PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851383

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851383

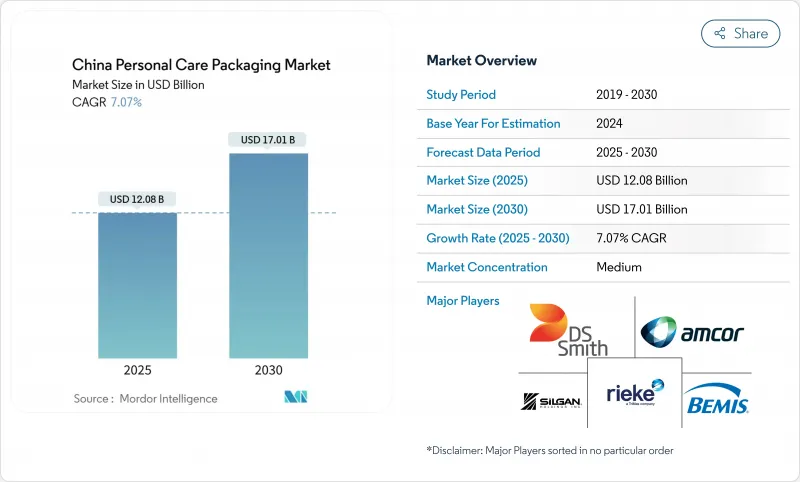

China Personal Care Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The China personal care packaging market reached USD 12.08 billion in 2025 and is forecast to expand to USD 17.01 billion by 2030, reflecting a 7.07% CAGR over the period.

This trajectory is propelled by regulatory measures that curb excessive packaging, the rapid migration of beauty shopping to social-commerce channels, and brand commitments to carbon-neutral operations. Sustainable material innovation, e-commerce-ready structural designs, and premium-tier product launches are converging to redefine competitive positioning across the value chain. Brands are investing in AI-assisted prototyping to trim development cycles, while packaging converters balance lightweighting with durability demands for nationwide last-mile delivery. Heightened enforcement of the GB 23350-2021 standard, the roll-out of China's national carbon trading scheme, and real-time social media feedback loops will continue to shape material choices and design parameters for the China personal care packaging market.

China Personal Care Packaging Market Trends and Insights

E-commerce boom for beauty and personal care

Explosive social-commerce growth is forcing brands to engineer packs capable of surviving wide-radius fulfilment while staging a photogenic unboxing moment. Douyin's beauty GMV more than doubled between 2021 and 2023, turning platform algorithm trends into near-instant packaging briefs for converters. Brands now weigh impact resistance, dimensional weight, and camera-ready aesthetics in equal measure. As fulfillment centers proliferate outside coastal provinces, flexible pouches and lightweight corrugates gain favor for their cushioning and freight-saving attributes, reinforcing the momentum of the China personal care packaging market.

Rise of refill-ready retail formats

Circularity targets from premium beauty houses accelerated trials of refill pods, concentrate sachets, and in-store bulk dispensers. Shiseido aims for 100% sustainable packaging by 2025 and has extended refill options to hero SKUs, prompting local ODMs to retool injection-molding lines for plug-in cartridges. Early pilots in Shanghai malls show consumers accepting reusable cores when refill stations are adjacent to point-of-sale, unlocking repeat-purchase stickiness and trimming material footprints.

Volatile resin and aluminum prices

Feedstock swings, driven by oil price gyrations and geopolitical uncertainty, are compressing converter margins. PET chip producers such as Wankai trimmed operating rates to 76% in late 2024, tightening supply and pushing converters to hedge through multi-month contracts or diversify into HDPE and PP blends. Smaller firms struggling to absorb surcharges may become acquisition targets, spurring gradual consolidation within the China personal care packaging market.

Other drivers and restraints analyzed in the detailed report include:

- Premiumization of skincare and cosmetic SKUs

- Male grooming uptake in lower-tier cities

- Recycling capacity bottlenecks for multi-layer laminates

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Plastic retained 58.47% of the China personal care packaging market share in 2024 owing to cost efficiency and process agility. Yet the GB 23350-2021 interspace ratio cap is prompting brands to trim wall thickness and explore paperboard sleeves for secondary packs. Paper and paperboard's 8.23% CAGR positions it as the standout growth engine, propelled by consumers equating fiber-based packs with environmental stewardship. Glass volumes are stabilizing in prestige skincare where weight signals luxury, while metal aerosols gain favor in premium deodorants as they align with infinitely recyclable narratives. Volatile resin prices further amplify the case for blended substrate strategies across the China personal care packaging market.

A steady pipeline of bio-based polymers has emerged, but many blends require industrial composting conditions that remain scarce. Consequently, producers are investing in mono-material PP tubes and PCR-rich PET bottles that meet recyclability thresholds without compromising barrier performance. State-owned banks' green finance instruments are expected to lower capital costs for retrofitting lines capable of handling recycled content, keeping material decisions tightly linked to both sustainability scorecards and input-cost hedging.

Plastic bottles and jars controlled 41.63% of 2024 revenues, backed by entrenched blow-molding assets and consumer familiarity. Flexible plastic pouches, however, are clocking an 8.07% CAGR as brands exploit weight savings that translate into lower courier tariffs. Tamper-evident zippers and gusseted bases are now standard to survive multi-node delivery routes while presenting flat fronts for influencer video close-ups. Tubes and sticks gain incremental traction alongside the male grooming boom, while refill cartridges enable footprint reduction in top-shelf skincare. Pumps, droppers, and actuators face cost pressure from metal spring components but benefit from premiumization that values dosage accuracy within the China personal care packaging market.

Corrugated shippers are evolving from plain kraft cubes into co-branded, print-on-demand canvases for social-media storytelling. Yet they must still comply with the GB 43352-2023 express-pack regulation limiting heavy-metal content, nudging converters toward water-based inks and starch adhesives. Aerosol cans and specialty glass remain niche by volume but over-index in value due to fragrance and spa-grade treatments that command higher averaged selling prices.

The China Personal Care Packaging Market is Segmented by Material Type (Plastic, Glass, Metal, Paper and Paperboard, and Bio-Based and Compostable Plastics), Packaging Type (Plastic Bottles and Jars, Tubes and Sticks, Pumps, Sprayers and Droppers, and More), Product Type (Skincare, Haircare, Oral Care, and More), and Sustainability Attribute (Recyclable, Post-Consumer Recycled (PCR) Content, Biodegradable, and More).

List of Companies Covered in this Report:

- Albea S.A.

- Amcor plc

- Silgan Holdings Inc.

- HCP Packaging (Shanghai) Co., Ltd.

- Berry Global Group, Inc.

- Gerresheimer AG

- AptarGroup, Inc.

- RPC Group Ltd (Berry Consumer Packaging Intl.)

- DS Smith Plc

- Huhtamaki Oyj

- Quadpack Industries, S.A.

- Rieke Packaging Systems Ltd.

- Shanghai Luxe-Pack Co., Ltd.

- Zhejiang Jinsheng New-Material Holding Group Co., Ltd.

- Shandong Yuhua Packing Products Co., Ltd.

- Guangzhou Beauty Packaging Co., Ltd.

- Xiamen Hexing Packaging Co., Ltd.

- Taizhou Forest Color Printing Packing Co., Ltd.

- Yunnan Yuxi Paper Co., Ltd.

- Ningbo NBG Plastic Packaging Co., Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 E-commerce boom for beauty and personal care

- 4.2.2 Rise of refill-ready retail formats

- 4.2.3 Premiumisation of skincare and cosmetic SKUs

- 4.2.4 Male grooming uptake in lower-tier cities

- 4.2.5 AI-enabled design and rapid prototyping

- 4.2.6 Mandatory "excessive-packaging" compliance (GB 23350-2021)

- 4.3 Market Restraints

- 4.3.1 Volatile resin and aluminum prices

- 4.3.2 Recycling capacity bottlenecks for multi-layer laminates

- 4.3.3 Stricter carbon-intensity quotas for plastics

- 4.3.4 Counterfeiting risk in secondary packaging

- 4.4 Evaluation of Critical Regulatory Framework

- 4.5 Value Chain Analysis

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

- 4.8 Impact Assessment of Key Stakeholders

- 4.9 Key Use Cases and Case Studies

- 4.10 Impact on Macroeconomic Factors of the Market

- 4.11 Investment Analysis

5 MARKET SEGMENTATION

- 5.1 By Material Type

- 5.1.1 Plastic

- 5.1.2 Glass

- 5.1.3 Metal

- 5.1.4 Paper and Paperboard

- 5.1.5 Bio-based and Compostable Plastics

- 5.2 By Packaging Type

- 5.2.1 Plastic Bottles and Jars

- 5.2.2 Tubes and Sticks

- 5.2.3 Pumps, Sprayers and Droppers

- 5.2.4 Aerosol Cans and Metal Containers

- 5.2.5 Folding Cartons

- 5.2.6 Corrugated Boxes

- 5.2.7 Flexible Plastic (Pouches, Sachets, Wraps)

- 5.2.8 Caps and Closures

- 5.2.9 Refillable / Reuse Systems

- 5.3 By Product Type

- 5.3.1 Skincare

- 5.3.2 Haircare

- 5.3.3 Oral Care

- 5.3.4 Color Cosmetics

- 5.3.5 Men's Grooming

- 5.3.6 Deodorants and Fragrances

- 5.3.7 Baby Care

- 5.4 By Sustainability Attribute

- 5.4.1 Recyclable (Mono-material)

- 5.4.2 Post-Consumer Recycled (PCR) Content

- 5.4.3 Biodegradable / Compostable

- 5.4.4 Refillable / Returnable

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Albea S.A.

- 6.4.2 Amcor plc

- 6.4.3 Silgan Holdings Inc.

- 6.4.4 HCP Packaging (Shanghai) Co., Ltd.

- 6.4.5 Berry Global Group, Inc.

- 6.4.6 Gerresheimer AG

- 6.4.7 AptarGroup, Inc.

- 6.4.8 RPC Group Ltd (Berry Consumer Packaging Intl.)

- 6.4.9 DS Smith Plc

- 6.4.10 Huhtamaki Oyj

- 6.4.11 Quadpack Industries, S.A.

- 6.4.12 Rieke Packaging Systems Ltd.

- 6.4.13 Shanghai Luxe-Pack Co., Ltd.

- 6.4.14 Zhejiang Jinsheng New-Material Holding Group Co., Ltd.

- 6.4.15 Shandong Yuhua Packing Products Co., Ltd.

- 6.4.16 Guangzhou Beauty Packaging Co., Ltd.

- 6.4.17 Xiamen Hexing Packaging Co., Ltd.

- 6.4.18 Taizhou Forest Color Printing Packing Co., Ltd.

- 6.4.19 Yunnan Yuxi Paper Co., Ltd.

- 6.4.20 Ningbo NBG Plastic Packaging Co., Ltd.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment