PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906935

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906935

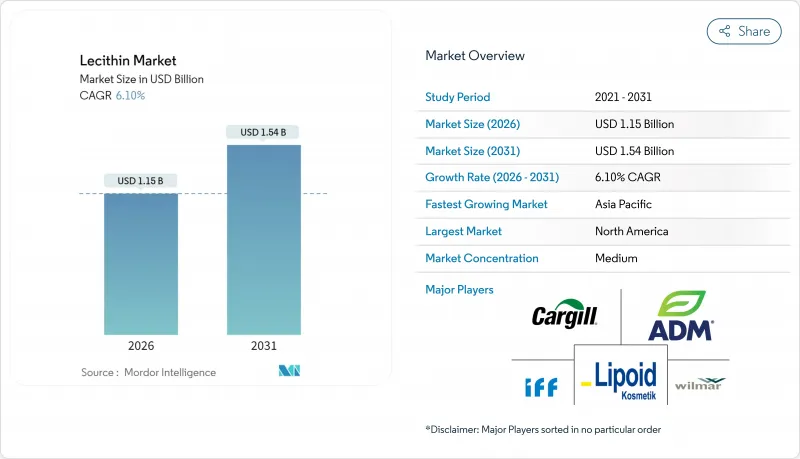

Lecithin - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The lecithin market is expected to grow from USD 1.08 billion in 2025 to USD 1.15 billion in 2026 and is forecast to reach USD 1.54 billion by 2031 at 6.1% CAGR over 2026-2031.

Rising uptake of natural emulsifiers in processed foods, stringent clean-label regulations, and deepening penetration of pharmaceutical-grade phospholipids keep demand on a solid upward path. In parallel, pharmaceutical companies extend lecithin's reach into drug-delivery and cognitive-health products, lifting average selling prices in the high-purity segment. Sunflower lecithin is experiencing significant growth due to its non-GMO status and allergen-free properties in clean-label formulations. Food and beverage manufacturers in North America and Europe are transitioning from soy-based to sunflower-derived lecithin as consumers become more concerned about genetically modified ingredients. The neutral flavor profile and high phospholipid content of sunflower lecithin make it suitable for plant-based dairy, bakery, and confectionery products. The pharmaceutical industry is also increasing its use of sunflower lecithin in liposomal drug delivery systems, where high purity and traceability requirements drive growth in the high-purity lecithin segment.

Global Lecithin Market Trends and Insights

Rising Need for Emulsifiers and Stabilizers in Processed Foods

The processed food industry is shifting toward natural emulsifiers, making lecithin an essential ingredient for maintaining product stability while meeting clean-label requirements. The increasing consumer preference for convenient, shelf-stable, and ready-to-eat food products has created a higher demand for emulsifying and stabilizing agents that maintain consistency, improve texture, and extend shelf life. Lecithin, extracted from natural sources such as soybeans, sunflower seeds, and eggs, serves multiple functions as an emulsifier, dispersing agent, and wetting agent, providing manufacturers with versatility and cost efficiency. The clean-label movement has encouraged food producers to choose natural additives like lecithin over synthetic alternatives, increasing its market demand. Consumer spending on processed and packaged foods remains strong, as evidenced by U.S. households spending an average of USD 574 on bakery products in 2023, according to the Bureau of Labor Statistics .

Increased Adoption in Animal Feed Applications

Animal nutrition applications represent a significant growth area for lecithin demand, supported by regulatory approvals and demonstrated benefits in livestock productivity. The Food and Drug Administration (FDA)'s 21 CFR Part 573 regulations confirm lecithin's safety for animal feed applications, providing a clear regulatory framework for feed manufacturers and ensuring consistent implementation across the industry . The phospholipid content in lecithin improves fat digestion in monogastric animals, resulting in better growth rates and feed efficiency in livestock operations. The aquaculture industry has become a major driver of demand for functional feed ingredients like lecithin. The Food and Agriculture Organization of the United Nations (FAO) reports that global aquaculture production reached 130.9 million tons in 2022/23, contributing to a total fisheries and aquaculture output of 223.2 million tons, representing a 4% increase from 2020 . This growth has increased pressure on aquafeed and animal feed industries to incorporate sustainable, plant-based alternatives to conventional feed ingredients.

