PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851416

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851416

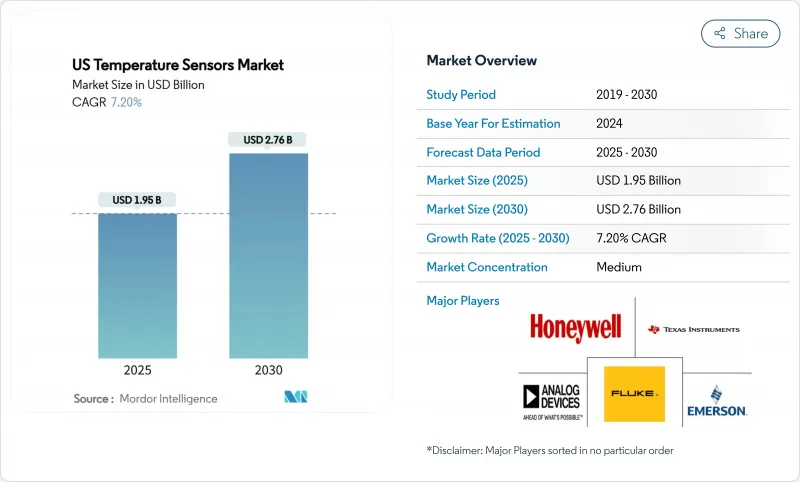

US Temperature Sensors - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The US Temperature Sensors Market size is estimated at USD 1.95 billion in 2025, and is expected to reach USD 2.76 billion by 2030, at a CAGR of 7.20% during the forecast period (2025-2030).

Sub-degree accuracy demands, federal incentives that strengthen on-shore semiconductor production, and the diffusion of real-time monitoring across electric-vehicle (EV) value chains and data-center cooling systems keep the growth engine running. Liquidity in private semiconductor investments already past USD 400 billion has unlocked new fabs that rely on in-process thermal diagnostics, while autonomous factories and predictive maintenance programs drive continuous sensor retrofits. Distributed fiber-optic solutions, advanced infrared arrays, and AI-enabled edge devices are widening the competitive moat for suppliers able to pair measurement precision with integrated analytics. At the same time, tighter safety regulations in healthcare, energy storage, and petrochemical sites ensure that replacement cycles remain brisk even in legacy wired installations.

US Temperature Sensors Market Trends and Insights

Expansion of Industry 4.0 and smart-factory adoption

Industrial digitalization reshapes factory floors by fusing AI, robotics, and connected instrumentation, and temperature sensing sits at the heart of that convergence. Predictive maintenance programs that once sampled a few key assets now blanket entire production lines with hundreds of nodes that flag thermal deviations hours before mechanical breakdowns. Edge AI chipsets embedded in new sensors from Texas Instruments crunch local data streams so millisecond-level alerts can trigger automated responses without cloud latency. Interoperable protocols such as FOUNDATION Fieldbus and PROFINET simplify system integration, while ruggedized housings and extended temperature ranges ensure reliable service in dusty, high-vibration zones. As a result, the US temperature sensors market keeps enjoying replacement sales into heritage PLC networks and fresh demand from green-field smart factories.

Growing demand for temperature sensing in wearable consumer electronics

Miniaturized, low-power die have brought clinical-grade temperature accuracy into everyday devices, letting consumers track core body temperature within +-0.1 °C for early illness detection. Stretchable substrates now conform to skin for days without irritation, and dual-sensor ear-canal designs deliver continuous readings that fit into telehealth workflows. Fifth-generation cellular links and edge computing chips send encrypted streams to healthcare dashboards so clinicians can intervene remotely, a capability valued by aging-in-place programs. For sensor makers, these design wins offer high-volume consumer channels plus technology leverage across industrial IoT where power budgets are equally tight. The resulting pull keeps the US temperature sensors market on a steep innovation curve.

Volatility in semiconductor and platinum-group metal prices

Price swings in gallium, germanium, and platinum upset cost structures for RTDs and high-precision chip-based probes. China's command of gallium and germanium refining keeps US buyers vulnerable to export restrictions, while platinum thin films face supply tightness amid intensified fuel-cell and catalytic-converter demand. Budget uncertainty can delay upgrade projects, trimming near-term volumes inside the US temperature sensors market.

Other drivers and restraints analyzed in the detailed report include:

- Rising automotive electronics and EV thermal-management requirements

- Adoption of cold-chain IoT sensors for mRNA-vaccine logistics

- Cyber-security concerns over wireless sensors in critical infrastructure

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Wired devices retained 69.20% of 2024 revenue thanks to hard-wired reliability in safety-critical loops and existing DCS cabling, yet wireless nodes are scaling 10.90% CAGR on retrofit ease and lower installation costs. The US temperature sensors market size for wireless products is forecast to reach USD 0.86 billion by 2030, reflecting robust adoption in data centers and food plants. Self-powered harvesters developed at MIT remove battery maintenance barriers and widen use cases in pumps, kilns, and rotating equipment. In sprawling factories, LoRaWAN and 5G NB-IoT enable kilometer-scale reach with milliwatt power budgets, giving plant managers granular heat maps without trenching cable.

Reliability fears that once shadowed wireless have faded as frequency-hopping and AES-128 encryption become standard. Edge microcontrollers now pre-process readings to slash packet payloads, reducing congestion on factory backbones. Meanwhile, wired incumbency endures in nuclear, pharma, and aerospace lines where governance protocols require fixed cabling and analog outputs. Suppliers that bundle mixed-mode gateways bridging 4-20 mA loops with Wi-Fi or Sub-GHz radios capitalize on hybrid roll-outs and expand their stake in the US temperature sensors market.

Thermocouples brought in 32.30% of 2024 turnover by covering extreme heat up to 2,300 °C, but distributed fiber-optic systems are rocketing at 11.90% CAGR as industries crave spatial resolution over point checks. The US temperature sensors market size for DTS is projected to exceed USD 470 million by 2030. Immune to EMI, fiber lines navigate high-voltage bays and induction furnaces where electronics fail. High-definition units from Luna Innovations achieve sub-millimeter granularity, mapping battery modules and cryogenic pipelines alike.

Resistance Temperature Detectors still dominate pharma cleanrooms and metrology labs that stipulate +-0.1 °C accuracy. Thermistors capture cost-sensitive appliances, while infrared arrays unlock thermal imaging for predictive maintenance. Hybrid transmitters delivering HART, Modbus, or Ethernet protocols simplify integration into digital twins. Vendors that supply full stacks sensing element, head-mount transmitter, and analytics firmware bolster recurring revenue and deepen their position inside the US temperature sensors market.

US Temperature Sensors Market Report is Segmented by Type (Wired, Wireless), Technology (Infrared, Thermocouple, RTD, Thermistor and More), End-User Industry (Chemical and Petrochemical, Oil and Gas, Metal and Mining and More), Connectivity (Contact, Non-Contact), Application Environment (Industrial Process Monitoring, HVAC and Building Automation and More). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Texas Instruments Inc.

- Honeywell International Inc.

- TE Connectivity Ltd

- Analog Devices Inc.

- Siemens AG

- Panasonic Corp.

- ABB Ltd

- Emerson Electric Co.

- STMicroelectronics

- Microchip Technology Inc.

- NXP Semiconductors NV

- Robert Bosch GmbH

- DENSO Corp.

- FLIR Systems (Teledyne)

- Omron Corp.

- Maxim Integrated (ADI)

- Fluke Process Instruments

- Sensirion AG

- Amphenol Advanced Sensors

- Silixa Ltd

- AP Sensing GmbH

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Expansion of Industry 4.0 and smart-factory adoption

- 4.2.2 Growing demand for temperature sensing in wearable consumer electronics

- 4.2.3 Rising automotive electronics and EV thermal-management requirements

- 4.2.4 Adoption of cold-chain IoT sensors for mRNA-vaccine logistics

- 4.2.5 Rapid growth of data-center liquid-cooling needs distributed sensing

- 4.2.6 Federal on-shoring incentives boosting in-fab thermal-process sensors

- 4.3 Market Restraints

- 4.3.1 Volatility in semiconductor and platinum-group metal prices

- 4.3.2 Lengthy design-in cycles slow sensor replacement in regulated sectors

- 4.3.3 Cyber-security concerns over wireless sensors in critical infrastructure

- 4.3.4 Shortage of fiber-optic installers curbs distributed sensing roll-out

- 4.4 Regulatory Landscape

- 4.5 Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitutes

- 4.6.5 Competitive Rivalry Intensity

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Type

- 5.1.1 Wired

- 5.1.2 Wireless

- 5.2 By Technology

- 5.2.1 Infrared

- 5.2.2 Thermocouple

- 5.2.3 Resistance Temperature Detector (RTD)

- 5.2.4 Thermistor

- 5.2.5 Temperature Transmitter

- 5.2.6 Fiber Optic

- 5.2.7 Others

- 5.3 By End-user Industry

- 5.3.1 Chemical and Petrochemical

- 5.3.2 Oil and Gas

- 5.3.3 Metal and Mining

- 5.3.4 Power Generation

- 5.3.5 Food and Beverage

- 5.3.6 Automotive

- 5.3.7 Medical

- 5.3.8 Aerospace and Military

- 5.3.9 Consumer Electronics

- 5.3.10 Other End-user Industries

- 5.4 By Connectivity

- 5.4.1 Contact

- 5.4.2 Non-Contact

- 5.5 By Application Environment

- 5.5.1 Industrial Process Monitoring

- 5.5.2 HVAC and Building Automation

- 5.5.3 Healthcare and Wearables

- 5.5.4 Electric-Vehicle Battery Management

- 5.5.5 Data Centers and Telecom

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Texas Instruments Inc.

- 6.4.2 Honeywell International Inc.

- 6.4.3 TE Connectivity Ltd

- 6.4.4 Analog Devices Inc.

- 6.4.5 Siemens AG

- 6.4.6 Panasonic Corp.

- 6.4.7 ABB Ltd

- 6.4.8 Emerson Electric Co.

- 6.4.9 STMicroelectronics

- 6.4.10 Microchip Technology Inc.

- 6.4.11 NXP Semiconductors NV

- 6.4.12 Robert Bosch GmbH

- 6.4.13 DENSO Corp.

- 6.4.14 FLIR Systems (Teledyne)

- 6.4.15 Omron Corp.

- 6.4.16 Maxim Integrated (ADI)

- 6.4.17 Fluke Process Instruments

- 6.4.18 Sensirion AG

- 6.4.19 Amphenol Advanced Sensors

- 6.4.20 Silixa Ltd

- 6.4.21 AP Sensing GmbH

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment