PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1907224

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1907224

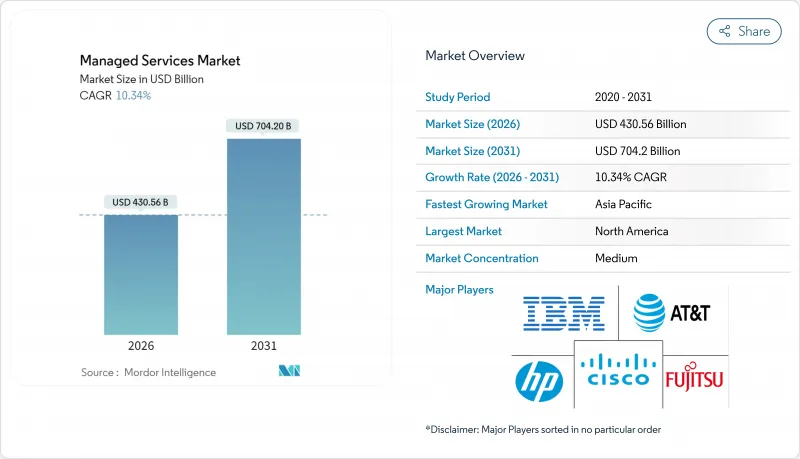

Managed Services - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

Managed services market size in 2026 is estimated at USD 430.56 billion, growing from 2025 value of USD 390.21 billion with 2031 projections showing USD 704.2 billion, growing at 10.34% CAGR over 2026-2031.

The strong growth reflects enterprises' pivot toward outsourced IT operations as they juggle hybrid-cloud complexity, rising cyber threats, and ongoing budget scrutiny. Cloud-centric delivery models, wider AI adoption, and regulatory pressures are reshaping provider offerings, while competitive differentiation now hinges on intelligent automation and vertical expertise. Strategic outsourcing has shifted from pure cost reduction to a core pillar of digital transformation, accelerating provider investments in security operations centers, multi-cloud orchestration tools, and edge management platforms. M&A activity underscores the appeal of scale, with providers pursuing inorganic growth to fill technology gaps and expand geographic reach.

Global Managed Services Market Trends and Insights

Hybrid-cloud complexity drives managed services adoption

Hybrid-cloud architectures combine on-premises, private, and multiple public clouds, elevating operational complexity that internal teams struggle to master. Regulatory initiatives such as the Microsoft EU Data Boundary require localized data handling, pushing enterprises toward providers that can guarantee compliance, portability, and unified security policies.Seamless workload portability and real-time policy enforcement across distributed environments cement long-term demand for managed infrastructure and security offerings.

Cost optimization pressures accelerate outsourcing decisions

Persistent margin pressure turns fixed IT overhead into a variable line item through managed services. Large transformation deals such as Accenture's USD 1.6 billion Cloud One contract with the U.S. Air Force illustrate how enterprises view outsourcing as strategic, not merely tactical. Providers bundle automation, AI tooling, and certified talent pools, allowing buyers to avoid up-front capital outlays while still accessing emerging capabilities.

Data-sovereignty regulations constrain service delivery models

Mandates requiring localized processing force providers to duplicate infrastructure in each jurisdiction, reducing economies of scale and complicating global delivery. Microsoft's EU Data Boundary illustrates the additional capital and operational overhead that providers must absorb to serve multi-region clients.

Other drivers and restraints analyzed in the detailed report include:

- Cybersecurity threat evolution demands specialized response capabilities

- Edge computing expansion creates remote management requirements

- Vendor lock-in concerns limit long-term commitments

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Cloud deployment held 52.35% share of the managed services market in 2025 and is widening its lead as hybrid cloud posts a 11.92% CAGR through 2031. The ability to spin up resources on demand, comply with data regulations, and integrate edge workloads explains why enterprises migrate from on-premises models. Hyperscaler alliances, like Accenture's engagement on Cloud One, show how co-innovation can unlock large multiyear deals.

The managed services market benefits as cloud deployment allows providers to pool infrastructure, automate patches, and roll out AI-driven cost-optimization at scale. Private cloud remains relevant for data-sensitive sectors, while on-premises services persist for legacy workloads that cannot be refactored easily. Providers that master multi-cloud orchestration and FinOps reporting are best positioned to capture new spend.

Managed infrastructure services owned 38.40% revenue in 2025, reflecting the baseline need to keep heterogeneous estates running. Yet managed security services lead growth with an 11.72% CAGR, mirroring board-level concern over ransomware and compliance fines. AI-enabled threat hunting, zero-trust rollouts, and automated incident containment set market winners apart.

The managed services market size for security offerings is expected to accelerate as cyber-insurance carriers tighten underwriting criteria. Providers are bundling SOC-as-a-service with compliance reporting and tabletop exercises, creating high-margin recurring revenue. Network and communication services gain from 5G roll-outs, while data-center energy management products ride sustainability mandates.

Managed Services Market is Segmented by Deployment (On-Premises, Cloud), Service Type (Managed Data Center, Managed Security, Managed Communications, and More), Enterprise Size (Small and Medium Enterprises, Large Enterprises), End-User Vertical (BFSI, IT and Telecommunication, Manufacturing, and More), and by Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America retained 32.40% revenue share in 2025, buoyed by early cloud migration, cyber regulations, and high IT spend. Federal programs such as the U.S. Air Force Cloud One create visibility for large managed services contracts. BFSI and healthcare customers continue to anchor demand, and providers use the region as a launchpad for AI and edge pilots.

Asia-Pacific is the fastest-growing region at 11.28% CAGR to 2031. China's manufacturing upgrades, India's digital-public-infrastructure push, and Japan's aging plant modernization funnel spend toward providers capable of bridging legacy and cloud workloads. Hyperscalers team with local MSPs to address sovereign-cloud requirements, while ASEAN governments adopt cloud-first mandates that shorten sales cycles.

Europe shows steady expansion as GDPR, Digital Operational Resilience Act, and sustainability rules heighten compliance complexity. Germany drives Industry 4.0 managed services, the United Kingdom leans on MSPs for post-Brexit financial regulation, and France emphasizes sovereign-cloud frameworks. Providers differentiate through localized data centers and green-energy sourcing to meet environmental targets. The Middle East and Africa remain nascent but grow quickly on smart-city and e-government projects.

- IBM Corporation

- Cisco Systems Inc.

- Fujitsu Ltd

- ATandT Inc.

- Hewlett Packard Enterprise (HPE)

- Microsoft Corporation

- Verizon Communications Inc.

- Dell Technologies Inc.

- Nokia Corporation

- Deutsche Telekom AG (T-Systems)

- Rackspace Technology Inc.

- Tata Consultancy Services Ltd

- Wipro Ltd

- Accenture plc

- Capgemini SE

- HCL Technologies Ltd

- Cognizant Technology Solutions

- NTT Data Corp.

- DXC Technology Co.

- Lumen Technologies Inc.

- Orange Business Services

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Shift to hybrid-cloud operating models

- 4.2.2 Cost-optimization pressure on enterprise IT budgets

- 4.2.3 Rising cyber-threat volume and compliance mandates

- 4.2.4 Edge-computing roll-outs demanding remote managed services

- 4.2.5 Cyber-insurance prerequisites for 24/7 managed detection and response

- 4.2.6 Sustainability and green-IT regulations driving managed power/cooling

- 4.3 Market Restraints

- 4.3.1 Persistent data-sovereignty and privacy regulations

- 4.3.2 Multi-vendor integration and legacy interoperability challenges

- 4.3.3 Vendor lock-in risk and high exit costs of long-term MSP contracts

- 4.3.4 Talent shortages within MSPs limiting service-quality scalability

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

- 4.8 Assesment of Macroeconomic Factors on the market

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Deployment

- 5.1.1 On-premise

- 5.1.2 Cloud

- 5.1.2.1 Public Cloud

- 5.1.2.2 Private Cloud

- 5.1.2.3 Hybrid Cloud

- 5.2 By Service Type

- 5.2.1 Managed Data Center

- 5.2.2 Managed Security

- 5.2.3 Managed Communications

- 5.2.4 Managed Network

- 5.2.5 Managed Infrastructure

- 5.2.6 Managed Mobility

- 5.2.7 Others

- 5.3 By Enterprise Size

- 5.3.1 Small and Medium Enterprises (SMEs)

- 5.3.2 Large Enterprises

- 5.4 By End-user Vertical

- 5.4.1 BFSI

- 5.4.2 IT and Telecommunication

- 5.4.3 Healthcare and Life Sciences

- 5.4.4 Manufacturing

- 5.4.5 Retail and E-commerce

- 5.4.6 Government and Public Sector

- 5.4.7 Energy and Utilities

- 5.4.8 Media and Entertainment

- 5.4.9 Others (Education, Non-Profit)

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 Japan

- 5.5.4.3 India

- 5.5.4.4 South Korea

- 5.5.4.5 Southeast Asia

- 5.5.4.6 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 Saudi Arabia

- 5.5.5.1.2 United Arab Emirates

- 5.5.5.1.3 Turkey

- 5.5.5.1.4 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Nigeria

- 5.5.5.2.3 Egypt

- 5.5.5.2.4 Rest of Africa

- 5.5.5.1 Middle East

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 IBM Corporation

- 6.4.2 Cisco Systems Inc.

- 6.4.3 Fujitsu Ltd

- 6.4.4 ATandT Inc.

- 6.4.5 Hewlett Packard Enterprise (HPE)

- 6.4.6 Microsoft Corporation

- 6.4.7 Verizon Communications Inc.

- 6.4.8 Dell Technologies Inc.

- 6.4.9 Nokia Corporation

- 6.4.10 Deutsche Telekom AG (T-Systems)

- 6.4.11 Rackspace Technology Inc.

- 6.4.12 Tata Consultancy Services Ltd

- 6.4.13 Wipro Ltd

- 6.4.14 Accenture plc

- 6.4.15 Capgemini SE

- 6.4.16 HCL Technologies Ltd

- 6.4.17 Cognizant Technology Solutions

- 6.4.18 NTT Data Corp.

- 6.4.19 DXC Technology Co.

- 6.4.20 Lumen Technologies Inc.

- 6.4.21 Orange Business Services

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment