PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851390

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851390

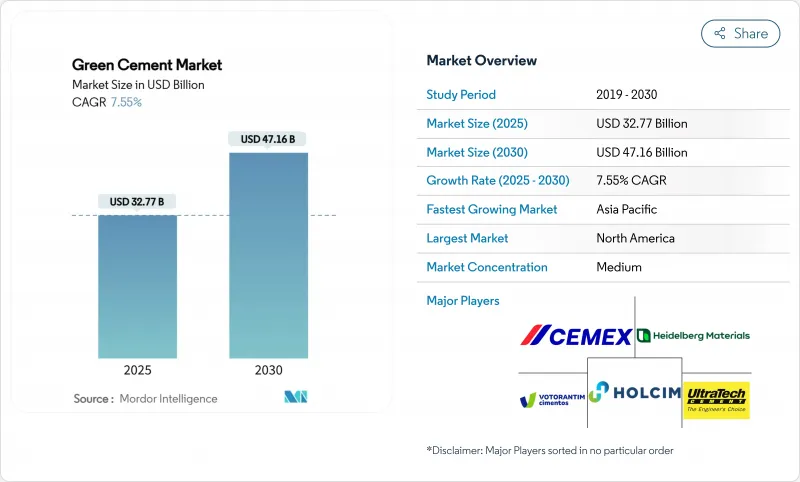

Green Cement - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Green Cement Market size is estimated at USD 32.77 billion in 2025, and is expected to reach USD 47.16 billion by 2030, at a CAGR of 7.55% during the forecast period (2025-2030).

Regulatory mandates, rising carbon prices, and procurement rules that favor low-carbon materials move the green cement market from niche status to mainstream selection in public and private projects. Fly-ash-based formulations command the largest revenue share, while infrastructure spending and ESG-linked financing accelerate uptake across non-residential works. Asia-Pacific provides the fastest growth, whereas North America retains volume leadership because of early policy adoption and mature supply chains. Competitive intensity stays moderate as incumbent cement majors scale green portfolios and specialized producers leverage secured feedstock contracts.

Global Green Cement Market Trends and Insights

Global Decarbonization Mandates & ESG-Centric Building Codes

Mandatory low-carbon procurement policies drive immediate demand shifts from ordinary Portland cement to verified green formulations. California targets a 40% emissions cut for its cement sector by 2035 and net-zero by 2045, anchoring similar actions in other U.S. states. The EU's revised Construction Products Regulation obliges digital passports and CO2 disclosure for concrete from 2024, pushing producers already equipped with life-cycle documentation to the front of tender lists. France, Denmark, Ireland, and New York State have each introduced progressive emissions ceilings or Buy Clean rules that make compliant materials the default choice rather than a premium option. As jurisdictions replicate pioneering statutes, the green cement market gains a policy-driven growth floor that traditional producers can meet only by retrofitting kilns or partnering with specialized suppliers.

Rising Carbon Pricing & Emissions-Trading Schemes

Carbon costs alter clinker economics by turning CO2 into a direct expense. The EU Emission Trading System gradually withholds free allowances, prompting cement manufacturers to accelerate low-carbon substitutions or risk margin compression. China's national trading platform now covers cement, expanding cost pressure to the world's largest producer. As more regions price carbon, supplementary cementitious materials gain relative competitiveness, and the green cement market benefits from a structural cost advantage over legacy products.

Performance Scepticism Among Builders & Contractors

Some contractors resist specification changes, citing extended curing, cold-weather set delays, and inconsistent regional availability of supplementary materials. Standards bodies work to replace prescriptive mix limits with performance-based guidelines, yet knowledge gaps persist, especially in small and mid-size firms. Demonstration projects and targeted training remain essential for mainstream adoption.

Other drivers and restraints analyzed in the detailed report include:

- APAC Urbanization Surge Requiring Low-Carbon Materials

- Abundant SCM Feedstocks Lowering Costs

- Fragmented Standards in Emerging Markets

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Fly-ash-based formulations kept a 44.22% green cement market share in 2024, underscoring their status as the default low-carbon substitute where coal-combustion residues remain abundant. Producers leverage mature logistics and well-documented performance to serve large infrastructure contracts and government tenders. However, declining coal generation narrows future feedstock pools, prompting companies to harvest legacy ash ponds or shift toward limestone-calcined clay blends. LC3 technology, able to trim emissions by up to 40%, gains visibility as laboratories validate mechanical parity with ordinary Portland cement. Silica-fume-based variants occupy high-specification niches, delivering impermeable concrete suited to marine and chemical containment structures. Slag-based alternatives struggle with impending supply shifts but retain relevance near integrated steelworks. Novel binder chemistries, including geopolymer concretes, progress through pilot projects that could diversify the green cement market if scale economics improve.

Growing diversification reduces over-reliance on any single supplementary stream and insulates producers from raw-material shocks. With harvested ash constituting 10% of recycled U.S. fly ash, supply security improves, yet processing costs rise. Strategic agreements between cement makers and utility coal-ash reclamation entities therefore feature prominently in recent deal flow. Slag-grinding partnerships and clay-calcination joint ventures become equally critical as companies balance technical feasibility, emissions objectives, and raw-material economics.

The Green Cement Market Report is Segmented by Product Type (Fly-Ash-Based, Slag-Based, Limestone-Based, Silica-Fume-Based, Other Product Types), Construction Sector (Residential, Non-Residential), and Geography (Asia-Pacific, North America, Europe, South America, Middle East and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America retained 37.88% of 2024 revenues, anchored by federal and state Buy Clean rules, early carbon-capture pilots, and high contractor familiarity with blended cements. Heidelberg Materials' Mitchell CCS project alone targets geological storage for more than 50 million t of CO2 over 30 years, signaling infrastructure that can underpin long-run volume commitments. Supply availability differs by region: Midwest states leverage proximity to coal-ash basins, while coastal areas import slag or calcined clay to meet specifications.

Asia-Pacific registers the fastest 8.22% CAGR to 2030, fueled by India's multi-year infrastructure pipeline and progressively stricter codes across Southeast Asia. China's consolidation efforts prompt large groups to upgrade plants with low-carbon lines to retain permits amid property-sector headwinds. Two-thirds of global high-speed rail networks reside in the region, requiring concrete that satisfies tightening emissions caps and boon the green cement market as projects replenish track and station stock.

Europe blends robust climate policy with mature industrial capabilities. Ireland's 2024 mandate for low-carbon cement in all state projects and Denmark's 2025 emissions ceiling of 7.1 kg CO2e/m2/year set influential benchmarks. Carbon pricing ensures that the green cement market size expands despite construction-volume volatility, as CO2 costs tilt bid evaluations toward low-clinker mixes. The Middle East and Africa witness emerging demand, especially in Gulf economies planning hydrogen hubs and large-scale public works, yet fragmented standards and limited on-site expertise slow penetration until harmonized guidelines mature.

- Adani Group

- Buzzi S.p.A.

- CarbonCure Technologies Inc.

- Cemex S.A.B DE C.V.

- Cenin

- China National Building Material Group Corporation

- Ecocem

- Heidelberg Materials

- Hoffmann Green Cement Technologies

- Holcim

- JSW Cement

- Kiran Global Chem Limited.

- TAIHEIYO CEMENT CORPORATION

- UltraTech Cement Ltd.

- Votorantim Cimentos

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Global decarbonisation mandates and ESG-centric building codes

- 4.2.2 Rising carbon pricing and emissions-trading schemes

- 4.2.3 APAC urbanisation surge requiring low-carbon materials

- 4.2.4 Abundant SCM feedstocks (fly-ash, slag) lowering costs

- 4.2.5 Commercialisation of hydrogen-fuelled kilns

- 4.3 Market Restraints

- 4.3.1 Performance scepticism among builders and contractors

- 4.3.2 Fragmented standards in emerging markets

- 4.3.3 Shrinking slag supply as steel shifts to EAF/DRI

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Competitive Rivalry

5 Market Size and Growth Forecasts (Value)

- 5.1 By Product Type

- 5.1.1 Fly-Ash-Based

- 5.1.2 Slag-Based

- 5.1.3 Limestone-Based

- 5.1.4 Silica-Fume-Based

- 5.1.5 Other Product Types

- 5.2 By Construction Sector

- 5.2.1 Residential

- 5.2.2 Non-Residential

- 5.3 By Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle East and Africa

- 5.3.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Adani Group

- 6.4.2 Buzzi S.p.A.

- 6.4.3 CarbonCure Technologies Inc.

- 6.4.4 Cemex S.A.B DE C.V.

- 6.4.5 Cenin

- 6.4.6 China National Building Material Group Corporation

- 6.4.7 Ecocem

- 6.4.8 Heidelberg Materials

- 6.4.9 Hoffmann Green Cement Technologies

- 6.4.10 Holcim

- 6.4.11 JSW Cement

- 6.4.12 Kiran Global Chem Limited.

- 6.4.13 TAIHEIYO CEMENT CORPORATION

- 6.4.14 UltraTech Cement Ltd.

- 6.4.15 Votorantim Cimentos

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment