PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851305

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851305

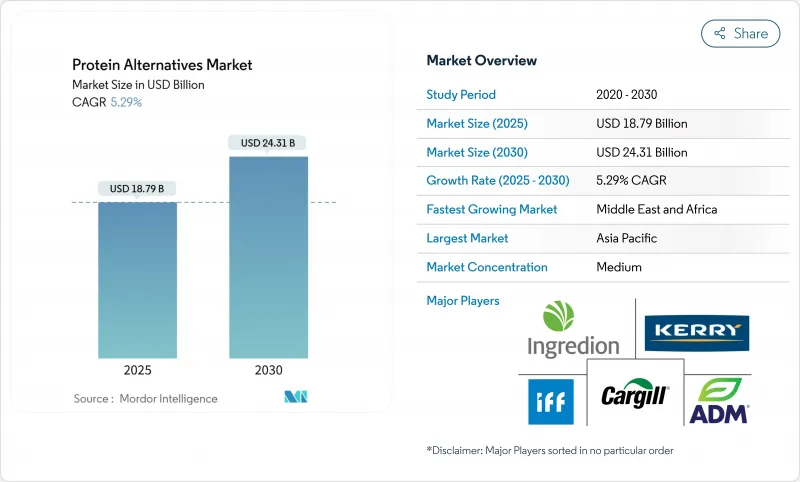

Protein Alternatives - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The alternative protein market reached USD 18.79 billion in 2025 and is projected to reach USD 24.31 billion by 2030, growing at a CAGR of 5.29%.

The market growth is driven by advances in precision fermentation technology, increasing consumer demand for sustainable food options, and regulatory changes that expedite novel food approvals. Manufacturers are transitioning from pilot to commercial production, reducing per-kilogram costs through larger bioreactor capacity and lower operating costs from renewable energy usage. Consumer packaged-goods companies are increasing their launches of products that replicate the taste and texture of conventional meat and dairy, while restaurant chains are expanding their plant-based menu offerings to reach more mainstream consumers.

Global Protein Alternatives Market Trends and Insights

Growth in Precision-Fermented Protein Production

Precision fermentation technology enables the production of animal-identical proteins through engineered microorganisms, transforming alternative protein manufacturing. Perfect Day's partnership with Unilever for Breyers lactose-free products validates the commercial potential of this technology. The process significantly reduces water usage and greenhouse gas emissions compared to traditional dairy production methods. The FDA's GRAS pathway provides faster market access compared to EU novel food regulations, creating regulatory advantages for companies. Onego Bio's production of bioidentical egg proteins through precision fermentation offers solutions to avian flu-related supply chain disruptions while providing clean-label alternatives to conventional egg whites. The increasing number of patents in precision fermentation indicates ongoing innovation and strategic positioning among biotechnology companies.

Growing Adoption of Plant-Based Options by Quick-Service Restaurants

Quick-service restaurants are strategically expanding their plant-based menu offerings, introducing meat alternatives such as burger patties, chicken substitutes, and non-dairy cheeses. This expansion has significantly increased consumer exposure and adoption rates. Despite McDonald's decision to discontinue its McPlant burger in the United States, specialized vegan restaurant chains are experiencing substantial growth, while manufacturers have made notable improvements in product taste profiles and competitive pricing. The quick-service segment remains a crucial testing ground for mainstream market acceptance, as products that successfully meet the rigorous operational efficiency standards and consumer price expectations in restaurants demonstrate strong potential for retail market expansion.

Protein Legume Supply-Chain Volatility Due to El Nino-Driven Yield Swings

Severe weather conditions have significantly impacted pulse crop production in Canada and Australia, causing substantial reductions in pea and fava bean availability for processing. These supply constraints have triggered widespread price increases throughout the contract manufacturing chain, particularly affecting the production costs of plant-protein isolates. In response, food manufacturers are implementing strategic measures, including geographical diversification of ingredient sourcing and increased investments in alternative protein production methods such as microbial fermentation and cellular agriculture, to minimize their exposure to climate-related supply disruptions.

Other drivers and restraints analyzed in the detailed report include:

- Increasing Prevalence of Lactose Intolerance and Allergies

- Growing Demand for Sustainable Food Sources

- Regulatory Restrictions Impact Insect Protein Adoption

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Plant proteins captured the lion's share of 71.43% in 2024 as soy, pea, and rice maintained strong purchasing contracts with global manufacturers. The alternative protein market size for plant-based sources will expand steadily yet cede relative share to faster-growing microbial inputs that deliver 7.82% CAGR on the back of precision-fermentation cost curves. Diversification into hemp and chickpea proteins supports allergen-free claims and regional crop strategies, while microbial mycoproteins gain retail listings in Europe.

Soy protein isolate remains the functional workhorse for meat analogs, but companies blend it with pea to improve amino-acid completeness and taste. Mycoprotein suppliers leverage controlled fermentation to bypass agricultural risk, securing year-round capacity. Regulatory nods for algae-based proteins later this decade would further broaden the ingredient toolbox and reduce pressure on pulse supplies.

Protein isolates account for 44.22% of market spend in 2024, primarily used in ready-to-drink beverages and powder formats due to their clear solubility and neutral flavor profile. Textured vegetable protein shows a 6.36% CAGR, driven by high-moisture extrusion technology that creates fibrous structures resembling muscle tissue for meat alternatives like burgers and chicken strips.

Manufacturing companies are investing in advanced extrusion equipment and cooling-die systems to improve texture and moisture retention. While protein isolates maintain strong market share in sports nutrition products, manufacturers are adopting precision-fermented isolates that replicate dairy functionality without lactose content. Hydrolysates maintain a specialized position in clinical and infant nutrition applications where rapid absorption is essential.

The Protein Alternatives Market Report Segmented by Source (Plant Proteins, Microbial Proteins, and More), Form (Protein Isolates, and More), Production Technology (Dry and Wet Fractionation, Extrusion and Texturization, and More), Application (Food and Beverage, Dietary Supplements and Sports Nutrition, and More), and Geography (North America, Europe, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific holds 33.89% of the 2024 alternative protein market value, driven by urbanization, rising incomes, and government support for food technology manufacturing zones. China's five-year plan includes "future foods" initiatives and provides funding for fermentation pilot facilities. Chinese dairy companies are developing animal-free casein to reduce import dependency. India's alternative protein ecosystem centers around Bengaluru, where contract manufacturers produce plant-protein concentrates for domestic and international markets.

North America's market growth stems from the FDA's efficient GRAS (Generally Recognized as Safe) assessment process, allowing precision-fermented dairy and egg proteins to enter the market quickly. The region maintains strong venture capital investment, while multinational companies participate in co-manufacturing agreements to expand production facilities. Generation Z shows higher acceptance of meat alternatives, while older consumers prioritize cost and familiar products.

Europe integrates alternative proteins into its Green Deal framework, supporting cellular-agriculture development and implementing sustainability reporting requirements that favor low-carbon ingredients. While novel-food approvals take longer than in the United States, approved products benefit from consistent labeling across the EU. The Middle East and Africa region, particularly the UAE and Saudi Arabia, achieves the highest regional growth rate at 6.43%, driven by food security initiatives and sovereign fund investments in fermentation technologies.

- ADM

- Cargill Inc.

- International Flavors & Fragrances Inc.

- Kerry Group plc

- Ingredion Inc.

- The Scoular Company

- Avebe

- Roquette Freres

- Mycotechnology Inc.

- Buhler Group

- Corbion N.V.

- Perfect Day Inc.

- DuPont

- Glanbia plc

- Ynsect SAS

- Calysta Inc.

- Eden Brew Pty Ltd.

- Novameat Tech SL

- Proeon

- AGT Food and Ingredients Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growth in Precision-Fermented Protein Production

- 4.2.2 Growing Adoption of Plant-Based Options by Quick-Service Restaurants

- 4.2.3 Increasing Prevalence of Lactose Intolerance and Allergies

- 4.2.4 Growing Demand for Sustainable Food Sources

- 4.2.5 Technological Advancements in Food Processing

- 4.2.6 Growing Vegan, Vegetarian, and Flexitarian Populations

- 4.3 Market Restraints

- 4.3.1 Protein Legume Supply-Chain Volatility Due to El Nino-Driven Yield Swings in Canada and Australia

- 4.3.2 Regulatory Restrictions Impact Insect Protein Adoption

- 4.3.3 Allergen Safety and Cross-Reactivity in Precision-Fermented Proteins

- 4.3.4 Limited Consumer Awareness in Emerging Markets

- 4.3.5 Taste and Texture Challenges

- 4.4 Value/Supply-Chain Analysis

- 4.5 Regulatory Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Source

- 5.1.1 Plant Proteins

- 5.1.1.1 Soy Protein

- 5.1.1.2 Wheat

- 5.1.1.3 Pea

- 5.1.1.4 Rice

- 5.1.1.5 Hemp

- 5.1.1.6 Others

- 5.1.2 Microbial Proteins

- 5.1.2.1 Mycoprotein

- 5.1.2.2 Algea Protein

- 5.1.3 Insect Proteins

- 5.1.3.1 Cricket

- 5.1.3.2 Black Soldier Fly Larvae (BSFL)

- 5.1.3.3 Others

- 5.1.1 Plant Proteins

- 5.2 By Form

- 5.2.1 Protein Isolates

- 5.2.2 Protein Concentrates

- 5.2.3 Textured Proteins and TVP

- 5.2.4 Hydrolysates and Peptides

- 5.3 By Production Technology

- 5.3.1 Dry and Wet Fractionation

- 5.3.2 Extrusion and Texturization

- 5.3.3 Precision Fermentation

- 5.3.4 Cellular Agriculture (Scaffold-Based, Suspension)

- 5.4 By Application

- 5.4.1 Food and Beverage

- 5.4.1.1 Plant-Based Meat Analogues

- 5.4.1.2 Dairy and Dairy Alternative Alternatives

- 5.4.1.3 Bakery and Confectionery

- 5.4.1.4 Beverages

- 5.4.1.5 Other Packaged Foods

- 5.4.2 Dietary Supplements and Sports Nutrition

- 5.4.3 Animal Feed and Pet Food

- 5.4.4 Personal Care and Cosmetics

- 5.4.1 Food and Beverage

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.1.4 Rest of North America

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 Italy

- 5.5.2.4 France

- 5.5.2.5 Spain

- 5.5.2.6 Netherlands

- 5.5.2.7 Poland

- 5.5.2.8 Belgium

- 5.5.2.9 Sweden

- 5.5.2.10 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 India

- 5.5.3.3 Japan

- 5.5.3.4 Australia

- 5.5.3.5 Indonesia

- 5.5.3.6 South Korea

- 5.5.3.7 Thailand

- 5.5.3.8 Singapore

- 5.5.3.9 Rest of Asia-Pacific

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Colombia

- 5.5.4.4 Chile

- 5.5.4.5 Peru

- 5.5.4.6 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 South Africa

- 5.5.5.2 Saudi Arabia

- 5.5.5.3 United Arab Emirates

- 5.5.5.4 Nigeria

- 5.5.5.5 Egypt

- 5.5.5.6 Morocco

- 5.5.5.7 Turkey

- 5.5.5.8 Rest of Middle East and Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)}

- 6.4.1 ADM

- 6.4.2 Cargill Inc.

- 6.4.3 International Flavors & Fragrances Inc.

- 6.4.4 Kerry Group plc

- 6.4.5 Ingredion Inc.

- 6.4.6 The Scoular Company

- 6.4.7 Avebe

- 6.4.8 Roquette Freres

- 6.4.9 Mycotechnology Inc.

- 6.4.10 Buhler Group

- 6.4.11 Corbion N.V.

- 6.4.12 Perfect Day Inc.

- 6.4.13 DuPont

- 6.4.14 Glanbia plc

- 6.4.15 Ynsect SAS

- 6.4.16 Calysta Inc.

- 6.4.17 Eden Brew Pty Ltd.

- 6.4.18 Novameat Tech SL

- 6.4.19 Proeon

- 6.4.20 AGT Food and Ingredients Inc.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK