PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851409

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851409

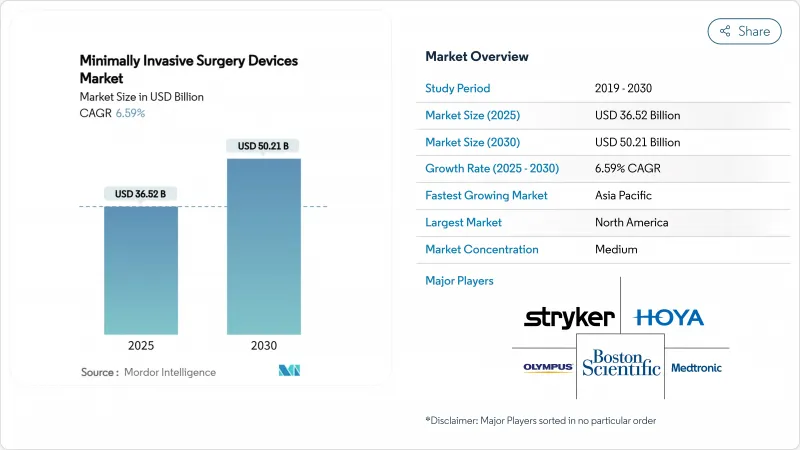

Minimally Invasive Surgery Devices - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Minimally Invasive Surgery Devices Market size is estimated at USD 36.52 billion in 2025, and is expected to reach USD 50.21 billion by 2030, at a CAGR of 6.59% during the forecast period (2025-2030).

Robust demand reflects the continuing shift away from traditional open surgery toward precision-guided treatments that shorten recovery times and lower complication rates. Accelerating adoption of robotic platforms, stronger reimbursement support for outpatient interventions, and rapid technology convergence around artificial intelligence are pivotal forces shaping this growth. Handheld instruments continue to serve as the procedural workhorse, yet robotic systems are scaling quickly as hospitals seek workflow efficiencies and differentiation. Emerging single-port systems, AI-assisted visualization suites, and pulsed-field ablation devices illustrate how continual innovation is widening clinical possibilities while expanding addressable patient pools. As payors reward surgical settings that reduce inpatient days, ambulatory centers gain momentum, further enlarging the minimally invasive surgery devices market.

Global Minimally Invasive Surgery Devices Market Trends and Insights

Higher Acceptance of MIS Over Open Surgery

Growing patient advocacy for less traumatic care, hospital mandates that prioritize MIS-first protocols, and payor incentives are accelerating adoption. Boston Scientific's FARAPULSE pulsed-field ablation system surpassed USD 1 billion in revenue within 12 months of launch, underscoring appetite for technologies that reduce procedural complexity while preserving outcomes. The shift is most pronounced in cardiac rhythm management, where pulsed-field energy offers selective tissue targeting and lower complication rates than thermal modalities. Institutions are seeing bed-utilization efficiencies and readmission reductions that further solidify MIS preference. Insurers now routinely provide favorable coverage terms for minimally invasive interventions, aligning economic and clinical rationales. As training curricula reposition MIS competencies as core skills, the minimally invasive surgery devices market gains a durable foundation for long-term growth.

Rising Prevalence of Chronic & Lifestyle Diseases

Global incidence of diabetes, cardiovascular disorders, and obesity is elevating surgical volumes suitable for less invasive solutions. Abbott's FDA-approved Tendyne transcatheter mitral valve replacement treats patients unfit for open surgery, opening a sizeable niche in structural heart interventions. Atrial fibrillation affects 33.5 million people worldwide, creating sustained demand for catheter-based ablation systems that offer definitive therapy without sternotomy. Single-port bariatric techniques are expanding eligibility for weight-loss surgery by lowering postoperative pain and improving recovery times. As healthcare systems pivot from reactive to preventive care, minimally invasive devices are positioned as cost-effective tools that curb chronic disease burdens. The resulting procedural growth underpins incremental gains in the minimally invasive surgery devices market.

Shortage of Skilled MIS Surgeons

Advanced robotic and single-port techniques require 50-100 supervised cases for proficiency, a hurdle that slows adoption even where hardware is available. Emerging markets experience pronounced shortages as surgeon migration toward higher-income regions erodes local capacity. Simulation programs, remote mentoring, and augmented reality guidance mitigate but do not eliminate skills gaps. Policy initiatives that fund fellowship programs are expanding, yet the time lag to produce fully trained specialists remains a structural brake on the minimally invasive surgery devices market.

Other drivers and restraints analyzed in the detailed report include:

- Rapid Adoption of Robotic-Assisted Platforms

- AI-Guided Visualization Improving Surgical Accuracy

- Capital-Intensive Robotic Systems

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Handheld instruments continued to command the largest portion of the minimally invasive surgery devices market size, generating 38.12% of revenue in 2024. Their ubiquity across laparoscopy, endoscopy, and catheter-based procedures ensures resilience even as new modalities arise. Conversely, robotic-assisted systems, though smaller in absolute value, are forecast to post a 9.47% CAGR, the swiftest in the category, as hospitals leverage their precision and ergonomic benefits to tackle complex surgeries. Guiding devices such as catheters and guidewires remain indispensable, providing steady incremental growth. Electrosurgical platforms are migrating to advanced energy sources that seal vessels more reliably, and ablation devices are shifting toward pulsed-field technologies that minimize collateral tissue damage.

Market entrants are funneling investment into single-port robotics, positioning these systems to erode dependence on multi-port configurations favored by handheld tools. AI-linked 4K and 8K visualization upgrades rejuvenate legacy laparoscopes, extending their lifespan while elevating diagnostic accuracy. Ablative lasers are finding traction in precise tissue removal for ENT and gynecologic procedures, expanding the addressable space of the minimally invasive surgery devices market. As technology cycles quicken, the product mix will continue to tilt toward software-enhanced hardware, yet core mechanical instruments will preserve relevance through affordability and familiarity.

The Minimally Invasive Surgery Devices Market Report is Segmented by Product Type (Handheld Instruments, Guiding Devices, Electrosurgical Devices, Endoscopic Devices, and More), Application (Aesthetic, Cardiovascular, Gastrointestinal, and More), End User (Hospitals, and More), and Geography (North America, Europe, Asia Pacific, Middle East & Africa, South America). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America maintained 42.41% of global revenue in 2024, underpinned by robust reimbursement, advanced training pipelines, and rapid regulatory pathways that shorten time-to-market for breakthrough devices. Consolidating health systems negotiate enterprise-wide procurement contracts, granting leading suppliers scalable access across multistate hospital networks. The aging demographic and high chronic-disease prevalence underpin steady procedural expansion, while academic centers pioneer novel techniques that diffuse into community settings.

Asia Pacific represents the fastest-growing territory, advancing at a 10.15% CAGR through 2030, fueled by capacity additions, rising middle-class incomes, and government promotion of medical tourism. China fosters domestic innovation while partnering with global device firms to spur technology transfer. India's cost-sensitive market turns to value-engineered platforms, often refurbishing Western systems to meet price points. Japan deploys premium robotic solutions to address surgeon shortages and accommodate an aging populace. Korea leverages state-of-the-art hospitals to attract international patients seeking aesthetic and spinal procedures.

Europe's stringent MDR framework fosters high product quality but lengthens approval cycles, requiring robust clinical dossiers. Germany remains a manufacturing stronghold, and the United Kingdom's NHS provides large-scale data sets that facilitate evidence generation. Middle East and Africa, though nascent, are investing in flagship tertiary centers, particularly in GCC nations that seek to reduce outbound medical travel. Latin America shows uneven adoption; Brazil's public-private mix sustains progress despite macroeconomic volatility. Collectively, regional heterogeneity compels suppliers to adopt nuanced entry strategies that safeguard compliance while scaling the minimally invasive surgery devices market.

- Abbott Laboratories

- Boston Scientific

- Intuitive Surgical

- Medtronic

- Johnson & Johnson

- Stryker

- Olympus

- Koninklijke Philips

- Zimmer Biomet

- HOYA

- Conmed

- Renishaw plc

- Smiths Group

- B. Braun

- Karl Storz

- Arthrex

- Teleflex

- Cook Group

- Becton Dickinson & Co.

- GE Healthcare Technologies Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Higher Acceptance of MIS Over Open Surgery

- 4.2.2 Rising Prevalence of Chronic & Lifestyle Diseases

- 4.2.3 Rapid Adoption of Robotic-Assisted Platforms

- 4.2.4 Reimbursement Tweaks Favouring Outpatient MIS

- 4.2.5 AI-Guided Visualization Improving Surgical Accuracy

- 4.2.6 Demand for Single-Port & Natural-Orifice Mis

- 4.3 Market Restraints

- 4.3.1 Shortage of Skilled MIS Surgeons

- 4.3.2 Capital-Intensive Robotic Systems

- 4.3.3 Supply-Chain Fragility for Key Disposables

- 4.3.4 Cyber-Security Risks in Connected OR Suites

- 4.4 Technological Outlook

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitutes

- 4.5.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value in USD)

- 5.1 By Product Type

- 5.1.1 Handheld Instruments

- 5.1.2 Guiding Devices

- 5.1.2.1 Guiding Catheters

- 5.1.2.2 Guidewires

- 5.1.3 Electrosurgical Devices

- 5.1.4 Endoscopic Devices

- 5.1.5 Laparoscopic Devices

- 5.1.6 Monitoring & Visualization Devices

- 5.1.7 Ablation Devices

- 5.1.8 Laser-based Devices

- 5.1.9 Robotic-assisted Surgical Systems

- 5.1.10 Other MIS Devices

- 5.2 By Application

- 5.2.1 Aesthetic

- 5.2.2 Cardiovascular

- 5.2.3 Gastrointestinal

- 5.2.4 Gynecological

- 5.2.5 Orthopedic

- 5.2.6 Urological

- 5.2.7 Neurological

- 5.2.8 Other Applications

- 5.3 By End User

- 5.3.1 Hospitals

- 5.3.2 Ambulatory Surgical Centers

- 5.3.3 Specialty Clinics

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 Australia

- 5.4.3.5 South Korea

- 5.4.3.6 Rest of Asia-Pacific

- 5.4.4 Middle East & Africa

- 5.4.4.1 GCC

- 5.4.4.2 South Africa

- 5.4.4.3 Rest of Middle East & Africa

- 5.4.5 South America

- 5.4.5.1 Brazil

- 5.4.5.2 Argentina

- 5.4.5.3 Rest of South America

- 5.4.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 Abbott Laboratories

- 6.3.2 Boston Scientific Corporation

- 6.3.3 Intuitive Surgical Inc.

- 6.3.4 Medtronic

- 6.3.5 Johnson & Johnson (Ethicon)

- 6.3.6 Stryker Corporation

- 6.3.7 Olympus Corporation

- 6.3.8 Koninklijke Philips N.V.

- 6.3.9 Zimmer Biomet Holdings Inc.

- 6.3.10 HOYA Corporation

- 6.3.11 CONMED Corporation

- 6.3.12 Renishaw plc

- 6.3.13 Smith & Nephew plc

- 6.3.14 B. Braun Melsungen AG

- 6.3.15 Karl Storz SE & Co. KG

- 6.3.16 Arthrex Inc.

- 6.3.17 Teleflex Incorporated

- 6.3.18 Cook Medical LLC

- 6.3.19 Becton Dickinson & Co.

- 6.3.20 GE Healthcare Technologies Inc.

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment