PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851295

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851295

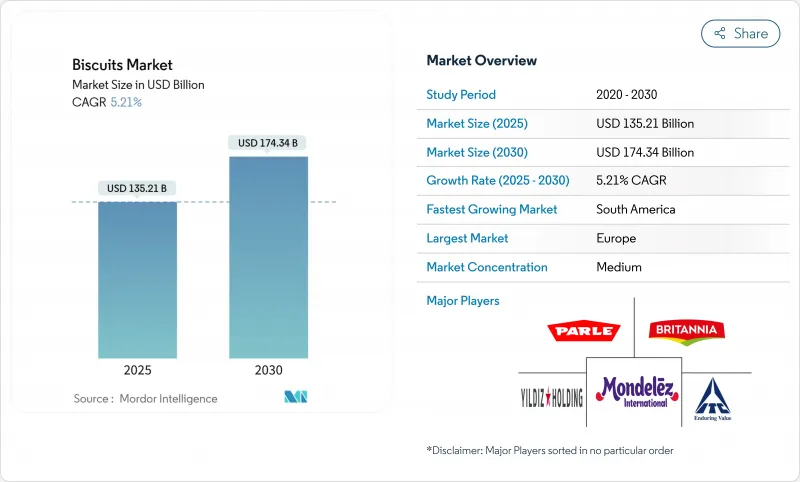

Biscuits - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The biscuit market size valued at USD 135.21 billion in 2025 is projected to reach USD 174.34 billion by 2030, growing at a CAGR of 5.21%.

This growth stems from continuous household consumption patterns, expanding urban middle-class demographics, and established snacking behaviors. Manufacturers are reformulating their product lines to include reduced-sugar and fiber-enriched variants while maintaining their traditional indulgent offerings, addressing both health-conscious consumers and those seeking treats. E-commerce expansion has facilitated premium product distribution and direct-to-consumer channels, with single-serve packaging formats capturing the on-the-go consumption segment. Major manufacturers are fortifying their supply chains through strategic acquisitions and geographical expansion initiatives to mitigate raw material cost fluctuations.

Global Biscuits Market Trends and Insights

Rising Demand for Indulgent Snack Occasions

Consumer behavior is shifting from traditional meals to more frequent snacking. Biscuits, once occasional treats, are now functional meal alternatives, driving growth in the category through premium product innovations. Roland Foods' 2025 industry trends report highlights rising demand for compact, flavor-rich portions, expanding biscuit consumption. Convenience, affordability, and psychological factors fuel this shift, as post-pandemic consumers seek indulgent yet cost-effective options for emotional well-being. For example, Mayora Indah achieved 15% growth in 2024 despite economic challenges. Younger consumers increasingly prefer globally-inspired snacks, seeking diverse flavors. This trend highlights opportunities for innovation and sustained growth in the biscuit market.

Health-Oriented Reformulations Driving Fiber-Enriched Biscuit

Regulatory requirements and increasing consumer health consciousness are driving extensive reformulation efforts in the biscuit industry. In Ireland, the Food Reformulation Taskforce has established comprehensive targets for 2025, requiring a 20% reduction in sugar and calories, alongside a 10% reduction in saturated fats and salt across biscuits and other priority food categories . Manufacturers are implementing strategic reductions in sugar, salt, and fat content while enhancing the overall nutritional value of their products. This shift aligns with evolving consumer preferences, as 62% of Americans consider healthfulness as a key driver for food and beverage purchases, as per the International Food Information Council's 2024 health survey report. The current market dynamics create opportunities for manufacturers to develop premium biscuit products that successfully combine nutritional benefits with appealing taste profiles.

Stringent HFSS advertising curbs limiting biscuit promotions

Advertising restrictions on high fat, sugar, and salt (HFSS) products are transforming marketing approaches in the biscuit industry, with European markets experiencing the most significant impact. The UK's HFSS advertising regulations specifically limit product promotions during peak viewing hours and on digital platforms that attract younger audiences. In response, companies like PepsiCo and Well & Truly are strategically reformulating their products to achieve non-HFSS compliance by 2025, primarily through salt reduction and nutritional improvements . Manufacturers have shifted their communication focus from taste alone to highlighting ingredient quality, portion control, and functional benefits. This strategic transformation demands considerable investment in consumer education and alternative marketing channels, creating entry barriers for smaller companies while favoring brands that successfully communicate health benefits without compromising their indulgence positioning.

Other drivers and restraints analyzed in the detailed report include:

- Premiumization Trend Fueling Single-Serve Portion Packs

- Product Innovation and Flavor Varieties

- Fluctuating wheat and sugar prices affect profit margins.

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Sweet biscuits dominate with a 72.69% market share in 2024, establishing their position as the primary product category across global markets. The segment's continued success stems from innovative product development, exemplified by Britannia's 'Pure Magic Choco Stars' featuring chocolate cream in a distinctive star-shaped cavity. Manufacturers maintain market momentum by balancing health regulation compliance with superior taste profiles. ITC's Dark Fantasy Choco Fills illustrates this approach through strategic premium positioning in a value-focused category.

The crackers and savory biscuits segment exhibits robust growth at 6.38% CAGR (2025-2030), propelled by evolving consumer preferences for diverse flavors and functional benefits. This expansion reflects the growing snacking trend, where consumers increasingly gravitate toward international flavors that combine satisfaction with health benefits. Food Business News reports rising consumer interest in umami flavors derived from seaweed and black garlic, particularly in plant-based offerings. The segment's evolution is further demonstrated by Absolutely! Gluten Free's introduction of Everything, Toasted Onion, and Cracked Pepper crackers, which successfully merge health considerations with distinctive flavor profiles.

Plastic packets and on-the-go pouches hold 58.42% market share in 2024, due to their combination of cost-effectiveness, product protection, and convenience. The growth of quick commerce and evolving shopping patterns has strengthened this format's position, as manufacturers adapt packaging for various retail channels and consumption scenarios. The format serves both value and premium market segments effectively. In response to environmental concerns, companies are developing sustainable solutions, with Greggs aiming to reduce packaging by 25% by 2025 from 2019 levels.

Box packaging is projected to grow at 4.12% CAGR from 2025 to 2030, driven by premium product trends and increased gift-giving occasions. Consumers demonstrate greater willingness to pay higher prices for enhanced presentation, while boxes provide opportunities for brand storytelling and reuse. The growth aligns with the broader premium biscuit segment, where packaging differentiates products in competitive retail environments. The expansion of e-commerce further supports box packaging adoption, as it provides superior product protection during shipping while enhancing the consumer unboxing experience.

The Biscuits Market Report is Segmented by Product Type (Crackers and Savory Biscuits and Sweet Biscuits), Packaging (Boxes, Plastic Packets/On-the-go Pouches, and Others), Category (Conventional and Free-From), Distribution Channel (Supermarkets/Hypermarkets and More), and Geography (North America, Europe, Asia-Pacific, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

In 2024, Europe holds 27.82% of the global biscuit market, with Germany, France, and the UK leading health-focused and premium product innovations. Biscuit International's acquisition of Patisserie Casteleijn on January 1, 2025, highlights the industry's response to strict sugar content and HFSS advertising regulations, driving product reformulation. In North America, 28% of US and Canadian consumers check ingredient lists, reflecting a preference for premium and health-centric products. The FDA's upcoming ban on Red Dye No. 3, effective January 15, 2027, emphasizes food safety . Advanced retail infrastructure and digital adoption are boosting online sales and direct-to-consumer marketing.

South America is the fastest-growing market, with a 7.03% CAGR (2025-2030), driven by urbanization and a growing middle class demanding convenient, affordable snacks. Local brands are innovating with traditional Latin American flavors to compete with global players. Economic volatility and currency fluctuations challenge raw material costs and pricing in Brazil and Argentina. However, a shift toward healthier biscuits with reduced sugar and added fiber creates opportunities for premium products. Expanding modern retail and e-commerce enhance accessibility, driving market growth.

Asia-Pacific is set for growth, driven by urbanization, rising incomes, and changing consumption habits. Mayora Indah achieved 15% growth in 2024 through strategic placements and celebrity endorsements. In China, artisanal bakeries and a preference for Western-style baked goods drive demand for premium offerings and innovative flavors. The Middle East and Africa are also growing. CBL Group's entry into Kenya highlights East Africa's potential. In Saudi Arabia, rising incomes and changing diets boost the packaged food market. Health-centric regulations push manufacturers toward reformulations. The UAE and South Africa stand out as growth hubs, benefiting from urbanization and modern retail. A youthful demographic and digital media engagement accelerate the adoption of products blending global and local flavors.

- Mondelez International Inc.

- ITC Limited

- Britannia Industries Limited

- Parle Products Private Limited

- Yildiz Holding A.S.

- Mars, Incorporated

- Grupo Bimbo, S.A.B. de C.V.

- The Campbell Soup Company

- Lotus Bakeries NV

- Nestle S.A.

- Bahlsen GmbH & Co. KG

- Walkers Shortbread Limited

- Fox's Burton's Companies (FBC) UK Limited

- PepsiCo Inc. (Nabisco)

- Orkla ASA (Goteborgs Kex)

- Grupo Arcor S.A.

- Universal Robina Corporation

- Lantmannen Unibake International

- Ferrero International S.A

- Associated British Foods plc (Ryvita)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising demand for indulgent snack occasions

- 4.2.2 Health-oriented reformulations driving fiber-enriched biscuit

- 4.2.3 Premiumization trend fueling single-serve portion packs

- 4.2.4 Product innovation and flavor varieties

- 4.2.5 Expansion of retail and e-commerce channels.

- 4.2.6 Rising demand for organic and natural ingredient biscuits

- 4.3 Market Restraints

- 4.3.1 Stringent HFSS advertising curbs limiting biscuit promotions

- 4.3.2 Fluctuating wheat and sugar prices affect profit margins.

- 4.3.3 Competition from traditional savory snacks

- 4.3.4 Intense private label competition

- 4.4 Value/Supply-Chain Analysis

- 4.5 Regulatory Outlook

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers/Consumers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitute Products

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE, VOLUME)

- 5.1 By Product Type

- 5.1.1 Crackers and Savory Biscuits

- 5.1.2 Sweet Biscuits

- 5.1.2.1 Plain Biscuits

- 5.1.2.2 Cookies

- 5.1.2.3 Sandwich Biscuits

- 5.1.2.4 Chocolate-Coated Biscuits

- 5.1.2.5 Others

- 5.2 By Packaging Type

- 5.2.1 Boxes

- 5.2.2 Plastic Packets/On-the-Pouches

- 5.2.3 Others

- 5.3 By Category

- 5.3.1 Conventional

- 5.3.2 Free-From

- 5.4 By Distribution Channel

- 5.4.1 Supermarkets/Hypermarkets

- 5.4.2 Convenience Stores

- 5.4.3 Specialty and Gourmet Stores

- 5.4.4 Online Retail Stores

- 5.4.5 Other Distribution Channels

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.1.4 Rest of North America

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 France

- 5.5.2.3 United Kingdom

- 5.5.2.4 Spain

- 5.5.2.5 Netherlands

- 5.5.2.6 Italy

- 5.5.2.7 Sweden

- 5.5.2.8 Poland

- 5.5.2.9 Belgium

- 5.5.2.10 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 India

- 5.5.3.3 Japan

- 5.5.3.4 Australia

- 5.5.3.5 South Korea

- 5.5.3.6 Indonesia

- 5.5.3.7 Thailand

- 5.5.3.8 SIngapore

- 5.5.3.9 Rest of Asia-Pacific

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Colombia

- 5.5.4.4 Chile

- 5.5.4.5 Peru

- 5.5.4.6 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 United Arab Emirates

- 5.5.5.2 South Africa

- 5.5.5.3 Nigeria

- 5.5.5.4 Saudi Arabia

- 5.5.5.5 Egypt

- 5.5.5.6 Morocco

- 5.5.5.7 Turkey

- 5.5.5.8 Rest of Middle East and Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Mondelez International Inc.

- 6.4.2 ITC Limited

- 6.4.3 Britannia Industries Limited

- 6.4.4 Parle Products Private Limited

- 6.4.5 Yildiz Holding A.S.

- 6.4.6 Mars, Incorporated

- 6.4.7 Grupo Bimbo, S.A.B. de C.V.

- 6.4.8 The Campbell Soup Company

- 6.4.9 Lotus Bakeries NV

- 6.4.10 Nestle S.A.

- 6.4.11 Bahlsen GmbH & Co. KG

- 6.4.12 Walkers Shortbread Limited

- 6.4.13 Fox's Burton's Companies (FBC) UK Limited

- 6.4.14 PepsiCo Inc. (Nabisco)

- 6.4.15 Orkla ASA (Goteborgs Kex)

- 6.4.16 Grupo Arcor S.A.

- 6.4.17 Universal Robina Corporation

- 6.4.18 Lantmannen Unibake International

- 6.4.19 Ferrero International S.A

- 6.4.20 Associated British Foods plc (Ryvita)

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK