PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851320

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851320

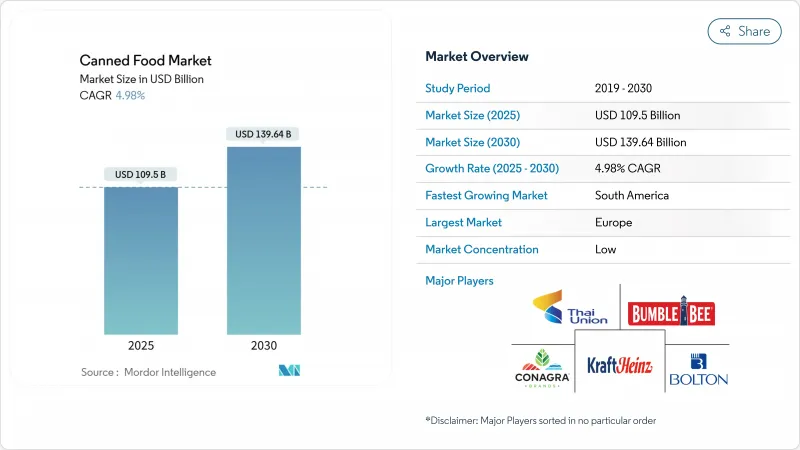

Canned Food - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The canned food market size reached USD 109.5 billion in 2025 and is expected to grow to USD 139.64 billion by 2030, at a CAGR of 4.98%.

Urbanization is fueling the demand for convenient meal options, especially among working professionals and students. Government mandates on emergency preparedness are bolstering the stockpiling of canned foods. Meanwhile, manufacturers are innovating, enhancing flavors, nutritional content, and embracing sustainable packaging. Regulatory shifts, like China's stringent clean-label mandates and Europe's push for sustainability, are nudging manufacturers towards natural ingredients, reduced artificial preservatives, and eco-friendly packaging. The market's fragmented landscape is a boon for regional players and niche producers, allowing them to carve out a niche with unique products, ethnic flavors, and locally-sourced ingredients. With economic recovery in South America boosting consumer spending, retail growth in emerging Asia-Pacific markets, and a rising appetite for premium, organic, and gourmet canned products in North America and Europe, the market is poised for robust growth.

Global Canned Food Market Trends and Insights

Urban Micro-kitchens Driving Single-serve Canned Meals Uptake

As high-density housing becomes the norm and kitchens shrink, there's a rising demand for compact, portion-controlled canned meals tailored for these space-constrained environments. Statistics Korea reports a jump in South Korea's one-person households, from 7.5 million in 2022 to 7.83 million in 2023. Premium canned food brands, like the innovative Fishwife, have successfully transformed the perception of tinned seafood. By positioning these products as sophisticated lifestyle enhancements, they've cultivated a digital community of 350,000 engaged members. This shift underscores a significant evolution in consumer behavior, especially among millennials and Gen Z. These demographics now seamlessly incorporate canned goods into their visually curated, social media-friendly meals. Social media's sway on purchasing decisions is undeniable. Consumers are increasingly discovering and experimenting with new food products online, presenting a golden opportunity for canned food brands to boost their market presence. Single-portion packaging not only commands a premium price but also plays a pivotal role in reducing household food waste. This approach addresses both economic concerns and environmental sustainability, especially for urban consumers grappling with rising food costs in competitive markets.

Extended Shelf life and Storage Capabilities aligned with Modern Consumer Requirements

During times of supply chain disruptions and high inflation, households increasingly rely on canned foods, thanks to their extended shelf life. Metal cans can preserve food quality and nutritional value for 2-5 years without refrigeration. This not only cuts down on food waste but also results in carbon dioxide savings, akin to taking millions of vehicles off the road. Such preservation is especially advantageous for consumers who buy in bulk, helping them counter rising food prices and secure their household's food supply. Beyond homes, institutional buyers and foodservice operators leverage canned products to manage inventory costs, ensure a steady supply, and reduce food spoilage. This shift has led to a surge in demand for shelf-stable foods, which promise long-term food security without the need for specialized storage or constant power. Canned foods, with their minimal storage requirements, play a pivotal role in sustainable food distribution, cutting down energy consumption while ensuring product quality. Moreover, the sturdy design of metal cans shields contents from external threats, guaranteeing safety and quality, whether in tough storage conditions or during lengthy transport.

Consumer Purchasing Behavior Influenced by Sodium Content and Preservative Levels in Products

As health consciousness rises, consumers are scrutinizing sodium and preservative levels in their food choices, driving growth in the canned food market. Alarmingly, Americans consume too much sodium, largely from processed foods, including canned goods. This trend has sparked concerns from health organizations and regulatory bodies alike. Responding to these concerns, the FDA has rolled out comprehensive sodium reduction guidelines, exerting significant pressure on the canned food industry to reformulate its products. Simultaneously, there's a growing consumer demand for preservative-free options. In China, the National Health Commission (NHC) and the State Administration for Market Regulation (SAMR) have introduced the National Food Safety Standard for Canned Foods (GB 7098-2025). This rigorous standard governs all canned products in China, detailing requirements for ingredients, physical and chemical indicators, contaminants, and microbial limits.

Other drivers and restraints analyzed in the detailed report include:

- Canned Seafood Consumption Increased by Protein Diversification

- Strategic Government Stockpiling for Military and Emergency Response

- Environmental Impact of Metal Can Disposal Raises Sustainability Concerns

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Canned fish and seafood hold the largest market share at 34.65% in 2024. The seafood segment benefits from protein diversification trends and premium positioning strategies, particularly in developed markets where consumers seek high-quality protein alternatives. Canned meat and poultry maintain steady demand through institutional channels, including schools, hospitals, and military facilities, while canned vegetables benefit from convenience trends and foodservice expansion across quick-service restaurants and catering services. Canned fruits are the fastest-growing segment with a 5.03% CAGR through 2030. The segment's growth is driven by innovations such as diabetic-friendly canned peaches using Stevia and Agave syrup, which offer reduced calorie content and a lower glycemic index compared to traditional sugar-based products.

These developments meet health-conscious consumer requirements while maintaining consumer-approved taste profiles. The segment also features enhanced preservation techniques that maintain fruit texture and nutritional content. Other product categories, including soups and ready meals, benefit from urban micro-kitchen trends, with single-serve formats offering premium pricing opportunities and portion control benefits. The segment reflects consumer preferences for health, convenience, and premium products, with brands differentiating themselves through ingredient quality, advanced packaging technologies, clean-label ingredients, and focused marketing approaches targeting specific dietary preferences and lifestyle choices.

The Canned Food Market Report is Segmented by Product Type (Canned Meat and Poultry, Canned Fish and Seafood, Canned Fruits, Canned Vegetables, and Other Types), Form (Whole, and Chunks/Pieces), Distribution Channel (Off-Trade, On-Trade, and Others), and Geography (North America, Europe, Asia-Pacific, South America, and Middle East and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Europe contributed 38.55% of 2024 revenue, maintaining its position as the largest regional market. This dominance stems from established consumption patterns, robust supply chains, and strict sustainability regulations. The region's emphasis on Marine Stewardship Council certification and high-recycled-content metal cans generates additional value that supports environmental innovations. Germany, France, the UK, the Netherlands, Belgium, and Spain represent the primary importing and consuming markets of canned food.

Germany, as Europe's largest food market, presents significant export opportunities, particularly in the organic segment. While the UK and France show strong demand due to lower domestic production compared to Spain and Italy, the Netherlands serves as both a major consumer and re-export hub. South America demonstrates the highest growth trajectory with a 6.32% CAGR. Economic recovery in Argentina and Colombia improves consumer purchasing power, while government initiatives support domestic seafood processing to enhance export value.

In Asia-Pacific, market conditions vary by country. Indian consumers increase spending on essential items, with canned legumes and fruits gaining popularity during monsoon-related supply disruptions. China's implementation of the National Food Safety Standard (GB 7098-2025) introduces tighter controls on contaminants and microbiological parameters, potentially increasing operational costs while improving consumer confidence. Chinese manufacturers are adapting to Beijing's February 2025 preservative restrictions by implementing enhanced thermal processing technology to maintain product quality. North America sustains market volume through product innovation, established brand preferences, and new fish-canning facilities in Oregon and Massachusetts, reducing import dependence.

List of Companies Covered in this Report:

- Kraft Heinz Company

- Conagra Brands Inc.

- Thai Union Group PCL

- Bolton Group (Rio Mare, Saupiquet)

- Bumble Bee Foods, LLC.

- Campbell Soup Company

- JBS S.A. (SAMPCO)

- Bonduelle SA

- Tyson Foods, Inc.

- Century Pacific Food Inc.

- Del Monte Pacific Ltd.

- StarKist Co.

- Hormel Foods Corp.

- Robert Damkjaer A/S

- Goya Foods, Inc.

- Denis Freres Group

- Keystone Meat Company

- Zwanenberg Food Group

- Maple Leaf Foods Inc.

- Morliny Foods Holding Limited

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Urban Micro-kitchens Driving Single-Serve Canned Meals Uptake

- 4.2.2 Extended Shelf Life and Storage Capabilities Aligned with Modern Consumer Requirements

- 4.2.3 Canned Seafood Consumption Increased by Protein Diversification

- 4.2.4 Strategic Government Stockpiling for Military and Emergency Response

- 4.2.5 Consumer Purchase Decisions Influenced by Sustainability Certifications and Product Traceability

- 4.2.6 Expansion of Canned Food offerings in the Foodservice Sectors

- 4.3 Market Restraints

- 4.3.1 Consumer purchasing behavior influenced by sodium content and preservative levels in products

- 4.3.2 Environmental impact of metal can disposal raises sustainability concerns

- 4.3.3 Raw material price volatility affects market expansion opportunities

- 4.3.4 Growing consumer preference for fresh and unprocessed food products

- 4.4 Value/Supply-Chain Analysis

- 4.5 Regulatory and Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Product Type

- 5.1.1 Canned Meat and Poultry

- 5.1.2 Canned Fish and Seafood

- 5.1.3 Canned Fruits

- 5.1.4 Canned Vegetables

- 5.1.5 Other Types

- 5.2 By Form

- 5.2.1 Whole

- 5.2.2 Chunks/Pieces

- 5.3 By Distribution Channel

- 5.3.1 Off-Trade

- 5.3.1.1 Supermarkets and Hypermarkets

- 5.3.1.2 Convenience/Grocery Stores

- 5.3.1.3 Online Retailers

- 5.3.1.4 Other Distribution Channels

- 5.3.2 On-Trade (Food-Service/Catering)

- 5.3.3 Others (Industrial and Ingredient Conversion)

- 5.3.1 Off-Trade

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.1.4 Rest of North America

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Netherlands

- 5.4.2.7 Russia

- 5.4.2.8 Norway

- 5.4.2.9 Sweden

- 5.4.2.10 Denmark

- 5.4.2.11 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 South Korea

- 5.4.3.5 Australia

- 5.4.3.6 Indonesia

- 5.4.3.7 Thailand

- 5.4.3.8 Vietnam

- 5.4.3.9 Malaysia

- 5.4.3.10 Rest of Asia-Pacific

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Chile

- 5.4.4.4 Peru

- 5.4.4.5 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 United Arab Emirates

- 5.4.5.3 South Africa

- 5.4.5.4 Rest of Middle East and Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Kraft Heinz Company

- 6.4.2 Conagra Brands Inc.

- 6.4.3 Thai Union Group PCL

- 6.4.4 Bolton Group (Rio Mare, Saupiquet)

- 6.4.5 Bumble Bee Foods, LLC.

- 6.4.6 Campbell Soup Company

- 6.4.7 JBS S.A. (SAMPCO)

- 6.4.8 Bonduelle SA

- 6.4.9 Tyson Foods, Inc.

- 6.4.10 Century Pacific Food Inc.

- 6.4.11 Del Monte Pacific Ltd.

- 6.4.12 StarKist Co.

- 6.4.13 Hormel Foods Corp.

- 6.4.14 Robert Damkjaer A/S

- 6.4.15 Goya Foods, Inc.

- 6.4.16 Denis Freres Group

- 6.4.17 Keystone Meat Company

- 6.4.18 Zwanenberg Food Group

- 6.4.19 Maple Leaf Foods Inc.

- 6.4.20 Morliny Foods Holding Limited

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK