PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851321

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851321

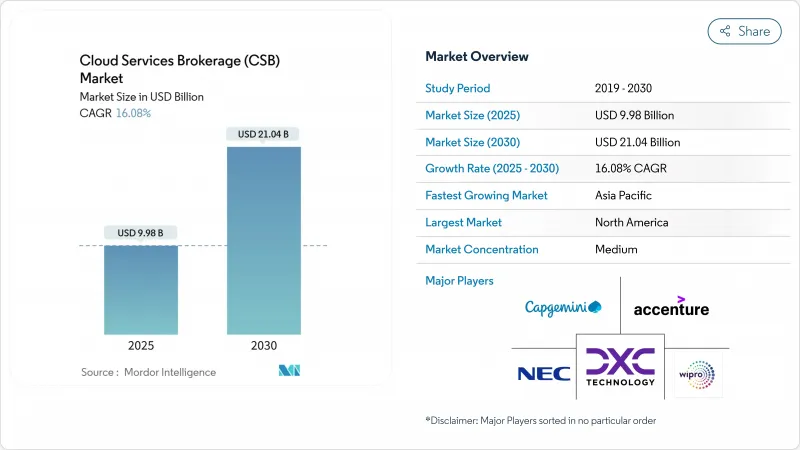

Cloud Services Brokerage (CSB) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Cloud Services Brokerage Market size is estimated at USD 9.98 billion in 2025, and is expected to reach USD 21.04 billion by 2030, at a CAGR of 16.08% during the forecast period (2025-2030).

This growth reflects enterprises' need for a single pane of glass to govern increasingly complex multi-cloud estates, where the typical organization now juggles 2.6 public clouds alongside private resources. Regulatory mandates add further momentum, especially in Europe, where the Digital Services Act and Data Act enforce strict portability and sovereignty rules that amplify demand for brokerage controls. Supplier consolidation, highlighted by Broadcom's VMware takeover, has nudged many IT leaders toward independent platforms to preserve negotiating power and avoid lock-in. Meanwhile, hyperscaler marketplaces have exploded, creating lucrative co-sell avenues for brokers tied into Amazon Web Services, Microsoft Azure, and Google Cloud ecosystems. Supply-chain headwinds persist, with semiconductor constraints lifting regional infrastructure costs by 15-20%, yet the cloud service brokerage market continues to absorb this pressure as cost governance tools prove indispensable.

Global Cloud Services Brokerage (CSB) Market Trends and Insights

Hybrid and Multi-Cloud Adoption Surge

Hybrid and multi-cloud strategies now dominate CIO roadmaps, with 92% of enterprises expected to pursue multi-cloud architectures by 2025. The resulting sprawl demands brokerage platforms that stitch disparate environments into unified policy domains while shielding organizations from vendor lock-in. Financial services firms stand at the forefront because data-residency mandates bar outright public-cloud migration. Oracle's direct interconnect with Google Cloud demonstrates how service brokers enable low-latency cross-cloud data flows without traversing the open internet. Container proliferation compounds complexity, pushing CSBs to deliver deep Kubernetes orchestration so DevOps teams avoid juggling console-specific scripts. With edge workloads entering the mix, a broker offers one governance fabric spanning on-prem, public, and edge nodes, minimizing skills gaps and operational risk.

Enterprise Cloud-Spend Acceleration

End-user cloud spending is on track to hit USD 723.4 billion in 2025, a 21.20% jump over 2024 levels. Bigger invoices expose finance leaders to budget overruns, turning FinOps insight into a board-level mandate. CSB platforms now embed machine-learning algorithms that forecast consumption spikes and trigger automated right-sizing. Banks showcase the urgency: despite using only 49% of their committed cloud outlays, they plan to boost allocations further to run AI models requiring premium GPUs. Without broker-led guardrails, many CFOs fear "bill shock," where a single poorly scoped data-science project can wipe out annual spend thresholds within months.

Security and Compliance Concerns

Shared-responsibility models confuse many risk officers, especially when the Digital Services Act imposes fresh notice-and-action rules on cloud operators. Brokers must therefore support granular access controls, geo-fencing, and tamper-proof audit logs across every connected provider. Implementing such depth raises R&D costs and lengthens sales cycles as buyers demand exhaustive penetration-test evidence. Identity management remains the hardest element: CSBs must federate credentials across Azure AD, AWS IAM, and Google Identity while preserving least-privilege defaults.

Other drivers and restraints analyzed in the detailed report include:

- Need for Centralized Cost and Governance

- Hyperscaler Marketplace Co-Sell Boom

- Low SME Awareness of CSB Value

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

External Brokerage Enablement platforms accounted for 48% of the cloud service brokerage market share in 2024, thanks to their vendor-neutral appeal and mature feature sets. Internal Brokerage Enablement, however, is forecast to compound at 18.70% CAGR, reflecting management's push to embed cloud governance natively into enterprise DevOps pipelines. The cloud service brokerage market size tied to internal platforms is set to more than double by 2030 as Fortune 500 banks and telecoms spin up bespoke portals linked to ServiceNow, Jira, and CI/CD stacks.

This internal surge rides on rising platform-engineering headcount and strategic acquisitions such as IBM's USD 6.4 billion purchase of HashiCorp, which delivers Terraform and Vault automation under one roof. Internal CSBs also cut license spend over time and let security teams inject organization-specific controls at the code level. External vendors still hold ground by offering faster time-to-value and evergreen marketplace integrations, positioning themselves as "broker of brokers" layers that manage legacy, internal, and SaaS estates together.

Public Cloud services retained 54% of the cloud service brokerage market in 2024, propelled by ever-expanding hyperscaler availability zones. Yet, Hybrid Cloud deployments are sprinting ahead at 20.30% CAGR as CFOs weigh egress fees against compliance mandates. EU sovereign initiatives have nudged buyers toward architectures where regulated data stays on-prem while analytics elastically burst to public capacity, a pattern Microsoft's EU Sovereign Cloud expressly targets.

Edge computing further boosts hybrid adoption because manufacturers want latency-critical workloads processed on factory floors. Brokers now knit local Kubernetes clusters with cloud back-ends, granting one-click workload mobility. As 5G private networks spread, expect CSB consoles to manage on-prem MEC nodes alongside classic IaaS resources, a capability public-only brokers cannot match.

The Cloud Services Brokerage (CSB) Market Report is Segmented by Platform (Internal Brokerage Enablement and External Brokerage Enablement ), Deployment Model (Public Cloud, Private Cloud, and Hybrid Cloud), Enterprise (Small and Medium-Sized Enterprises and Large Enterprises), End-User Industry (IT and Telecommunications, Banking, Financial Services and Insurance, Retail and Consumer Goods, and More), and Geography.

Geography Analysis

North America retained 44% of global revenue in 2024, owing to early cloud maturity and dense partner ecosystems. Financial services and healthcare providers dominate adoption, drawn to brokers that streamline Sarbanes-Oxley and HIPAA reporting. Semiconductor shortages continue to inflate regional rack costs, yet brokers mitigate the impact by optimizing workload placement across lower-cost zones. Sovereign-cloud conversations are growing louder as federal agencies and defense contractors seek domestic data-residency assurances, nudging brokers to certify FedRAMP High controls.

Asia Pacific is the fastest-growing territory at an 18.50% CAGR through 2030. Governments from India to Japan run "cloud-first" directives, while regional GDP uplift from cloud computing is estimated at 0.25%-2.23%. Japanese providers such as Sakura Internet now bundle brokerage functions with domestic clouds, appealing to firms wary of trans-border data transfer rules. Meanwhile, semiconductor manufacturing clusters in Taiwan and South Korea secure component supply for local data-center rollout, counterbalancing geopolitical risks.

Europe stands out for regulatory pull: the EU Data Act and GAIA-X lay down stringent portability and sovereignty targets. Microsoft's sovereign-cloud roadmap and Oracle's EU Regulated Cloud hint at a service landscape tailor-made for broker overlays. The Middle East and Africa, plus South America, remain emergent but promising; national digital-economy programs in the UAE, Saudi Arabia, and Brazil are funding hyperscaler region launches, planting fertile ground for broker uptake once connectivity gaps close.

- Accenture

- IBM

- Wipro

- Capgemini

- DXC Technology

- NEC

- NTT Data

- Cognizant

- Jamcracker

- VMware

- Flexera (RightScale)

- Ingram Micro Cloud

- Arrow Electronics (CloudBlue)

- AppDirect

- Pax8

- Cloudmore

- Boomi

- DoubleHorn

- TietoEVRY

- Tech Mahindra

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Hybrid and multi-cloud adoption surge

- 4.2.2 Enterprise cloud-spend acceleration

- 4.2.3 Need for centralized cost and governance

- 4.2.4 Hyperscaler marketplace co-sell boom

- 4.2.5 AI-driven FinOps within CSBs

- 4.2.6 Sovereign-cloud compliance layers

- 4.3 Market Restraints

- 4.3.1 Security and compliance concerns

- 4.3.2 Low SME awareness of CSB value

- 4.3.3 Native hyperscaler tools cannibalize CSBs

- 4.3.4 Fee-compression squeezes margins

- 4.4 Value/Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Platform

- 5.1.1 Internal Brokerage Enablement

- 5.1.2 External Brokerage Enablement

- 5.2 By Deployment Model

- 5.2.1 Public Cloud

- 5.2.2 Private Cloud

- 5.2.3 Hybrid Cloud

- 5.3 By Enterprise Size

- 5.3.1 Small and Medium-sized Enterprises

- 5.3.2 Large Enterprises

- 5.4 By End-user Industry

- 5.4.1 IT and Telecommunications

- 5.4.2 Banking, Financial Services and Insurance

- 5.4.3 Retail and Consumer Goods

- 5.4.4 Healthcare and Life Sciences

- 5.4.5 Government and Public Sector

- 5.4.6 Manufacturing

- 5.4.7 Media and Entertainment

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Chile

- 5.5.2.4 Rest of the South America

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Rest of Europe

- 5.5.4 Asia Pacific

- 5.5.4.1 China

- 5.5.4.2 Japan

- 5.5.4.3 India

- 5.5.4.4 Rest of Asia Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 United Arab Emirates

- 5.5.5.2 Saudi Arabia

- 5.5.5.3 South Africa

- 5.5.5.4 Rest of Middle East and Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Accenture

- 6.4.2 IBM

- 6.4.3 Wipro

- 6.4.4 Capgemini

- 6.4.5 DXC Technology

- 6.4.6 NEC

- 6.4.7 NTT Data

- 6.4.8 Cognizant

- 6.4.9 Jamcracker

- 6.4.10 VMware

- 6.4.11 Flexera (RightScale)

- 6.4.12 Ingram Micro Cloud

- 6.4.13 Arrow Electronics (CloudBlue)

- 6.4.14 AppDirect

- 6.4.15 Pax8

- 6.4.16 Cloudmore

- 6.4.17 Boomi

- 6.4.18 DoubleHorn

- 6.4.19 TietoEVRY

- 6.4.20 Tech Mahindra

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment