PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906956

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906956

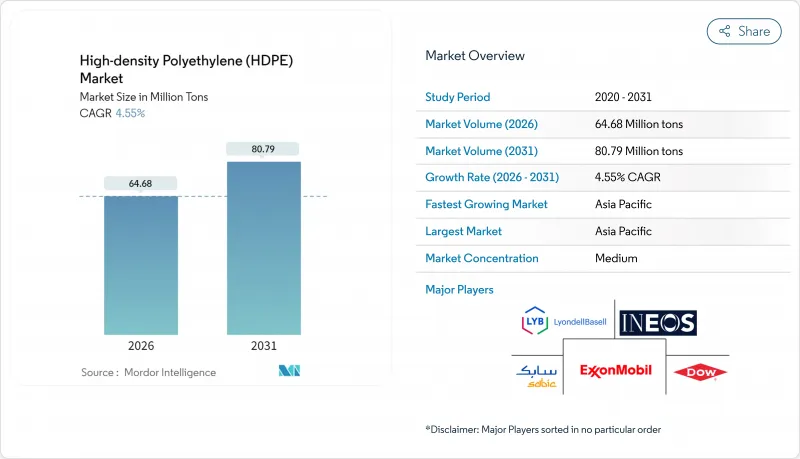

High-density Polyethylene (HDPE) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The High-density Polyethylene (HDPE) market is expected to grow from 61.87 Million tons in 2025 to 64.68 Million tons in 2026 and is forecast to reach 80.79 Million tons by 2031 at 4.55% CAGR over 2026-2031.

Strong infrastructure spending, widening chemical-recycling supply chains, and rising adoption of hydrogen-ready pipe systems anchor this trajectory, while the material's intrinsic durability, chemical resistance, and recyclability keep end-users committed to high-density polyethylene solutions. Accelerated public-housing programs across India and ASEAN, expanding food-grade blow-molding in e-commerce distribution, and the rollout of PE-100-RC pipe networks for low-carbon gas grids collectively widen the HDPE market's addressable demand. Chemical recyclers diverting mixed-waste streams into virgin-grade rHDPE strengthen supply security, temper feedstock volatility, and reinforce circular-economy mandates. Moderately fragmented competition persists, yet vertically integrated producers that pair cracker capacity with advanced recycling retain cost and sustainability advantages.

Global High-density Polyethylene (HDPE) Market Trends and Insights

Rising Demand for Pressure and Non-Pressure Plastic Pipes in Water-Infrastructure Retrofit Programmes

Water-network modernisation projects prioritise HDPE pipes because they combine a 100-year service life with trenchless installation capability that cuts civil works costs by 30-40%. The American Society of Civil Engineers underscores HDPE's corrosion resistance for ageing distribution lines. India's 2024 quality-standard mandate for virgin polyethylene reinforces material integrity in critical water applications. Project designers favour HDPE because its flexibility accommodates ground movement, reducing leakage risk. Public-sector funding cycles spanning multiple five-year plans guarantee steady pipe volumes, ensuring predictable growth for the HDPE market. Integration of trenchless methods further differentiates HDPE from concrete and ductile-iron alternatives by lowering total installed costs.

Expansion of Food-Grade Blow-Molded Packaging in Emerging E-Commerce Channels

Rapid e-commerce penetration demands packaging that survives complex logistics while protecting food quality. Food-grade HDPE containers pass stringent migration tests and hold FDA clearance, making them default choices for dairy, condiments, and shelf-stable beverages. European Union regulations, effective March 2025, require extensive traceability for food-contact plastics, a standard that HDPE producers already meet. Weight-reduction via thin-wall blow-molding lowers resin usage, aligns with corporate emission targets, and sustains demand, reinforcing the HDPE market's resilience.

Escalating Anti-Single-Use-Plastic Regulations and Taxation

Tighter packaging rules compress demand for disposable HDPE articles in Europe and parts of North America. However, HDPE's recyclability mitigates policy risk in multi-use applications, and well-established collection streams preserve its appeal versus multi-layer films that lack mechanical-recycling pathways. Converters are redesigning closures and dispensing systems to remain within weight thresholds, limiting volume loss. Consequently, regulation restrains but does not reverse HDPE market growth.

Other drivers and restraints analyzed in the detailed report include:

- Sustained Public-Housing and Mega-Infrastructure Spend Across ASEAN and India

- Roll-out of Hydrogen-Ready Gas Grids Requiring PE-100-RC Pipes

- Volatile Crude-Oil-Linked Ethylene Feedstock Pricing

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Sheets and Films held 40.65% of the 2025 HDPE market share, underpinned by steady packaging demand and downstream converter familiarity with blown-film processes. Sustainable packaging targets stimulate mono-material film designs that favour HDPE over mixed polymers.

Pipes and Tubes, although a smaller slice of the HDPE market size, posted the sharpest 6.07% CAGR for 2026-2031 on the back of water-infrastructure retrofits, hydrogen-ready gas grids, and trenchless renewals. Rising leak-loss penalties push utilities toward HDPE piping thanks to its homogenous fusion joints and 100-year service life. Industrial films, geomembranes, and carrier bags round out the portfolio, sustaining baseline resin offtake when construction spending softens.

The High-Density Polyethylene (HDPE) Market Report is Segmented by Application (Pipes and Tubes, Sheets and Films, Rigid Articles, and Other Applications), Resin Grade (PE-80, PE-100, PE-100-RC, and More), End-User Industry (Packaging, Building and Construction, Agriculture, Transportation, Electrical and Electronics, and More), and Geography ( Asia-Pacific, North America, Europe, South America, and Middle-East and Africa).

Geography Analysis

Asia-Pacific controlled 42.30% of the 2025 HDPE market share and is forecast to record a 5.55% CAGR to 2031, propelled by Chinese downstream film exports and India's infrastructure boom. Integrated producers in the region benefit from coal-to-olefins and naphtha-cracker flexibility, buffering ethylene volatility. However, oversupply periods have compressed regional margins, prompting scheduled maintenance to balance inventories.

North America's HDPE market benefits from ethane-advantaged feedstock and a wave of chemical-recycling investments that elevate circular-resin availability. While growth rates are lower than Asia-Pacific, value-added pipe, film, and medical-grade demand sustains profit pools.

Europe remains policy-driven; its hydrogen-network build-out channels HDPE into PE-100-RC pipe projects and chemical-recycling alliances that secure recycled feedstock. Anti-single-use-plastic mandates depress thin-wall rigid packaging volumes, yet high recyclability keeps HDPE firmly in multi-use, returnable crates and chemical drums.

- BASF

- Borealis AG

- Braskem

- Chevron Phillips Chemical

- Dow

- Exxon Mobil Corporation

- Formosa Plastics Corporation, U.S.A.

- Indian Oil Corporation

- INEOS

- LG Chem

- LyondellBasell Industries Holdings B.V.

- Mitsui Chemicals, Inc.

- NOVA Chemicals Corporate

- PTT Global Chemical Public Company Limited

- Qatar Chemical Company Ltd

- Reliance Industries Limited

- SABIC

- Sasol

- Sinopec

- TotalEnergies

- Westlake Corporation

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Demand for Pressure and Non-Pressure Plastic Pipes in Water-Infrastructure Retrofit Programmes

- 4.2.2 Expansion of Food?Grade Blow-Moulded Packaging in Emerging E-Commerce Channels

- 4.2.3 Sustained Public-Housing and Mega-Infrastructure Spend across ASEAN and India

- 4.2.4 Roll-Out of Hydrogen-Ready Gas Grids Requiring PE-100-RC Pipes

- 4.2.5 Chemical Recycling Plants Shifting Mixed-Waste Streams into Virgin-Grade RHDPE

- 4.3 Market Restraints

- 4.3.1 Escalating Anti-Single-Use-Plastic Regulations and Taxation

- 4.3.2 Volatile Crude-Oil-Linked Ethylene Feedstock Pricing

- 4.3.3 Accelerated Materials-Switch to PP Random Copolymers in Consumer Rigid Packaging

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Consumers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitute Products and Services

- 4.5.5 Degree of Competition

5 Market Size and Growth Forecasts (Volume)

- 5.1 By Application

- 5.1.1 Pipes and Tubes

- 5.1.2 Sheets and Films

- 5.1.3 Rigid Articles

- 5.1.4 Other Applications

- 5.2 By Resin Grade

- 5.2.1 PE-80

- 5.2.2 PE-100

- 5.2.3 PE-100-RC

- 5.2.4 Ultra-High-Molecular-Weight HDPE

- 5.3 By End-User Industry

- 5.3.1 Packaging

- 5.3.2 Building and Construction

- 5.3.3 Agriculture

- 5.3.4 Transportation

- 5.3.5 Electrical and Electronics

- 5.3.6 Industrial Machinery

- 5.3.7 Other End-user Industries

- 5.4 By Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 ASEAN

- 5.4.1.6 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Spain

- 5.4.3.6 Russia

- 5.4.3.7 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle-East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 United Arab Emirates

- 5.4.5.3 South Africa

- 5.4.5.4 Rest of Middle-East and Africa

- 5.4.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 BASF

- 6.4.2 Borealis AG

- 6.4.3 Braskem

- 6.4.4 Chevron Phillips Chemical

- 6.4.5 Dow

- 6.4.6 Exxon Mobil Corporation

- 6.4.7 Formosa Plastics Corporation, U.S.A.

- 6.4.8 Indian Oil Corporation

- 6.4.9 INEOS

- 6.4.10 LG Chem

- 6.4.11 LyondellBasell Industries Holdings B.V.

- 6.4.12 Mitsui Chemicals, Inc.

- 6.4.13 NOVA Chemicals Corporate

- 6.4.14 PTT Global Chemical Public Company Limited

- 6.4.15 Qatar Chemical Company Ltd

- 6.4.16 Reliance Industries Limited

- 6.4.17 SABIC

- 6.4.18 Sasol

- 6.4.19 Sinopec

- 6.4.20 TotalEnergies

- 6.4.21 Westlake Corporation

7 Market Opportunities and Future Outlook

- 7.1 White-Space and Unmet-Need Assessment