PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851358

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851358

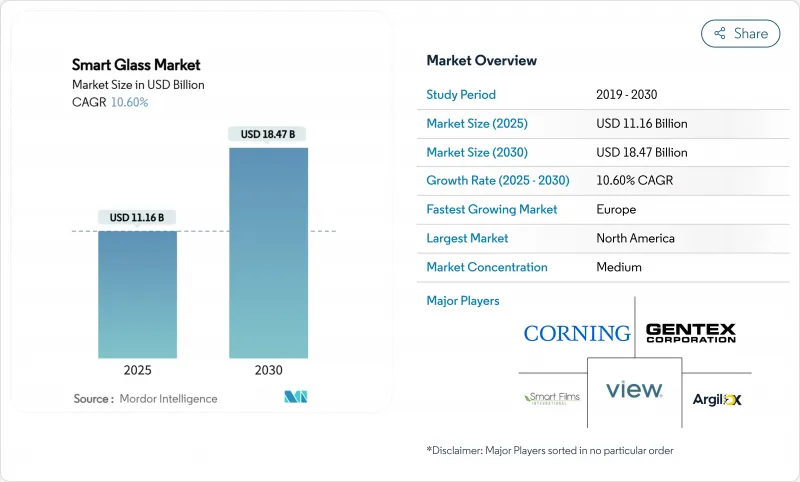

Smart Glass - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The smart glass market stands at USD 11.16 billion in 2025 and is forecast to post USD 18.47 billion by 2030, expanding at a 10.60% CAGR.

This trajectory is propelled by mandatory energy-performance codes, electrochromic efficiency gains, and premium automotive adoption that shortens technology payback cycles. Commercial landlords are prioritizing HVAC cost control, automotive OEMs are bundling dynamic sunroofs into high-margin trims, and materials scientists are converging on electrode-free devices that lower production costs. Simultaneously, government incentives for advanced manufacturing and 5G-ready facades are enlarging the smart glass market opportunity set.

Global Smart Glass Market Trends and Insights

Stringent Green-Building Codes and Retrofit Mandates

Mandatory envelope performance thresholds such as California's 2025 Building Energy Efficiency Standards are creating non-discretionary demand for electrochromic facades that outperform conventional glazing on U-factor and Solar Heat Gain Coefficient criteria. The 2024 International Energy Conservation Code revision delivers 9.8% incremental savings versus the prior cycle, eliminating trade-off loopholes and elevating glass performance baselines. Similar measures in Europe, including the Netherlands' hybrid-furnace initiative, reinforce a compliance-driven procurement cycle that lifts retrofit activity. As owners witness lower peak cooling loads, green-finance eligibility, and enhanced asset values, the smart glass market gains a durable regulatory tailwind.

Rapid Adoption in Premium Automotive Glazing and Sunroofs

Automakers are deploying dynamic light-control roofs to differentiate cabins and trim HVAC loads. Renault's Solarbay PDLC sunroof supplies segmental opacification while using nearly 50% recycled content. AGC's SPD-based Wonderlite roof on the Mercedes S-Class Coupe cuts air-conditioning demand and lowers tailpipe CO2. Hyundai's Nano Cooling Film shows mainstream migration by shaving interior temperatures by 12.33 °C in pilot fleets. Automotive design cycles of 3-5 years accelerate cost degression that cascades into the building sector, expanding the smart glass market addressable base.

High Upfront Cost vs. Conventional Glazing

Electrochromic windows still price at USD 180-250 m2 against USD 20-30 m2 for standard units. Analysts peg USD 215 m2 (USD 20 ft2) as the crossover point for mass substitution, prompting an innovation race. Electrode-free electrochromic prototypes have sliced costs toward USD 80 m2 by stripping indium-tin-oxide layers. Plasma-enhanced chemical vapor deposition promises costs near USD 5.26 m2 at 1.4 million m2 annual scale. Installation complexity is receding as contractor familiarity grows, but price resistance remains the foremost limiting factor in cost-sensitive slices of the smart glass market.

Other drivers and restraints analyzed in the detailed report include:

- Energy-Cost Savings for Commercial Real-Estate Operators

- IoT-Ready Glass-as-a-Sensor Platforms for Smart Buildings

- Reliability Issues in Extreme Climates

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Electrochromic solutions dominated 2024 with 43.00% smart glass market share. Their low-power operation, gradual tinting, and proven 50,000 cycle life make them the default choice for large facades and corporate campuses. The smart glass market size for electrochromic products is projected to expand from USD 4.80 billion in 2025 to USD 7.70 billion by 2030 at a 9.8% CAGR. Cost-out roadmaps ranging from in-line sputtering to all-solid-state chemistries keep capex budgets predictable. Meanwhile, hybrid photovoltaic glass is scaling at an 18.50% CAGR, leveraging transparent organic photovoltaics that already hit 12.3% cell efficiency in Denmark's CitySolar project. NEXT Energy Technologies estimates these panels could offset 25% of typical office demand while retaining architectural clarity, positioning hybrids as the disruptor that challenges electrochromic incumbency.

Suspended Particle Device products maintain a niche where sub-second switching is critical-cockpits, rail cabins, and luxury sedans. Polymer-Dispersed Liquid Crystal windows are penetrating healthcare suites and conference rooms as low-voltage privacy partitions. Thermochromic and photochromic variants stay limited to passive climates, yet their wiring-free installation appeals to retrofit budgets. The technology stack is therefore bifurcating: electrochromic for energy mandates and hybrid PV for net-zero facades, with SPD and PDLC covering speed and privacy use cases.

Commercial real-estate applications captured 38.20% of 2024 revenue through broad office and retail uptake. The segment relied on energy savings, daylight optimization, and ESG credentialing to justify premium costs. Smart glass market size for commercial real estate is forecast to grow at 9.6% CAGR, moving from USD 4.27 billion in 2025 to USD 6.75 billion in 2030. Healthcare, however, secures the steepest 17.50% CAGR as infection-control protocols privilege touch-free privacy. Intensive-care wards deploy instant-opaque PDLC panels to reduce curtain laundering, while psychiatric units harness break-resistant dynamic glass to balance patient oversight with dignity.

Automotive glazing remains the third revenue pillar, particularly within luxury and electric vehicles, where dynamic skylights offset battery-draining HVAC. Residential uptake is slower, but tax incentives and lower module prices are shifting the ROI narrative for high-performance homes. Aerospace, rail, and marine progress steadily, albeit off smaller bases, and consumer electronics experiment with miniaturized electrochromic screens and AR headsets.

Smart Glass Market Report is Segmented by Technology Type (Electrochromic, Thermochromic, Photochromic, and More), End User (Automotive, Avionics, Marine, Retail, and More), Control Mode (Wired Switch / Wall Panel, Remote / RF Controller, Dimming Panel / Slider, and More), Application (Facades and Curtain Walls, Interior Partitions and Privacy Panels, and More), and Geography.

Geography Analysis

North America anchored 34.70% of 2024 revenue as California's building code raised glazing baselines and the federal CHIPS Act funnelled incentives to high-purity glass fabs. Corning's USD 315 million fused-silica expansion in New York exemplifies local supply-chain maturation that lowers lead times and underwrites five-year service warranties. The regional smart glass market is also buoyed by OEM demand for panoramic roofs and public-private retrofit programmes targeting federal properties.

Asia Pacific charts the fastest 14.60% CAGR through 2030, propelled by China's BOE USD 8.8 billion OLED campus, Japan's 5G facade pilots, and South Korea's EV-glass upgrades. Chinese producers such as Fuyao are adding CNY 5.8 billion of auto-grade capacity, amplifying economies of scale that compress selling prices. While tungsten-oxide precursor restrictions pose supply risk, regional governments are accelerating localised mining and recycling to fortify strategic autonomy.

Europe advances at a stable pace underpinned by stricter EPC ratings and renovation-wave subsidies. Saint-Gobain's low-carbon ORAE glass and AGC Interpane's multi-site expansion validate a regional focus on recycled content and net-zero manufacturing. However, elevated electricity prices and overlapping permitting frameworks dampen return profiles in mass-market housing, steering demand toward commercial towers and premium retrofits. Together, these dynamics sustain a geographically diversified smart glass market footprint.

- AGC Inc.

- Compagnie de Saint-Gobain S.A. (SageGlass)

- Guardian Glass LLC

- View Inc.

- Halio International SA

- Gentex Corporation

- Corning Incorporated

- Nippon Sheet Glass Co. Ltd. (NSG)

- Polytronix Inc.

- Research Frontiers Inc.

- Pleotint LLC

- EControl-Glas GmbH

- BOE Technology Group Co.

- Hitachi Chemical Co.

- Merck KGaA (liquid-crystal materials)

- Smart Films International

- uniteGlass (CNBM)

- Pro Display / Intelligent Glass

- Magic Film Factory

- Argil Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Stringent green-building codes and retrofit mandates

- 4.2.2 Rapid adoption in premium automotive glazing and sunroofs

- 4.2.3 Energy-cost savings for commercial real-estate operators

- 4.2.4 IoT-ready glass-as-a-sensor platforms for smart-buildings

- 4.2.5 5G/mm-wave friendly, low-loss facade solutions

- 4.2.6 Post-COVID demand for antimicrobial, touch-free surfaces

- 4.3 Market Restraints

- 4.3.1 High upfront cost vs. conventional glazing

- 4.3.2 Reliability issues in extreme climates

- 4.3.3 EMI-emission compliance limits for large EC facades

- 4.3.4 Supply bottlenecks for specialty EC precursors

- 4.4 Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Technology Snapshot

- 4.8 Porter's Five Forces Analysis

- 4.8.1 Bargaining Power of Suppliers

- 4.8.2 Bargaining Power of Buyers

- 4.8.3 Threat of New Entrants

- 4.8.4 Threat of Substitutes

- 4.8.5 Competitive Rivalry

- 4.9 Investment Analysis

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Technology Type

- 5.1.1 Electrochromic

- 5.1.2 Suspended Particle Device (SPD)

- 5.1.3 Polymer-Dispersed Liquid Crystal (PDLC)

- 5.1.4 Thermochromic

- 5.1.5 Photochromic

- 5.1.6 Hybrid and Photovoltaic

- 5.2 By End User

- 5.2.1 Automotive

- 5.2.2 Architectural - Residential

- 5.2.3 Architectural - Commercial

- 5.2.4 Avionics

- 5.2.5 Marine

- 5.2.6 Rail

- 5.2.7 Consumer Electronics and Wearables

- 5.2.8 Healthcare Facilities

- 5.2.9 Other End Users

- 5.3 By Control Mode

- 5.3.1 Wired Switch / Wall Panel

- 5.3.2 Remote / RF Controller

- 5.3.3 Dimming Panel / Slider

- 5.3.4 Smartphone / Voice Assistant

- 5.3.5 Sensor-Based Automatic Control

- 5.4 By Application

- 5.4.1 Facades and Curtain Walls

- 5.4.2 Interior Partitions and Privacy Panels

- 5.4.3 Sunroofs, Skylights and Roof Glazing

- 5.4.4 Mirrors and Displays

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Russia

- 5.5.3.7 Rest of Europe

- 5.5.4 Asia Pacific

- 5.5.4.1 China

- 5.5.4.2 India

- 5.5.4.3 Japan

- 5.5.4.4 South Korea

- 5.5.4.5 ASEAN

- 5.5.4.6 Rest of Asia Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 Turkey

- 5.5.5.1.2 Saudi Arabia

- 5.5.5.1.3 United Arab Emirates

- 5.5.5.1.4 Qatar

- 5.5.5.1.5 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Nigeria

- 5.5.5.2.3 Egypt

- 5.5.5.2.4 Rest of Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 AGC Inc.

- 6.4.2 Compagnie de Saint-Gobain S.A. (SageGlass)

- 6.4.3 Guardian Glass LLC

- 6.4.4 View Inc.

- 6.4.5 Halio International SA

- 6.4.6 Gentex Corporation

- 6.4.7 Corning Incorporated

- 6.4.8 Nippon Sheet Glass Co. Ltd. (NSG)

- 6.4.9 Polytronix Inc.

- 6.4.10 Research Frontiers Inc.

- 6.4.11 Pleotint LLC

- 6.4.12 EControl-Glas GmbH

- 6.4.13 BOE Technology Group Co.

- 6.4.14 Hitachi Chemical Co.

- 6.4.15 Merck KGaA (liquid-crystal materials)

- 6.4.16 Smart Films International

- 6.4.17 uniteGlass (CNBM)

- 6.4.18 Pro Display / Intelligent Glass

- 6.4.19 Magic Film Factory

- 6.4.20 Argil Inc.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment