PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851276

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851276

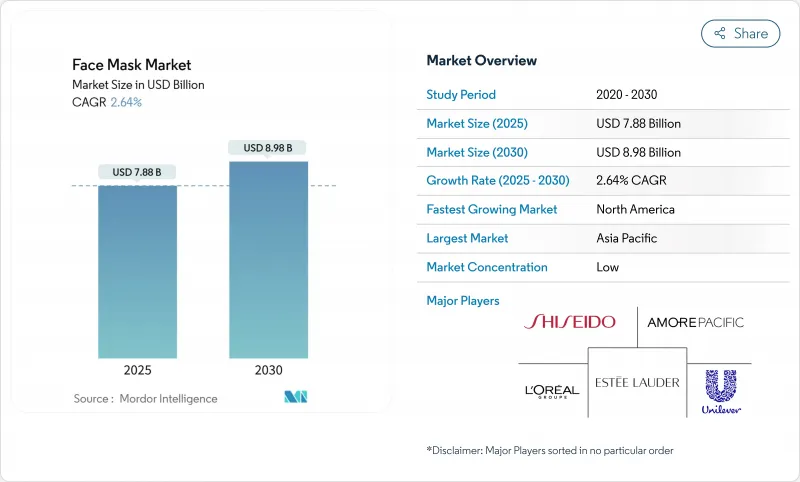

Face Mask - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The global face mask market, valued at USD 7.88 billion in 2025, is projected to reach USD 8.98 billion by 2030, reflecting a CAGR of 2.64% during the forecast period.

This growth is primarily driven by increasing consumer awareness of skincare routines, rising exposure to environmental pollutants, and a growing preference for natural and clean-label beauty products. Technological advancements in product formulations, such as the incorporation of antioxidants, probiotics, and anti-pollution agents, are significantly enhancing the effectiveness of face masks. Additionally, higher disposable incomes, the influence of social media, and the rapid expansion of e-commerce platforms have improved product visibility and accessibility, particularly in urban and emerging markets. The male grooming segment, though smaller in size, is steadily expanding as brands develop tailored solutions to address men's specific skincare needs. Furthermore, sustainability concerns are pushing manufacturers to innovate with biodegradable and eco-friendly mask formats, aligning with the increasing consumer demand for environmentally responsible products.

Global Face Mask Market Trends and Insights

Technological Innovations in terms of Ingredient and Functionality

Advanced ingredient technologies, leveraging peptide integration and nanotechnology, are enhancing the efficacy of facial masks. In response, regulatory bodies are rolling out new testing protocols to ensure these products are both safe and effective. Starting August 2025, China's National Medical Products Administration (NMPA) will implement measures for monitoring cosmetic safety risks. Meanwhile, the Food and Drug Administration (FDA), bolstered by its expanded authority under Modernization of Cosmetics Regulation Act (MoCRA), can now enforce mandatory recalls and require reporting of adverse events. This elevation in oversight sets a higher bar for technological advancements in cosmetic formulations. In Europe, the EU Cosmetic Regulation enforces strict safety compliance, pushing manufacturers to pivot towards biodegradable substitutes and natural ingredients that not only meet these standards but also deliver on efficacy. Such innovations, driven by regulatory demands, offer a competitive edge to companies adept at navigating the intricate approval maze, all while providing tangible benefits to consumers through scientifically-backed formulations.

Increased Air Pollution and Environmental Concerns

Urban pollution continues to drive the demand for facial mask formulations designed to protect and repair skin. Environmental agencies have reported a significant rise in skin health concerns in heavily polluted metropolitan areas. The European Investment Bank's 2024/2025 Investment Report highlights the EU's focus on green initiatives and decarbonization strategies, emphasizing how stringent environmental regulations are fostering innovation in sustainable cosmetics manufacturing. In the Asia-Pacific region, deteriorating air quality metrics reported by environmental protection agencies are directly linked to increased skincare product consumption. This trend is particularly evident in China and India, where pollution-protection skincare has become a growing regulatory priority. To address consumer concerns about both personal health and environmental impact, the industry is increasingly adopting biodegradable materials. Regulatory bodies are also introducing guidelines to promote sustainable packaging and eco-friendly formulations. Additionally, government initiatives aimed at improving air quality and protecting the environment are creating new market opportunities for brands that align their product development strategies with environmental policies and sustainability regulations.

Health Concern Over Chemical Ingredient

Health concerns over chemical ingredients, including parabens, sulfates, and artificial fragrances, are significantly restraining the global face mask market. An increasing number of consumers are wary of potential skin irritations, allergies, and long-term effects associated with the synthetic additives prevalent in face masks. This heightened preference for natural and clean-label products is driving brands to reformulate their products, steering clear of harsh chemicals. Moreover, stringent regulations in major markets, particularly the Europe and North America, are compelling manufacturers to prioritize ingredient safety and transparency. Collectively, these dynamics challenge market growth by diminishing the allure of conventional face masks for health-conscious consumers.

Other drivers and restraints analyzed in the detailed report include:

- Rising Consumer Spending on Skincare Products

- Influence of Social Media and Celebrity Endorsements

- Alternative and Traditional Methods of Skin Routine Practices

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

In 2024, cream and gel masks secured a leading 44.34% market share, driven by regulatory support for leave-on formulations that integrate effectively into comprehensive skincare routines. The FDA's cosmetic safety guidelines prioritize cream and gel formulations due to their stable ingredient delivery systems and lower risk of adverse reactions compared to harsher peel-off or chemical-based alternatives. Similarly, the EU Cosmetic Regulation establishes stringent safety standards that favor these formulations, highlighting their superior stability and ingredient compatibility during regulatory testing. Furthermore, government dermatological associations recommend cream-based treatments for sensitive skin conditions, reinforcing consumer demand for gentle, hydrating formulations that comply with clinical safety standards and cater to diverse skincare needs.

Clay masks exhibit the highest growth potential, with a projected CAGR of 2.96% through 2030, fueled by their purifying properties and regulatory endorsement of natural mineral ingredients. Additionally, government environmental agencies advocate for sustainable mining practices for cosmetic-grade clays, ensuring a stable and ethical supply chain for this expanding segment. Regulatory bodies across key markets enforce rigorous quality standards for clay ingredients, ensuring contamination-free products and consistent therapeutic benefits. These measures provide a competitive advantage to manufacturers that adhere to strict purity requirements and sustainable sourcing practices, positioning them favorably in the market.

In 2024, women accounted for a significant 57.44% share of the market, driven by comprehensive regulatory frameworks that address their specific skincare needs and safety requirements. Government health agencies play a pivotal role by providing gender-specific guidelines for cosmetic product safety, focusing on critical factors such as hormonal considerations and pregnancy-related restrictions. These regulations directly influence the formulation of products targeted at women. Additionally, European regulatory bodies enforce stringent testing protocols for products marketed to women, including endocrine disruption assessments, ensuring the long-term safety and reliability of products for this primary consumer group.

Driven by heightened skincare awareness and evolving views on male grooming, the men's segment is on a steady rise, eyeing a CAGR of 3.26% through 2030. Factors such as increasing disposable incomes, urban living, and the sway of social media are nudging men towards face masks, addressing concerns from hydration to anti-aging. In response, brands are unveiling products tailored for men, featuring distinct scents and packaging. Moreover, the surge in popularity of convenient formats, like sheet and peel-off masks, underscores the burgeoning prospects in the male skincare arena.

The Face Mask Market Report is Segmented by Product Type (Clay Mask, Peel-Off Mask, Sheet Mask, and Cream Mask/Gel Mask), End User (Men and Women), Ingredient (Natural and Organic and Conventional), Distribution Channel (Supermarkets/Hypermarkets, Specialty Stores, and More), and Geography (North America, Europe, Asia-Pacific, South America, and Middle East and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

In 2024, Asia-Pacific retained its dominant position in the market, accounting for a substantial 73.48% share. This leadership is driven by a combination of government initiatives that promote traditional beauty practices, advancements in modern cosmetic technologies, and regulatory harmonization across regional markets. Government trade promotion agencies in the region actively support cosmetic exports by fostering favorable regulatory environments for facial mask production and international distribution. The Association of Southeast Asian Nations (ASEAN) has implemented harmonized cosmetic regulations, simplifying cross-border trade and reducing compliance costs for manufacturers. Additionally, public funding provided to research institutions in Japan and South Korea is accelerating innovation in facial mask formulations and manufacturing processes, further strengthening the region's competitive edge.

North America is emerging as the fastest-growing region, with a projected CAGR of 4.75% through 2030. This growth is underpinned by regulatory modernization under the Modernization of Cosmetics Regulation Act (MoCRA) and government initiatives aimed at bolstering domestic cosmetic manufacturing. The FDA's expanded authority under MoCRA ensures comprehensive safety oversight, which enhances consumer confidence and supports the positioning of premium products in the market. Furthermore, government economic development agencies are offering incentives to encourage local cosmetic production, reducing reliance on imports and fostering the development of robust domestic supply chains.

Europe, as a mature market, continues to prioritize sustainability and clean formulations. Europe is a leader in developing innovative eco-friendly packaging solutions. In South America, countries such as Brazil and Argentina are experiencing rising disposable incomes and a growing sophistication in beauty culture, presenting significant opportunities for international brands to expand their presence. Meanwhile, the Middle East and Africa are witnessing increasing consumer sophistication, signaling strong growth potential in regions that have traditionally been underserved by premium facial mask brands. These trends highlight the evolving dynamics of the global facial mask market and the opportunities for growth across diverse regions.

- L'Oreal S.A.

- The Estee Lauder Companies Inc.

- Unilever PLC

- Shiseido Company, Limited

- Amorepacific Corporation

- Kenvue

- Natura & Co Holding S.A.

- Kao Corporation

- Himalaya Global Holdings Ltd.

- Tony Moly

- Honasa Consumer Limited

- Beiersdorf AG

- Procter and Gamble Company

- Herbivore Botanicals

- LVMH Moet Hennessy Louis Vuitton SE

- Church & Dwight Co., Inc.

- Coty Inc.

- Oriflame Holding AG

- Groupe Rocher

- Kose Corporation

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Technological Innovations in terms of Ingredient and Functionality

- 4.2.2 Increased Air Pollution and Environmental Concerns

- 4.2.3 Rising Consumer Spending on Skincare Products

- 4.2.4 Influence of Social Media and Celebrity Endorsements

- 4.2.5 Increasing Prevalence of Skin Issues

- 4.2.6 Demand for Natural, Organic, and Clean Facial Care Products

- 4.3 Market Restraints

- 4.3.1 Health Concern Over Chemical Ingredient

- 4.3.2 Alternative and Traditional Methods of Skin Routine Practices

- 4.3.3 Skin Sensitivity and Allergic Reactions

- 4.3.4 Supply Chain and Raw Material Constraints

- 4.4 Consumer Behaviour Analysis

- 4.5 Regulatory Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitutes

- 4.6.5 Degree of Competition

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Product Type

- 5.1.1 Clay Mask

- 5.1.2 Peel-Off Mask

- 5.1.3 Sheet Mask

- 5.1.4 Cream Mask/Gel Mask

- 5.2 By End User

- 5.2.1 Men

- 5.2.2 Women

- 5.3 By Ingredient

- 5.3.1 Natural and Organic

- 5.3.2 Conventional

- 5.4 By Distribution Channel

- 5.4.1 Supermarkets/Hypermarkets

- 5.4.2 Specialty Stores

- 5.4.3 Online Retail Stores

- 5.4.4 Other Distribution Channels

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.1.4 Rest of North America

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 Italy

- 5.5.2.4 France

- 5.5.2.5 Spain

- 5.5.2.6 Netherlands

- 5.5.2.7 Poland

- 5.5.2.8 Belgium

- 5.5.2.9 Sweden

- 5.5.2.10 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 India

- 5.5.3.3 Japan

- 5.5.3.4 Australia

- 5.5.3.5 Indonesia

- 5.5.3.6 South Korea

- 5.5.3.7 Thailand

- 5.5.3.8 Singapore

- 5.5.3.9 Rest of Asia-Pacific

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Colombia

- 5.5.4.4 Chile

- 5.5.4.5 Peru

- 5.5.4.6 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 South Africa

- 5.5.5.2 Saudi Arabia

- 5.5.5.3 United Arab Emirates

- 5.5.5.4 Nigeria

- 5.5.5.5 Egypt

- 5.5.5.6 Morocco

- 5.5.5.7 Turkey

- 5.5.5.8 Rest of Middle East and Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (Includes Global-level Overview, Market-level Overview, Core Segments, Financials (if available), Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 L'Oreal S.A.

- 6.4.2 The Estee Lauder Companies Inc.

- 6.4.3 Unilever PLC

- 6.4.4 Shiseido Company, Limited

- 6.4.5 Amorepacific Corporation

- 6.4.6 Kenvue

- 6.4.7 Natura & Co Holding S.A.

- 6.4.8 Kao Corporation

- 6.4.9 Himalaya Global Holdings Ltd.

- 6.4.10 Tony Moly

- 6.4.11 Honasa Consumer Limited

- 6.4.12 Beiersdorf AG

- 6.4.13 Procter and Gamble Company

- 6.4.14 Herbivore Botanicals

- 6.4.15 LVMH Moet Hennessy Louis Vuitton SE

- 6.4.16 Church & Dwight Co., Inc.

- 6.4.17 Coty Inc.

- 6.4.18 Oriflame Holding AG

- 6.4.19 Groupe Rocher

- 6.4.20 Kose Corporation

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK