PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851426

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851426

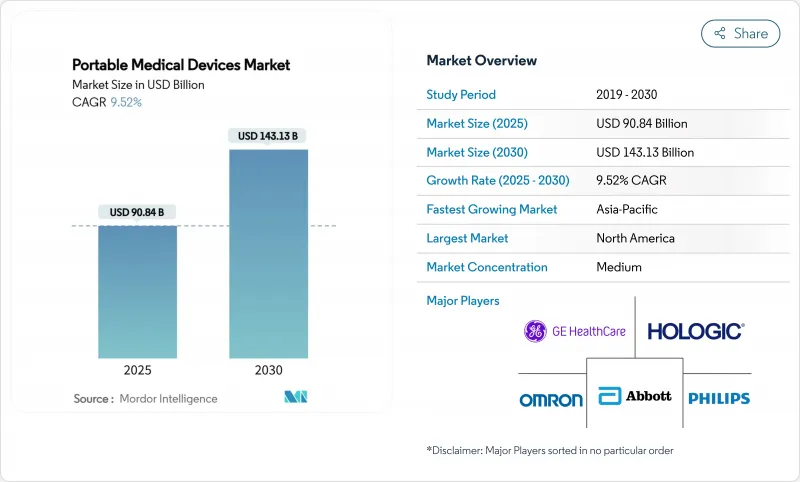

Portable Medical Devices - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The portable medical devices market size stood at USD 90.84 billion in 2025 and is forecast to climb to USD 143.13 billion by 2030, registering a 9.52% CAGR.

This growth reflects mounting demand for out-of-hospital care, maturing semiconductor miniaturization, and reimbursement models that now reward continuous monitoring. Rapid integration of on-device artificial intelligence is redefining diagnostic accuracy, while home-care adoption expands as health systems look to trim preventable readmissions. Technology giants are entering with software-centric approaches, intensifying competition and accelerating product lifecycles. Meanwhile, supply-chain vulnerabilities in specialized chips and rising cybersecurity compliance costs temper near-term momentum.

Global Portable Medical Devices Market Trends and Insights

Escalating Demand for Home-Based Chronic-Disease Monitoring

Health systems are deploying connected monitors to cut preventable readmissions and routine clinic visits. The Centers for Medicare & Medicaid Services expanded reimbursement for remote patient monitoring in 2024, signalling payer endorsement of at-home technology. Data from major providers show 15-20% drops in emergency department use when monitored patients transmit daily metrics. Diabetes, cardiovascular disease, and COPD now account for most remote-monitoring enrollments, creating a scalable addressable base for the portable medical devices market. Clinical outcomes remain stable, encouraging payers to widen coverage horizons. Device makers are responding with turnkey service bundles that combine hardware, cloud analytics, and clinical coaching to overcome staffing constraints in primary care.

Rapid Adoption of Wearable Health & Fitness Electronics

Consumer familiarity with smartwatches and fitness bands shortens the learning curve for medical wearables, enabling cross-over into regulated indications. North America leads shipments, yet Asia-Pacific overtook Europe in 2024 unit growth after regional smartphone brands embedded SpO2 and ECG functions in mass-market devices. Sports-science endorsements drive early uptake, while insurers experiment with premium discounts for verified activity data. Seamless Bluetooth-to-telemedicine integration positions wearables as the on-ramp for continuous data streams that feed AI algorithms, thereby amplifying the value proposition of the portable medical devices market. Regulatory agencies now reference ISO/IEC standard 60601-1-11 to streamline approvals for body-worn sensors, cutting average review times by 15%.

Cyber-Security & Patient-Data Privacy Liabilities

The FDA's 2024 cybersecurity guidance obliges manufacturers to embed threat-mitigation protocols from design through post-market support. EU GDPR fines now reach 4% of annual revenue for breaches, pushing procurement teams to demand penetration-testing evidence before purchase. Hospitals hesitate to connect new devices to electronic health-record backbones without zero-trust architectures. Vendors invest in hardware root-of-trust and over-the-air patching, raising bill-of-materials costs that ripple through pricing in the portable medical devices market. Cyber-insurance premiums climbed 15% year-on-year in 2025, reflecting rising attack frequency on connected infusion pumps and cardiac monitors.

Other drivers and restraints analyzed in the detailed report include:

- Advances in Low-Power Miniaturised Medical Components

- Aging Population Driving Imaging & Monitoring Needs

- High Upfront Costs & Limited Reimbursement Pathways

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Monitoring devices generated the largest revenue, commanding 45.51% share of the portable medical devices market in 2024. Their mature clinical validation and reimbursement backing underpin procurement preference across hospitals and home-care agencies. Mobile medical apps and software, although contributing a small base, exhibit the fastest 14.25% CAGR as smartphones morph into FDA-cleared diagnostic tools. This surge is redefining patient engagement because software leverages pre-existing cameras, microphones, and inertial sensors. Diagnostic imaging systems maintain specialized penetration, particularly hand-carried ultrasound for emergency triage. Therapeutic devices such as electrical nerve stimulators post steady growth supported by value-based care incentives. The portable medical devices market benefits from blended hardware-software propositions exemplified by Withings' BeamO, whose 4-in-1 vitals capture encourages preventive check-ups from home.

Software's scalable economics accelerates global diffusion; once a regulatory dossier is in place, incremental distribution costs trend toward zero, favouring freemium models tied to premium analytics subscriptions. Traditional device makers respond by embedding cloud dashboards and AI triage recommendations, closing the gap with app-first competitors. Cross-platform interoperability emerges as a differentiator, as providers seek unified views that aggregate data from blood-glucose sensors, blood-pressure cuffs, and weight scales. Consequently, licensing revenue from application-programming interfaces grows faster than hardware margins within the portable medical devices market.

Sensors retained 35.53% revenue leadership in the portable medical devices market size for components in 2024, yet processors and dedicated AI chips register a striking 15.85% CAGR. The momentum stems from real-time inference workloads such as arrhythmia detection and sepsis prediction at the bedside. Semiconductor vendors bundle neural-processing units with integrated power-management, shrinking board count and lowering system cost. Communication modules gain from 5G and Wi-Fi 6 adoption, enabling high-resolution imaging transfer without tethered connections. Displays transition to AMOLED touchscreens with haptic feedback, simplifying user training for non-technical caregivers.

Edge processing relocates analytics previously hosted in the cloud, slashing latency and easing compliance with data-sovereignty laws. Hospitals value on-premises decisions that continue uninterrupted during network outages, while home users appreciate immediate actionable insights. Processor upgrades trigger replacement cycles that shorten average device life to four years, expanding annuity revenue opportunities. As healthcare moves towards predictive medicine, algorithm complexity intensifies compute demand, ensuring sustained investment in processor roadmaps across the portable medical devices market.

The Portable Medical Devices Market is Segmented by Product Type (Diagnostic Imaging Systems, Monitoring Devices [Cardiac Monitoring, and More], and More), Component (Sensors, Batteries & Power Modules, and More), Portability Type (Hand-Held, and More), End User (Hospitals, Physician Offices & Clinics, and More), and Geography (North America, Europe, Asia-Pacific and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America retained leadership with 38.32% of global revenue in 2024, supported by robust reimbursement frameworks and a vibrant innovation ecosystem. Collaboration between cloud hyperscalers and device firms accelerates AI deployment, while domestic semiconductor incentives mitigate supply-risk exposure. Canada's single-payer model creates predictable procurement volumes for vital-sign monitors targeting chronic-disease cohorts. Mexico doubles as manufacturing hub and emerging customer base, drawing contract electronics makers near the United States border to shorten logistics lead times. Consequently, the portable medical devices market benefits from vertically integrated value chains across the continent.

Asia-Pacific posts the fastest 11.61% CAGR to 2030 as demographic shifts, rising disposable incomes, and government stimulus coalesce. China's regulatory reforms streamline Class II approvals, encouraging international brands to localize production. Japan's super-aged society adopts remote monitoring to offset caregiver shortages, spurring domestic innovators to pilot AI in-home robots. India prioritizes cost-effective diagnostics for rural health clinics, favouring smartphone-tethered hardware that leverages existing networks. South Korea's nationwide 5G coverage enables low-latency tele-ECG during ambulance transit. These diverse drivers require nuanced go-to-market strategies yet collectively fortify volume outlook for the portable medical devices market.

Europe experiences steady expansion underpinned by MDR compliance, significant digital-health funding, and cross-border telemedicine initiatives. Germany's manufacturing prowess anchors regional supply for sensor modules, while France channels public investment toward preventive care that includes reimbursing blood-pressure wearables. The United Kingdom capitalizes on regulatory autonomy to introduce conditional approvals that hasten AI diagnostics to market. Southern European nations, facing budgetary constraints, adopt device-as-a-service models to minimize upfront expenditure. GDPR enforcement shapes cybersecurity best practice, positioning European vendors to export privacy-centric designs globally, which in turn elevates trust in the portable medical devices market.

- Koninklijke Philips

- GE Healthcare

- Medtronic

- Abbott Laboratories

- Omron Healthcare Co. Ltd

- Beckton Dickinson

- Siemens Healthineers

- Samsung Electronics (Samsung Healthcare)

- FUJIFILM

- Hologic

- Boston Scientific

- Dexcom

- Masimo

- Nihon Kohden

- Mindray Bio-Medical Electronics

- Resmed

- Smiths Group

- Insulet

- iRhythm Technologies

- AliveCor

- Baxter

- BIOTRONIK

- Beurer

- Qardio Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Escalating Demand For Home-Based Chronic-Disease Monitoring

- 4.2.2 Rapid Adoption Of Wearable Health & Fitness Electronics

- 4.2.3 Advances In Low-Power Miniaturised Medical Components

- 4.2.4 Aging Population Driving Imaging & Monitoring Needs

- 4.2.5 On-Device AI Inference Accelerating Point-Of-Care Diagnostics

- 4.2.6 Regulatory Fast-Track Pathways For Connected Class II Devices

- 4.3 Market Restraints

- 4.3.1 Cyber-Security & Patient-Data Privacy Liabilities

- 4.3.2 High Upfront Costs & Limited Reimbursement Pathways

- 4.3.3 Battery Lifespan & Thermal-Management Limitations

- 4.3.4 Volatile Supply Of Specialised Medical Semiconductor Chips

- 4.4 Technological Outlook

- 4.5 Porter's Five Forces

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers/Consumers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Product Type

- 5.1.1 Diagnostic Imaging Systems

- 5.1.2 Monitoring Devices

- 5.1.2.1 Cardiac Monitoring

- 5.1.2.2 Neuro Monitoring

- 5.1.2.3 Respiratory Monitoring

- 5.1.2.4 Fetal & Neonatal Monitoring

- 5.1.2.5 Multi-parameter Monitors

- 5.1.3 Therapeutic Devices

- 5.1.4 Mobile Medical Apps & Software

- 5.1.5 Other Products

- 5.2 By Component

- 5.2.1 Sensors

- 5.2.2 Batteries & Power Modules

- 5.2.3 Communication Modules (BT/Wi-Fi/5G)

- 5.2.4 Display & Interface Modules

- 5.2.5 Processors & AI Chips

- 5.3 By Portability Type

- 5.3.1 Hand-held

- 5.3.2 Wearable

- 5.3.3 Portable Trolley-mounted

- 5.4 By End User

- 5.4.1 Hospitals

- 5.4.2 Physician Offices & Clinics

- 5.4.3 Home-care Settings

- 5.4.4 Emergency Medical Services

- 5.4.5 Military & Remote Healthcare

- 5.5 Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 South Korea

- 5.5.3.5 Australia

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 Middle East and Africa

- 5.5.4.1 GCC

- 5.5.4.2 South Africa

- 5.5.4.3 Rest of Middle East and Africa

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Argentina

- 5.5.5.3 Rest of South America

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 Koninklijke Philips N.V.

- 6.3.2 GE Healthcare

- 6.3.3 Medtronic plc

- 6.3.4 Abbott Laboratories

- 6.3.5 Omron Healthcare Co. Ltd

- 6.3.6 Becton Dickinson & Company

- 6.3.7 Siemens Healthineers AG

- 6.3.8 Samsung Electronics (Samsung Healthcare)

- 6.3.9 Fujifilm Holdings Corporation

- 6.3.10 Hologic Inc.

- 6.3.11 Boston Scientific Corporation

- 6.3.12 Dexcom Inc.

- 6.3.13 Masimo Corporation

- 6.3.14 Nihon Kohden Corporation

- 6.3.15 Mindray Bio-Medical Electronics

- 6.3.16 ResMed Inc.

- 6.3.17 Smith & Nephew plc

- 6.3.18 Insulet Corporation

- 6.3.19 iRhythm Technologies Inc.

- 6.3.20 AliveCor Inc.

- 6.3.21 Baxter International

- 6.3.22 Biotronik SE & Co. KG

- 6.3.23 Beurer GmbH

- 6.3.24 Qardio Inc.

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment