PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851363

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851363

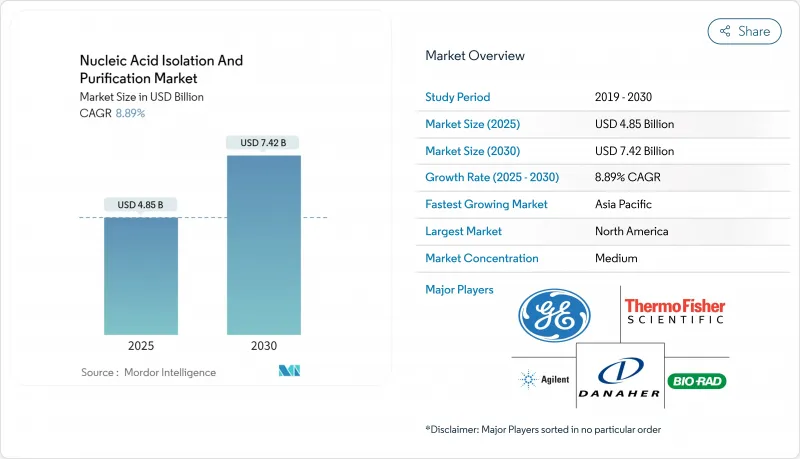

Nucleic Acid Isolation And Purification - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The nucleic acid isolation and purification market size is valued at USD 4.85 billion in 2025 and is forecast to reach USD 7.42 billion by 2030, expanding at an 8.89% CAGR.

Robust demand for high-quality nucleic acid extraction in precision medicine, combined with rapid adoption of liquid biopsy workflows, underpins sustained growth. Column-based purification maintains the largest revenue share thanks to proven reliability, yet magnetic bead workflows are scaling quickly as laboratories automate sample preparation. Government-backed genomics initiatives, notably in India and China, are widening the customer base, while clinical laboratories intensify procurement as molecular diagnostics become routine. Competitive intensity is heightening as leading vendors integrate AI-driven automation modules that trim hands-on time and raise reproducibility, creating a clear efficiency dividend for early adopters.

Global Nucleic Acid Isolation And Purification Market Trends and Insights

Surge in Liquid-Biopsy cfDNA Extraction Demand in Oncology

The transition from tissue to blood-based oncology testing has amplified requirements for ultra-sensitive cfDNA isolation protocols. Clinical oncologists now rely on circulating tumor DNA at fractional abundance levels to guide therapy selection, sparking a spike in demand for kits that recover picogram-level DNA with minimal background. Magnetic bead chemistries tailored for cfDNA have achieved >90% recovery, enabling real-time tumor burden monitoring for lung, breast, and colorectal cancers . Instrument makers are embedding pre-validated cfDNA scripts into automated workstations, allowing hospital labs to process 96 plasma samples in under two hours. As payer reimbursement expands, cfDNA volumes are expected to outpace tissue biopsies in leading oncology centers.

Growing Technological Advancements

Robotics, AI-curated extraction parameters, and alternative separation chemistries are reshaping day-to-day workflows. High-end platforms now cut manual intervention by up to 80%, improve batch-to-batch consistency, and curtail contamination risk. Isotachophoresis leverages electric fields rather than solid-phase binding, delivering higher-molecular-weight DNA with less fragmentation and preserving epigenetic signatures essential for long-read sequencing . Complementary breakthroughs include 3D-printed integrated separators that complete magnetic-free extractions in under one minute, accelerating throughput in core facilities.

High Capital and Maintenance Costs

Automated workstations list between USD 50,000 and USD 200,000, excluding proprietary plastics and annual service contracts. Smaller laboratories often delay upgrades or depend on fee-for-service partners, reinforcing a tiered ecosystem where cutting-edge capabilities concentrate in well-funded centers. Leasing models ease cash flow constraints yet lock users into consumable commitments, raising life-cycle costs.

Other drivers and restraints analyzed in the detailed report include:

- Wide Range Applications of Nucleic Acid Testing in Diagnostics

- Genomics Initiatives Driving gDNA Preparation

- Stringent Regulatory Norms

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Column-based purification generated 48.12% of 2024 revenue, reflecting entrenched protocols in clinical and academic labs. Nonetheless, magnetic bead systems are projected to register a 9.8% CAGR, the highest within the nucleic acid isolation and purification market. Enhanced surface chemistries now enable selective binding and rapid elution, while open-deck automation modules like INTEGRA's MAG platform streamline 96-well processing. The nucleic acid isolation and purification market size attributable to magnetic bead platforms is forecast to expand steeply as high-throughput sequencing becomes routine in oncology and hereditary disease testing. Reagent-based and emerging electrophoretic methods retain niche traction where cost or sample integrity considerations outweigh speed.

Automation drives the migration toward beads. Pharmaceutical QC laboratories have validated bead workflows on fully enclosed robots, achieving 20% shorter cycle times relative to spin columns. Meanwhile, early adopters report lower cross-contamination thanks to sealed tip architectures. These advantages explain why magnetic bead installations are approaching parity with columns in newly built core facilities, a trend likely to intensify through 2030.

Kits and reagents contributed 67.78% of 2024 turnover, reflecting daily consumable demand across diverse workflows. Still, instrument sales are poised for a 10.4% CAGR, the fastest within the nucleic acid isolation and purification market, as laboratories replace manual benches with integrated robotics. The nucleic acid isolation and purification market size for instruments is expanding alongside enterprise-wide automation initiatives where traceability and standardization are priorities. Trilobio's whole-lab automation suite demonstrated a 33% rise in throughput during pilot deployments, validating ROI for high-volume users. Consumables such as spin columns, beads, and plates maintain steady demand, providing recurring revenue that cushions vendors from capital expenditure cyclicality.

Scalability remains the decisive buying criterion. Multi-module robots capable of parallel DNA and RNA extractions dominate pharmaceutical pipelines, while compact cartridge-based systems penetrate decentralized hospital labs. Vendors are differentiating through AI-guided run set-ups that auto-adjust incubation times based on upstream QC metrics, further cementing the shift from manual to automated platforms.

The Nucleic Acid Isolation and Purification Market Report Segments the Industry Into by Technology (Column-Based Purification, and More), by Product (Kits and Reagents, and More), by Application (Plasmid DNA Isolation, and More), by End User (Hospitals, Academic and Research Institutes, and More), and Geography. The Market Sizes and Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America commanded 39.15% of global revenue in 2024, anchored by mature biopharmaceutical sectors and early uptake of automated extraction platforms. Favorable reimbursement for genomic assays and well-defined regulatory pathways further reinforce regional dominance. The nucleic acid isolation and purification market size in the United States alone benefited from precision oncology trials such as myeloMATCH that integrate next-generation sequencing into treatment assignment.

Asia-Pacific is the fastest-growing territory, forecast at a 9.5% CAGR until 2030. Expanding healthcare expenditure, domestic biomanufacturing capacity, and national genomics drives fuel uptake in China, India, and South Korea. High-throughput projects such as Genome India require consistent, scalable extraction workflows, propelling demand for both kits and automated instruments. Rising incidence of cancer and infectious diseases further amplifies molecular diagnostic adoption, ensuring sustained market expansion.

Europe maintains a significant share owing to established research networks and stringent quality standards that favor premium extraction solutions. Implementation of IVDR is reshaping supplier selection criteria, prompting laboratories to prioritize vendors with comprehensive performance dossiers. Emerging regions in the Middle East and South America register smaller bases but exhibit accelerating adoption as public health systems modernize molecular diagnostics infrastructure, opening fresh avenues for technology diffusion.

- Agilent Technologies

- Bio-Rad Laboratories

- Thermo Fisher Scientific

- Danaher Corp. (Beckman Coulter & Cepheid)

- Roche

- QIAGEN

- Merck

- Promega Corp.

- GE Healthcare

- PerkinElmer

- Illumina

- Takara Bio

- New England Biolabs

- Zymo Research Corp.

- Oxford Nanopore Technologies

- Norgen Biotek

- LGC Biosearch Technologies

- Analytik Jena

- Invitek Molecular

- Biovision

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Surge in Liquid-Biopsy cfDNA Extraction Demand in Oncology

- 4.2.2 Growing Technological Advancements

- 4.2.3 Wide Range Applications of Nucleic Acid Testing in Diagnostics

- 4.2.4 Decentralization of Infectious-Disease RNA Testing in LMICs

- 4.2.5 Genomics Initiatives (e.g., Genome India) Driving gDNA Prep

- 4.2.6 Rise in R&D Funding in Biotechnology

- 4.3 Market Restraints

- 4.3.1 High Capital and Maintenance Costs

- 4.3.2 Supply-Chain Volatility for Critical Raw Materials

- 4.3.3 Stringent Regulatory Norms

- 4.3.4 Contamination Concerns in Magnetic-Bead Workflows

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Outlook

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 Market Size & Growth Forecasts (Value & Volume)

- 5.1 By Technology

- 5.1.1 Column-Based Purification

- 5.1.2 Magnetic Bead-Based Purification

- 5.1.3 Reagent-Based Purification

- 5.1.4 Others

- 5.2 By Product

- 5.2.1 Kits & Reagents

- 5.2.2 Instruments & Workstations

- 5.2.3 Consumables (Spin-Columns, Beads, Cartridges)

- 5.3 By Application

- 5.3.1 Genomic DNA Isolation & Purification

- 5.3.2 mRNA Isolation & Purification

- 5.3.3 microRNA Isolation & Purification

- 5.3.4 Cell-free DNA / Liquid Biopsy Isolation

- 5.3.5 Plasmid DNA Isolation

- 5.3.6 PCR Clean-up

- 5.4 By End-User

- 5.4.1 Academic & Research Institutes

- 5.4.2 Pharmaceutical / Biotechnology Companies

- 5.4.3 Hospitals & Diagnostic Labs

- 5.4.4 Contract Research & Manufacturing Organizations

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 South Korea

- 5.5.3.5 Australia

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 Middle East

- 5.5.4.1 GCC

- 5.5.4.2 South Africa

- 5.5.4.3 Rest of Middle East

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Argentina

- 5.5.5.3 Rest of South America

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products & Services, Recent Developments)

- 6.3.1 Agilent Technologies

- 6.3.2 Bio-Rad Laboratories Inc.

- 6.3.3 Thermo Fisher Scientific

- 6.3.4 Danaher Corp. (Beckman Coulter & Cepheid)

- 6.3.5 F. Hoffmann-La Roche Ltd.

- 6.3.6 Qiagen N.V.

- 6.3.7 Merck KGaA (Sigma-Aldrich)

- 6.3.8 Promega Corp.

- 6.3.9 GE HealthCare

- 6.3.10 PerkinElmer Inc.

- 6.3.11 Illumina Inc.

- 6.3.12 Takara Bio Inc.

- 6.3.13 New England Biolabs

- 6.3.14 Zymo Research Corp.

- 6.3.15 Oxford Nanopore Technologies

- 6.3.16 Norgen Biotek Corp.

- 6.3.17 LGC Biosearch Technologies

- 6.3.18 Analytik Jena AG

- 6.3.19 Invitek Molecular

- 6.3.20 BioVision Inc.

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment