PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851278

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851278

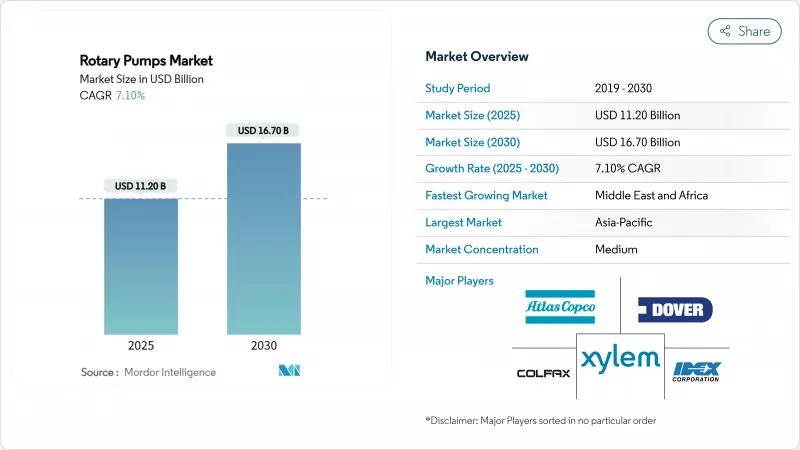

Rotary Pumps - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The rotary pumps market is valued at USD 11.2 billion in 2025 and is forecast to reach USD 16.7 billion by 2030, advancing at a 7.1% CAGR.

Rising brownfield upgrades across Middle East oil assets, China's record refining throughput, and Brazil's new-generation FPSOs are expanding demand for API-676 compliant units capable of handling high-viscosity and multiphase fluids. Strict clean-in-place mandates under the US Food Safety Modernization Act and Europe's hygienic directives spur uptake of food-grade gear and eccentric-disc designs. Energy-sector retrofit programs favour pump replacement studies that cut energy use and emissions, while petrochemical operators integrate rotary pumps with smart sensors to improve uptime and reduce flaring. Technology upgrades toward dry-gas or seal-less configurations help users meet tightening VOC rules, and aftermarket opportunities grow as 26-year FPSO charters guarantee long service contracts.

Global Rotary Pumps Market Trends and Insights

Energy-sector brownfield upgrades

Middle East national oil companies are modernizing mature fields to extend asset life and sustain production. Kuwait Oil Company is overhauling 14 gathering centers in Greater Burgan with new separation trains that need rotary pumps tolerant of emulsions and high sand content. Abu Dhabi Marine Operating Company is modifying the Zakum West and Central super complexes to keep 425,000 barrels per day flowing, which requires pumps engineered for variable viscosity crude under corrosive offshore conditions. Saudi Aramco optimised stabilizer bottom pumps at the Khurais central plant, cutting energy while processing 1,263,000 barrels per day. These retrofits specify API-676 compliant twin-screw and gear pumps with upgraded metallurgy and variable-speed drives that manage polymer-rich fluids and steam-injection temperatures. Suppliers gain aftermarket revenues from swap-out programs that replace decades-old units with digitally monitored models.

Petrochemical capacity additions

China processed 14.8 million barrels per day of crude in 2024 and keeps adding integrated refinery-petrochemical complexes, including the 400,000 barrels per day Yulong project scheduled for 2025. Such hubs rely on rotary pumps for naphtha hydrotreating, LPG transfer, and polymer feed handling where downtime cascades across the site. India plans USD 142 billion in petrochemical investment that will push capacity to 46 million tonnes by 2030, highlighted by Nayara Energy's USD 8 billion ethane cracker at Vadinar. Public refiners IndianOil, BPCL, and HPCL are each adding polypropylene trains that demand screw and gear pumps able to handle molten monomers at 240 °C. All-electric refinery concepts and zero-flaring mandates drive adoption of seal-less magnetic-drive units that curb fugitive emissions.

Availability of low-cost counterfeit spares from unorganised Asian vendors

Uncertified impellers, bushings, and seal kits entering supply chains threaten safety and shorten mean-time-between-failure. ADMA-OPCO's counterfeit-prevention program trains inspectors and locks vendors to approved lists. Chinese OEMs still invest less than 2% of sales in RandD, constraining quality upgrades that could combat counterfeit perception gaps. Buyers choose imported pumps, reinforcing a grey market where fake parts appear genuine and undermine warranties.

Other drivers and restraints analyzed in the detailed report include:

- Recovery of offshore FPSO construction

- Food-grade gear pump uptake under FSMA

- Strict VOC-emission rules limiting mechanical-seal selection for rotary pumps

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

External-gear pumps held 32% of the rotary pumps market share in 2024 due to their robust design for medium-viscosity duties. Twin-screw units deliver the fastest 7.71% CAGR as FPSO topsides and polymer services need smooth flow with minimal pulsation. From 2019-2024, external-gear variants posted 3.2% annual growth, while twin-screw advanced at 6.8%, reflecting a shift toward higher performance. Internal-gear crescent pumps cater to confectionery and pharma batches that demand gentle handling. Vane pumps continue in automotive lube circuits but face energy-efficiency pressure. The rise of IIoT-ready gearboxes lets operators monitor clearances and adjust speed to avoid cavitation.