Fluctuating Raw Material Prices

The lecithin market faces significant constraints due to fluctuating raw material prices, particularly soybeans, sunflower seeds, and eggs. These primary sources are vulnerable to various factors, including weather conditions, geopolitical issues, trade policies, and supply chain disruptions. For instance, extreme weather events or droughts in major producing regions such as the United States, Brazil, or Ukraine can reduce crop yields, affecting the availability and cost of lecithin production materials. The volatility in the broader edible oil market also influences lecithin prices, as lecithin is derived from oilseed processing. Changes in soybean or sunflower oil demand, whether from shifting consumption patterns or biofuel regulations, affect lecithin supply and pricing. This instability creates challenges for manufacturers in maintaining stable cost structures and profit margins. The increased production costs also affect lecithin's competitiveness against synthetic emulsifiers, particularly in price-sensitive markets.

Other drivers and restraints analyzed in the detailed report include:

- Expanding Applications in Pharmaceutical and Nutraceutical Industries

- Growing Demand from Plant-Based and Vegan Food Sectors

- Negative Consumer Perception of GMO Ingredients

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Soy lecithin holds a dominant 64.78% market share in 2025, supported by established supply chains and cost benefits from the global soybean processing infrastructure. Sunflower lecithin represents the fastest-growing source segment with a projected 7.65% CAGR during 2026-2031, driven by its non-GMO status and allergen-free characteristics that align with consumer health preferences and increasing market demands. Egg lecithin maintains its position in specialized applications requiring superior functionality, particularly in pharmaceutical and premium food products, while demonstrating consistent performance in high-value segments.

Rapeseed lecithin has emerged as a viable alternative during supply chain disruptions affecting conventional sources, offering manufacturers additional sourcing flexibility. Alternative sources, including canola lecithin, have expanded their market presence through regulatory approvals, such as Cargill's Food and Drug Administration (FDA) Generally Recognised as Safe (GRAS) determination, enabling broader use in organic and non-GMO formulations.

Food grade lecithin holds 56.62% market share in 2025, primarily serving the processed food industry with emulsification solutions across bakery, confectionery, and dairy applications. The ingredient demonstrates significant versatility in food processing operations. Pharmaceutical grade lecithin projects a 9.02% CAGR during 2026-2031, driven by its increasing use in drug delivery systems and nutraceutical formulations. The pharmaceutical segment expands through lecithin's proven safety profile and Food and Drug Administration (FDA) approval for various applications. The regulatory acceptance strengthens market growth potential across pharmaceutical formulations.

Additional grades, including cosmetic and industrial applications, present growth opportunities as manufacturers implement lecithin in non-traditional uses. Companies such as American Lecithin Company advance the pharmaceutical-grade segment by developing specialized derivatives, including phosphatidylserine from soy and sunflower lecithins. These formulations comply with stringent pharmaceutical quality standards and specifications. The high-value derivatives enable suppliers to benefit from premium pricing and enhanced profit margins in pharmaceutical applications.

The Lecithin Market is Segmented by Source (Soy, Sunflower, and More), by Grade (Food Grade, Pharmaceutical Grade, and Others), by Form (Liquid, Powder, and Others), by Nature (Organic, and Conventional), by Application (Food and Beverage, Animal Feed, and More), and Geography (North America, Europe, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America holds a dominant 35.21% share of the lecithin market in 2025, supported by strict Food and Drug Administration (FDA) regulations favoring natural emulsifiers. The region maintains balanced capacity through significant investments in soybean and canola crushing facilities and increased plant-based food product launches. High consumer spending on supplements drives the adoption of premium phospholipids in brain-health products. Asia-Pacific demonstrates the highest growth rate with an 8.38% CAGR during 2026-2031. The expansion of China's supplement industry and India's bakery chains drives demand for both standard and premium lecithin products.

Asia-Pacific emerges as the fastest-growing region with a CAGR of 8.38% during 2026-2031, driven by expanding nutraceutical markets and rising disposable incomes that enable premium ingredient adoption. China's dietary supplement market, particularly for lecithin applications in cognitive health and cardiovascular wellness products, contributes significantly to regional demand expansion. The region's processed food manufacturing base generates substantial demand for cost-effective emulsification solutions, while increasing consumer awareness of health benefits supports premium lecithin usage in various applications.

Europe maintains a balanced approach between volume and value segments. European Food Safety Authority (EFSA) regulations and GMO concerns drive demand toward sunflower and rapeseed lecithin. Eastern European producers benefit from proximity to sunflower production regions, pending resolution of geopolitical issues. South America serves as a key supply center, leveraging Brazil's substantial soybean production. The Middle East and Africa present growth potential due to the expansion of food processing industries and rising consumer awareness of functional ingredients. However, infrastructure constraints and underdeveloped regulatory frameworks continue to limit market growth compared to mature markets.

- Archer Daniels Midland Company

- Cargill Inc.

- Bunge Limited

- International Flavors & Fragrances, Inc.

- Wilmar International

- Lipoid GmbH

- Sternchemie GmbH and Co KG

- VAV Life Sciences Pvt Ltd

- American Lecithin Company

- The Scoular Company

- Ciranda Inc.

- Sonic Biochem

- Lecico GmbH

- Clarkson Specialty Lecithins

- Fishmer Lecithin

- AAK

- GIIAVA Industrial Biotech

- SternWywiol Gruppe

- Emerson Resources

- Austrade Ingredients

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising need for emulsifiers and stabilizers in processed foods

- 4.2.2 Increased adoption in animal feed applications

- 4.2.3 Expanding applications in pharmaceutical and nutraceutical industries

- 4.2.4 Growing demand from plant-based and vegan food sectors

- 4.2.5 Consumer demand for clean-label and natural food ingredients

- 4.2.6 Increased adoption in natural cosmetics formulations

- 4.3 Market Restraints

- 4.3.1 Fluctuating Raw Material Prices

- 4.3.2 Negative consumer perception of GMO ingredients

- 4.3.3 Competition from alternative emulsifiers and surfactants

- 4.3.4 Limited shelf life of liquid lecithin products

- 4.4 Supply Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Source

- 5.1.1 Soy

- 5.1.2 Sunflower

- 5.1.3 Egg

- 5.1.4 Rapeseed

- 5.1.5 Other Sources

- 5.2 By Grade

- 5.2.1 Food Grade

- 5.2.2 Pharmaceutical Grade

- 5.2.3 Others

- 5.3 By Form

- 5.3.1 Liquid

- 5.3.2 Powder

- 5.3.3 Others

- 5.4 By Nature

- 5.4.1 Organic

- 5.4.2 Conventional

- 5.5 By Application

- 5.5.1 Food and Beverage

- 5.5.1.1 Bakery and Confectionery

- 5.5.1.2 Dairy Products

- 5.5.1.3 Beverages

- 5.5.1.4 Other Food and Beverages

- 5.5.2 Animal Feed

- 5.5.3 Dietary Supplements

- 5.5.4 Pharmaceuticals

- 5.5.5 Cosmetics and Personal Care

- 5.5.6 Other Application

- 5.5.1 Food and Beverage

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.1.4 Rest of North America

- 5.6.2 Europe

- 5.6.2.1 Germany

- 5.6.2.2 France

- 5.6.2.3 United Kingdom

- 5.6.2.4 Spain

- 5.6.2.5 Netherlands

- 5.6.2.6 Italy

- 5.6.2.7 Sweden

- 5.6.2.8 Poland

- 5.6.2.9 Belgium

- 5.6.2.10 Rest of Europe

- 5.6.3 Asia-Pacific

- 5.6.3.1 China

- 5.6.3.2 India

- 5.6.3.3 Japan

- 5.6.3.4 Australia

- 5.6.3.5 South Korea

- 5.6.3.6 Indonesia

- 5.6.3.7 Thailand

- 5.6.3.8 Singapore

- 5.6.3.9 Rest of Asia-Pacific

- 5.6.4 South America

- 5.6.4.1 Brazil

- 5.6.4.2 Argentina

- 5.6.4.3 Chile

- 5.6.4.4 Colombia

- 5.6.4.5 Peru

- 5.6.4.6 Rest of South America

- 5.6.5 Middle East and Africa

- 5.6.5.1 United Arab Emirates

- 5.6.5.2 South Africa

- 5.6.5.3 Nigeria

- 5.6.5.4 Saudi Arabia

- 5.6.5.5 Egypt

- 5.6.5.6 Morocco

- 5.6.5.7 Turkey

- 5.6.5.8 Rest of Middle East and Africa

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Archer Daniels Midland Company

- 6.4.2 Cargill Inc.

- 6.4.3 Bunge Limited

- 6.4.4 International Flavors & Fragrances, Inc.

- 6.4.5 Wilmar International

- 6.4.6 Lipoid GmbH

- 6.4.7 Sternchemie GmbH and Co KG

- 6.4.8 VAV Life Sciences Pvt Ltd

- 6.4.9 American Lecithin Company

- 6.4.10 The Scoular Company

- 6.4.11 Ciranda Inc.

- 6.4.12 Sonic Biochem

- 6.4.13 Lecico GmbH

- 6.4.14 Clarkson Specialty Lecithins

- 6.4.15 Fishmer Lecithin

- 6.4.16 AAK

- 6.4.17 GIIAVA Industrial Biotech

- 6.4.18 SternWywiol Gruppe

- 6.4.19 Emerson Resources

- 6.4.20 Austrade Ingredients

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK