PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851293

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851293

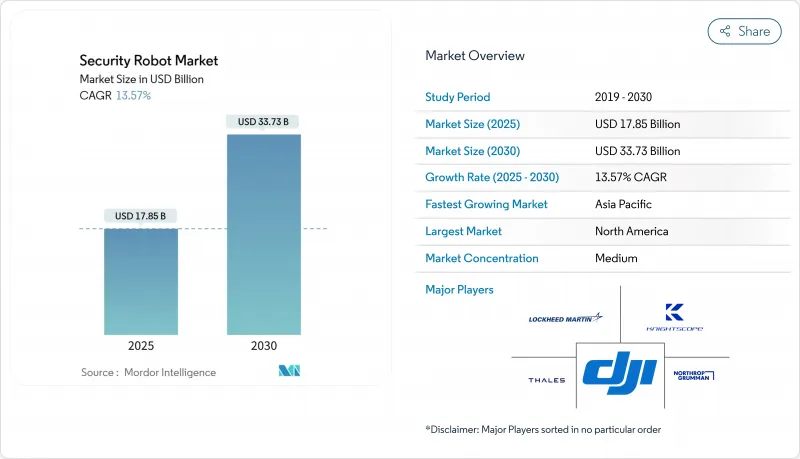

Security Robot - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The security robotics market reached USD 17.85 billion in 2025 and is forecast to advance to USD 33.73 billion by 2030, reflecting a robust 13.57% CAGR.

Demand is rising because autonomous platforms now blend AI perception, advanced sensors, and all-domain navigation into systems that operate continuously and predict threats before they materialize. Defense installations, airports, power plants, and commercial campuses increasingly replace fixed cameras and roving guards with robots that deliver round-the-clock coverage, lower false-alarm rates, and cut personnel expenses. Growth is further reinforced by subscription pricing that removes upfront capex, by national mandates for perimeter intrusion detection at critical infrastructure, and by regulatory progress that opens Beyond Visual Line of Sight (BVLOS) air corridors for drones. Meanwhile, cyber-hardening gaps, fragmented spectrum policy, and public unease over facial recognition create headwinds that vendors must manage through technology design and transparent governance.

Global Security Robot Market Trends and Insights

Deployment of AI-enabled perception stacks lowering false-alarm rates

Thermal imaging fused with multi-spectral cameras and computer-vision models has cut nuisance alarms by 40%, easing operator workload at airports and nuclear plants. NVIDIA's Cosmos platform feeds Vision-Language-Action models that interpret context, letting robots distinguish normal activity from genuine threats. Energy companies that integrated these stacks trimmed incident response times by 50% because operators receive precise coordinates and threat classifications. Superior detection accuracy shifts robots from experimental trials to mission-critical roles.

Expansion of civilian BVLOS drone corridors for security patrols in Asia

Australia and Japan now permit BVLOS patrols through risk-based regulatory frameworks that keep drones beyond pilot sight while maintaining safety via detect-and-avoid systems. Single aircraft can secure multi-kilometer perimeters that previously demanded dozens of guards, amplifying coverage and lowering cost per hectare. Governments across the Indo-Pacific see autonomous patrols as essential for vast coastlines and remote installations, spurring regional demand.

Fragmented radio-frequency spectrum regulations limiting multi-robot fleets

EU member states allocate spectrum differently, forcing vendors to customize radios for each country and undermining economies of scale. The 2024 EU AI Act also classifies security robots as high-risk systems, piling on compliance paperwork that inflates costs. These hurdles discourage small providers and delay multi-nation deployments, especially at cross-border facilities.

Other drivers and restraints analyzed in the detailed report include:

- Mandates for perimeter intrusion detection at energy assets in the Middle East

- Adoption of robot-as-a-service by commercial real-estate operators in the USA

- Cyber-hardening gaps exposing command-and-control links to spoofing and jamming

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

UAVs retained 54% of the security robotics market in 2024 thanks to rapid deployment and wide-area coverage that slash response times during perimeter breaches. Platforms integrate electro-optical, infrared, and acoustic sensors to track intruders day and night. The security robotics market size attributed to UAV patrols is projected to expand steadily through 2030 as BVLOS rules mature. Indian and Australian navies also push demand for extra-large autonomous underwater vehicles (XLUUVs) that extend surveillance into contested littorals.

UGVs represent the fastest-growing segment with a 15.2% CAGR because indoor malls, warehouses, and data centers need persistent ground-level monitoring where aerial flight is impractical. Retailers grappling with theft adopt compact UGVs that stream real-time video to control rooms and issue audible deterrence announcements. When linked via 5G, multiple robots coordinate patrols, creating a mesh that reduces blind spots. Vendors enhance autonomy with lidar-based SLAM and cloud-hosted AI, tightening loops between detection, classification, and response actions. Hybrid amphibious robots and AUVs carve a specialized niche around ports and offshore platforms, addressing threats that cross land-sea boundaries.

Hardware captured 68% of 2024 revenue because perception sensors, compute modules, and rugged chassis still carry high production costs. Lidar units, thermal cameras, and edge GPUs account for most of the bill of materials, anchoring near-term sales. Yet services are racing ahead at 18.9% CAGR as end users pivot to operating-expenditure models. RaaS bundles deliver robots, software, and field support under multi-year contracts, freeing customers from depreciation concerns. In 2024 Knightscope demonstrated that upgrading its entire K5 fleet to the v5 configuration incurred zero incremental cost to clients, underscoring the value proposition of subscription offerings.

Software and AI stacks generate sticky revenue through annual licenses that unlock advanced analytics, natural-language interfaces, and integration APIs. Over time, these digital layers command higher margins than hardware. Cloud dashboards let security directors monitor dispersed robot fleets, run forensics on incident video, and push over-the-air algorithm updates, creating a virtuous circle that ties users to a vendor's ecosystem and expands the total addressable security robotics market.

Security Robots Market Report Segments the Industry Into Type of Robot (Unmanned Aerial Vehicles, Unmanned Ground Vehicles, Autonomous, and More), Component (Software, Service), End User (Defense and Military, Residential, and Mroe), by Application (Spying, Explosive Detection, Patrolling, and More), and by Geography (North America, Europe, and More ). The Market Sizes and Forecasts are Provided in Terms of Value in (USD)

Geography Analysis

North America generated 40% of 2024 revenue, supported by unrivaled defense budgets, early BVLOS legislation, and venture funding for robotics start-ups. The United States alone fields 1,200-plus autonomous patrol units across malls, corporate campuses, and municipal parking structures. Knightscope deployments cut incidents by up to 50% within months, convincing mid-tier cities to pilot fleets as a force multiplier. Canada and Mexico adopt similar solutions for border crossings and energy corridors, reinforcing regional scale advantages.

Asia-Pacific posts the highest 15.4% CAGR thanks to regulatory overtures that permit long-range drone patrols and surging naval budgets. Australia's USD 140 million Ghost Shark XLUUV program exemplifies undersea robotics investment, while China showcases humanoid police robots that interact with citizens on the streets of Shenzhen. India's navy plans 12 indigenous XLUUVs for anti-submarine warfare, confirming pent-up demand for maritime domain awareness in contested waters.

Europe advances steadily but contends with complex AI and spectrum regulations that stretch project timelines. High-profile defense initiatives such as Thales's £1.8 billion maritime sensor contract and QinetiQ's £160 million directed-energy program sustain momentum. Still, spectrum fragmentation hampers seamless multi-robot coordination across borders, compelling integrators to tailor communications systems country by country.

- Lockheed Martin Corp.

- Northrop Grumman Corp.

- Thales SA

- BAE Systems plc

- Leonardo S.p.A.

- Elbit Systems Ltd.

- AeroVironment Inc.

- Knightscope Inc.

- SZ DJI Technology Co. Ltd.

- SMP Robotics

- Boston Dynamics Inc.

- Teledyne FLIR LLC

- Kongsberg Gruppen

- QinetiQ Group plc

- RoboTex Inc.

- Recon Robotics Inc.

- Cobalt Robotics Inc.

- Shield AI

- G4S plc (Allied Universal)

- Magos Systems

- DroneSense Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Drivers

- 4.1.1 Deployment of AI-enabled perception stacks lowering false-alarm rates in critical infrastructure (North America and Europe)

- 4.1.2 Expansion of civilian BVLOS drone corridors for security patrols in Asia

- 4.1.3 Mandates for perimeter intrusion detection at energy assets in Middle East

- 4.1.4 Adoption of robot-as-a-service (RaaS) by commercial real-estate operators in USA

- 4.1.5 Accelerated demand for indoor UGVs triggered by retail "shrink" crisis (US and UK)

- 4.1.6 Growing naval budgets for autonomous underwater ISR in Indo-Pacific

- 4.2 Market Restraints

- 4.2.1 Fragmented radio-frequency spectrum regulations limiting multi-robot fleets (EU)

- 4.2.2 Public backlash against face-recognition patrol bots in municipal deployments (Europe)

- 4.2.3 High total cost of ruggedised all-terrain platforms for petro-chemical sites (Middle East)

- 4.2.4 Cyber-hardening gaps exposing C2 links to spoofing and jamming (global)

- 4.3 Value / Supply-Chain Analysis

- 4.4 Regulatory and Standardisations Outlook

- 4.5 Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Type

- 5.1.1 Unmanned Ground Vehicles (UGV)

- 5.1.2 Autonomous Underwater Vehicles (AUV)

- 5.1.3 Hybrid/Amphibious Robots

- 5.2 By Component

- 5.2.1 Hardware

- 5.2.2 Software and AI Stack

- 5.2.3 Services (Integration, RaaS, MRO)

- 5.3 By End User

- 5.3.1 Defense and Military

- 5.3.2 Government and Law-Enforcement

- 5.3.3 Commercial and Industrial Facilities

- 5.3.4 Residential and Private Estates

- 5.4 By Application

- 5.4.1 Patrolling and Surveillance

- 5.4.2 Explosive Detection and Disposal

- 5.4.3 Spying and Reconnaissance

- 5.4.4 Search and Rescue / Disaster Response

- 5.4.5 Fire and Hazardous-Environment Response

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 United Kingdom

- 5.5.2.2 Germany

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 South Korea

- 5.5.3.5 Rest of Asia-Pacific

- 5.5.4 Middle East

- 5.5.4.1 Israel

- 5.5.4.2 Saudi Arabia

- 5.5.4.3 United Arab Emirates

- 5.5.4.4 Turkey

- 5.5.4.5 Rest of Middle East

- 5.5.5 Africa

- 5.5.5.1 South Africa

- 5.5.5.2 Egypt

- 5.5.5.3 Rest of Africa

- 5.5.6 South America

- 5.5.6.1 Brazil

- 5.5.6.2 Argentina

- 5.5.6.3 Rest of South America

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Strategic Moves and Partnerships

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.3.1 Lockheed Martin Corp.

- 6.3.2 Northrop Grumman Corp.

- 6.3.3 Thales SA

- 6.3.4 BAE Systems plc

- 6.3.5 Leonardo S.p.A.

- 6.3.6 Elbit Systems Ltd.

- 6.3.7 AeroVironment Inc.

- 6.3.8 Knightscope Inc.

- 6.3.9 SZ DJI Technology Co. Ltd.

- 6.3.10 SMP Robotics

- 6.3.11 Boston Dynamics Inc.

- 6.3.12 Teledyne FLIR LLC

- 6.3.13 Kongsberg Gruppen

- 6.3.14 QinetiQ Group plc

- 6.3.15 RoboTex Inc.

- 6.3.16 Recon Robotics Inc.

- 6.3.17 Cobalt Robotics Inc.

- 6.3.18 Shield AI

- 6.3.19 G4S plc (Allied Universal)

- 6.3.20 Magos Systems

- 6.3.21 DroneSense Inc.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-Space and Unmet-Need Assessment