Adoption of twin-screw assemblies in enhanced oil recovery improves shear tolerance and gas-locking resistance. SMU-coded API-676 machines run at lower RPM, extending seal life. Integration with cloud analytics flags wear well before flow-rate drift, cutting unplanned downtime. OEMs differentiate with HVOF-coated rotors that survive polymer abrasives. External-gear models remain favoured in cost-sensitive blender skids were standardised parts lower maintenance. Patent activity focuses on helical screw profiles that reduce noise and allow higher discharge pressures without increasing footprint.

The oil and gas segment retained 27.5% share of the rotary pumps market in 2024 as refineries, pipelines, and tank farms demand API-compliant equipment. However, food and beverage post the quickest 7.91% CAGR through 2030 as FSMA and EC1935 rules tighten hygiene expectations. From 2019-2024, oil and gas grew 4.1% annually, while food and beverage rose 6.9%. Power generation also lifts demand, illustrated by Flowserve's >USD 100 million nuclear orders in three straight quarters. Chemical and petrochemical operators specify seal-less pumps that handle corrosive monomers at temperatures above 200 °C.

Food processors switch to stainless internal-gear pumps for chocolate and syrup transfer, citing 50% productivity gains at Midleton Distilleries. Craft brewers in Europe adopt low-shear lobe pumps from INOXPA that sustain yeast viability. Water utilities evaluate rotary lobe blowers that cut energy by 30%, but high-speed turbos compete on large plants. Petrochemical majors integrate rotary pumps with digital twins to simulate cavitation and schedule maintenance around cracker turnarounds.

Rotary Pumps Market Report is Segmented by Type (External-Gear, Internal-Gear, and More), End-User Industry (Oil and Gas, Power Generation, and More), Discharge Pressure (Up To 10 Bar, 10-25 Bar, 25-100 Bar, Above 100 Bar), Pump Capacity (Up To 50, 51-150, 151-500, Above 500), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific commands 38.4% share of the rotary pumps market in 2024, led by China's sale of more than 13.5 million pump units yearly. Beijing's subsidies for energy-efficient gear drives and urban water projects underpin demand. India's USD 142 billion petrochemical plan lifts domestic pump manufacturing and draws global OEM licensing deals. Japan supplies precision metering pumps for semiconductor rinse lines, while South Korea's shipyards adopt API-676 twin-screw units for VLCC engine rooms.

The Middle East posts the fastest 7.81% CAGR as Kuwait and Abu Dhabi upgrade separation trains and Saudi Aramco cuts energy via pump rerates. Brownfield work favours screw pumps that handle sand-laden emulsions without cavitation. QatarGas invests in low-flow internal-gear pumps for LNG boil-off, tackling methane regulations. National champions create local-content thresholds that drive new assembly hubs in Dammam and Muscat.

North America is a mature but technologically advanced market. FSMA rules raise gear-pump sales in dairy and brewing, while shale producers fit magnetically coupled pumps to curb VOCs. Sulzer invested CHF 10 million in Easley, South Carolina, adding submersible lines to meet Build America mandates. Canada's oil-sands operators swap diluent pumps for twin-screw models that handle 30% gas volume fraction at sub-zero temperatures.

Europe emphasizes emissions. Revised TA-Luft pushes refineries toward dry-gas seals, and the region's craft breweries adopt hygienic rotary lobe pumps. Norway's electrified offshore fields specify seal-less water-injection pumps to limit methane. EU grants under Horizon programs support digital-twin research for chemical pumps.

South America benefits from Brazil's USD 8 billion FPSO spree. Local content at 25% on P-85 lifts demand for Brazilian-machined casings. Argentina's Vaca Muerta shale develops gas-processing plants that need high-pressure screw pumps. Colombia's biodiesel expansion installs stainless steel gear pumps for palm oil feedstock.

Sub-Saharan Africa grows from a small base but faces maintenance skill gaps that limit adoption of advanced screw pumps. Nigerian modular refineries choose low-cost external-gear units, while South Africa's mining pumps retrofit IIoT sensors to combat theft.

- Dover Corporation (Pump Solutions Group)

- IDEX Corporation (Viking Pump)

- Colfax Corporation (IMO / Allweiler)

- SPX Flow Inc.

- Xylem Inc.

- Atlas Copco AB

- Gardner Denver Holdings Inc.

- Pfeiffer Vacuum Technology AG

- ULVAC Inc.

- Busch SE

- Flowserve Corporation

- KSB SE & Co. KGaA

- Netzsch Pumpen & Systeme GmbH

- Alfa Laval AB

- PCM SA

- Seepex GmbH

- ITT Inc.

- Sulzer Ltd.

- DESMI A/S

- Kirloskar Brothers Ltd.

- Verder Group

- Roto Pumps Ltd.

- Tuthill Corporation

- Blackmer (PSG brand)

- Vogelsang GmbH & Co. KG

- Roper Technologies Inc. (Roper Pump Company)

- Leistritz AG

- Eureka Pumps AS

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

5 MARKET OVERVIEW

- 5.1 Market Drivers

- 5.1.1 Energy-sector brown-field upgrades driving high-viscosity fluid handling demand (Middle East)

- 5.1.2 Petrochemical capacity additions in China and India requiring API-676 compliant rotary pumps

- 5.1.3 Recovery of offshore FPSO construction in Brazil boosting twin-screw pump orders

- 5.1.4 Food-grade gear pump uptake amid U.S. FSMA clean-in-place mandates

- 5.1.5 Rising European craft-brewery installations favoring low-shear lobe pumps

- 5.2 Market Restraints

- 5.2.1 Availability of low-cost counterfeit spares from unorganised Asian vendors

- 5.2.2 Strict VOC-emission rules limiting mechanical-seal selection for rotary pumps in EU

- 5.2.3 High upfront cost versus centrifugal alternatives in municipal water plants

- 5.2.4 Skilled-labour shortage for screw-pump maintenance in Sub-Saharan Africa

- 5.3 Value / Supply-Chain Analysis

- 5.4 Regulatory or Technological Outlook

- 5.5 Porter's Five Forces Analysis

- 5.5.1 Threat of New Entrants

- 5.5.2 Bargaining Power of Buyers

- 5.5.3 Bargaining Power of Suppliers

- 5.5.4 Threat of Substitutes

- 5.5.5 Competitive Rivalry

6 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 6.1 By Type

- 6.1.1 External-Gear

- 6.1.2 Internal-Gear

- 6.1.3 Twin-Screw

- 6.1.4 Triple-Screw

- 6.1.5 Vane

- 6.2 By End-user Industry

- 6.2.1 Oil and Gas (Upstream, Midstream, Downstream)

- 6.2.2 Power Generation (Conventional, Nuclear, Renewables)

- 6.2.3 Chemicals and Petrochemicals

- 6.2.4 Food and Beverage

- 6.2.5 Water and Waste-water

- 6.3 By Discharge Pressure

- 6.3.1 Up to 10 bar

- 6.3.2 10-25 bar

- 6.3.3 25-100 bar

- 6.3.4 Above 100 bar

- 6.4 By Pump Capacity (m3/h)

- 6.4.1 Up to 50

- 6.4.2 51-150

- 6.4.3 151-500

- 6.4.4 Above 500

- 6.5 By Geography

- 6.5.1 North America

- 6.5.1.1 United States

- 6.5.1.2 Canada

- 6.5.1.3 Mexico

- 6.5.2 Europe

- 6.5.2.1 United Kingdom

- 6.5.2.2 Germany

- 6.5.2.3 France

- 6.5.2.4 Italy

- 6.5.2.5 Rest of Europe

- 6.5.3 Asia-Pacific

- 6.5.3.1 China

- 6.5.3.2 Japan

- 6.5.3.3 India

- 6.5.3.4 South Korea

- 6.5.3.5 Rest of Asia-Pacific

- 6.5.4 Middle East

- 6.5.4.1 Israel

- 6.5.4.2 Saudi Arabia

- 6.5.4.3 United Arab Emirates

- 6.5.4.4 Turkey

- 6.5.4.5 Rest of Middle East

- 6.5.5 Africa

- 6.5.5.1 South Africa

- 6.5.5.2 Egypt

- 6.5.5.3 Rest of Africa

- 6.5.6 South America

- 6.5.6.1 Brazil

- 6.5.6.2 Argentina

- 6.5.6.3 Rest of South America

- 6.5.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Market Concentration

- 7.2 Strategic Moves (M&A, JV, Capacity Expansion, Contracts)

- 7.3 Market Share Analysis

- 7.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials, Strategic Information, Market Rank/Share, Products & Services, Recent Developments)

- 7.4.1 Dover Corporation (Pump Solutions Group)

- 7.4.2 IDEX Corporation (Viking Pump)

- 7.4.3 Colfax Corporation (IMO / Allweiler)

- 7.4.4 SPX Flow Inc.

- 7.4.5 Xylem Inc.

- 7.4.6 Atlas Copco AB

- 7.4.7 Gardner Denver Holdings Inc.

- 7.4.8 Pfeiffer Vacuum Technology AG

- 7.4.9 ULVAC Inc.

- 7.4.10 Busch SE

- 7.4.11 Flowserve Corporation

- 7.4.12 KSB SE & Co. KGaA

- 7.4.13 Netzsch Pumpen & Systeme GmbH

- 7.4.14 Alfa Laval AB

- 7.4.15 PCM SA

- 7.4.16 Seepex GmbH

- 7.4.17 ITT Inc.

- 7.4.18 Sulzer Ltd.

- 7.4.19 DESMI A/S

- 7.4.20 Kirloskar Brothers Ltd.

- 7.4.21 Verder Group

- 7.4.22 Roto Pumps Ltd.

- 7.4.23 Tuthill Corporation

- 7.4.24 Blackmer (PSG brand)

- 7.4.25 Vogelsang GmbH & Co. KG

- 7.4.26 Roper Technologies Inc. (Roper Pump Company)

- 7.4.27 Leistritz AG

- 7.4.28 Eureka Pumps AS

8 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 8.1 White-space and Unmet-Need Assessment