PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851376

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851376

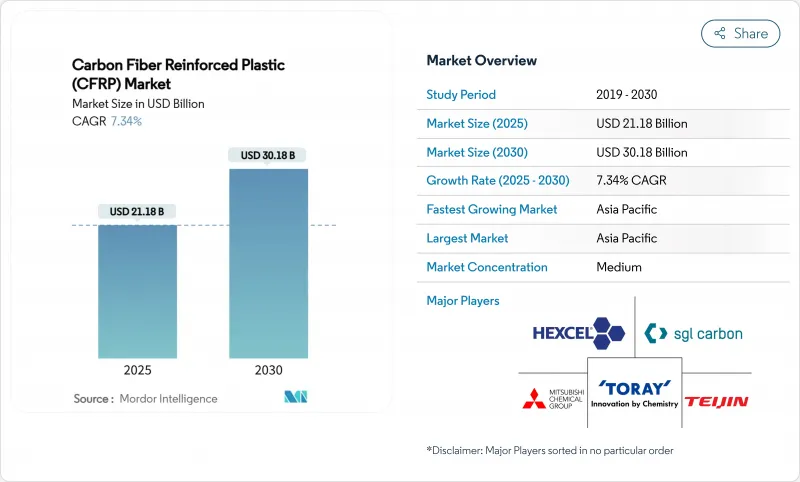

Carbon Fiber Reinforced Plastic (CFRP) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Carbon Fiber Reinforced Plastic Market size is estimated at USD 21.18 billion in 2025, and is expected to reach USD 30.18 billion by 2030, at a CAGR of 7.34% during the forecast period (2025-2030).

The growth mirrors the material's journey from niche aerospace uses to mainstream industrial adoption as designers try to trim weight while safeguarding structural strength. Tighter sustainability rules, the electrification wave in transport, and the need for durable lightweight parts across renewable-energy infrastructure jointly advance the carbon fiber reinforced plastic market. Leading suppliers have shifted investment from pure fiber capacity to downstream processing, recycling, and circular-economy solutions that deepen customer integration. Meanwhile, capacity expansions in China and alternative precursor research in the United States shape a supply chain increasingly defined by security of supply rather than headline tonnage.

Global Carbon Fiber Reinforced Plastic (CFRP) Market Trends and Insights

Surge in Commercial Aircraft Backlog

The commercial aviation sector's unprecedented order backlog exceeding 15,000 aircraft creates sustained demand for carbon fiber composites. Air-framer push for thermoplastic secondary structures aims at faster build rates without sacrificing performance. Suppliers respond by qualifying multiple fiber sources to diversify risk and assure uninterrupted deliveries.

Electrification Accelerating CFRP Battery Enclosures

Electric-vehicle makers now specify carbon-fiber battery housings that cut enclosure weight by up to 91% versus aluminum. Each kilogram saved can be redeployed as extra battery capacity, extending range without enlarging the vehicle footprint. Flame-retardant thermoplastics and integrated thermal-management layers help composites meet strict safety codes, moving the carbon fiber reinforced plastic market deeper into high-volume automotive production.

High Cost of Aerospace-grade PAN Precursor

Aerospace-qualified polyacrylonitrile (PAN) sells for USD 33-66 per kg, limiting crossover into cost-sensitive sectors. Few suppliers meet stringent cleanliness and consistency norms, creating supply concentration risk. Water-soluble precursor research promises cost cuts, yet commercial validation in conservative aerospace supply chains will take time.

Other drivers and restraints analyzed in the detailed report include:

- Mega-blade Wind Turbines (>100 m) Adopting CFRP Spar Caps

- Hydrogen Mobility Pressure-vessel Build-out

- Industrial-grade Fibre Capacity Bottlenecks

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Thermoset systems commanded 72.78% of the carbon fiber reinforced plastic market share in 2024, cemented by aerospace's long reliance on epoxy prepregs. Yet thermoplastic solutions record an 8.13% CAGR through 2030, reflecting rising needs for fast processing and recyclability. Airbus's thermoplastic fuselage panels show cycle-time savings compatible with monthly production rates above 70 airframes, while automotive suppliers cut stamping cycles to seconds.

Thermoplastic composites also expand the carbon fiber reinforced plastic market size in mobility, eVTOL, and hydrogen storage because they can be welded or re-melted during assembly. CF-PEEK parts deliver tensile strength of 425 MPa versus 311 MPa for CF-epoxy, together with higher continuous-use temperatures. The shift is far from replacing thermosets in primary aircraft wings, but it unlocks a broad set of secondary structures and automotive parts where cost per component dictates material choice.

The Carbon Fiber Reinforced Plastics Market Report Segments the Industry by Resin Type (Thermoset CFRP and Thermoplastic CFRP), Raw-Material Precursor (PAN, Pitch, Rayon, and Others (Lignin-Based, Etc. ), End-User Industry (Aerospace, Automotive, Wind Power Industry, and More), and Geography (Asia-Pacific, North America, Europe, South America, and Middle East and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific captured 42.30% of the carbon fiber reinforced plastic market in 2024 and exhibits the highest 8.54% CAGR through 2030. China alone consumed about 69,000 t of composites in 2023, propelled by wind, EV, and hydrogen infrastructure projects. Yet lingering gaps in T1000-level fibers and export-control headwinds could temper its aerospace momentum.

North America leverages aerospace programs and hydrogen-mobility pilots. Boeing's backlog plus emerging eVTOL firms sustain a robust demand base, while investments in recycling plants and alternative precursors aim to fortify domestic supply. Hexcel reported 5.2% commercial-aerospace revenue growth in Q1 2024 despite logistics challenges.

Europe anchors sustainability leadership. Airbus's thermoplastic initiatives and EU recycling regulations spur circular-economy advances. The region also channels investment into hydrogen tank manufacturing and offshore wind, both heavy carbon-fiber users. Solvay's long-term supply deal with Boeing underlines transatlantic collaboration even as European producers tighten local value retention.

- Toray Industries Inc.

- Hexcel Corporation

- SGL Carbon

- Mitsubishi Chemical Corporation

- Teijin Limited

- Solvay

- DowAksa

- Formosa Plastics Corporation, U.S.A.

- Gurit Services AG

- TPI Composites

- HS HYOSUNG ADVANCED MATERIALS

- Nippon Graphite Fiber Co., Ltd.

- Rochling

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Surge in commercial aircraft backlog

- 4.2.2 Electrification accelerating Carbon Fiber Reinforced Plastics (CFRP) battery enclosures

- 4.2.3 Mega-blade wind turbines (less than 100 m) adopting Carbon Fiber Reinforced Plastics (CFRP) spar caps

- 4.2.4 Hydrogen mobility pressure-vessel build-out

- 4.2.5 eVTOL & urban-air-mobility platforms favouring thermoplastic CFRP

- 4.2.6 Closed-loop recycling unlocking low-cost recycled Carbon Fiber (rCF)

- 4.3 Market Restraints

- 4.3.1 High cost of aerospace-grade Polyacrylonitrile (PAN) precursor

- 4.3.2 Industrial-grade fibre capacity bottlenecks

- 4.3.3 Export controls on high-modulus fibre

- 4.3.4 Immature end-of-life recycling infrastructure

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

5 Market Size & Growth Forecasts (Value)

- 5.1 By Resin Type

- 5.1.1 Thermoset Carbon Fiber Reinforced Plastics (CFRP)

- 5.1.2 Thermoplastic Carbon Fiber Reinforced Plastics (CFRP)

- 5.2 By Raw-Material Precursor

- 5.2.1 Polyacrylonitrile (PAN)

- 5.2.2 Pitch

- 5.2.3 Rayon

- 5.2.4 Others (Lignin-based, Recycled CF (Carbon Fiber))

- 5.3 By End-user Industry

- 5.3.1 Aerospace

- 5.3.2 Automotive

- 5.3.3 Wind Power Industry

- 5.3.4 Sports and Leisure

- 5.3.5 Building and Construction

- 5.3.6 Other End-user Industry

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 South America

- 5.4.2.1 Brazil

- 5.4.2.2 Argentina

- 5.4.2.3 Rest of South America

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Spain

- 5.4.3.6 Russia

- 5.4.3.7 Rest of Europe

- 5.4.4 Asia-Pacific

- 5.4.4.1 China

- 5.4.4.2 Japan

- 5.4.4.3 South Korea

- 5.4.4.4 India

- 5.4.4.5 Rest of Asia-Pacific

- 5.4.5 Middle East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 United Arab Emirates

- 5.4.5.3 South Africa

- 5.4.5.4 Rest of Middle East and Africa

- 5.4.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share (%)/ Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.4.1 Toray Industries Inc.

- 6.4.2 Hexcel Corporation

- 6.4.3 SGL Carbon

- 6.4.4 Mitsubishi Chemical Corporation

- 6.4.5 Teijin Limited

- 6.4.6 Solvay

- 6.4.7 DowAksa

- 6.4.8 Formosa Plastics Corporation, U.S.A.

- 6.4.9 Gurit Services AG

- 6.4.10 TPI Composites

- 6.4.11 HS HYOSUNG ADVANCED MATERIALS

- 6.4.12 Nippon Graphite Fiber Co., Ltd.

- 6.4.13 Rochling

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment

- 7.2 Introduction of Carbon Nanomaterials in Carbon Fiber Reinforced Plastics (CFRP)