PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851437

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851437

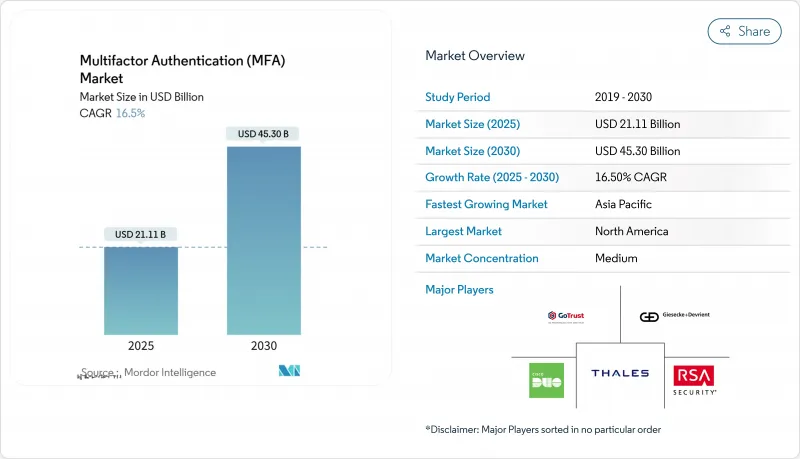

Multifactor Authentication (MFA) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The global multifactor authentication market size currently stands at USD 21.11 billion in 2025 and is projected to reach USD 45.30 billion by 2030, reflecting a strong 16.50% CAGR.

This growth trajectory is underpinned by zero-trust adoption, tightening data-protection directives, and escalating ransomware premiums that drive urgent investment in stronger authentication. Regulatory mandates such as the 2025 HIPAA Security Rule in the United States and the European Digital Identity Wallet regulation are shifting procurement from basic OTP tools to phishing-resistant passkeys and hardware tokens, confirming the multifactor authentication market's transition toward high-assurance solutions. At the same time, supply-chain shocks to secure-element chips and escalating A2P SMS fees are pushing buyers to favor software-based or device-embedded factors. North America's zero-trust leadership, Asia-Pacific's mobile-identity initiatives, and Europe's wallet regulation together create a global flywheel that sustains double-digit expansion for the multifactor authentication industry through 2030.

Global Multifactor Authentication (MFA) Market Trends and Insights

Rapid Migration to Zero-Trust Security Architectures Across Regulated Industries

Zero-trust blueprints now require continuous identity checks on every session, elevating MFA from an optional add-on to core control. Canadian banks must abandon SMS OTP under OSFI B-13, pushing hardware tokens and biometric factors into routine operations. U.S. financial majors, including Capital One have pledged to remove employee passwords by end-2025, substituting device-certificate-anchored passkeys that cut credential-stuffing risk. Vendors respond by building platform fabrics that unify authentication across workforce, customer, and machine identities, strengthening the multifactor authentication market's ecosystem breadth.

Surge in Ransomware-as-a-Service Driving Insurance Premium Hikes

Cyber insurers now treat phishing-resistant MFA as baseline hygiene. Policies are refused or repriced upward where email-only or SMS-OTP remains in place, making MFA investment a direct insurance-cost hedge. As adversary-in-the-middle kits commoditize, boards shift funding from perimeter firewalls to identity assurance, propelling multifactor authentication market demand among mid-size enterprises previously slow to modernize.

Legacy SCADA/ICS Environments' Limited MFA Interoperability

Industrial networks depend on deterministic latency and continuous uptime. Injecting extra login steps risks downtime, so plant operators isolate OT from IT rather than retrofit full MFA, capping reachable multifactor authentication market revenue in heavy industry.

Other drivers and restraints analyzed in the detailed report include:

- Mandated FIDO-Based Strong Authentication for EU e-Government Portals

- Push-Notification Phishing Kits Raising Demand for Phishing-Resistant MFA

- Rising OTP SMS Costs Amid A2P Fee Inflation

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Software solutions generated 48.3% of 2024 revenue and anchor the largest slice of the multifactor authentication market. Subscription licensing, API toolkits, and cloud consoles streamline rollouts across hybrid workforces. The segment's value proposition scales further as enterprises migrate perimeter controls into identity fabrics that integrate compliance reporting and adaptive risk metrics. Passwordless platforms-led by WebAuthn toolchains and SDKs-are clocking 19.2% CAGR, reflecting buyer preference for factors that erase credential databases and defeat phishing at the root. Hardware remains indispensable for regulated workloads that stipulate isolated secure-element storage, yet chip shortages inflate token costs and nudge budgets toward software.

Demand for implementation expertise turns managed services into an attractive niche. Service partners design enrollment campaigns, retrofit legacy apps, and monitor MFA dashboards, turning one-off product placement into recurring advisory revenue. As a result, large integrators bundle rollouts with broader zero-trust projects, lifting average contract values and reinforcing the multifactor authentication market's shift to platform-centric procurement.

Two-factor login still underpins 46.4% of 2024 revenue, primarily through authenticator apps and SMS codes that deliver quick risk reduction. However, phishing-resistant passkeys are expanding at 18.4% CAGR as browser and mobile-OS vendors bake FIDO2 into native workflows. Microsoft's decision to make new consumer accounts passwordless by default supplies a powerful reference model. Multifactor frameworks requiring three or more factors remain compulsory in select government and financial segments, but the broader commercial appetite pivots toward risk-based orchestration that elevates factor strength dynamically.

Multifactor Authentication Market is Segmented by Offering Type (Hardware, Software, Services), Authentication Model (Two-Factor, Multifactor, and More), Deployment Mode (On-Premises, Cloud, Hybrid), Enterprise Size (SMEs, Large Enterprises), Access Channel (VPN and Remote Login, and More), End-User Industry (Banking and Financial Institutions, and More), and by Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America retained 37.8% revenue in 2024 and should log 14.2% CAGR to 2030. U.S. executive orders on critical-infrastructure cybersecurity and Canadian OSFI B-13 collectively institutionalize MFA, while the ecosystem of identity SaaS vendors headquartered in the region keeps innovation cycles brisk. The multifactor authentication market size for North America thus scales steadily as zero-trust procurement enters the maintenance phase and vendors upsell adaptive analytics.

Asia-Pacific is on a 16.5% CAGR trajectory thanks to government identity programs. Japan's My Number smartphone credential now underpins login for over 650 firms, and Singapore's banks have replaced SMS with FIDO tokens, broadening mainstream adoption. Australia's Digital ID framework rolls out passkeys for federal services, spurring private-sector copycats. Emerging economies across Southeast Asia and India extend market runway by leapfrogging legacy passwords straight into mobile biometrics.

Europe advances at solid double digits as Regulation 2024/1183 standardizes wallet login across 27 nations. Public-sector volume guarantees vendor scale, and private online-service providers must interoperate or risk customer churn. The Middle East and Africa, though starting from a smaller base, record increasing deployments aligned with cloud migration and cyber-resilience bids, adding diversified revenue streams to the global multifactor authentication market.

- Giesecke+Devrient GmbH

- Thetis

- GoTrustID Inc.

- Thales Group

- Duo Security (Cisco Systems Inc.)

- RSA Security LLC

- Okta Inc.

- Google LLC (Alphabet Inc.)

- Ping Identity Corp.

- ManageEngine (Zoho Corp.)

- Microsoft Corp.

- TeleSign Corp. (Proximus Group)

- HID Global Corp.

- OneSpan Inc.

- CyberArk Software Ltd.

- ForgeRock Inc.

- Entrust Corp.

- SecureAuth Corp.

- Symantec Corp. (Broadcom Inc.)

- Keyless Technologies

- Secret Double Octopus

- Trusona Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rapid migration to Zero-Trust security architectures across regulated industries

- 4.2.2 Surge in ransomware-as-a-service driving insurance premium hikes

- 4.2.3 Mandated FIDO-based strong authentication for e-Government portals in EU

- 4.2.4 Push-notification phishing kits raising demand for phishing-resistant MFA

- 4.2.5 AI-powered deep-fake attacks forcing higher-factor biometrics

- 4.2.6 Mandalorian Class Public-Private threat-intel sharing models (US and Five-Eyes)

- 4.3 Market Restraints

- 4.3.1 Legacy SCADA/ICS environments limited MFA interoperability

- 4.3.2 Rising OTP SMS costs amid A2P fee inflation

- 4.3.3 Fragmented mobile authenticator UX hurting workforce adoption

- 4.3.4 Hardware token chip shortages and secure-element supply risk

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory and Technological Outlook

- 4.6 Porter's Five Forces

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Suppliers

- 4.6.3 Bargaining Power of Buyers

- 4.6.4 Threat of Substitutes

- 4.6.5 Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Offering Type

- 5.1.1 Hardware

- 5.1.1.1 Tokens (USB, Smart-card, Smartkey)

- 5.1.1.2 Biometric Devices (Fingerprint, Palm-vein, Facial)

- 5.1.1.3 Other Devices (Wearables, Smartcards-NFC)

- 5.1.2 Software

- 5.1.2.1 Authenticator Solutions (TOTP, Push, U2F)

- 5.1.2.2 Mobile Apps (Native, SDK)

- 5.1.3 Services

- 5.1.3.1 Managed and Professional Services

- 5.1.1 Hardware

- 5.2 By Authentication Model

- 5.2.1 Two-Factor (2FA)

- 5.2.2 Multifactor (3F and 4F)

- 5.2.3 Adaptive / Risk-Based MFA

- 5.2.4 Password-less (WebAuthn, Passkeys)

- 5.3 By Deployment Mode

- 5.3.1 On-premises

- 5.3.2 Cloud

- 5.3.2.1 Public

- 5.3.2.2 Private

- 5.3.3 Hybrid

- 5.4 By Enterprise Size

- 5.4.1 Small and Medium-sized Enterprises (SMEs)

- 5.4.2 Large Enterprises

- 5.5 By Access Channel

- 5.5.1 VPN and Remote Login

- 5.5.2 Web and SaaS Applications

- 5.5.3 Mobile Workforce

- 5.6 By End-user Industry

- 5.6.1 Banking and Financial Institutions

- 5.6.2 Cryptocurrency and Web3 Exchanges

- 5.6.3 Technology (SaaS, IT Services, DevOps)

- 5.6.4 Government (Federal, State, Local, Integrators)

- 5.6.5 Healthcare and Pharmaceutical

- 5.6.6 Retail and E-commerce

- 5.6.7 Energy, Utilities and Manufacturing

- 5.6.8 Education, Immigration and Public Services

- 5.7 By Geography

- 5.7.1 North America

- 5.7.1.1 United States

- 5.7.1.2 Canada

- 5.7.2 South America

- 5.7.2.1 Brazil

- 5.7.2.2 Rest of South America

- 5.7.3 Europe

- 5.7.3.1 United Kingdom

- 5.7.3.2 Germany

- 5.7.3.3 France

- 5.7.3.4 Rest of Europe

- 5.7.4 Asia-Pacific

- 5.7.4.1 China

- 5.7.4.2 Japan

- 5.7.4.3 India

- 5.7.4.4 South Korea

- 5.7.4.5 Rest of Asia-Pacific

- 5.7.5 Middle East and Africa

- 5.7.5.1 Middle East

- 5.7.5.1.1 GCC

- 5.7.5.1.2 Turkey

- 5.7.5.1.3 Israel

- 5.7.5.1.4 Rest of Middle East

- 5.7.5.2 Africa

- 5.7.5.2.1 South Africa

- 5.7.5.2.2 Nigeria

- 5.7.5.2.3 Egypt

- 5.7.5.2.4 Rest of Africa

- 5.7.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves (Funding, Partnerships)

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Giesecke+Devrient GmbH

- 6.4.2 Thetis

- 6.4.3 GoTrustID Inc.

- 6.4.4 Thales Group

- 6.4.5 Duo Security (Cisco Systems Inc.)

- 6.4.6 RSA Security LLC

- 6.4.7 Okta Inc.

- 6.4.8 Google LLC (Alphabet Inc.)

- 6.4.9 Ping Identity Corp.

- 6.4.10 ManageEngine (Zoho Corp.)

- 6.4.11 Microsoft Corp.

- 6.4.12 TeleSign Corp. (Proximus Group)

- 6.4.13 HID Global Corp.

- 6.4.14 OneSpan Inc.

- 6.4.15 CyberArk Software Ltd.

- 6.4.16 ForgeRock Inc.

- 6.4.17 Entrust Corp.

- 6.4.18 SecureAuth Corp.

- 6.4.19 Symantec Corp. (Broadcom Inc.)

- 6.4.20 Keyless Technologies

- 6.4.21 Secret Double Octopus

- 6.4.22 Trusona Inc.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment