PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851287

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851287

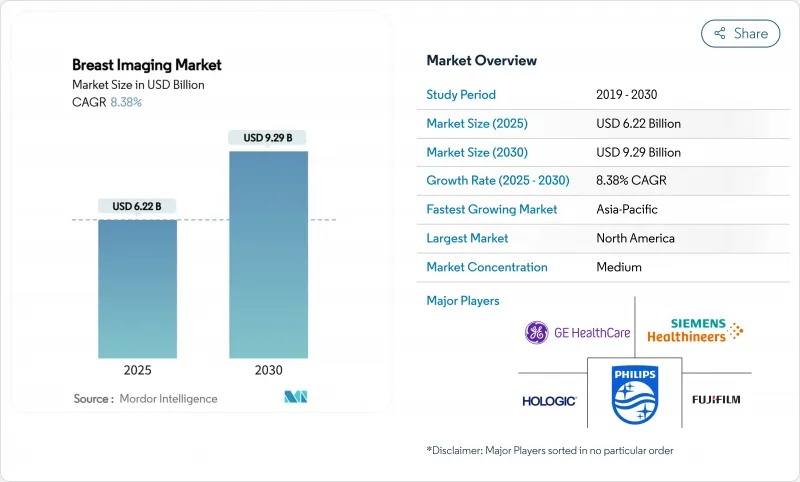

Breast Imaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The breast imaging market size stands at USD 6.22 billion in 2025 and is on course to reach USD 9.29 billion by 2030, reflecting an 8.38% CAGR over the forecast window.

Growth stems from widespread AI adoption that accelerates reading times, evolving FDA Mammography Quality Standards Act (MQSA) regulations that require dense-breast notifications, and a steady shift toward three-dimensional screening. Hospitals remain the foundation of service delivery, yet outpatient imaging centers scale rapidly as payers push care into lower-cost settings and patients look for convenience. Rising procedure volumes also magnify the urgency of workforce and cybersecurity shortfalls, both of which shape purchase criteria for new equipment. Regionally, North America keeps its leadership position, but Asia-Pacific delivers the greatest incremental revenue on the back of government-funded screening rollouts and middle-class expansion. Competitive intensity tightens as established vendors pair hardware strength with proprietary algorithms while smaller AI specialists carve out high-value workflow niches.

Global Breast Imaging Market Trends and Insights

Growing prevalence of breast cancer

An expanding at-risk female population sustains demand for advanced imaging. The American Cancer Society predicts 310,720 new invasive cases and 42,250 deaths in the United States during 2024, reinforcing the value of early detection. Incidence climbs fastest in Eastern Europe, while rising obesity and later first-birth age widen the screening cohort across emerging economies. Ageing demographics amplify volumes because risk escalates steeply after menopause, driving planners to enlarge capacity and upgrade to higher-sensitivity tools. Regular screening improves five-year survival, and payers increasingly treat it as a cost-saving measure rather than a discretionary expense.

Rapid uptake of 3-D/DBT mammography

Digital breast tomosynthesis reduces tissue-overlap artefacts and lowers false-positive callbacks by up to 15% Updated EU guidelines recommend DBT for routine screening, prompting wholesale replacement of 2-D units in public fleets. Providers in the United States still upgrade despite Medicare fee cuts because DBT attracts patient preference and mitigates medicolegal risk. When paired with triage algorithms, DBT shortens interpretation time and lifts throughput, enabling centres to balance lower unit reimbursement with higher daily exam counts.

High upfront cost of DBT systems

Full-featured scanners list between USD 400,000 and USD 600,000, stretching capital budgets for independent sites. Consecutive Medicare fee cuts of 11.72% in 2024 and 9.67% in 2025 erode payback calculations. Vendors counter with trade-in credits and usage-based financing, yet adoption lags in price-sensitive regions, slowing replacements of ageing 2-D fleets.

Other drivers and restraints analyzed in the detailed report include:

- AI-powered image analysis boosts workflow efficiency

- Portable handheld ultrasound broadens access

- Shortage of sub-specialty radiologists

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Mammography produced 38.585% of 2024 revenue, anchoring the breast imaging market even as DBT reshapes modality mix. The 3-D upgrade path supports a 12.57% CAGR to 2030, validated by European Commission screening guidance that highlights superior invasive-cancer detection. Breast ultrasound persists as the leading adjunct, providing radiation-free evaluation in dense tissue and in high-risk cohorts. Magnetic resonance imaging (MRI) retains gold-standard status for hereditary risk populations but faces cost and contrast-agent barriers.

Image-guided biopsy workflows integrate seamlessly with diagnostic imaging, streamlining tissue sampling under mammographic, ultrasound, or MRI guidance. Vacuum-assisted systems improve diagnostic yield and patient comfort, while clip-placement advances aid surgical localization. Molecular breast imaging (MBI) remains a targeted problem-solver when other modalities deliver inconclusive results, though radiation exposure limits broad use. AI overlays on each technique raise diagnostic consistency and cut observer variability, further embedding algorithmic support in daily practice.

Ionizing platforms still account for 62.345% of global sales, reaffirming their ubiquity in national screening programs. Yet non-ionizing modalities post a 10.46% CAGR through 2030 as payer and patient sentiment shifts toward radiation-free solutions. Automated breast ultrasound (ABUS) and contrast-enhanced ultrasound expand beyond handheld scans, addressing reproducibility and sensitivity concerns. High-field MRI systems push anatomic detail higher, while abbreviated protocols shorten table time and cost.

Artificial intelligence reduces exposure in ionizing studies by optimizing acquisition parameters, and hybrid workstations suggest second-look ultrasound for suspicious mammograms, blending both technology classes. Capital costs still tilt higher for MRI, but lifecycle savings accrue from reduced regulatory compliance on radiation. Over the forecast horizon, market competition will likely hinge on delivering diagnostic power with minimal or no ionizing dose.

The Breast Imaging Market Report is Segmented by Imaging Technique (Mammography, Breast Ultrasound, Breast MRI, Image-Guided Breast Biopsy, Molecular Breast Imaging), Technology (Ionizing Technology, Non-Ionizing Technology), Stage of Care (Screening, Diagnostic, Interventional/Therapeutic), End User (Hospitals, Diagnostic Imaging Centers, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America produced 36.29% of 2024 revenue. The breast imaging market benefits from federally mandated dense-breast notifications effective September 2024, which lift demand for supplemental ultrasound and MRI. AI adoption matures fastest here because early algorithm clearances and venture funding support broad deployment. Growth moderates, however, because replacement purchases dominate a saturated installed base.

Europe follows with high screening penetration and unified clinical guidelines that now recommend DBT. The European Artificial Intelligence Act sets a harmonised approval path, lengthening validation but ultimately creating a single digital market. Public health agencies co-finance refresh cycles, and competitive tenders encourage volume-based discounts that widen access to mid-sized clinics.

Asia-Pacific shows the strongest 10.78% CAGR. Government insurance schemes in China fund biennial mammograms for millions of women, while India's Ayushman Bharat drives mobile vans into secondary cities. Middle-class awareness campaigns and international NGO partnerships further widen screening coverage. Capital spending migrates from tier-one metros to provincial hubs, where handheld ultrasound and entry-level MRI enable affordable services. Regulatory heterogeneity persists, but local manufacturing incentives attract global vendors into joint ventures.

The Middle East & Africa and South America trail in revenue but post steady single-digit growth. Oil-exporting Gulf states buy premium suites for public centres, whereas sub-Saharan Africa relies on mobile vans and donor funding. Brazil expands public screening capacity, but reimbursement lags, restraining wholesale adoption of DBT.

- Hologic

- GE Healthcare

- Siemens Healthineers

- Fujifilm Holdings Corp.

- Koninklijke Philips

- Canon

- iCAD Inc.

- Delphinus Medical Technologies

- Gamma Medica

- CMR Naviscan Corp.

- Agfa-Gevaert

- Carestream Health

- Planmed

- Aurora Imaging Technology

- Micrima Ltd.

- SonoCine Inc.

- KUB Technologies

- Bracco Imaging S.p.A.

- Paragon Biosciences (Clarix Imaging)

- Zebra Medical Vision

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing Prevalence Of Breast Cancer

- 4.2.2 Rapid Adoption Of 3-D/DBT Mammography

- 4.2.3 AI-Powered Image-Analysis Improves Workflow Efficiency

- 4.2.4 Expansion Of Portable, Handheld Ultrasound For Remote Screening

- 4.2.5 Government-Mandated Dense-Breast Notification Laws

- 4.2.6 Rapid Roll-Out Of Contrast-Enhanced Mammography (CEM)

- 4.3 Market Restraints

- 4.3.1 High Upfront Cost Of Digital Breast Tomosynthesis Systems

- 4.3.2 Shortage Of Sub-Specialty Radiologists In Emerging Markets

- 4.3.3 Cyber-Security Risks For Cloud-Connected Imaging Modalities

- 4.3.4 Limited Third-Party Reimbursement For Advanced Breast-Imaging Modalities

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technology Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size and Growth Forecasts (Value-USD)

- 5.1 By Imaging Technique

- 5.1.1 Mammography

- 5.1.2 Breast Ultrasound

- 5.1.3 Breast MRI

- 5.1.4 Image-guided Breast Biopsy

- 5.1.5 Molecular Breast Imaging (MBI)

- 5.2 By Technology

- 5.2.1 Ionizing Technology

- 5.2.2 Non-Ionizing Technology

- 5.3 By Stage of Care

- 5.3.1 Screening

- 5.3.2 Diagnostic

- 5.3.3 Interventional / Therapeutic

- 5.4 By End User

- 5.4.1 Hospitals

- 5.4.2 Diagnostic Imaging Centers

- 5.4.3 Ambulatory Surgery Centers

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 Australia

- 5.5.3.5 South Korea

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 Middle East and Africa

- 5.5.4.1 GCC

- 5.5.4.2 South Africa

- 5.5.4.3 Rest of Middle East and Africa

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Argentina

- 5.5.5.3 Rest of South America

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.3.1 Hologic Inc.

- 6.3.2 GE HealthCare

- 6.3.3 Siemens Healthineers

- 6.3.4 Fujifilm Holdings Corp.

- 6.3.5 Koninklijke Philips N.V.

- 6.3.6 Canon Inc.

- 6.3.7 iCAD Inc.

- 6.3.8 Delphinus Medical Technologies

- 6.3.9 Gamma Medica

- 6.3.10 CMR Naviscan Corp.

- 6.3.11 Agfa-Gevaert Group

- 6.3.12 Carestream Health

- 6.3.13 Planmed Oy

- 6.3.14 Aurora Imaging Technology

- 6.3.15 Micrima Ltd.

- 6.3.16 SonoCine Inc.

- 6.3.17 KUB Technologies

- 6.3.18 Bracco Imaging S.p.A.

- 6.3.19 Paragon Biosciences (Clarix Imaging)

- 6.3.20 Zebra Medical Vision

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment