PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851325

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851325

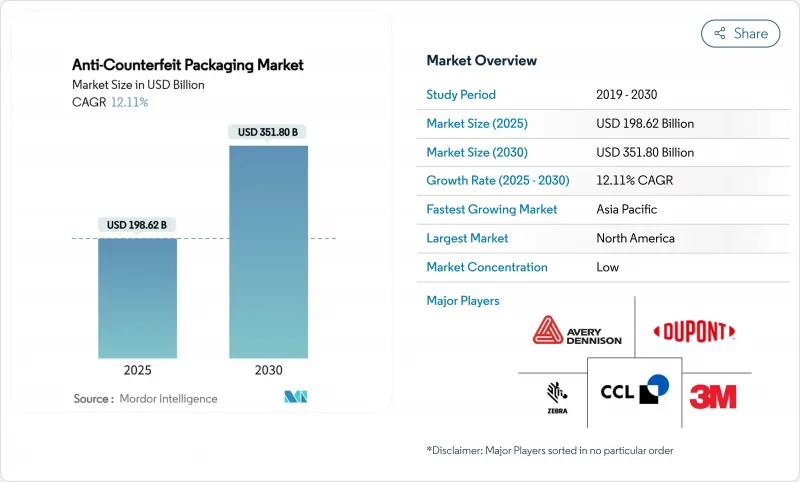

Anti-Counterfeit Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Anti-Counterfeit Packaging market size reached USD 198.62 billion in 2025 and is projected to climb to USD 351.80 billion by 2030, translating into a solid 12.11% CAGR over the forecast period.

Rising counterfeit sophistication, the spread of generative-AI printing, and a wave of tighter global traceability laws continue to enlarge the addressable opportunity for security technologies. Pharmaceutical serialization deadlines in the United States and the European Union anchor a sizable base of recurring demand, while new food, electronics, and luxury-goods mandates open fresh growth lanes. Brand owners increasingly look beyond visible holograms to multi-layered solutions that blend covert nano-pigment inks, mobile-readable digital watermarks, and blockchain provenance, ensuring that packages defend themselves throughout e-commerce fulfilment and reverse logistics. Large converters face material-cost inflation yet keep investing in embedded RFID and invisible watermarking because operating data show counterfeit incursions erode brand equity faster than packaging outlays rise. Venture investment stays healthy thanks to evidence that connected packs can double consumer-engagement time, turning security spend into a marketing asset.

Global Anti-Counterfeit Packaging Market Trends and Insights

Rapid e-commerce-driven serialization demand

Surging online sales shorten distribution chains and remove physical inspection points, forcing brands to embed unit-level digital identifiers that travel with every parcel. RFID pilots between Avery Dennison and US grocery chains show scan rates above 99% accuracy, confirming that serialized data flow improves both inventory turns and counterfeit detection. Cloud dashboards now fit into fulfilment apps, so retailers block suspected fakes before last-mile dispatch, preserving shopper trust. The trend shifts cap-ex priority toward print-on-demand coders and away from decorative embellishments, raising the strategic value of software-ready converters in the Anti-Counterfeit Packaging market.

Proliferation of national track-and-trace mandates

After the United States enforced DSCSA unit-level traceability in late-2024, pharmaceutical exporters equipped plants worldwide with EPCIS-ready coding platforms to avoid dual inventories. The European Union's FMD introduced parallel serialization and tamper-evident rules, prompting a template that Brazil, Saudi Arabia, and Thailand study for rollout. When regulations converge, vendors in the Anti-Counterfeit Packaging market win multi-country service contracts and amortize R&D faster, reinforcing scale advantages.

High capex for full-line serialization retro-fits

Legacy fillers and cartoners often lack space for vision cameras and reject stations, so firms must buy new turnkey lines rather than bolt-on modules. Although TraceLink's no-code OPUS platform eases integration of data layers, hardware outlays still average USD 1 million per bottle line. Small generics players and contract packers in India and Vietnam defer upgrades, shrinking their accessible share of the Anti-Counterfeit Packaging market until financing improves.

Other drivers and restraints analyzed in the detailed report include:

- Expansion of QR/NFC-enabled connected packaging

- Nano-pigment security inks enabling low-cost authentication

- Inter-operability gaps between global coding standards

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

In 2024, Trace and Track solutions captured 32.43% of the Anti-Counterfeit Packaging market, equal to an Anti-Counterfeit Packaging market size of roughly USD 64.4 billion, while Forensic Markers are projected to post a brisk 15.54% CAGR to 2030. Serialization hardware, vision inspection, and cloud vaults form a compliance backbone that pharmaceutical lines cannot sidestep. As counterfeiters mimic overt holograms with AI-guided presses, brands pivot to covert DNA inks and forensic taggants that require lab-grade readers, pushing solution diversity within the Anti-Counterfeit Packaging market.

Generative-AI printing tools now replicate guilloche patterns and kinetic micro-text with startling fidelity, cutting the deterrent value of purely visible marks. Research at MIT on terahertz-wave ID tags opens hope for tamper-proof physical-fingerprint systems that link packages to a unique spectral signature. Vendors selling hybrid traceability plus forensic stacks, therefore, command higher margins and lengthier service contracts.

Serialization Codes owned 36.32% of Anti-Counterfeit Packaging market share in 2024, supplying the backbone for DSCSA and FMD compliance; RFID/NFC, at a 16.73% CAGR, outpaces all other features as smartphone adoption universalizes contactless reading. Pack-level GS1 Digital Link formats now bind EPC codes to web-resolvable URLs, so consumers verify goods inside shopping apps.

Holographic seals still appear on spirits and luxury cosmetics because visual flair complements brand aesthetics. Yet digital watermarks, embedded invisibly in artwork, allow zero-ink alterations during line changeovers. Digimarc's integration of such marks into the C2PA 2.1 standard shows how packaging and online imagery share one verification protocol. This convergence increases subscription revenue pools inside the Anti-Counterfeit Packaging market.

The Anti-Counterfeit Packaging Market Report is Segmented by Technology (Trace and Track, and More), Usage Feature (Serialization Codes, and More), Packaging Component (Labels and Tags, Security Inks and Coatings, and More), Packaging Format (Blister Packs, and More), End-User Industry (Food and Beverage, Healthcare and Pharmaceuticals, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America retained 39.01% revenue in 2024, buoyed by full DSCSA enforcement and a dense network of CMOs that need turnkey coding, inspection, and data-exchange stacks. Canada's Plastics Pact also nudges converters to blend security and recyclability, favoring fiber-based packs that carry invisible watermark tracers enabling automated sortation. Mexico, intertwined with US supply chains, ramps anti-counterfeit adoption in medical devices and tequila exports to safeguard market access.

Asia-Pacific registers the swiftest 16.01% CAGR, driven by China's new pre-packaged labeling law, India's QR-code drug lists, and Japan's Positive List for food-contact resins. Contract manufacturers across Guangdong and Ho Chi Minh City deploy low-cost inkjet coders and blockchain pilots to satisfy multinational audits. Flexible-pack printers in Indonesia install nano-pigment stations after early ROI studies show counterfeit returns fall by half within one year, proving the Anti-Counterfeit Packaging market's potential beyond legacy pharma hubs.

Europe holds a mature but sizable share, with FMD and the upcoming Packaging and Packaging Waste Regulation intertwining sustainability and security. Brands explore fibre-based barrier packs paired with Digimarc watermarks so automated sorters read signals through dirt and glare. Russia's PET bans and the EU's BPA prohibition push resin switchovers, which in turn invite fresh security print trials. The Middle East and Africa remain nascent, yet luxury auto-parts suppliers in the Gulf invest in 2D code vaults to reassure global buyers, hinting at a wider Anti-Counterfeit Packaging market take-off once regional customs unions finalize common coding laws.

- Avery Dennison Corporation

- CCL Industries Inc.

- 3M Company

- DuPont de Nemours Inc.

- Zebra Technologies Corporation

- SICPA Holding SA

- AlpVision SA

- Applied DNA Sciences Inc.

- Uflex Limited

- Authentix Inc.

- Ampacet Corporation

- PharmaSecure Inc.

- Sun Chemical Corporation

- Alien Technology LLC

- Honeywell International Inc.

- TraceLink Inc.

- OPTEL Group

- Prooftag SAS

- Giesecke + Devrient GmbH

- SATO Holdings Corp.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rapid e-commerce-driven serialization demand

- 4.2.2 Proliferation of national track-and-trace mandates

- 4.2.3 Expansion of QR / NFC-enabled "connected packaging" for brand engagement

- 4.2.4 Nano-pigment security inks enabling low-cost authentication

- 4.2.5 Blockchain-based provenance pilots maturing into roll-outs

- 4.2.6 AI image-forensics integrated into consumer apps

- 4.3 Market Restraints

- 4.3.1 High capex for full-line serialization retro-fits

- 4.3.2 Inter-operability gaps between global coding standards

- 4.3.3 Data-privacy and cybersecurity liabilities in cloud TandT

- 4.3.4 Counterfeiters' rapid adoption of generative printing

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Technology

- 5.1.1 Trace and Track

- 5.1.2 Tamper-Evident

- 5.1.3 Covert

- 5.1.4 Overt

- 5.1.5 Forensic Markers

- 5.2 By Usage Feature

- 5.2.1 Serialization Codes

- 5.2.2 RFID / NFC Tags

- 5.2.3 Holographic Seals

- 5.2.4 Digital Watermarks

- 5.3 By Packaging Component

- 5.3.1 Labels and Tags

- 5.3.2 Security Inks and Coatings

- 5.3.3 Films and Pouches

- 5.3.4 Holograms

- 5.3.5 Other Packaging Component

- 5.4 By Packaging Format

- 5.4.1 Blister Packs

- 5.4.2 Bottles

- 5.4.3 Cartons

- 5.4.4 Flexible Packs

- 5.4.5 Other Packaging Format

- 5.5 By End-User Industry

- 5.5.1 Food and Beverage

- 5.5.2 Healthcare and Pharmaceuticals

- 5.5.3 Industrial and Automotive

- 5.5.4 Consumer Electronics

- 5.5.5 Other End-User Industry

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 Europe

- 5.6.2.1 Germany

- 5.6.2.2 United Kingdom

- 5.6.2.3 France

- 5.6.2.4 Italy

- 5.6.2.5 Spain

- 5.6.2.6 Russia

- 5.6.2.7 Rest of Europe

- 5.6.3 Asia-Pacific

- 5.6.3.1 China

- 5.6.3.2 India

- 5.6.3.3 Japan

- 5.6.3.4 South Korea

- 5.6.3.5 Australia and New Zealand

- 5.6.3.6 Rest of Asia-Pacific

- 5.6.4 Middle East and Africa

- 5.6.4.1 Middle East

- 5.6.4.1.1 United Arab Emirates

- 5.6.4.1.2 Saudi Arabia

- 5.6.4.1.3 Turkey

- 5.6.4.1.4 Rest of Middle East

- 5.6.4.2 Africa

- 5.6.4.2.1 South Africa

- 5.6.4.2.2 Nigeria

- 5.6.4.2.3 Egypt

- 5.6.4.2.4 Rest of Africa

- 5.6.5 South America

- 5.6.5.1 Brazil

- 5.6.5.2 Argentina

- 5.6.5.3 Rest of South America

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Avery Dennison Corporation

- 6.4.2 CCL Industries Inc.

- 6.4.3 3M Company

- 6.4.4 DuPont de Nemours Inc.

- 6.4.5 Zebra Technologies Corporation

- 6.4.6 SICPA Holding SA

- 6.4.7 AlpVision SA

- 6.4.8 Applied DNA Sciences Inc.

- 6.4.9 Uflex Limited

- 6.4.10 Authentix Inc.

- 6.4.11 Ampacet Corporation

- 6.4.12 PharmaSecure Inc.

- 6.4.13 Sun Chemical Corporation

- 6.4.14 Alien Technology LLC

- 6.4.15 Honeywell International Inc.

- 6.4.16 TraceLink Inc.

- 6.4.17 OPTEL Group

- 6.4.18 Prooftag SAS

- 6.4.19 Giesecke + Devrient GmbH

- 6.4.20 SATO Holdings Corp.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment