PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851419

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851419

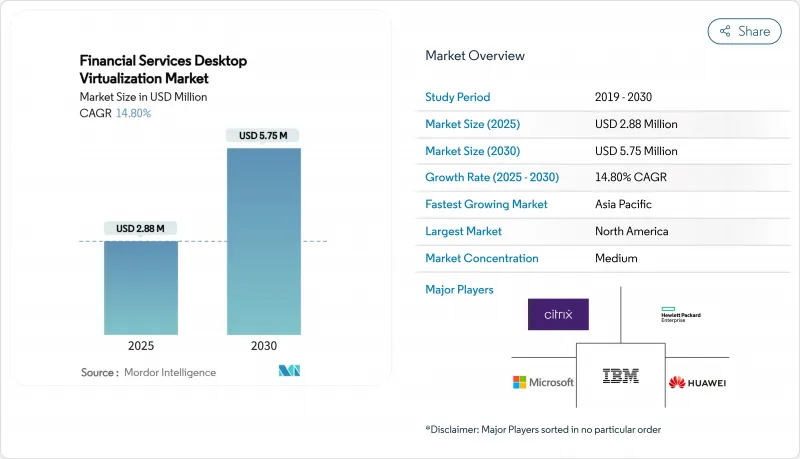

Financial Services Desktop Virtualization - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The financial services desktop virtualization market size stands at USD 2.88 million in 2025 and is projected to reach USD 5.75 million by 2030, posting a 14.8% CAGR over the forecast period.

Demand rises as banks, insurers, and FinTechs converge on secure virtual desktop environments that satisfy zero-trust mandates, GPU-accelerated risk analytics, and stringent data-residency rules. Tier-1 institutions are shifting from capital spending to consumption-based models, pushing vendors to embed compliance tooling and high-performance graphics in offerings. Asia-Pacific outpaces other regions on account of rapid financial-sector digitization and supportive cloud guidelines, while North America remains the largest adopter owing to mature trading and regulatory infrastructures [CMCGLOBAL.COM.VN]. Vendor competition centers on balancing ultra-low-latency trader desktops with operational efficiency gains from cloud orchestration.

Global Financial Services Desktop Virtualization Market Trends and Insights

Widespread Cloud-Migration Strategies Among Tier-1 Banks

Large banks refactor desktop estates around hybrid-cloud blueprints to improve resilience and cut ownership costs. Sensitive trading platforms stay on-premises, while back-office desktops shift to cloud subscription models, enabling dynamic provisioning for contractors, test teams, and disaster-recovery drills . Procurement therefore pivots from hardware refresh cycles to operating-expense contracts aligned with business outcomes. The shift accelerates standardization on cloud-native security controls and drives embedded audit-trail functionality across virtual sessions. Vendors capable of bridging legacy data centers with multi-cloud orchestration capture heightened demand as institutions roll out phased migrations over 24-36 months.

Accelerated Move to Zero-Trust Security Frameworks

Financial firms now insist that every virtual desktop connection authenticates continuously, integrating MFA, behavioral analytics, and session-based risk scoring. Traders log in with biometrics and location controls that inhibit data access when anomalies arise, while compliance teams audit keystroke-level histories in real time. These capabilities elevate VDI selection criteria beyond performance to encompass native zero-trust alignment. Consequently, specialist integrators with combined cybersecurity and virtualization expertise command premium consulting rates, and platform roadmaps increasingly embed API hooks for threat-intelligence feeds.

Legacy Mainframe Integration Complexity

Many banks still process high-value transactions on decades-old mainframes. Bridging these systems to modern VDI stacks demands custom middleware, doubled authentication paths, and latency work-arounds that add 6-12 months to roll-outs and raise budgets by double-digit percentages. Dependence on scarce COBOL specialists and proprietary tooling reduces vendor leverage and slows innovation, hampering time-to-value compared to digital-native peers.

Other drivers and restraints analyzed in the detailed report include:

- Hybrid-Work Mandates for Capital-Market Trading Floors

- Growing GPU-Enabled Risk-Analytics Workloads

- Skills Gap in Cloud-Native VDI Operations

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Hosted Virtual Desktop retained 47.1% revenue share in 2024, yet Desktop-as-a-Service posts a 17.8% CAGR that steadily erodes incumbent dominance. DaaS gains ground because fee-for-use pricing aligns with volatile head-count swings common in advisory, trading, and compliance units. Service providers bundle regulatory logging and GPU options, letting mid-tier banks access enterprise-grade stacks without capital expenditure spikes. Hosted Shared Desktop products occupy niche environments with standardized apps, while Remote Desktop Services deliver legacy Windows workloads in branches.

The financial services desktop virtualization market benefits as DaaS vendors pre-integrate zero-trust and disaster-recovery playbooks, shortening deployment from months to weeks. Multi-tenant control planes automate patching and vulnerability scans, easing audit pressures. In contrast, on-premises HVD estates still appeal to institutions whose policies prohibit off-site data but face refresh cycles that elevate total cost. Forward-looking buyers therefore favor hybrid procurement, sinking core trading desktops into private clouds while diverting clerical users to public DaaS.

On-premises estates held 58.4% financial services desktop virtualization market share in 2024, but cloud instances compound at 16.2% through 2030. Banks reconcile sovereignty concerns by ring-fencing sensitive data sets locally, then off-loading seasonal or low-risk workloads to hyperscalers. Hybrid orchestration platforms schedule desktops based on latency, compliance tags, and cost.

Cloud acceleration intensifies as regulators publish clearer guidance on encryption, key management, and audit access, lowering perceived risk. Insurers run claims adjudication in cloud regions close to customers for better experience, while core actuarial models remain in private zones. Vendors that deliver uniform policy enforcement across AWS, Azure, and GCP win share as institutions resist platform lock-in.

The Financial Services Desktop Virtualization Market Report Segments the Industry Into Desktop Delivery Platform (Hosted Virtual Desktop (HVD), Hosted Shared Desktop (HSD), and More), Deployment Mode (On-Premise, Cloud and Hybrid), Organization Size (Large Enterprises, and Small and Mid-Sized Enterprises (SMEs)), End-User (Retail and Commercial Banking, Capital Markets and Trading, and More), and Geography.

Geography Analysis

North America led with 41.2% market share in 2024, powered by early zero-trust adoption, dense trading hubs, and large-scale GPU virtualization pilots in New York, Chicago, and Toronto. Institutions invest heavily in resilience, building active-active desktop pairs across metro zones to satisfy Federal guidelines on business continuity. Sub-second failover and encryption-in-transit are baseline specifications, and spending shifts toward monitoring and automated remediation to guard against ransomware.

Asia-Pacific records the fastest 12.7% CAGR, as regulators in Singapore, Australia, and Japan clarify cloud usage rules, encouraging banks to modernize branch technology and launch mobile-first services. Financial groups deploy hybrid desktop grids blending local data-center pods with regional hyperscaler capacity, allowing rapid expansion into adjacent markets. FinTech ecosystems in India and Southeast Asia further fuel demand through green-field builds that leapfrog legacy limitations.

Europe experiences steady replacement cycles driven by GDPR compliance and energy-efficiency mandates. Banks in Frankfurt and Paris emphasize thin-client rollouts tied to ESG targets, swapping aging PCs for low-wattage endpoints that integrate with centralized virtual desktops. Stringent data-sovereignty statutes spur investments in country-specific cloud regions and encryption key escrow. Middle East and Africa show nascent but accelerating uptake in Dubai and Johannesburg, where financial free zones incentivize digital-first banking licenses. South America advances selectively, with Brazilian and Chilean lenders piloting cloud desktops for contact-centre agents while core applications stay on-premises.

- Citrix Systems, Inc.

- Microsoft Corporation

- VMware, Inc.

- Amazon Web Services, Inc.

- Hewlett Packard Enterprise Development LP

- IBM Corporation

- Dell Technologies Inc.

- Huawei Technologies Co., Ltd.

- Oracle Corporation

- Google LLC

- Parallels International GmbH (Corel)

- NComputing Co., Ltd.

- Evolve IP, LLC

- Ericom Software Ltd.

- Workspot, Inc.

- Nerdio, Inc.

- Anunta Tech Inc.

- Accops Systems Pvt. Ltd.

- XTIUM (ATSG)

- DXC Technology Company

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Widespread cloud-migration strategies among Tier-1 banks

- 4.2.2 Accelerated move to zero-trust security frameworks

- 4.2.3 Hybrid-work mandates for capital-market trading floors

- 4.2.4 ESG-driven demand for energy-efficient thin clients

- 4.2.5 Growing GPU-enabled risk-analytics workloads

- 4.2.6 Proliferation of AI-PC endpoints enabling local inference off-loading

- 4.3 Market Restraints

- 4.3.1 Legacy mainframe integration complexity

- 4.3.2 Skills gap in cloud-native VDI operations

- 4.3.3 Concentrated vendor-dependency risk

- 4.3.4 Regulatory data-residency requirements raising deployment cost

- 4.4 Evaluation of Critical Regulatory Framework

- 4.5 Value Chain Analysis

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

- 4.8 Key Use Cases and Case Studies

- 4.9 Impact on Macroeconomic Factors of the Market

- 4.10 Investment Analysis

5 MARKET SEGMENTATION

- 5.1 By Desktop Delivery Platform

- 5.1.1 Hosted Virtual Desktop (HVD)

- 5.1.2 Hosted Shared Desktop (HSD)

- 5.1.3 Desktop-as-a-Service (DaaS)

- 5.1.4 Remote Desktop Services (RDS)

- 5.2 By Deployment Mode

- 5.2.1 On-Premises

- 5.2.2 Cloud

- 5.2.3 Hybrid

- 5.3 By Organization Size

- 5.3.1 Large Enterprises

- 5.3.2 Small and Mid-sized Enterprises (SMEs)

- 5.4 By End-User

- 5.4.1 Retail and Commercial Banking

- 5.4.2 Capital Markets and Trading

- 5.4.3 Insurance

- 5.4.4 FinTech and Payment Providers

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Russia

- 5.5.3.7 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 Japan

- 5.5.4.3 India

- 5.5.4.4 South Korea

- 5.5.4.5 Australia and New Zealand

- 5.5.4.6 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 Saudi Arabia

- 5.5.5.1.2 United Arab Emirates

- 5.5.5.1.3 Turkey

- 5.5.5.1.4 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Nigeria

- 5.5.5.2.3 Egypt

- 5.5.5.2.4 Rest of Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)}

- 6.4.1 Citrix Systems, Inc.

- 6.4.2 Microsoft Corporation

- 6.4.3 VMware, Inc.

- 6.4.4 Amazon Web Services, Inc.

- 6.4.5 Hewlett Packard Enterprise Development LP

- 6.4.6 IBM Corporation

- 6.4.7 Dell Technologies Inc.

- 6.4.8 Huawei Technologies Co., Ltd.

- 6.4.9 Oracle Corporation

- 6.4.10 Google LLC

- 6.4.11 Parallels International GmbH (Corel)

- 6.4.12 NComputing Co., Ltd.

- 6.4.13 Evolve IP, LLC

- 6.4.14 Ericom Software Ltd.

- 6.4.15 Workspot, Inc.

- 6.4.16 Nerdio, Inc.

- 6.4.17 Anunta Tech Inc.

- 6.4.18 Accops Systems Pvt. Ltd.

- 6.4.19 XTIUM (ATSG)

- 6.4.20 DXC Technology Company

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment