PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851425

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851425

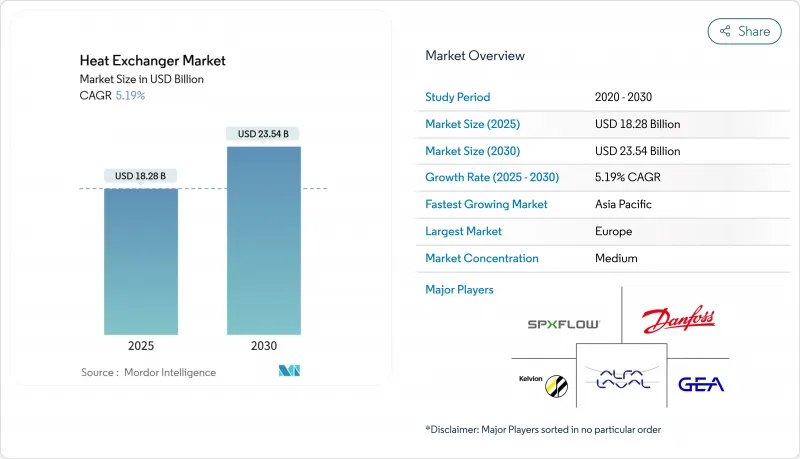

Heat Exchanger - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Heat Exchanger Market size is estimated at USD 18.28 billion in 2025, and is expected to reach USD 23.54 billion by 2030, at a CAGR of 5.19% during the forecast period (2025-2030).

Growth is fueled by LNG infrastructure build-outs, data-center liquid-cooling adoption, and regulations that force efficiency upgrades in industrial boilers and district energy networks. Shell-and-tube systems remain the mainstay for high-pressure duties, yet air-cooled equipment is scaling rapidly as water conservation drives procurement decisions. Exotic alloy demand rises in line with hydrogen pilot projects and super-critical CO2 power cycles, while modular printed-circuit designs gain traction where extreme pressures converge with space constraints. Competitive dynamics stay moderately fragmented: global incumbents rely on broad portfolios and aftermarket reach, whereas specialists target niches such as cryogenic LNG trains and 200-bar hydrogen units.

Global Heat Exchanger Market Trends and Insights

Surge in LNG Liquefaction Projects Boosting Demand for Cryogenic Exchangers

Global build-outs of mid-scale and large LNG trains require coil-wound and plate-fin units that perform below -150 °C while maintaining tight thermal approaches, accelerating procurement of high-grade stainless steels and aluminum alloys . Modular exchanger skids shorten construction schedules and curb cost overruns, benefiting fabricators integrating 3D-printed flow plates for weight reduction and enhanced turbulence. During 2025-2026, Gulf Coast and Qatari megaprojects are expected to anchor the heat exchanger market, with secondary demand arising from brownfield debottlenecking across Asia. Suppliers that certify to ASME Section VIII while offering 12-week delivery windows will secure framework contracts as EPC firms standardize equipment lists to de-risk timelines.

District-Cooling Expansion in GCC & Southeast Asia Driving Plate-Frame Sales

High-humidity metros such as Dubai, Riyadh, and Singapore continue to subsidize district-cooling systems to shave peak power loads, prompting utilities to specify gasketed plate-frame exchangers owing to compact footprints and easy capacity scaling . These deployments rely on stainless and titanium plates to mitigate brine corrosion, with district operators demanding 99% availability guarantees. OEMs that bundle condition-monitoring sensors will capture recurring service revenue as concession operators pivot toward performance-based maintenance models.

Nickel and Titanium Price Volatility Inflating Corrosion-Resistant Units

Class 1 nickel and aerospace-grade titanium prices have swung by up to 35% quarter-on-quarter since 2024, undermining order pipelines for hydrogen, marine, and offshore projects that cannot down-spec materials. Fabricators pass surcharges to EPC clients, but budget overruns trigger project deferrals, trimming short-term volumes in the heat exchanger market. Stainless-steel clad plates partly offset exposure, yet diffusion bonding of dissimilar metals complicates weld integrity certification.

Other drivers and restraints analyzed in the detailed report include:

- Hydrogen Pilot Plants Adopting Printed-Circuit Exchangers for 200-Bar Service

- Data-Centre Liquid-Cooling Uptake Accelerating Micro-Channel Adoption

- Bio-Process Fouling Issues Limiting Adoption in Biorefineries

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Shell-and-tube designs retained 35% of the heat exchanger market share in 2024, upholding their position as the default choice where pressures exceed 60 bar and fouling margins are high. Their standardized TEMA classifications simplify specification for refineries, LNG pretreatment trains, and sulfur recovery units, supporting repeat orders for tube bundles and gaskets that underpin aftermarket revenues. At the same time, air-cooled variants are climbing at a 6% CAGR as water-stressed utilities in India, Texas, and the Middle East prioritize zero-liquid-discharge strategies, driving units with forced-draft fans and low-noise gearboxes.

Across 2025-2030, printed-circuit and spiral-wound formats will nibble share in high-pressure hydrogen and super-critical CO2 cycles as designers seek compact footprints that conventional shells cannot match. Nevertheless, the heat exchanger market will continue to favor shell-and-tube for brownfield revamps because existing nozzle locations fit retrofit bundles, keeping life-cycle costs predictable. Suppliers that blend stainless-steel shells with copper-nickel tubes for marine scrubbers will tap IMO 2020 compliance budgets, adding a modest lift to volumes.

Stainless steel maintained 30% of the heat exchanger market size in 2024 because grades such as 316L balance corrosion resistance and cost efficiency. In food, beverage, and pharmaceutical lines, sanitary finishes and low-carbon content fulfill regulatory mandates without premium alloy surcharges. Exotic alloys-titanium, nickel, Incoloy, and Hastelloy-are moving at a 6.5% CAGR through 2030, capturing hydrogen, desalination, and offshore wind converter platforms where chloride-rich brines or hydrogen embrittlement preclude stainless options.

Polymers and composites grow from a small base as PTFE and graphite blocks outperform metals under highly acidic or fluoride-laden streams, notably in semiconductor wet-etch and lithium-ion battery recycling. Additive manufacturing unlocks dual-material lattices that place high-alloy material only where corrosion is severe, trimming cost and weight. Such innovations cement the heat exchanger industry's transition toward application-specific metallurgy rather than defaulting to legacy stainless catalogues.

The Heat Exchanger Market Report is Segmented by Type (Shell and Tube, Plate Frame, Air-Cooled, and Others), Material of Construction (Stainless Steel, Carbon Steel and Others), Flow Arrangement (Counter-Current, Parallel, Cross-Flow, and Hybrid/Multi-Pass), End-User Industry (Oil and Gas, Power Generation, Water and Waste-Water Treatment, and Others), and Geography (North America, Europe, Asia-Pacific, South America and Others).

Geography Analysis

Europe commanded 33% of 2024 global revenue, propelled by EU Eco-design directives that push boiler retrofits and district energy rollouts. Germany's integrated hydrogen strategy channels funding toward printed-circuit prototypes for electrolyzer plants, anchoring a high-value corner of the heat exchanger market. France accelerates SMR projects that require compact safety-class exchangers, while Nordic countries pioneer low-temperature district loops using titanium plate packs to exploit ambient seawater. OEMs maintaining EN13445 pressure-vessel accreditations and in-region spare-parts hubs capture share as uptime guarantees dominate tender scoring.

Asia-Pacific posts the fastest 5.9% CAGR to 2030, with China's petrochemical capacity additions, India's expanding power fleet, and ASEAN district-cooling concessions underpinning volume growth. Domestic manufacturers leverage cost-advantaged supply chains to win shell-and-tube orders, while Japanese and Korean firms focus on titanium and nickel PCHEs for ammonia-cracking pilots. Local EPCs value suppliers that offer modular skids shipped within 10 weeks, compelling global brands to localize fabrication or risk losing relevance amid aggressive pricing.

North America benefits from LNG export terminals along the Gulf Coast and data-center campus expansions across Virginia, Texas, and Quebec. The US Department of Energy's hydrogen hubs funnel grants into PCHE demonstrations that use diffusion-bonded nickel alloys. Canada's oil-sands operators retrofit air-fin units to curtail water withdrawals, creating a secondary pull on fan-assisted equipment. Across Latin America, mining concentrates and solar-thermal plants drive boutique orders, whereas the Middle East leans on desalination and petrochemical mega-complexes to sustain demand. Africa's momentum remains gradual but steady, tied to copper-belt smelting upgrades.

- Alfa Laval AB

- Kelvion Holding GmbH

- Danfoss A/S

- SPX Flow Inc.

- GEA Group AG

- Hisaka Works Ltd.

- Xylem Inc.

- Thermax Ltd.

- Mersen SA

- API Heat Transfer Inc.

- GE Vernova Inc.

- Barriquand Technologies Thermiques SAS

- Koch Heat Transfer Company LP

- SWEP International AB

- Heatric

- Kobelco Steel Ltd.

- Accessen Group

- Funke WarmeaustauscherGmbH

- Tranter Inc.

- HRS Heat Exchangers Ltd.

- Hamon Thermal Europe SA

- Graham Corporation

- United Heat Transfer Ltd.

- KRN Heat Exchanger & Refrigeration Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Surge in LNG liquefaction projects boosting demand for cryogenic exchangers

- 4.2.2 District-cooling expansion in GCC & SE-Asia driving plate-frame sales

- 4.2.3 Hydrogen pilot plants adopting printed-circuit exchangers for 200-bar service

- 4.2.4 Mandatory EU industrial boiler upgrades spurring retrofit tube bundles

- 4.2.5 SMR (small modular reactor) roll-out needing compact safety-class exchangers

- 4.2.6 Data-centre liquid cooling uptake accelerating micro-channel adoption

- 4.3 Market Restraints

- 4.3.1 Nickel & titanium price volatility inflating corrosion-resistant units

- 4.3.2 Bio-process fouling issues limiting adoption in biorefineries

- 4.3.3 EPC demand for 12-week lead-times curbing engineered-to-order designs

- 4.3.4 Direct air-cooling in power plants cannibalising air-cooled exchangers

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Outlook

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts

- 5.1 By Type

- 5.1.1 Shell and Tube

- 5.1.2 Plate and Frame (Gasketed Plate, Brazed Plate, Welded Plate)

- 5.1.3 Air-Cooled (Fin and Tube, Plate-Fin, Micro-Channel)

- 5.1.4 Regenerative (Rotary and Plate)

- 5.1.5 Printed Circuit

- 5.1.6 Others (Double-Pipe, Spiral, Coaxial)

- 5.2 By Material of Construction

- 5.2.1 Stainless Steel

- 5.2.2 Carbon Steel

- 5.2.3 Non-Ferrous (Copper, Aluminium)

- 5.2.4 Exotic Alloys (Titanium, Nickel, Hastelloy)

- 5.2.5 Polymers and Composites (PTFE, Graphite, Ceramic)

- 5.3 By Flow Arrangement

- 5.3.1 Counter-Current

- 5.3.2 Parallel

- 5.3.3 Cross-Flow

- 5.3.4 Hybrid/Multi-Pass

- 5.4 By End-Use Industry

- 5.4.1 Oil and Gas

- 5.4.2 Chemical and Petrochemical

- 5.4.3 Power Generation (incl. Nuclear)

- 5.4.4 Food and Beverage

- 5.4.5 Pulp and Paper

- 5.4.6 Water and Waste-water Treatment

- 5.4.7 Other Industries (Automotive and Transportation, Metallurgy, Mining, HVACR, Pharmaceutical and Biotechnology)

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 United Kingdom

- 5.5.2.2 Germany

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Nordic Countries

- 5.5.2.7 Russia

- 5.5.2.8 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 India

- 5.5.3.3 Japan

- 5.5.3.4 South Korea

- 5.5.3.5 ASEAN Countries

- 5.5.3.6 Australia

- 5.5.3.7 Rest of Asia-Pacific

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Chile

- 5.5.4.4 Colombia

- 5.5.4.5 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 Saudi Arabia

- 5.5.5.2 United Arab Emirates

- 5.5.5.3 South Africa

- 5.5.5.4 Egypt

- 5.5.5.5 Rest of Middle East and Africa

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves (M&A, Partnerships, PPAs)

- 6.3 Market Share Analysis (Market Rank/Share for key companies)

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Products & Services, Recent Developments)

- 6.4.1 Alfa Laval AB

- 6.4.2 Kelvion Holding GmbH

- 6.4.3 Danfoss A/S

- 6.4.4 SPX Flow Inc.

- 6.4.5 GEA Group AG

- 6.4.6 Hisaka Works Ltd.

- 6.4.7 Xylem Inc.

- 6.4.8 Thermax Ltd.

- 6.4.9 Mersen SA

- 6.4.10 API Heat Transfer Inc.

- 6.4.11 GE Vernova Inc.

- 6.4.12 Barriquand Technologies Thermiques SAS

- 6.4.13 Koch Heat Transfer Company LP

- 6.4.14 SWEP International AB

- 6.4.15 Heatric

- 6.4.16 Kobelco Steel Ltd.

- 6.4.17 Accessen Group

- 6.4.18 Funke WarmeaustauscherGmbH

- 6.4.19 Tranter Inc.

- 6.4.20 HRS Heat Exchangers Ltd.

- 6.4.21 Hamon Thermal Europe SA

- 6.4.22 Graham Corporation

- 6.4.23 United Heat Transfer Ltd.

- 6.4.24 KRN Heat Exchanger & Refrigeration Ltd.

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment