PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851462

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851462

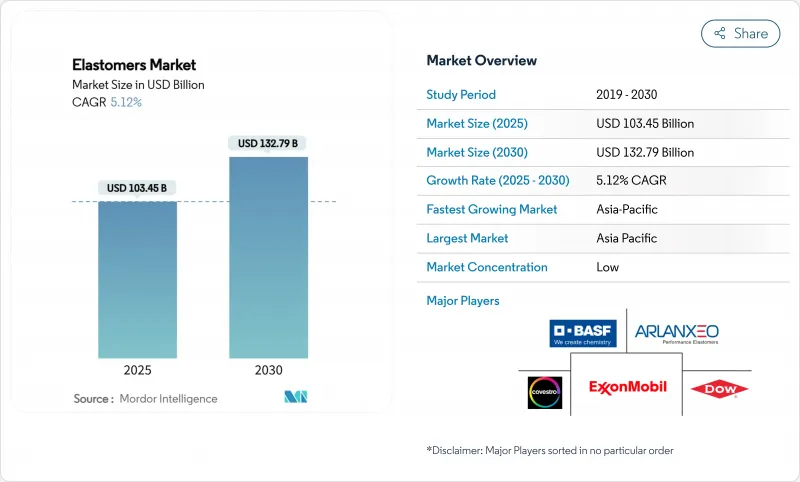

Elastomers - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Elastomers Market size is estimated at USD 103.45 billion in 2025, and is expected to reach USD 132.79 billion by 2030, at a CAGR of 5.12% during the forecast period (2025-2030).

The upward trajectory of the Elastomers market is tied to the material's ability to deliver weight reduction in automotive platforms, extend electric-vehicle range, and meet circular-economy expectations without sacrificing durability. Thermoplastic grades are displacing conventional rubbers because they melt-process on standard plastics equipment, cut cycle times, and enable closed-loop re-grind streams that lower scrap rates. Rapid urbanization in Asia Pacific and the push for energy-efficient buildings keep construction demand elevated, while medical device makers accelerate the shift away from PVC tubing toward biocompatible TPEs that survive sterilization.

Global Elastomers Market Trends and Insights

Growing Demand for Lightweighting and EV Parts in Automotive

Electric-vehicle makers rely on advanced elastomers to shave kilograms from battery housings, suspension boots, and fluid-handling lines, which directly boosts driving range. Materials such as Hytrel TPC LCF cut carbon footprints by 50% compared with incumbent polymers, yet keep flexibility under low-temperature shock. Commercial fleet owners echo the same need in heavy-duty packs, fueling multi-year programs for high-temperature gaskets and vibration isolators. Even in a year when global light-vehicle sales slipped, OEMs funneled research and development budgets toward lightweight sealing solutions, creating a counter-cyclical lift for the Elastomers market. Cooper Standard's Fortrex platform highlights the trend with a 53% mass reduction versus EPDM while extending service life. Charging-station manufacturers add to demand because elastomeric over-mold parts must tolerate thermal cycling during fast charging.

Expansion of Construction and Infrastructure in Asia-Pacific

High-rise projects and mega-transport corridors across China, India, and Southeast Asia use elastomeric sealants to enable movement joints, glazing systems, and waterproof membranes that maintain building envelope integrity under seismic loads. Government green-building codes reward the use of low-VOC, energy-saving materials, turning high-performance TPE and PU sealants into default specifications. Covestro's recent capacity ramp-up in Taiwan for cast polyurethane elastomers is aimed at equipment used in automated factories and wind-turbine components, reinforcing regional self-sufficiency. Smart-city investments generate incremental pulls from sensor housings and air-quality monitors that require UV-stable elastomer skins. Contractors favor locally compounded grades to avoid shipping delays, giving global suppliers a reason to co-locate with end-markets in the Elastomers market.

Volatile Crude Oil and Feedstock Prices

Producers such as BASF implemented 8-10 cents per pound surcharges on key diols to maintain margins. Tight supply obliges converters to balance inventories carefully, and some shift sourcing to bio-based feedstocks, although volumes remain limited. The volatility clouds budgeting and can postpone capital expenditure, dampening near-term expansion of the Elastomers market.

Other drivers and restraints analyzed in the detailed report include:

- Rapid Penetration of Thermoplastic Elastomers in Flexible Consumer Electronics

- Surge in Medical-Grade PVC-Free Tubing Applications

- Stricter Micro-Plastic and Tire-Wear Regulations

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Thermoplastic elastomers not only own 81.56% share of the Elastomers market but also log the fastest 5.35% CAGR to 2030, thanks to closed-loop reprocessability that helps OEMs hit recycling targets. This dominance means every major automotive window seal, wire harness grommet, and wearable band increasingly relies on TPE, often replacing cross-linked rubber to shorten molding cycles.

Thermoset elastomers maintain footholds where temperatures exceed 150 °C, for instance, in turbocharger hoses and oil-field packers. Yet even in these niches, hybrid concepts mix TPE outer layers with vulcanized cores to marry chemical resistance with recyclability. