PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851281

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851281

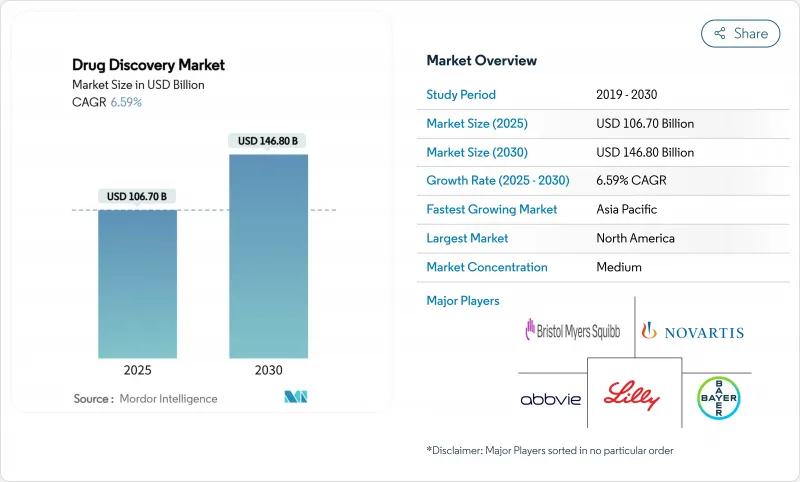

Drug Discovery - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The global drug discovery market size stands at USD 106.70 billion in 2025 and is forecast to reach USD 146.80 billion by 2030, expanding at a 6.59% CAGR.

Growth is propelled by rising chronic disease prevalence, sustained R&D spending, and the accelerating adoption of artificial intelligence across discovery workflows. Large pharmaceutical companies are directing resources toward late-stage assets, while biotechnology firms leverage agile operating models to advance novel modalities. Artificial intelligence shortens candidate identification from years to months and reduces pre-clinical costs, encouraging wider participation from mid-tier players. Precision medicine is steering investment toward targeted therapies and rare-disease programs, and supportive regulatory initiatives are refining expedited pathways for high-unmet-need indications.

Global Drug Discovery Market Trends and Insights

Increasing Prevalence of Chronic and Rare Diseases

Chronic and rare conditions are redefining program priorities, with oncology alone attracting 41% of active projects due to high unmet need and commercial potential. Neuroscience pipelines are also expanding as companies pursue therapies for Alzheimer's disease, essential tremor, and other debilitating disorders. The trend extends to orphan indications: 88% of novel cell and gene therapies approved in 2024 carried Orphan Drug designations, underscoring a pivot toward smaller, genetically defined populations. Investment in rare disease research drives sophisticated biomarker strategies, improving target validation and de-risking early development. These dynamics collectively lift demand for advanced discovery platforms and attract specialized capital, bolstering long-run growth of the drug discovery market.

Rising Investment From Pharmaceutical and Biotechnology Companies

Global R&D returns rose to 5.9% in 2024 after the launch of 29 blockbuster drugs, prompting companies to channel resources into late-stage assets with clearer paths to market. Venture funding in life sciences increased 10% year-over-year in Q3 2024, reflecting renewed confidence despite macroeconomic uncertainty. Partnerships surged, with 105 AI-centric discovery deals registered in 2025 as firms sought computational expertise to boost productivity. Capital is becoming more selective, favoring programs with strong mechanistic rationale, regulatory clarity, and differentiated value propositions. Sustained inflows underpin a robust innovation cycle, supporting the expansion of the drug discovery market.

High Cost and Lengthy Development Timelines

Average outlay per successful asset climbed to USD 2.23 billion, a burden acutely felt by small and mid-cap innovators. Traditional 10-15-year pathways strain capital and delay patient access, especially for complex modalities requiring bespoke manufacturing. Opportunity costs rise as funds remain tied up in protracted programs. Companies counter these pressures by embracing AI-enabled platforms that cut pre-clinical discovery by four years and slash experimental iterations. Risk-sharing collaborations distribute costs, while contract research organizations provide modular capacity, yet financing constraints persist in regions lacking deep capital markets, tempering overall drug discovery market growth.

Other drivers and restraints analyzed in the detailed report include:

- Growing Adoption of Artificial Intelligence and Machine Learning in Drug Discovery

- Increasing Focus on Personalized Medicine and Targeted Therapies

- Stringent Regulatory Requirements

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Cell and gene therapy candidates expand at a 12.8% CAGR, eclipsing overall drug discovery market growth as curative potential shifts investment priorities. The pipeline of 4,418 advanced therapies reflects surging developer interest, while eight U.S. approvals in 2024 validate regulatory momentum. Small molecules still command 56% of drug discovery market size due to predictable chemistry and established manufacturing, yet growth is decelerating relative to biologics. RNA therapeutics illustrate modality convergence, bridging small-molecule versatility and biologic specificity with projected USD 30 billion sales by 2030. Developers increasingly select modalities based on molecular pathology rather than legacy capability, a strategic realignment reinforcing the dynamism of the drug discovery market.

Adoption of vector engineering and allogeneic cell platforms is improving scalability and lowering cost of goods, enabling wider commercial viability for gene therapies. Meanwhile, peptide and oligonucleotide platforms offer rapid synthesis and favorable toxicity profiles for intracellular targets historically deemed undruggable. Collectively, these shifts diversify the drug discovery market and recalibrate competitive strategies toward platform versatility and modality-agnostic pipelines.

AI-driven CADD grows at a 13.2% CAGR, underpinned by transformer models capable of generating novel chemical entities with optimized ADMET properties. Predictive algorithms evaluate millions of variants in silico, reducing reliance on brute-force screening and trimming cycles in medicinal chemistry. In contrast, high-throughput screening retains the largest share at 32% of the drug discovery market size by leveraging massive compound libraries and established robotics. Integration, not substitution, is the prevailing trend: teams use AI to triage libraries, then deploy HTS on refined subsets, combining computational insight with empirical validation to maximize hit quality.

Pharmacogenomics gains traction by linking genetic variants to drug response, enhancing trial design and post-marketing safety. DNA-encoded libraries offer combinatorial reach while enabling affinity-based selection, complementing AI chemistries. Nanotechnology introduces carrier systems that improve solubility and tissue penetration, broadening target space. Companies that orchestrate these technologies through unified data environments gain speed, accuracy, and lower attrition, thereby enlarging the drug discovery market share of integrated platforms.

The Drug Discovery Market Report is Segmented by Drug Type (Small Molecule, Biologic, and More), Technology (High Throughput Screening, Pharmacogenomics, and More), Process Workflow (Target Identification, Target Validation, and More), Therapeutic Area (Oncology, and More), End User (Pharmaceutical Companies, and More), and Geography (North America, Europe, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America led with 35% of the drug discovery market size in 2024, supported by deep research infrastructure, abundant capital, and seven FDA approvals for advanced therapies in the same year. Venture funding resilience and policy frameworks such as the Rare Disease Innovation Hub sustain momentum. However, average per-drug costs rising to USD 2.23 billion challenge smaller enterprises, spurring adoption of AI-enabled efficiency tools and encouraging cross-border outsourcing of selected functions.

Asia-Pacific is the fastest-growing region, poised for a 10.8% CAGR through 2030. Governments in China, South Korea, and Japan promote AI-rich innovation clusters, streamline trial regulations, and subsidize infrastructure. China alone contributes 23% of global pipeline candidates, reflecting the region's mounting scientific capacity and large patient pools. Antibody-drug conjugate research flourishes, and clinical trial outsourcing benefits from cost-effective operations, reinforcing the region's contribution to the expanding drug discovery market.

Europe maintains a robust scientific base, leveraging Horizon Europe funding mechanisms and pan-EU initiatives aiming to harmonize regulatory review. Focus areas include rare diseases and advanced therapies, with academic-industry consortia accelerating translation. The Middle East & Africa build targeted capabilities in diseases of regional prevalence, supported by sovereign-wealth investment in life-science parks. South America emphasizes natural-product discovery, benefiting from its biodiversity and the NIH's 500,000-sample natural-product library. Cross-regional collaboration intensifies, enabling access to diverse expertise, reducing single-market risk, and collectively enlarging the drug discovery market.

- Pfizer

- Novartis

- Roche

- Merck

- AstraZeneca

- Bristol-Myers Squibb

- Abbvie

- Eli Lilly and Company

- Takeda Pharmaceutical Co.

- Sanofi

- Bayer

- GlaxoSmithKline

- Amgen

- Gilead Sciences

- Boehringer Ingelheim

- Johnson & Johnson

- Charles River Laboratories Intl.

- Evotec

- Thermo Fisher Scientific

- Syngene International

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing Prevalence Of Chronic And Rare Diseases

- 4.2.2 Rising Investment From Pharmaceutical And Biotechnology Companies

- 4.2.3 Growing Adoption Of Artificial Intelligence And Machine Learning In Drug Discovery

- 4.2.4 Increasing Focus On Personalized Medicine and Targeted Therapies

- 4.2.5 Advances In Genomics And Proteomics Technologies

- 4.3 Market Restraints

- 4.3.1 High Cost And Lengthy Development Timelines

- 4.3.2 Stringent Regulatory Requirements

- 4.3.3 Limited Access To Advanced Technologies In Emerging Markets

- 4.4 Technological Outlook

- 4.5 Porter's Five Forces

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitutes

- 4.5.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Drug Type

- 5.1.1 Small Molecule

- 5.1.2 Biologic

- 5.1.3 Cell & Gene-therapy Candidates

- 5.1.4 Peptide & Oligonucleotide Drugs

- 5.2 By Technology

- 5.2.1 High-Throughput Screening (HTS)

- 5.2.2 Computer-Aided Drug Design (CADD) & AI Platforms

- 5.2.3 Pharmacogenomics

- 5.2.4 Combinatorial Chemistry

- 5.2.5 DNA-Encoded Libraries

- 5.2.6 Nanotechnology-enabled Discovery

- 5.3 By Process Workflow

- 5.3.1 Target Identification

- 5.3.2 Target Validation

- 5.3.3 Hit-to-Lead & Lead Optimisation

- 5.3.4 Candidate Selection

- 5.3.5 Pre-clinical Testing

- 5.4 By Therapeutic Area

- 5.4.1 Oncology

- 5.4.2 Neurology

- 5.4.3 Cardiovascular

- 5.4.4 Infectious Diseases

- 5.4.5 Metabolic Disorders

- 5.4.6 Others

- 5.5 By End User

- 5.5.1 Pharmaceutical Companies

- 5.5.2 Biotechnology Firms

- 5.5.3 Contract Research Organisations (CROs)

- 5.5.4 Academic & Research Institutes

- 5.6 Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 Europe

- 5.6.2.1 Germany

- 5.6.2.2 United Kingdom

- 5.6.2.3 France

- 5.6.2.4 Italy

- 5.6.2.5 Spain

- 5.6.2.6 Rest of Europe

- 5.6.3 Asia-Pacific

- 5.6.3.1 China

- 5.6.3.2 Japan

- 5.6.3.3 India

- 5.6.3.4 South Korea

- 5.6.3.5 Australia

- 5.6.3.6 Rest of Asia-Pacific

- 5.6.4 Middle East and Africa

- 5.6.4.1 GCC

- 5.6.4.2 South Africa

- 5.6.4.3 Rest of Middle East and Africa

- 5.6.5 South America

- 5.6.5.1 Brazil

- 5.6.5.2 Argentina

- 5.6.5.3 Rest of South America

- 5.6.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and analysis of Recent Developments)

- 6.3.1 Pfizer Inc.

- 6.3.2 Novartis AG

- 6.3.3 F. Hoffmann-La Roche Ltd

- 6.3.4 Merck & Co., Inc.

- 6.3.5 AstraZeneca PLC

- 6.3.6 Bristol-Myers Squibb Co.

- 6.3.7 AbbVie Inc.

- 6.3.8 Eli Lilly and Company

- 6.3.9 Takeda Pharmaceutical Co.

- 6.3.10 Sanofi SA

- 6.3.11 Bayer AG

- 6.3.12 GSK PLC

- 6.3.13 Amgen Inc.

- 6.3.14 Gilead Sciences Inc.

- 6.3.15 Boehringer Ingelheim GmbH

- 6.3.16 Johnson & Johnson (Janssen)

- 6.3.17 Charles River Laboratories Intl.

- 6.3.18 Evotec SE

- 6.3.19 Thermo Fisher Scientific Inc.

- 6.3.20 Syngene International Ltd

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment