PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906943

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906943

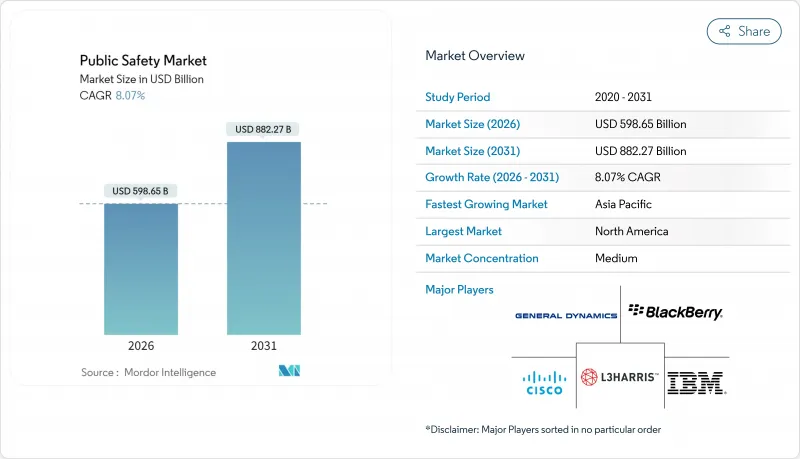

Public Safety - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The public safety market is expected to grow from USD 553.95 billion in 2025 to USD 598.65 billion in 2026 and is forecast to reach USD 882.27 billion by 2031 at 8.07% CAGR over 2026-2031.

Rising disaster-relief appropriations, heightened defense outlays, and a global mandate to replace aging land-mobile-radio (LMR) assets with mission-critical 5G networks jointly underpin this upward trajectory. Federal initiatives such as FirstNet's USD 6.3 billion 5G upgrade are accelerating platform modernization, while FEMA's FY 2025 request of USD 28.969 billion underscores the scale of climate-related response funding. At the same time, a proposed USD 1 billion smart-city grant program promises to widen adoption of real-time surveillance and analytics capabilities. Corporate capital flows mirror these macro signals: Microsoft's USD 1.5 billion stake in UAE-based G42 and Dubai Police's all-encompassing AI roadmap exemplify how geopolitical ambitions translate into local public-safety spend.

Global Public Safety Market Trends and Insights

Heightened Frequency and Severity of Climate-related Disasters Increasing Emergency-Response Spending

Climate-induced hazards are redefining agency procurement priorities. Hurricane Helene's USD 200 billion, 10-year recovery bill spotlighted the fiscal magnitude of disaster response. The 2025 Los Angeles wildfire crisis razed >12,000 structures and triggered California's USD 2.5 billion emergency allocation, accelerating contracts for integrated incident-command systems. FEMA's FY 2025 Disaster Relief Fund call for USD 28.969 billion, including a USD 1 billion Building Resilient Infrastructure and Communities carve-out, further evidences commitment to technology-centric resilience. Agencies increasingly favor interoperable platforms that aggregate multi-source data, as documented in the Carnegie Disaster Dollar Database. Japan's Spectee Pro illustrates demand for AI-driven situational intelligence, having secured 1,100+ local-government contracts with near-perfect retention.

Rising Geopolitical Tensions Pushing Defense and Homeland-Security Budgets for Integrated Command-and-Control Centres

Global insecurity is funneling capital into hardened communications and cyber-defense. The U.S. FY 2024 National Defense Authorization Act prioritizes counter-UAS and zero-trust gateways, signaling cross-over benefits for civil agencies. Domestic Preparedness notes the spill-over of nation-state cyber risk into civic domains, prompting emergency managers to seek quantum-resilient encryption. L3Harris' next-generation security-processor award underlines vendor response to these requirements.

Fragmented Radio-Spectrum Governance Hindering Interoperability Between Agency Networks

Diverse band plans and legacy protocols remain stubborn barriers. CISA's National Interoperability Field Operations Guide lists incompatible frequencies as a primary operational risk. Governance gaps exacerbate the issue; the "Why Can't We Talk?" report cites duplicated funding streams and absent coordination as root causes. Though Project 25 and AES-256 transitions are endorsed at federal level, inconsistent local adoption perpetuates silos.

Other drivers and restraints analyzed in the detailed report include:

- Mandated Transition from Legacy LMR to 4G/5G Mission-Critical Broadband Networks Across Public-Safety Agencies

- Smart-City Programs Scaling Real-time Video Surveillance and Situational-Awareness Platforms

- High Up-front CAPEX and Long Procurement Cycles Limiting Adoption in Cash-Strapped Municipalities

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Solutions contributed 67.60% of 2025 revenue, a dominance underpinned by bundled communication networks, AI-enabled video analytics, and emergency-management platforms that agencies increasingly procure as single, interoperable suites. Critical-communication sub-systems benefited directly from the public safety market size uplift generated by FirstNet's nationwide 5G build-out. Within services, managed operations and professional consulting are growing at 8.94% CAGR as agencies outsource spectrum optimization, cybersecurity hardening, and AI model tuning.

Professional-services revenue momentum also mirrors growing demand for interoperability audits and spectrum-management road-maps-skill sets rarely retained in-house. Managed-service contracts reduce total cost of ownership yet bolster uptime guarantees, appealing to municipalities constrained by head-count caps. Biometric-security rollouts face privacy headwinds but still post gains in transportation hubs and correctional facilities. FEMA's USD 28.969 billion disaster-fund call fuels spend on incident-command dashboards, expanding the public safety market size attached to integrated response platforms.

On-premise still holds 71.20% of 2025 deployments as federal entities insist on physical control over sensitive data. Cloud, however, advances at 9.41% CAGR, driven by pay-as-you-go economics and reduced refresh cycles. Tyler Technologies' revelation that SaaS now represents 90% of new contract value signals a decisive pivot toward subscription models.

Hybrid architectures are emerging as the preferred governance-risk compromise: edge nodes retain location-based data while analytical workloads float in the cloud, trimming latency for AI-driven video feeds. The U.S. government's Personnel Emergency Notification System, explicitly requiring BlackBerry AtHoc's cloud platform, signals increasing federal comfort with off-premise software for non-classified uses. As compliance frameworks mature, vendors bundle FedRAMP-ready stacks, expanding addressable share while mitigating data-sovereignty concerns.

Public Safety Market is Segmented by Component (Solution - Critical Communication Network, Surveillance and Analytics Systems, and More), Deployment Type (On-Premise, Cloud), End-User Vertical (Law Enforcement Agencies, and More), Technology (Artificial Intelligence and Predictive Analytics, and More), Agency Type (Federal/National, and More), and by Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America retained 33.90% revenue share in 2025, underpinned by entrenched grant programs and the mature public safety market size tied to FirstNet's nationwide footprint. Europe continues steady adoption, bolstered by the UK's Home Office-IBM Emergency Services Network that will serve 300,000 responders. Yet the Middle East commands the highest regional CAGR at 8.73% through 2031 as UAE, Saudi Arabia, and Israel embed public-safety tech within broader economic-diversification blueprints.

Large sovereign investment vehicles accelerate AI incubation; Microsoft's USD 1.5 billion equity in G42 brings hyperscale compute and cloud best practices to regional agencies. Dubai Police's AI strategy spans predictive analytics, unmanned patrol vehicles, and citizen-service kiosks, illustrating a holistic digital-policing vision. Asia-Pacific displays mixed maturity: Singapore's Home Team Science and Technology Agency (HTX) co-develops the Phoenix generative-AI model with Google, Microsoft, and Thales for advanced incident-analytics. Latin America leverages Inter-American Development Bank guidance to integrate AI responsibly, focusing first on crime-data harmonization across provincial jurisdictions.

- Motorola Solutions Inc.

- Cisco Systems Inc.

- L3Harris Technologies Inc.

- Hexagon AB

- IBM Corporation

- General Dynamics Corporation

- BlackBerry Ltd.

- Thales Group

- NICE Ltd

- Verint Systems Inc.

- Atos SE

- CentralSquare Technologies

- Semtech Corporation

- Huawei Technologies Co. Ltd.

- Everbridge Inc.

- Tyler Technologies Inc.

- Axon Enterprise Inc.

- Bosch Security Systems

- Digital Barriers plc

- Cape Analytics Inc.

- NEC Corporation

- Leonardo S.p.A.

- Intrado Corporation

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Heightened Frequency and Severity of Climate-related Disasters Increasing Emergency Response Spending

- 4.2.2 Rising Geopolitical Tensions Pushing Defense and Homeland Security Budgets for Integrated Command-and-Control Centres

- 4.2.3 Mandated Transition from Legacy LMR to 4G/5G Mission-Critical Broadband Networks Across Public Safety Agencies

- 4.2.4 Smart City Programs Scaling Real-time Video Surveillance and Situational Awareness Platforms

- 4.2.5 Federal Stimulus Packages Accelerating Cloud-based Public Safety Software Procurement

- 4.2.6 Convergence of AI-Powered Predictive Policing Analytics Reducing Response Time

- 4.3 Market Restraints

- 4.3.1 Fragmented Radio Spectrum Governance Hindering Interoperability Between Agency Networks

- 4.3.2 High Up-front CAPEX and Long Procurement Cycles Limiting Adoption in Cash-Strapped Municipalities

- 4.3.3 Rising Public Scrutiny and Data-Privacy Regulations (GDPR, CCPA) Slowing Deployment of Facial-Recognition Surveillance

- 4.3.4 Cyber-security Vulnerabilities in IoT Sensors Creating Reluctance for Full-scale Roll-outs

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Outlook

- 4.6 Technology Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Component

- 5.1.1 Solution

- 5.1.1.1 Critical Communication Network

- 5.1.1.2 Surveillance and Analytics Systems

- 5.1.1.3 Biometric Security and Authentication Systems

- 5.1.1.4 Emergency and Disaster Management Platforms

- 5.1.1.5 Incident and Evidence Management Software

- 5.1.2 Services

- 5.1.2.1 Professional Services

- 5.1.2.2 Managed Services

- 5.1.1 Solution

- 5.2 By Deployment Type

- 5.2.1 On-premise

- 5.2.2 Cloud

- 5.3 By End-user Vertical

- 5.3.1 Law Enforcement Agencies

- 5.3.2 Firefighting Departments

- 5.3.3 Emergency Medical Services

- 5.3.4 Transportation and Critical Infrastructure Operators

- 5.3.5 Disaster and Rescue Management Authorities

- 5.3.6 Other Public Safety Bodies

- 5.4 By Technology

- 5.4.1 Artificial Intelligence and Predictive Analytics

- 5.4.2 Internet of Things Sensors and Gateways

- 5.4.3 Cloud and Edge Computing

- 5.4.4 Big-Data and GIS Analytics

- 5.4.5 5G and Mission-Critical LTE Networks

- 5.5 By Agency Type

- 5.5.1 Federal / National

- 5.5.2 State and Provincial

- 5.5.3 Municipal / Local

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 South America

- 5.6.2.1 Brazil

- 5.6.2.2 Argentina

- 5.6.2.3 Rest of South America

- 5.6.3 Europe

- 5.6.3.1 United Kingdom

- 5.6.3.2 Germany

- 5.6.3.3 France

- 5.6.3.4 Italy

- 5.6.3.5 Spain

- 5.6.3.6 Rest of Europe

- 5.6.4 Asia Pacific

- 5.6.4.1 China

- 5.6.4.2 Japan

- 5.6.4.3 India

- 5.6.4.4 South Korea

- 5.6.4.5 ASEAN

- 5.6.4.6 Australia

- 5.6.4.7 New Zealand

- 5.6.4.8 Rest of Asia Pacific

- 5.6.5 Middle East and Africa

- 5.6.5.1 Middle East

- 5.6.5.1.1 GCC

- 5.6.5.1.2 Turkey

- 5.6.5.1.3 Israel

- 5.6.5.1.4 Rest of Middle East

- 5.6.5.2 Africa

- 5.6.5.2.1 South Africa

- 5.6.5.2.2 Nigeria

- 5.6.5.2.3 Egypt

- 5.6.5.2.4 Rest of Africa

- 5.6.5.1 Middle East

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)}

- 6.4.1 Motorola Solutions Inc.

- 6.4.2 Cisco Systems Inc.

- 6.4.3 L3Harris Technologies Inc.

- 6.4.4 Hexagon AB

- 6.4.5 IBM Corporation

- 6.4.6 General Dynamics Corporation

- 6.4.7 BlackBerry Ltd.

- 6.4.8 Thales Group

- 6.4.9 NICE Ltd

- 6.4.10 Verint Systems Inc.

- 6.4.11 Atos SE

- 6.4.12 CentralSquare Technologies

- 6.4.13 Semtech Corporation

- 6.4.14 Huawei Technologies Co. Ltd.

- 6.4.15 Everbridge Inc.

- 6.4.16 Tyler Technologies Inc.

- 6.4.17 Axon Enterprise Inc.

- 6.4.18 Bosch Security Systems

- 6.4.19 Digital Barriers plc

- 6.4.20 Cape Analytics Inc.

- 6.4.21 NEC Corporation

- 6.4.22 Leonardo S.p.A.

- 6.4.23 Intrado Corporation

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment