PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851323

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851323

MNS - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

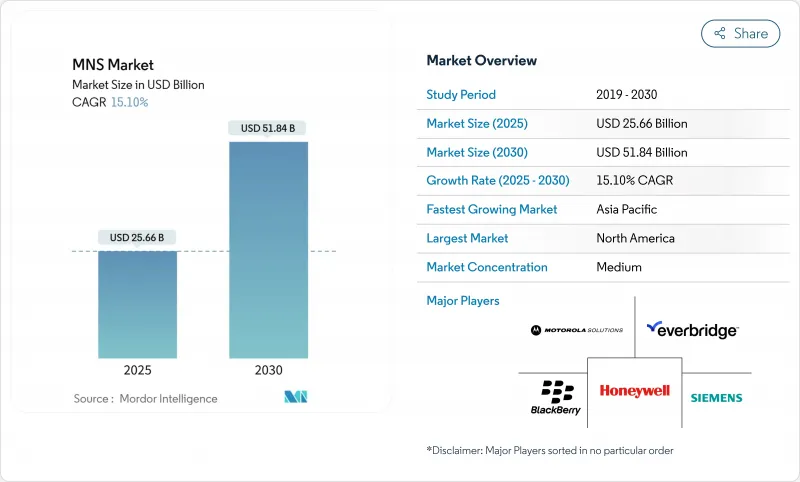

The mass notification systems market is valued at USD 25.66 billion in 2025 and is on track to reach USD 51.84 billion by 2030, rising at a 15.1% CAGR.

Heightened climate risks, tougher safety regulations, and technology advances are converging to keep adoption momentum high. Organizations now expect a single platform to reach people through text, voice, social, desktop pop-ups, public address, and IoT sensors, all while tailoring messages to location and role. Cloud deployment dominates because enterprises want immediate scale and remote management, yet the hybrid model is catching up as security teams look for tighter on-premise control. Suppliers that master integration with 5G, analytics, and legacy infrastructure are best positioned to win new projects as spending spreads from government to healthcare, education, utilities, and small businesses.

Global MNS Market Trends and Insights

Accelerated 5G roll-outs enabling real-time multimedia alerting

5G brings gigabit throughput and millisecond latency, allowing platforms to push high-definition video, floor plans, and interactive evacuation maps rather than plain text. Urban centers in Japan, South Korea, and Singapore already use location-based warnings that adapt as recipients move through a city. Operators report 20% higher connectivity satisfaction during large events compared with 4G, a data point that reassures emergency managers planning for congested networks. Vendors able to embed network- slicing and edge-compute features are differentiating on speed, redundancy, and content richness. As spectrum auctions continue and device penetration rises, the mass notification systems market will capture incremental public-safety funding tied to 5G coverage targets.

EU's EECC Article 110 driving multi-channel compliance

The code obliges all 27 EU states to reach "the maximum possible affected population," pushing governments to marry cell broadcast, location-based SMS, and app alerts. Funding streams earmarked for compliance have accelerated roll-outs of hybrid platforms that support multilingual content, two-way messaging, and cross-border interoperability. Commercial users are following the same architecture to streamline business continuity communications, pulling private investment into the mass notification systems market sooner than projected.

Fragmented spectrum policies hampering African adoption

Cell broadcast relies on harmonized spectrum guidelines, yet policies vary widely across 54 African nations. Vendors face custom integrations for each carrier, prolonging pilots and inflating costs, which slows public-safety deployments even as 3G and 4G coverage climbs above 90%. Regional harmonization efforts are underway, but until they mature, growth lags other emerging regions.

Other drivers and restraints analyzed in the detailed report include:

- Escalating climate catastrophes accelerating municipal deployments

- Campus digitization transforming educational safety

- Cyber-insurance premiums elevating cloud TCO in healthcare

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The mass notification systems market size for solutions reached USD 17 billion in 2024, translating to a 66% share as agencies and enterprises replaced hardware-centric setups with command-center software. Software unifies SMS, voice, email, sirens, and signage under one console, reducing training needs and license duplication. In the second half of the decade, analytics modules that predict recipient behavior are expected to prompt upgrades among existing customers, keeping solutions revenue on a double-digit climb. Services, while a smaller slice, are advancing at an 18.6% CAGR because integration, customization, and 24/7 monitoring demand specialist skills.

Hardware retains a foothold in plants, airports, and schools where strobe beacons, wall-mounted speakers, and outdoor sirens remain mission critical. Yet manufacturers are embedding IP connectivity in these devices so they can report status back to the central platform. Professional services teams are packaging assessments, regulatory consulting, and lifecycle maintenance into multi-year contracts, creating predictable cash flow for vendors and lowering surprise costs for clients. Such managed models are further widening the solutions edge within the mass notification systems market.

Cloud captured 71% of the mass notification systems market in 2024 as administrators favored instant scale, pay-as-you-go pricing, and hassle-free upgrades. SaaS platforms also simplified multi-tenant management for large enterprises spanning dozens of sites. That model resonates with SMEs that lack IT staff, fueling the highest net-new logo count. Even so, data-sovereignty rules, the need for on-site survivability, and concerns over vendor lock-in are steering financial services, utilities, and hospitals toward hybrid approaches. Hybrid adoption is forecast to grow at 20.4% CAGR, the fastest rate in deployment choices.

On-premise deployments are shrinking but will not disappear. Critical infrastructure owners often keep a local instance running on hardened servers so messages still flow when external links fail. Containerized architectures now let operators shift workloads between public clouds and local clusters, balancing cost and control. As such flexibility becomes mainstream, the mass notification systems market will likely see blurred lines between "cloud" and "on-premise," with buyers selecting per-workload policies rather than a single blanket model.

Mass Notification Systems Market Report Segments the Industry Into Component (Solution, Services, Hardware), Deployment (Cloud, On-Premise, Hybrid), Application (In-Building, Wide-Area and More), Solution Purpose (Business Continuity and Disaster Recovery, and More), End-User Vertical (Government and Defense, and More), and Geography. The Market Sizes and Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America retained 40% of 2024 revenue, reflecting mature telecommunications infrastructure, grant funding, and a track record of extreme weather events. Municipalities now embed mass alerting into broader smart-city platforms that tie traffic sensors, flood gauges, and wildfire cameras to automatic outbound messaging. Cloud-native upgrades also coincide with the region's high cyber-insurance requirements, ensuring data protection features are woven into every deployment.

Asia-Pacific is expanding at a 17.5% CAGR, the highest among all regions. Accelerated 5G roll-outs in South Korea, Japan, and Australia let agencies attach video clips and multilingual subtitles to alerts, boosting comprehension in dense cities. Government stimulus for disaster resilience in typhoon-prone nations such as the Philippines is funneling fresh capital into the mass notification systems market. Meanwhile China's mega-city projects integrate alerts with surveillance cameras and e-wallet super-apps, blending public safety with everyday digital behavior.

Europe sits between these extremes, but its growth is dominated by regulatory compliance. The EECC Article 110 deadline drove every member state to budget for multi-channel warnings, while GDPR pushed vendors to invest in consent management and data minimization. The Nordic region's focus on multilingual content slows some projects but ultimately broadens product capability for export. The United Kingdom, operating outside EU directives, is drafting its own standards that still align with cell broadcast best practice, ensuring continued cross-border interoperability.

- Everbridge Inc.

- Motorola Solutions Inc.

- Honeywell International Inc.

- Siemens AG

- Blackberry AtHoc Inc.

- Eaton Corp.

- OnSolve LLC

- Singlewire Software LLC

- Alertus Technologies LLC

- xMatters

- AlertMedia Inc.

- F24 AG

- Rave Mobile Safety

- Regroup Mass Notification

- HipLink Software

- Volo (Volo Alert)

- BlackBoard Connect (Anthology)

- Preparis (Agility Recovery)

- Pocketstop RedFlag

- Vecima Networks (Engage IP)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Accelerated 5G roll-outs enabling real-time, multimedia alerting in APAC

- 4.2.2 Mandated multi-channel public-warning regulations in EU (EECC Article 110)

- 4.2.3 Escalating climate-induced catastrophes in North America driving municipal deployments

- 4.2.4 Rapid campus digitization creating BYOD-ready safety ecosystems in Higher-Ed

- 4.2.5 Utilities' grid-modernization projects demanding OT/IT converged alert platforms

- 4.3 Market Restraints

- 4.3.1 Fragmented spectrum policies delaying cell-broadcast adoption in Africa

- 4.3.2 Rising cyber-insurance premiums increasing TCO for cloud MNS in healthcare

- 4.3.3 Alarm fatigue concerns curbing message frequency in large enterprises

- 4.3.4 Limited multilingual content libraries slowing uptake in the Nordics

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Outlook

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Investment Analysis

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Component

- 5.1.1 Hardware

- 5.1.1.1 Fire Alarm Control Panels

- 5.1.1.2 Public Address and Voice Evacuation Systems

- 5.1.1.3 Notification Beacons and Digital Signage

- 5.1.2 Solutions

- 5.1.2.1 Emergency/Mass Notification Software

- 5.1.2.2 Incident Management and Situation Awareness

- 5.1.3 Services

- 5.1.3.1 Professional (Consulting, Integration)

- 5.1.3.2 Managed Services

- 5.1.1 Hardware

- 5.2 By Deployment Mode

- 5.2.1 On-premise

- 5.2.2 Cloud

- 5.2.3 Hybrid

- 5.3 By Solution Purpose

- 5.3.1 Business Continuity and Disaster Recovery

- 5.3.2 Integrated Public Alert and Warning

- 5.3.3 Interoperable Emergency Communication

- 5.4 By Organization Size

- 5.4.1 Large Enterprises

- 5.4.2 Small and Mid-size Enterprises (SMEs)

- 5.5 By Application

- 5.5.1 In-Building

- 5.5.2 Wide-Area

- 5.5.3 Distributed Recipient

- 5.6 By End-User Vertical

- 5.6.1 Government and Defense

- 5.6.2 Energy and Utilities

- 5.6.3 Healthcare

- 5.6.4 Education

- 5.6.5 Commercial and Industrial

- 5.6.6 Transportation and Logistics

- 5.6.7 IT and Telecommunications

- 5.6.8 Others

- 5.7 By Geography

- 5.7.1 North America

- 5.7.1.1 United States

- 5.7.1.2 Canada

- 5.7.1.3 Mexico

- 5.7.2 South America

- 5.7.2.1 Brazil

- 5.7.2.2 Argentina

- 5.7.3 Europe

- 5.7.3.1 Germany

- 5.7.3.2 United Kingdom

- 5.7.3.3 France

- 5.7.3.4 Italy

- 5.7.3.5 Rest of Europe

- 5.7.4 Middle East

- 5.7.4.1 GCC

- 5.7.4.2 Turkey

- 5.7.4.3 Rest of Middle East

- 5.7.5 Africa

- 5.7.5.1 South Africa

- 5.7.5.2 Nigeria

- 5.7.5.3 Rest of Africa

- 5.7.6 Asia-Pacific

- 5.7.6.1 China

- 5.7.6.2 Japan

- 5.7.6.3 India

- 5.7.6.4 South Korea

- 5.7.6.5 Southeast Asia

- 5.7.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Everbridge Inc.

- 6.4.2 Motorola Solutions Inc.

- 6.4.3 Honeywell International Inc.

- 6.4.4 Siemens AG

- 6.4.5 Blackberry AtHoc Inc.

- 6.4.6 Eaton Corp.

- 6.4.7 OnSolve LLC

- 6.4.8 Singlewire Software LLC

- 6.4.9 Alertus Technologies LLC

- 6.4.10 xMatters

- 6.4.11 AlertMedia Inc.

- 6.4.12 F24 AG

- 6.4.13 Rave Mobile Safety

- 6.4.14 Regroup Mass Notification

- 6.4.15 HipLink Software

- 6.4.16 Volo (Volo Alert)

- 6.4.17 BlackBoard Connect (Anthology)

- 6.4.18 Preparis (Agility Recovery)

- 6.4.19 Pocketstop RedFlag

- 6.4.20 Vecima Networks (Engage IP)

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment