PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851360

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851360

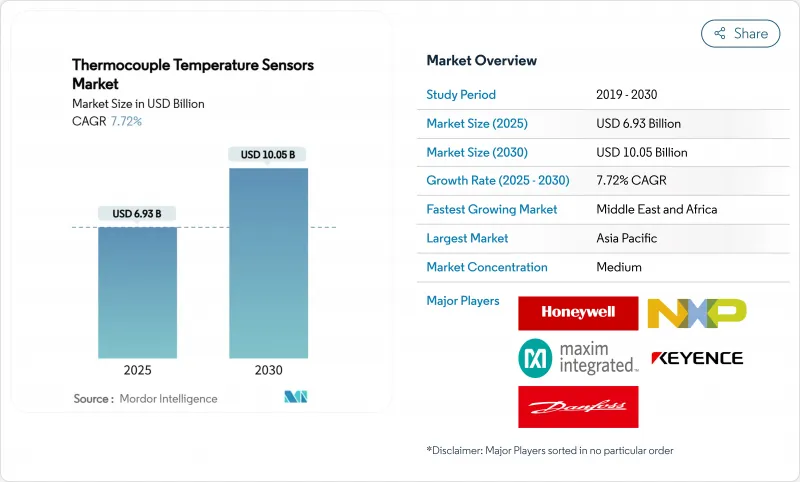

Thermocouple Temperature Sensors - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The thermocouple temperature sensors market size is valued at USD 6.93 billion in 2025 and is forecast to reach USD 10.05 billion by 2030, reflecting a 7.72% CAGR.

Demand stems from industries where real-time thermal data underpins efficiency, safety and yield-especially at temperatures where RTDs and thermistors fall short. Expansion in Industry 4.0 retrofits, green-hydrogen electrolysers, LNG infrastructure and EV battery gigafactories is elevating use cases that favour Type K, N and T probes. At the same time, digital networking standards such as EtherNet/IP profiles are turning legacy sensors into smart nodes that feed predictive-maintenance platforms. Intensifying competition comes from low-cost Asian imports and fiber-optic alternatives, yet regulatory mandates for tighter motor-efficiency tests and embedded monitoring add fresh tailwinds.

Global Thermocouple Temperature Sensors Market Trends and Insights

Predictive maintenance driving multi-point thermocouple adoption

Factory operators adopting Industry 4.0 standards are replacing single-point sensors with multi-point thermocouple strings that create detailed thermal maps. When paired with machine-learning algorithms, these arrays detect drift or hotspots weeks ahead of a fault, reducing unplanned downtime by up to 30%. European plants pioneered the retrofit wave, yet North American automakers and chemical processors are following as CEN Workshop Agreement 18038 offers a blueprint for data-driven maintenance. Broader adoption is fuelled by falling computing costs and ODVA's plug-and-play EtherNet/IP profiles that shrink integration time. As more plants normalize thermal profiling, suppliers able to bundle sensors with analytics services capture higher margins.

Green hydrogen driving high-temperature monitoring demand

Scaling of solid-oxide electrolyser cells pushes operating zones beyond 800 °C, a threshold where Type N and upgraded Type K probes outclass other metal-based sensors. Continuous profiling guards against thermal cycling that shortens stack life, and California Energy Commission grants have sharpened global attention on temperature-control protocols. Asian electrolyser vendors now specify pre-welded mineral-insulated (MI) assemblies rated for hydrogen exposure, creating a premium tier within the thermocouple temperature sensors market. As European climate-policy funds funnel into green-hydrogen clusters, collective demand for ultra-stable probes widens the addressable sales pool well past pilot plants.

Price erosion challenging Western manufacturers

A surge of low-cost K and J probes from China and India has cut average selling prices by 15-20% since 2023, squeezing margins on standard assemblies that make up over half of unit volumes. Asian vendors also ship MI cables at 30-40% discounts, forcing legacy brands to pivot toward specialized designs or service-heavy contracts. Distributors in the United States report inventory turns slowing as end users defer replacements in anticipation of further price drops. Short-cycle inflationary spikes in nickel and chromium amplify cost control woes for European firms, yet buyers remain reluctant to shoulder surcharges, deepening the restraint on revenue growth.

Other drivers and restraints analyzed in the detailed report include:

- LNG infrastructure expansion boosts cryogenic sensor demand

- EV battery manufacturing driving precision temperature control

- Fiber-optic sensors threatening high-EMI applications

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Type K maintained a 35% hold on the thermocouple temperature sensors market share in 2024 on versatility across -200 °C to +1350 °C. That span covers mainstream manufacturing, food processing and HVAC loops, positioning the variant for volume contracts even as commoditization trims margins. Type N, however, is capturing orders in aerospace test stands and hydrogen reactors at an 8.9% CAGR through 2030, aided by immunity to green-rot oxidation. OEMs see life-cycle savings from longer calibration intervals, swinging purchasing departments toward higher upfront costs. Emerging R, S and B alloys remain priced for boutique ultra-high-temperature work, but incremental breakthroughs in platinum wire purity are nudging them into semiconductor epitaxy lines where 1200 °C drift control is paramount.

Recent material science gains widen adoption envelopes. Thin-film deposition now embeds micron-scale thermocouple grids on ceramic substrates, serving real-time wafer temperature measurement. Suppliers highlight alumina insulation and Fibro Platinum wire for 1600 °C continuous service, enabling glass, refractory and additive-manufacturing kilns to retire legacy optical pyrometers. Type T retains a thriving micro-niche at -200 °C LNG duties where accuracy trumps cost. Collectively, these moves reinforce the premium segments' resilience against bulk price compression.

Grounded junction models still dominate OEM catalogues because they achieve millisecond response times. Yet the push for electrical isolation in servo drives and variable-frequency motor systems moves procurement toward ungrounded versions that damp ground-loop noise by 90% while sacrificing only 20% response speed. Semiconductor fabricators specify these variants to shield sensitive measurement electronics from stray currents. Exposed junctions continue in lab glassware and non-pressurized pilot rigs but carry limited share due to fragility. As factories re-wire for predictive maintenance, control engineers balance electromagnetic compatibility against dynamic response, favouring hybrid designs such as partially insulated mini junctions.

Advances in laser-welded tip construction lift fatigue life, letting ungrounded MI probes survive high-vibration turbine stages. Vendors add miniature connectors and epoxy potting salts that improve seal integrity without hampering thermal lag. Some battery producers adopt clip-on skin sensors-essentially exposed junctions set in ceramic beads-to audit cell casing temperatures, pulling junction innovation into consumer-electronics territory. These cross-industry learnings keep the thermocouple temperature sensors market vibrant despite encroachment from silicon-based chips.

Thermocouple Temperature Sensors Market Segmented by Thermocouple Type, Junction Type (Grounded Junction, Ungrounded Junction and More), Temperature Range (Below 0 °C, 0 °C - 350 °C and More), Probe Configuration (Beaded-Wire, Mineral-Insulated (MI) Cable and More) End-User Industry (Oil and Gas, Power Generation and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia Pacific's 42% command of the thermocouple temperature sensors market rests on its dense manufacturing base. China's battery kilns and Japan's chip fabs consume high-accuracy probes, while South Korea specifies platinum alloys for OLED glass melt zones. India's petrochemical expansion adds orders for standard K and J variants yet increasingly demands local content, spurring joint ventures. Low-cost plants across the region manufacture commoditized probes that flow into global supply chains, creating price headwinds elsewhere.

The Middle East posts the quickest regional climb at 9.5% CAGR through 2030. Saudi Aramco-approved facilities in Dammam now produce MI probes and thermowells domestically. Investment flows span petrochemical hubs, solar-thermal farms and desalination units, all requiring rugged sensors from cryogenic to 1000 °C zones. Local assembly shortens lead times and helps suppliers meet in-country value mandates, reshaping distribution networks in the thermocouple temperature sensors market.

North America maintains substantial share via aerospace, LNG and advanced manufacturing. New liquefaction trains along the Gulf Coast order Type T strings for -162 °C service, whereas jet-engine OEMs qualify noble-metal probes for 1200 °C combustors. Europe's uptake hinges on regulatory stimuli; EU Motor Regulation 2019/1781 obliges embedded thermocouple verification for efficiency labelling, and hydrogen pilot plants in Germany necessitate 900 °C measurement of SOEC stacks. South America and Africa remain nascent but show upticks tied to mining, pulp-and-paper and fertilizer plants seeking process upgrades.

- Omega Engineering (Spectris plc)

- Emerson Electric Co.

- Endress+Hauser Group

- Honeywell International Inc.

- ABB Ltd

- Yokogawa Electric Corp.

- WIKA Alexander Wiegand SE

- TE Connectivity Ltd.

- Watlow Electric Manufacturing Co.

- Fluke Corporation

- Siemens AG

- JUMO GmbH and Co. KG

- Tempsens Instruments

- Pyromation Inc.

- Durex Industries

- Thermo Fisher Scientific Inc.

- GHM Group (Greisinger)

- TC Ltd (UK)

- Thermo Electric Instrumentation

- Tip TEMP

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Drivers

- 4.1.1 Shift toward predictive maintenance in Industry 4.0 boosting multi-point thermocouple retrofits across European factories

- 4.1.2 Expansion of green-hydrogen electrolyzes build-outs (>800 C monitoring) in Asia Pacific

- 4.1.3 LNG regasification terminal build-outs requiring cryogenic Type-T probes in North America

- 4.1.4 EV battery gigafactory kiln installations in China demanding high-accuracy Type-K sensors

- 4.1.5 EU Regulation 2019/1781 mandating tighter motor-efficiency tests and embedded thermocouples

- 4.2 Market Restraints

- 4.2.1 Price erosion from commoditized K and J imports out of low-cost Asian supply chains

- 4.2.2 Substitution threat from fiber-optic sensors in high-EMI aerospace engines

- 4.2.3 Calibration drift >1 200 C limiting use in semiconductor epitaxy lines

- 4.2.4 Nickel and chromium supply volatility disrupting MI-cable probe output in Europe

- 4.3 Value / Supply-Chain Analysis

- 4.4 Regulatory Outlook

- 4.5 Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

- 4.7 PESTLE Analysis

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 Thermocouple Type

- 5.1.1 Type J

- 5.1.2 Type T

- 5.1.3 Type N

- 5.1.4 Type E

- 5.1.5 Type R and S

- 5.1.6 Type B

- 5.1.7 Others

- 5.2 By Junction Type

- 5.2.1 Grounded Junction

- 5.2.2 Ungrounded Junction

- 5.2.3 Exposed Junction

- 5.3 By Temperature Range

- 5.3.1 Below 0 C

- 5.3.2 0 C 350 C

- 5.3.3 350 C 700 C

- 5.3.4 Above 700 C

- 5.4 By Probe Configuration

- 5.4.1 Beaded-Wire

- 5.4.2 Mineral-Insulated (MI) Cable

- 5.4.3 Thermowell and Protection Tube

- 5.4.4 Surface and Penetration

- 5.4.5 Flexible / Custom Harness

- 5.5 By End-User Industry

- 5.5.1 Oil and Gas

- 5.5.2 Power Generation

- 5.5.3 Chemicals and Petrochemicals

- 5.5.4 Metals and Mining

- 5.5.5 Food and Beverage

- 5.5.6 Automotive and EV Battery

- 5.5.7 Aerospace and Defense

- 5.5.8 Semiconductor and Electronics

- 5.5.9 Healthcare and Life Sciences

- 5.5.10 HVAC and Building Automation

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.1.4 Rest of North America

- 5.6.2 South America

- 5.6.2.1 Brazil

- 5.6.2.2 Argentina

- 5.6.2.3 Rest of South America

- 5.6.3 Europe

- 5.6.3.1 Germany

- 5.6.3.2 United Kingdom

- 5.6.3.3 France

- 5.6.3.4 Italy

- 5.6.3.5 Spain

- 5.6.3.6 Russia

- 5.6.3.7 Rest of Europe

- 5.6.4 Asia Pacific

- 5.6.4.1 China

- 5.6.4.2 Japan

- 5.6.4.3 India

- 5.6.4.4 South Korea

- 5.6.4.5 Australia

- 5.6.4.6 Rest of Asia Pacific

- 5.6.5 Middle East

- 5.6.5.1 Saudi Arabia

- 5.6.5.2 United Arab Emirates

- 5.6.5.3 Turkey

- 5.6.5.4 Rest of Middle East

- 5.6.6 Africa

- 5.6.6.1 South Africa

- 5.6.6.2 Egypt

- 5.6.6.3 Nigeria

- 5.6.6.4 Rest of Africa

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.3.1 Omega Engineering (Spectris plc)

- 6.3.2 Emerson Electric Co.

- 6.3.3 Endress+Hauser Group

- 6.3.4 Honeywell International Inc.

- 6.3.5 ABB Ltd

- 6.3.6 Yokogawa Electric Corp.

- 6.3.7 WIKA Alexander Wiegand SE

- 6.3.8 TE Connectivity Ltd.

- 6.3.9 Watlow Electric Manufacturing Co.

- 6.3.10 Fluke Corporation

- 6.3.11 Siemens AG

- 6.3.12 JUMO GmbH and Co. KG

- 6.3.13 Tempsens Instruments

- 6.3.14 Pyromation Inc.

- 6.3.15 Durex Industries

- 6.3.16 Thermo Fisher Scientific Inc.

- 6.3.17 GHM Group (Greisinger)

- 6.3.18 TC Ltd (UK)

- 6.3.19 Thermo Electric Instrumentation

- 6.3.20 Tip TEMP

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet Need Analysis