 5.6 By Country

- 5.6.1 United States

- 5.6.2 Canada

- 5.6.3 Mexico

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 ABB Ltd.

- 6.4.2 Emerson Electric Co.

- 6.4.3 General Electric Co.

- 6.4.4 Honeywell International Inc.

- 6.4.5 Johnson Controls International plc

- 6.4.6 Mitsubishi Electric Corp.

- 6.4.7 Omron Corp.

- 6.4.8 Rockwell Automation Inc.

- 6.4.9 Schneider Electric SE

- 6.4.10 Siemens AG

- 6.4.11 Yokogawa Electric Corp.

- 6.4.12 Bosch Rexroth AG

- 6.4.13 Phoenix Contact GmbH

- 6.4.14 Advantech Co. Ltd.

- 6.4.15 Eaton Corp. plc

- 6.4.16 BandR Industrial Automation GmbH

- 6.4.17 Beckhoff Automation GmbH

- 6.4.18 FANUC Corp.

- 6.4.19 Delta Electronics Inc.

- 6.4.20 Hitachi Ltd.

- 6.4.21 IDEC Corp.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment