PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851328

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851328

Safety Switches - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

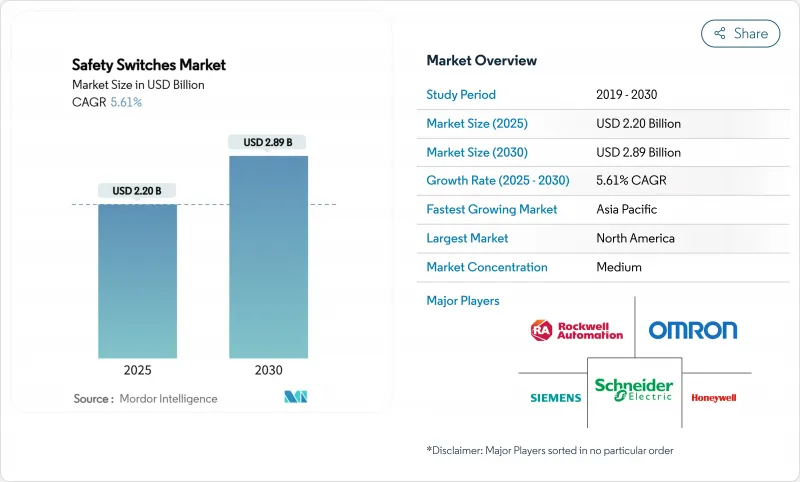

The global Safety switches market size stands at USD 2.2 billion in 2025 and is forecast to reach USD 2.89 billion by 2030, registering a 5.61% CAGR.

Growth is underpinned by aggressive factory-automation investments, stricter machine-safety laws and a rapid shift toward collaborative robot workspaces. End users now demand devices that combine tamper resistance, self-diagnostics and fieldbus connectivity, pushing suppliers to embed RFID coding, IoT sensors and predictive-maintenance analytics. Asia-Pacific holds the largest regional position, benefitting from large-scale smart-factory programs, while the Middle East is set for the quickest rise on the back of oil-and-gas modernization and explosion-proof mandates. Competitive focus has moved toward solution-oriented portfolios that integrate hardware, software and services, enabling quicker compliance and reduced total cost of ownership. Device makers able to bridge functional safety and real-time data visibility are expected to capture the next wave of opportunities in the Safety switches market.

Global Safety Switches Market Trends and Insights

Expanding automation-driven safety requirements in Asia

Asia's manufacturing sector is experiencing a fundamental shift in safety paradigms as automation adoption accelerates, creating substantial demand for sophisticated safety switches. Countries like China, Japan, and South Korea are implementing stricter workplace safety regulations that mandate the use of certified safety devices in automated production lines. This regulatory evolution coincides with the region's push toward smart manufacturing, where safety switches serve as critical components in ensuring human-machine coexistence. The integration of safety switches with factory automation systems has become a strategic priority for manufacturers seeking to balance productivity with worker protection, particularly as labor costs rise and skilled worker shortages persist. According to IDEC, demand for safety switches in Asia has grown by over 30% since 2024, with non-contact varieties seeing the highest adoption rates in electronics manufacturing

Rise in collaborative robots necessitating integrated safety solutions

The proliferation of collaborative robots (cobots) across manufacturing environments is fundamentally transforming safety system requirements, creating significant opportunities for advanced safety switch technologies. Unlike traditional industrial robots that operate in caged environments, cobots work alongside humans, necessitating sophisticated safety mechanisms that can dynamically adjust protection parameters based on proximity and operation mode. The revision of ISO 10218 standard for industrial robot safety in 2024 has established clearer functional safety requirements for collaborative applications, driving demand for safety switches that can interface with robot control systems. Despite their inherent safety features, cobots still require complementary guarding solutions to address residual risks such as pinch points and programming errors. PowerSafe Automation reports that properly integrated safety switches can reduce cobot-related incidents by up to 85% while maintaining operational efficiency, making them essential components in Industry 4.0 implementations

Higher ASPs of Non-Contact Switches in Cost-Sensitive SMEs

RFID sensors cost two to three times more than electromechanical models, discouraging rapid swap-outs in small workshops where budget and technical skills are limited. Consequently, penetration of advanced units among SME machine builders remains below 25%, tempering near-term uptake across the Safety switches market .

Other drivers and restraints analyzed in the detailed report include:

- Mandatory Retrofit of Legacy Machinery in Europe's Process Industries

- Demand Surge for Explosion-Proof Devices in Middle-East Oil & Gas

- Complex Certification Cycles Across Multi-Jurisdictional Plants

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Electromechanical models still lead the Safety switches market thanks to proven durability in dusty, high-vibration sites. Yet non-contact RFID sensors show the swiftest momentum, expanding at 7.8% CAGR as OEMs look to curb bypassing and gain live diagnostic data. In 2024, electromechanicals held a 46% revenue share, while RFID uptake in pharma lines rose sharply after regulators tightened tampering rules. The Safety switches market size for non-contact devices is projected to reach USD 1.04 billion by 2030, mirroring wider adoption in robotic assembly cells.

RFID sensors also unlock predictive-maintenance analytics; embedded memory logs cycle counts, enabling service alerts before failure. Explosion-proof housings and stainless-steel variants are broadening use in corrosive and hazardous settings, expanding supplier addressable revenue pools. Continuous miniaturization further allows multi-sensor arrays inside compact cobot grippers, reinforcing future demand within the Safety switches market.

Key-operated interlocks retain widespread use due to mechanical simplicity and low unit cost. Still, RFID-coded and magnetic actuators now set the pace, especially in Category 4, PLe applications that prohibit guard cheating. These designs cascade up to 32 nodes over a single cable, shrinking installation time. Pharmaceutical cleanrooms and food-processing lines favor non-contact formats to eliminate crevices where contaminants might lodge, spurring fresh volume in the Safety switches market.

Functional safety over Ethernet is also emerging. Vendors bundle actuator and safety-relay functions in the same housing, streaming diagnostics to MES dashboards. This virtualizes traditional hard-wired chains and supports flexible cell reconfiguration, a core Industry 4.0 requirement. Consequently, actuator innovation will remain pivotal to value capture within the Safety switches market.

Industrial Safety Switch Market is Segmented Type (Electromagnetic, Non-Contact), Actuator Type ( Key-Operated Interlock and More). Installation Configuration( Panel-Mounted, DIN-Rail Mounted ), End-User (Industrial, Commercial, Healthcare, Oil & Gas), and Geography (North America, Europe, and Asia-Pacific). The Market Sizes and Forecasts are Provided in Terms of Value (USD Million)

Geography Analysis

Asia-Pacific generated 38.2% of 2024 revenue, led by Chinese and South Korean electronics clusters. Factory upgrades under national "smart manufacturing" plans specify RFID interlocks and IO-Link diagnostics, lifting average selling prices. Government subsidies for automated lines in India and Vietnam will sustain regional leadership of the Safety switches market.

The Middle East is forecast to grow at 9.1% CAGR through 2030. National oil companies in UAE and Saudi Arabia now demand ATEX or IECEx-certified switchgear for gas compression, refining and LNG export trains. Suppliers offering -55 °C to +55 °C temperature ratings and stainless-steel enclosures have secured multiyear framework deals, catalyzing swift market expansion.

Europe and North America remain mature but opportunity rich. EU Machinery Directive revisions compel chemical and food processors to retrofit older mixers and conveyors within two years; this short-cycle demand inflates replacement volumes. In the US, e-commerce fulfillment centers adopt network-ready switches that feed safety data to cloud WMS platforms, preserving steady unit growth in the Safety switches market.

- Schneider Electric

- Rockwell Automation

- Banner Engineering

- Eaton Corporation

- Euchner GmbH

- SICK AG

- Pilz GmbH and Co. KG

- Siemens AG

- Omron Corporation

- Honeywell International

- Phoenix Contact

- ABB Ltd.

- IDEC Corporation

- BERNSTEIN AG

- Pepperl+Fuchs

- Keyence Corporation

- Leuze electronic

- Schmersal Group

- TURCK

- Crouzet

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Expanding Automation-Driven Safety Requirements in Asia

- 4.2.2 Rise in Collaborative Robots Necessitating Integrated Safety Solutions

- 4.2.3 Mandatory Retrofit of Legacy Machinery in Europe's Process Industries

- 4.2.4 Demand Surge for Explosion-Proof Devices in Middle-East Oil and Gas

- 4.2.5 Adoption of RFID-Coded Interlocks in High-Potency Pharma Facilities (US/EU)

- 4.2.6 E-Commerce Warehousing Boom Boosting Conveyor Safety Switch Usage (NA)

- 4.3 Market Restraints

- 4.3.1 Higher ASPs of Non-Contact Switches in Cost-Sensitive SMEs

- 4.3.2 Complex Certification Cycles Across Multi-Jurisdictional Plants

- 4.3.3 Compatibility Gaps with Industry-Specific Safety Fieldbuses

- 4.3.4 Counterfeit Low-Cost Imports Undermining Brand Adoption (APAC)

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Outlook

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Type

- 5.1.1 Electromechanical Safety Switches

- 5.1.2 Non-Contact (RFID / Magnetic) Safety Switches

- 5.1.3 Explosion-Proof / Heavy-Duty Safety Switches

- 5.1.4 Other Types

- 5.2 By Actuator Type

- 5.2.1 Key-Operated Interlock

- 5.2.2 Hinge-Operated Interlock

- 5.2.3 RFID-Coded Interlock

- 5.2.4 Magnetic Actuator

- 5.3 By Installation Configuration

- 5.3.1 Panel-Mounted

- 5.3.2 DIN-Rail Mounted

- 5.4 By End-User

- 5.4.1 Industrial Manufacturing

- 5.4.1.1 Automotive

- 5.4.1.2 Food and Beverage

- 5.4.1.3 Chemicals and Pharmaceuticals

- 5.4.1.4 Aerospace and Defense

- 5.4.1.5 Metals and Mining

- 5.4.2 Energy and Power

- 5.4.2.1 Oil and Gas

- 5.4.2.2 Power Generation

- 5.4.3 Commercial and Institutional

- 5.4.3.1 Building Automation

- 5.4.3.2 Logistics and Warehousing

- 5.4.4 Healthcare

- 5.4.5 Others

- 5.4.1 Industrial Manufacturing

- 5.5 By Sales Channel

- 5.5.1 Direct OEM

- 5.5.2 Distributor / System Integrator

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 South America

- 5.6.2.1 Brazil

- 5.6.2.2 Argentina

- 5.6.2.3 Rest of Latin America

- 5.6.3 Europe

- 5.6.3.1 Germany

- 5.6.3.2 United Kingdom

- 5.6.3.3 France

- 5.6.3.4 Italy

- 5.6.3.5 Spain

- 5.6.3.6 Rest of Europe

- 5.6.4 Middle East and Africa

- 5.6.4.1 Turkey

- 5.6.4.2 United Arab Emirates

- 5.6.4.3 Saudi Arabia

- 5.6.4.4 South Africa

- 5.6.4.5 Rest of Middle East and Africa

- 5.6.5 Asia-Pacific

- 5.6.5.1 China

- 5.6.5.2 Japan

- 5.6.5.3 South Korea

- 5.6.5.4 India

- 5.6.5.5 Australia

- 5.6.5.6 Rest of Asia Pacific

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Schneider Electric

- 6.4.2 Rockwell Automation

- 6.4.3 Banner Engineering

- 6.4.4 Eaton Corporation

- 6.4.5 Euchner GmbH

- 6.4.6 SICK AG

- 6.4.7 Pilz GmbH and Co. KG

- 6.4.8 Siemens AG

- 6.4.9 Omron Corporation

- 6.4.10 Honeywell International

- 6.4.11 Phoenix Contact

- 6.4.12 ABB Ltd.

- 6.4.13 IDEC Corporation

- 6.4.14 BERNSTEIN AG

- 6.4.15 Pepperl+Fuchs

- 6.4.16 Keyence Corporation

- 6.4.17 Leuze electronic

- 6.4.18 Schmersal Group

- 6.4.19 TURCK

- 6.4.20 Crouzet

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet Need Analysis