PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851429

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851429

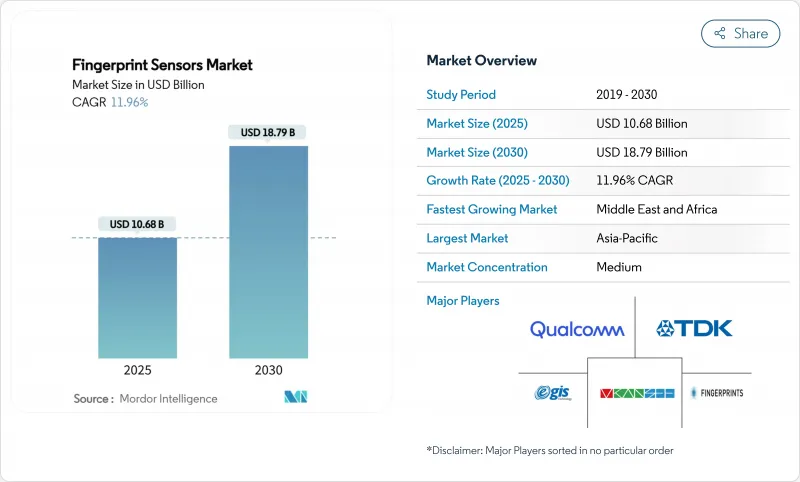

Fingerprint Sensors - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The fingerprint sensors market stands at USD 10.68 billion in 2025 and is forecast to reach USD 18.79 billion by 2030, reflecting an 11.96% CAGR.

Expanding biometric mandates in consumer electronics, mobility, payments and government identity programs continue to widen the addressable base. Smartphone brands have turned to ultrasonic under-display solutions to deliver bezel-free designs without compromising spoof resistance, while payment-grade biometric cards enable card-present transactions that meet PSD3 and EMV requirements. Automotive suppliers are qualifying AEC-Q100 fingerprint ICs for keyless entry and in-cabin personalization and falling PMUT production costs are easing bill-of-materials pressures. Parallel improvements in AI-based liveness detection and edge processing further lift the reliability of fingerprint authentication, reinforcing its position in the wider multimodal security stack.

Global Fingerprint Sensors Market Trends and Insights

Smartphone OEM Shift to Under-Display Ultrasonic Sensors

Ultrasonic under-display designs let handset makers preserve edge-to-edge OLED screens while retaining high-confidence biometric security. Qualcomm's latest 3D Sonic Max transducer captures a 600 mm2 image in 250 ms and sustains unlock even with damp or oily skin, outperforming optical modules in spoof testing. Samsung, Google and Xiaomi have committed flagship lines to ultrasonic implementations in 2025 product roadmaps, aligning with Android 16 biometric APIs that raise FAR/FRR certification thresholds. The resulting scale economies lower ASPs for tier-2 OEMs, accelerating volume growth across price bands and propelling the fingerprint sensors market into its next device cycle.

Government e-ID & e-Passport Rollouts Accelerating Demand

Digital identity programs from the UAE to South Africa now specify multi-factor biometrics, typically including fingerprint templates stored in secure elements. Mauritius issued its MNIC 3.0 card in February 2024, embedding match-on-card fingerprint authentication that enables wallet-based cross-border recognition. Papua New Guinea's SevisPass pilot underscores how small economies leapfrog to biometric IDs without legacy infrastructure. Such schemes create multi-year procurement waves for trusted sensor modules, anchoring the fingerprint sensors market in the public-sector budget cycle.

Rapid Adoption of Facial Recognition in Premium Devices

Apple's iPhone 17 range and Samsung's Galaxy Z7 Fold Pro both default to 3-D facial unlock, shifting biometric mindshare toward camera-based modalities. Yet 93% of handsets shipping in 2025 still carry a fingerprint reader, and under-display sensors are expected to return to the iPhone portfolio when technology meets Apple's 0.002 % FAR target. Fingerprint methods remain preferred for wet environments, gloved usage and privacy-sensitive workflows such as banking apps that require on-device template storage, so cannibalization largely affects the premium tail rather than the bulk of the fingerprint sensors market.

Other drivers and restraints analyzed in the detailed report include:

- Payment-Grade Biometric Smartcard Commercial Launches

- Automotive In-Cabin Biometrics Mandated for Keyless Access

- Data-Privacy Legislation Limiting Biometric Data Retention

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Capacitive units retained a 51% share of the fingerprint sensors market in 2024 owing to mature cost curves and broad application reach. Ultrasonic chips, however, are set to climb at 15.42% CAGR and are projected to narrow the revenue gap by 2030 as OEMs migrate high-tier phones and automotive consoles toward volumetric imaging. The fingerprint sensors market size for ultrasonic devices is on track to surpass USD 4 billion by 2030, reflecting premium ASPs and automotive qualification margins. Research from Berkeley's Sensor & Actuator Center shows KNN-based PMUT arrays generating 105.5 dB/V output, enhancing penetration through thick cover glass and gloves.

Performance advantages are translating into certification wins. Qualcomm's 3D Sonic Max achieved FIDO Level-3 and BSI CC EAL 6+ in 2025, enabling German eID compliance. Optical sensors continue servicing cost-sensitive tiers and kiosk terminals, while thermal variants remain niche for harsh-environment and postmortem forensics. Altogether, technology diversity sustains the broader fingerprint sensors market even as ultrasonic leadership cements in premium segments.

Rear/front mounts generated 42% of 2024 revenue, helped by legacy handset designs and rugged handhelds. Yet under-display ultrasonic modules will post the fastest 16.28% CAGR, taking advantage of OLED substrate thinning and localized acoustic coupling layers. The fingerprint sensors market share for under-display formats is expected to reach 38% by 2030 as bezel-less design becomes ubiquitous among sub-USD 400 devices. Apple, Samsung and Oppo collectively placed orders exceeding 250 million under-display sensors die in H2 2024 production slots, signalling scale adoption.

Side-mounted capacitive strips remain popular in foldables and gaming phones that prioritize rapid tap detection, while on-button/home-key designs linger in enterprise notebooks where keyboard replacement cycles lag smartphones by 2-3 years. Sensor-in-OLED prototypes under test at BOE and Visionox merge fingerprint capture with heart rate photoplethysmography, hinting at multifunctional panels that could redefine the next chapter of the fingerprint sensors market.

Fingerprint Sensors Market Segmented by Sensor Type (Optical, Capacitive, and More), Form Factor (Rear/Front Mount, Side-Mounted, and More), Application (Smartphones & Tablets, Laptops/PCs, and More), End-User Industry (Consumer Electronics OEM, BFSI & FinTech, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific's 46% revenue share reflects a unique integration of supply chain depth and end-market demand. China's vertically aligned handset ecosystem, Korea's AMOLED innovation and Japan's piezo ceramics leadership collectively anchor a resilient regional value chain. India's Aadhaar 2.0 roadmap and Indonesia's e-KTP upgrade pipeline further underwrite multi-year domestic demand. Regional governments also sponsor local silicon fabrication incentives, lowering landed costs and reinforcing Asia-Pacific as the gravitational center of the fingerprint sensors market.

Middle East & Africa is projected to expand at 15.4% CAGR, the fastest worldwide. The UAE's national biometric wallet and Saudi Arabia's Nafath platform both require certified fingerprint modules for citizen onboarding, catalysing bulk card and kiosk orders. South Africa's USD 2.5 million smart ID card tender aims for mass issuance before the 2029 elections, illustrating Africa's leapfrogging toward digital identity infrastructures. With regional payment networks such as made and e-Fawateer shifting to biometric tokenization, supplier pipelines for sensors are tightening, underscoring the growth potential of the fingerprint sensors market in emerging economies.

North America and Europe sustain mid-single-digit trajectories underpinned by automotive biometrics, enterprise security upgrades and stringent data-privacy compliance. The European Digital Identity Framework mandates wallet rollout by 2026, translating into 450 million residents requiring device or card-based fingerprint authentication. TSMC's USD 40 billion Arizona fabs, due to open Phase 2 lines in 2026, will localize ultrasonic PMUT wafer starts for key U.S. handset accounts, strengthening onshore supply resilience and balancing the global distribution of the fingerprint sensors market.

- Apple Inc.

- AU Optronics Corp.

- CrucialTec Co., Ltd.

- Egis Technology Inc.

- Fingerprint Cards AB

- Goodix Technology Co., Ltd.

- HID Global Corporation

- IDEX Biometrics ASA

- Infineon Technologies AG

- NEC Corporation

- Next Biometrics ASA

- Qualcomm Technologies Inc.

- Samsung System LSI Business

- Shenzhen Chipone / Novatek (Biometric BU)

- Sonavation Inc.

- STMicroelectronics N.V.

- Synaptics Incorporated

- TDK Corporation (InvenSense)

- Thales Group

- TKH Group (Nedap)

- VKANSEE Technology Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Smartphone OEM shift to under-display ultrasonic sensors

- 4.2.2 Government e-ID and e-Passport roll-outs accelerating demand

- 4.2.3 Payment-grade biometric smart-card commercial launches

- 4.2.4 Automotive in-cabin biometrics mandated for key-less access

- 4.2.5 AI-driven spoof-detection improving security certification

- 4.2.6 Falling cost/area of thin-film piezoelectric PMUT arrays

- 4.3 Market Restraints

- 4.3.1 Rapid adoption of facial recognition in premium devices

- 4.3.2 Data-privacy legislation limiting biometric data retention

- 4.3.3 Supply-chain reliance on high-end 8-inch CIS foundries

- 4.3.4 False-accept anxiety in wet-finger outdoor conditions

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Bargaining Power of Buyers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Sensor Type

- 5.1.1 Optical

- 5.1.2 Capacitive

- 5.1.3 Thermal

- 5.1.4 Ultrasonic

- 5.2 By Form Factor / Placement

- 5.2.1 Rear/Front Mount

- 5.2.2 Side-mounted

- 5.2.3 Under-display (Optical)

- 5.2.4 Under-display (Ultrasonic)

- 5.2.5 On-button / Home-key

- 5.3 By Application

- 5.3.1 Smartphones and Tablets

- 5.3.2 Laptops / PCs

- 5.3.3 Smart-Cards and Payment Tokens

- 5.3.4 IoT / Smart Locks and Wearables

- 5.4 By End-user Industry

- 5.4.1 Consumer Electronics OEM

- 5.4.2 BFSI and FinTech

- 5.4.3 Government and Law-Enforcement

- 5.4.4 Military and Defense

- 5.4.5 Automotive and Mobility

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 United Kingdom

- 5.5.2.2 Germany

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 South Korea

- 5.5.3.5 Rest of Asia-Pacific

- 5.5.4 Middle East

- 5.5.4.1 Israel

- 5.5.4.2 Saudi Arabia

- 5.5.4.3 United Arab Emirates

- 5.5.4.4 Turkey

- 5.5.4.5 Rest of Middle East

- 5.5.5 Africa

- 5.5.5.1 South Africa

- 5.5.5.2 Egypt

- 5.5.5.3 Rest of Africa

- 5.5.6 South America

- 5.5.6.1 Brazil

- 5.5.6.2 Argentina

- 5.5.6.3 Rest of South America

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Apple Inc.

- 6.4.2 AU Optronics Corp.

- 6.4.3 CrucialTec Co., Ltd.

- 6.4.4 Egis Technology Inc.

- 6.4.5 Fingerprint Cards AB

- 6.4.6 Goodix Technology Co., Ltd.

- 6.4.7 HID Global Corporation

- 6.4.8 IDEX Biometrics ASA

- 6.4.9 Infineon Technologies AG

- 6.4.10 NEC Corporation

- 6.4.11 Next Biometrics ASA

- 6.4.12 Qualcomm Technologies Inc.

- 6.4.13 Samsung System LSI Business

- 6.4.14 Shenzhen Chipone / Novatek (Biometric BU)

- 6.4.15 Sonavation Inc.

- 6.4.16 STMicroelectronics N.V.

- 6.4.17 Synaptics Incorporated

- 6.4.18 TDK Corporation (InvenSense)

- 6.4.19 Thales Group

- 6.4.20 TKH Group (Nedap)

- 6.4.21 VKANSEE Technology Inc.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment