PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851407

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851407

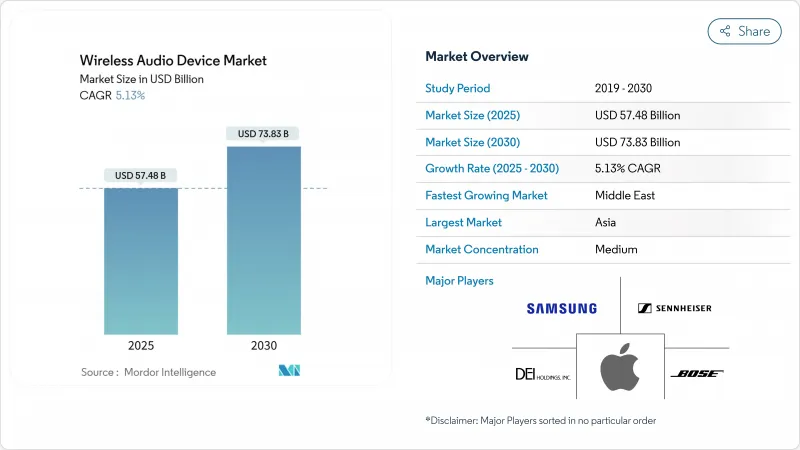

Wireless Audio Device - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The wireless audio device market size is estimated reached USD 57.48 billion in 2025 and is forecast to climb to USD 73.83 billion by 2030, advancing at a 5.13% CAGR.

Rapid gains stem from rising demand for true wireless stereo (TWS) earbuds, premium in-vehicle infotainment upgrades, and sustained smart-speaker adoption. Vendors are reallocating R&D budgets toward artificial-intelligence (AI) features, energy-efficient connectivity, and seamless cross-device ecosystems to defend margins as basic wireless functionality becomes commoditized. Bluetooth Classic remains dominant, yet the expanding installed base of Bluetooth LE Audio-enabled smartphones is accelerating migration to multi-stream, low-power architectures. Vertically integrated brands that control silicon, software, and services are consolidating share, often through targeted acquisitions that deepen platform capabilities and widen product portfolios.

Global Wireless Audio Device Market Trends and Insights

Proliferation of TWS Ear-buds Through Smartphone Bundling

Chinese and Indian handset brands increasingly ship entry-level TWS units inside the box, catalyzing mass adoption beyond early urban adopters. The practice sacrifices near-term margins but enlarges the future upgrade pool for higher-priced models, embedding brand loyalty from a user's first audio experience. Local chipset suppliers now deliver entry-level voice-recognition silicon that meets sub-USD 50 bill-of-materials targets, reinforcing the volume flywheel.

Smart-Speaker Surge in Voice-Assistant Households

North-American homes now average 3.2 connected audio devices, transforming single speaker purchases into multi-room ecosystems anchored by cloud-based assistants. The expanding device footprint fuels ancillary revenue from music subscriptions and home-automation services, raising consumer switching costs. Brands with robust back-end AI platforms command clear advantage over hardware-only rivals, reinforcing ecosystem stickiness.

2.4 GHz Congestion Undermining Multi-Room Audio

Apartments in Shanghai, Seoul, and Mumbai host a dozen connected devices competing on crowded 2.4 GHz channels. Packet collisions raise latency beyond the 40 ms threshold that disrupts synchronized playback, prompting vendors to embed proprietary mesh networking or mandate 5 GHz set-ups-both of which add bill-of-materials cost and reduce plug-and-play simplicity.

Other drivers and restraints analyzed in the detailed report include:

- Automotive OEM Adoption of Bluetooth LE Audio

- BYOD-led demand for wireless conferencing headsets

- EU WEEE/RoHS III Compliance Burden

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Bluetooth Classic retained an 87.3% wireless audio device market share in 2024, supported by near-universal backward compatibility. Nonetheless, Bluetooth LE Audio is expanding at a 9.3% CAGR as Android and iOS platforms unlock Auracast broadcast and multi-stream capabilities. The wireless audio device market size tied to LE Audio-enabled products is projected to surpass USD 14 billion by 2030. Early adopters include hearing-aid firms and premium sound-bar brands seeking low-latency multi-listener streaming.

Premium Wi-Fi 6/6E speakers target audiophiles who value lossless playback; however, escalating 6 GHz congestion in metro areas tempers mainstream appeal. Ultra-wideband remains niche for automotive positional soundscapes. As interoperability matures, chipset vendors are bundling dual-mode Classic and LE Audio support, smoothing transition risk for OEMs.

TWS units accounted for 48.2% of 2024 revenue, buoyed by bundling and rapid design cycles that deliver yearly battery-life gains. Yet the wearable-audio category-smart glasses, hearables, and audio rings-posts the fastest 7.1% CAGR as users seek contextual cues, health metrics, and augmented-reality overlays. In value terms, the wireless audio device market size for wearables could exceed USD 9 billion by 2030.

Over-ear headphones stabilise as a premium refuge aided by adaptive ANC and personalised DSP. Smart speakers evolve into household hubs that orchestrate lighting, security, and HVAC, lifting average selling prices. Portable speakers hold steady within outdoor leisure niches, while soundbars profit from streaming-driven home-cinema upgrades.

The Wireless Audio Device Market Report is Segmented by Technology (Bluetooth Classic, Bluetooth LE Audio, and More), Product (True Wireless Stereo Earbuds, Wireless Headphones, and More), Application (Consumer, Commercial, and More), Price Range (Premium (More Than USD 250), Mid-Range (USD 100-249), and More), Distribution Channel (Online, Offline), Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia accounted for 43.1% of 2024 revenue. China leverages vast scale in both manufacturing and consumption, while India's ongoing smartphone wave broadens rural penetration. Japan's circular-economy trade-ins shorten refresh cycles, and South Korea's 5G backbone unlocks Wi-Fi 6E lossless streaming pilots.

North America's installed base of smart speakers underpins multi-room audio adoption. Enterprise BYOD policies augment headset demand, with stipends converting cost centers into recurring premium sales. Canada mirrors US trajectories, whereas Mexico supplies volume growth at mid-range price points.

Europe positions audio quality as a luxury differentiator, especially in automotive. Early integration of Bluetooth LE Audio aligns with accessibility directives and pushes export opportunities. The Middle East grows fastest as disposable income and entertainment venues rise. Latin American expansion is uneven; Brazil and Mexico capture most Pro-AV spend but face tariff and grey-market headwinds that squeeze high-end importers.

- Apple Inc.

- Samsung Electronics Co. Ltd (Harman International, incl. JBL, AKG)

- Sony Group Corporation

- Bose Corporation

- Sennheiser Electronic GmbH and Co. KG

- Shure Incorporated

- Vizio Inc.

- Koninklijke Philips N.V.

- LG Electronics Inc.

- GN Audio A/S (Jabra)

- HP Inc. (Poly)

- Skullcandy Inc.

- Xiaomi Corporation

- Amazon .com Inc. (Echo Devices)

- Bang and Olufsen A/S

- Anker Innovations Ltd (Soundcore)

- Logitech International S.A.

- Pioneer Corporation

- Sonos Inc.

- Edifier International Ltd

- Sound United LLC (Denon, Marantz, Polk Audio, Bowers and Wilkins, Definitive Technology)

- Yamaha Corporation

- DEI Holdings Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Proliferation of TWS earbuds through smartphone OEM bundling in China and India

- 4.2.2 Smart-speaker surge in North-American voice-assistant households

- 4.2.3 Automotive OEM adoption of Bluetooth LE Audio for premium infotainment in Europe

- 4.2.4 BYOD-led demand for wireless conferencing headsets in United States and W-Europe enterprises

- 4.2.5 5G-enabled lossless Wi-Fi 6E streaming services in South Korea and Nordics

- 4.2.6 Sustainability trade-in programs shortening audio?device replacement cycles in Japan and Germany

- 4.3 Market Restraints

- 4.3.1 2.4 GHz congestion causing latency in dense Asian multi-room Wi-Fi speaker setups

- 4.3.2 EU WEEE/RoHS III battery-disposal compliance costs for headphones

- 4.3.3 Counterfeit TWS inflow via LATAM e-commerce squeezing brand margins

- 4.3.4 MLCC supply volatility limiting ANC-headphone production scalability

- 4.4 Industry Ecosystem Analysis

- 4.5 Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUES)

- 5.1 By Technology

- 5.1.1 Bluetooth Classic

- 5.1.2 Bluetooth LE Audio

- 5.1.3 Wi-Fi 5 (802.11ac)

- 5.1.4 Wi-Fi 6/6E (802.11ax)

- 5.1.5 AirPlay

- 5.1.6 RF/ZigBee

- 5.1.7 Ultra-Wideband (UWB)

- 5.2 By Product

- 5.2.1 True Wireless Stereo (TWS) Earbuds

- 5.2.2 Wireless Headphones (Over-Ear/On-Ear)

- 5.2.3 Wireless Speakers

- 5.2.3.1 Smart Speakers

- 5.2.3.2 Portable Speakers

- 5.2.3.3 Sound Bars

- 5.2.4 Wireless Microphones

- 5.2.5 Wearable Audio (Smart Glasses, Hearables)

- 5.2.6 Others

- 5.3 By Application

- 5.3.1 Consumer

- 5.3.1.1 Home Entertainment

- 5.3.1.2 Gaming

- 5.3.1.3 Fitness and Sports

- 5.3.2 Commercial

- 5.3.2.1 Corporate and Education

- 5.3.2.2 Hospitality

- 5.3.2.3 Events and Venues

- 5.3.3 Automotive

- 5.3.3.1 Passenger Vehicles

- 5.3.3.2 Commercial Vehicles

- 5.3.4 Public Safety and Defence

- 5.3.5 Others

- 5.3.1 Consumer

- 5.4 By Price Range

- 5.4.1 Premium (More than USD 250)

- 5.4.2 Mid-range (USD 100-249)

- 5.4.3 Budget (Less than USD 100)

- 5.5 By Distribution Channel

- 5.5.1 Online

- 5.5.1.1 Direct Brand E-Stores

- 5.5.1.2 E-commerce Marketplaces

- 5.5.2 Offline

- 5.5.2.1 Consumer-Electronics Retail

- 5.5.2.2 Hypermarkets and Mass Merchandisers

- 5.5.2.3 Specialty Audio Stores

- 5.5.2.4 Automotive Aftermarket

- 5.5.1 Online

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 Europe

- 5.6.2.1 Germany

- 5.6.2.2 United Kingdom

- 5.6.2.3 France

- 5.6.2.4 Nordics

- 5.6.2.5 Rest of Europe

- 5.6.3 South America

- 5.6.3.1 Brazil

- 5.6.3.2 Rest of South America

- 5.6.4 Asia-Pacific

- 5.6.4.1 China

- 5.6.4.2 Japan

- 5.6.4.3 India

- 5.6.4.4 South-East Asia

- 5.6.4.5 Rest of Asia-Pacific

- 5.6.5 Middle East and Africa

- 5.6.5.1 Middle East

- 5.6.5.1.1 Gulf Cooperation Council Countries

- 5.6.5.1.2 Turkey

- 5.6.5.1.3 Rest of Middle East

- 5.6.5.2 Africa

- 5.6.5.2.1 South Africa

- 5.6.5.2.2 Rest of Africa

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global?level Overview, Market?level Overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, Recent Developments)

- 6.4.1 Apple Inc.

- 6.4.2 Samsung Electronics Co. Ltd (Harman International, incl. JBL, AKG)

- 6.4.3 Sony Group Corporation

- 6.4.4 Bose Corporation

- 6.4.5 Sennheiser Electronic GmbH and Co. KG

- 6.4.6 Shure Incorporated

- 6.4.7 Vizio Inc.

- 6.4.8 Koninklijke Philips N.V.

- 6.4.9 LG Electronics Inc.

- 6.4.10 GN Audio A/S (Jabra)

- 6.4.11 HP Inc. (Poly)

- 6.4.12 Skullcandy Inc.

- 6.4.13 Xiaomi Corporation

- 6.4.14 Amazon .com Inc. (Echo Devices)

- 6.4.15 Bang and Olufsen A/S

- 6.4.16 Anker Innovations Ltd (Soundcore)

- 6.4.17 Logitech International S.A.

- 6.4.18 Pioneer Corporation

- 6.4.19 Sonos Inc.

- 6.4.20 Edifier International Ltd

- 6.4.21 Sound United LLC (Denon, Marantz, Polk Audio, Bowers and Wilkins, Definitive Technology)

- 6.4.22 Yamaha Corporation

- 6.4.23 DEI Holdings Inc.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment