PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851381

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851381

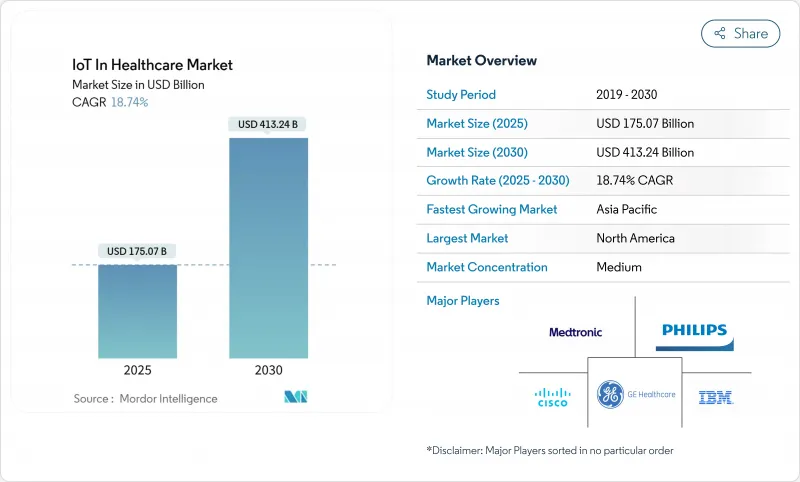

IoT In Healthcare - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The IoT in healthcare market is valued at USD 175.07 billion in 2025 and is projected to reach USD 413.24 billion by 2030, advancing at an 18.74% CAGR.

Rapid progress stems from reimbursement modernization, maturing 5G campus networks, and a post-pandemic expectation for uninterrupted patient oversight. Combined, these forces position connected devices as indispensable healthcare infrastructure rather than optional add-ons, pushing providers toward continuous engagement and data-driven interventions. Investment momentum is further sustained by private network deployments that cut implementation time by 90% and by digital-twin simulations that allow clinicians to test drug protocols virtually before bedside administration. Together, these shifts signal a durable reallocation of capital toward data liquidity, edge analytics, and device interoperability that enlarges the IoT in healthcare market opportunity horizon.

Global IoT In Healthcare Market Trends and Insights

Wearable-device penetration surge

Medical-grade wearables have shifted from fitness novelties to clinically validated diagnostics. iRhythm's Zio AT logged 98% patient adherence in 2024, showing that continuous cardiac telemetry is feasible without lifestyle disruption. FDA clearance of Dexcom's over-the-counter Stelo glucose monitor in the same year widens consumer access to regulated biosensors.Cloud-linked analytics convert these streams into real-time alerts, cutting emergency visits and readmissions. Specialized form factors such as Movano's Evie Ring target underserved cohorts, signaling new segmentation dynamics. As device diversity grows, the IoT in healthcare market gains incremental user pools across chronic-disease management and preventive screening.

Falling IoT sensor and connectivity costs

Global semiconductor overcapacity and miniaturization advances continue to pull unit prices down, allowing hospitals to connect more endpoints per budget dollar. The dispersion of 5G and LPWAN infrastructure trims data-transmission overheads while improving reliability. Edge-ready chipsets now process signals locally, lowering cloud egress fees and latency. Automotive-sector investments in power-efficient sensors spill over into medical designs, extending battery life on wearable patches. Interoperability standards under IEEE P2413 streamline multi-vendor integration, shrinking project lead-times and reinforcing the attractiveness of the IoT in healthcare market for cash-constrained providers.

Cyber-security and data-privacy risks

Proposed HIPAA updates mandate multi-factor authentication, encryption at rest, and AI-driven breach containment, adding an estimated USD 9.3 billion to first-year compliance budgets. EU providers juggle GDPR with the AI Act, extending procurement cycles. Healthcare remains the most expensive industry for breaches at USD 10.1 million per incident, driving cautious CIO behavior. Blockchain pilots promise immutable audit trails but raise energy-use worries. While security vendors see upside, inertia tempers expansion speed of the IoT in healthcare market.

Other drivers and restraints analyzed in the detailed report include:

- Digital-twin guided therapy optimization

- Hospital-at-home reimbursement roll-outs

- Lack of AI-grade interoperability standards

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Services accounted for 46% of 2024 revenue, reflecting hospitals' reliance on consulting, integration, and lifecycle support to unlock ROI. Systems and Software is forecast to grow at 19.7% CAGR as AI and cloud-native stacks become the baseline for new device introductions. Medtronic invested USD 2.7 billion in R&D to embed analytics layers that drive subscription revenue. Philips already orchestrates 1.3 million IoT endpoints on AWS, lowering compute spend by 36%. The IoT in healthcare market, therefore, tilts toward platform centricity rather than one-off hardware sales.

Edge analytics, cyber-secured middleware, and predictive-maintenance dashboards dominate fresh spending requests. Hospitals negotiate outcome-based contracts that bundle device leasing with real-time analytics and 24/7 service desks. Vendors that master end-to-end orchestration capture higher wallet share as organizations phase out multi-supplier patchworks. By 2030, the services subtotal is projected to eclipse hardware in absolute dollars, anchoring a high-recurring-revenue profile across the IoT in healthcare market.

Tele-medicine retained a 29.3% share in 2024 as the foundational use-case, yet Asset and Staff Tracking is climbing at 21.3% CAGR on the back of workforce shortages and throughput pressures. Private 5G and ultra-wideband tags support bed-level geofencing, cutting search times for ventilators in ICU corridors. Predictive maintenance schedules improve equipment uptime and audit compliance. These operational wins entice CFOs who view tracking projects as quick payback gateways into the broader IoT in healthcare market.

In-patient monitoring embraces 5G gateways that feed telemetry into AI triage engines. Medication-management kiosks register dose adherence in real time, curbing adverse events. Imaging suites deploy edge accelerators to render CT scans instantly, slashing radiologist turnaround. Emergency response teams use geotagged panic buttons linked to hospital command centers, shaving minutes off door-to-needle times. Collectively, these workflows diversify revenue streams and deepen penetration of the IoT in the healthcare industry.

The IoT in Healthcare Market Report is Segmented by Component (Medical Devices, Systems and Software, and More), Application (Tele-Medicine, In-Patient Monitoring, and More), End-User (Hospitals and Clinics, Home-Care / Patients, and More), Connectivity Technology (Bluetooth Low Energy (BLE), Wi-Fi, Cellular and 5G, and More), Deployment Model (Cloud and On-Premise / Edge), and Geography.

Geography Analysis

North America retained 42.2% revenue in 2024, fortified by Medicare's permanent remote-monitoring CPT codes and an FDA fast-track environment for wearable diagnostics Strong EHR penetration eases device-platform integration, while venture-capital activity supplies scaling fuel for startups. State Medicaid programs increasingly replicate federal reimbursement, expanding addressable populations. As a result, the IoT in healthcare market enjoys predictable demand curves across the United States and Canada.

Europe posted steady growth under the European Health Data Space, which allocates EUR 810 million to interoperability projects. Germany's hospital reform law mandates electronic patient records, propelling middleware upgrades. The EU Battery Regulation 2023/1542 raises design complexity but aligns with sustainability mandates. Simultaneously, the AI Act clarifies algorithmic transparency rules, fostering clinician trust. These coordinated policies position Europe as a quality-driven yet compliant slice of the IoT in healthcare market.

Asia-Pacific is the fastest climber at 23.25% CAGR to 2030. Japan's Medical DX initiative links national ID cards to insurance databases, streamlining IoT-data flow. In China, more than 100 smart hospitals leverage 5G campus grids for end-to-end patient tracking. India's Ayushman Bharat Digital Mission seeds foundational IDs for future device integration. High smartphone penetration and competitive telecom pricing encourage household monitoring kits, expanding the IoT in healthcare market footprint well beyond megacities. South America and the Middle East and Africa are nascent but primed for leapfrog adoption once broadband gaps narrow.

- Medtronic plc

- Koninklijke Philips N.V.

- GE Healthcare

- Cisco Systems Inc.

- IBM Corporation

- Microsoft Corporation

- SAP SE

- Siemens Healthineers

- Honeywell International

- Oracle Corporation

- Amazon Web Services

- Cerner Corporation

- Qualcomm Life

- Capsule Technologies Inc.

- Resideo Technologies Inc.

- Stanley Healthcare

- Telit Communications

- AliveCor Inc.

- Dexcom Inc.

- Insulet Corporation

- BioTelemetry Inc.

- Masimo Corporation

- Intel Corporation

- Armis Security

- SoftServe Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Wearable-device penetration surge

- 4.2.2 Falling IoT sensor and connectivity costs

- 4.2.3 Digital-twin guided therapy optimisation

- 4.2.4 Hospital-at-home reimbursement roll-outs

- 4.2.5 Private 5G networks in hospital campuses

- 4.2.6 Remote patient monitoring after COVID-19

- 4.3 Market Restraints

- 4.3.1 Cyber-security and data-privacy risks

- 4.3.2 Up-front legacy-integration costs

- 4.3.3 Lack of AI-grade interoperability standards

- 4.3.4 Battery e-waste tightening regulations

- 4.4 Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Rivalry

- 4.8 Assessment of COVID-19 Impact

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Component

- 5.1.1 Medical Devices

- 5.1.1.1 Wearable External Medical Devices

- 5.1.1.2 Implanted Medical Devices

- 5.1.1.3 Stationary Medical Devices

- 5.1.2 Systems and Software

- 5.1.3 Services

- 5.1.1 Medical Devices

- 5.2 By Application

- 5.2.1 Tele-medicine

- 5.2.2 In-patient Monitoring

- 5.2.3 Medication Management

- 5.2.4 Imaging and Diagnostics

- 5.2.5 Asset and Staff Tracking

- 5.2.6 Emergency Response

- 5.3 By End-user

- 5.3.1 Hospitals and Clinics

- 5.3.2 Clinical Research Organisations

- 5.3.3 Home-care / Patients

- 5.3.4 Other End-users

- 5.4 By Connectivity Technology

- 5.4.1 Bluetooth Low Energy (BLE)

- 5.4.2 Wi-Fi

- 5.4.3 Cellular and 5G

- 5.4.4 LPWAN (NB-IoT, LoRaWAN)

- 5.4.5 Zigbee and Other Short-range

- 5.5 By Deployment Model

- 5.5.1 Cloud

- 5.5.2 On-premise / Edge

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 Europe

- 5.6.2.1 United Kingdom

- 5.6.2.2 Germany

- 5.6.2.3 France

- 5.6.2.4 Italy

- 5.6.2.5 Spain

- 5.6.2.6 Russia

- 5.6.3 Asia Pacific

- 5.6.3.1 China

- 5.6.3.2 India

- 5.6.3.3 Japan

- 5.6.3.4 South Korea

- 5.6.3.5 ASEAN

- 5.6.3.6 Rest of Asia Pacific

- 5.6.4 South America

- 5.6.4.1 Brazil

- 5.6.4.2 Argentina

- 5.6.5 Middle East and Africa

- 5.6.5.1 GCC

- 5.6.5.2 South Africa

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Medtronic plc

- 6.4.2 Koninklijke Philips N.V.

- 6.4.3 GE Healthcare

- 6.4.4 Cisco Systems Inc.

- 6.4.5 IBM Corporation

- 6.4.6 Microsoft Corporation

- 6.4.7 SAP SE

- 6.4.8 Siemens Healthineers

- 6.4.9 Honeywell International

- 6.4.10 Oracle Corporation

- 6.4.11 Amazon Web Services

- 6.4.12 Cerner Corporation

- 6.4.13 Qualcomm Life

- 6.4.14 Capsule Technologies Inc.

- 6.4.15 Resideo Technologies Inc.

- 6.4.16 Stanley Healthcare

- 6.4.17 Telit Communications

- 6.4.18 AliveCor Inc.

- 6.4.19 Dexcom Inc.

- 6.4.20 Insulet Corporation

- 6.4.21 BioTelemetry Inc.

- 6.4.22 Masimo Corporation

- 6.4.23 Intel Corporation

- 6.4.24 Armis Security

- 6.4.25 SoftServe Inc.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment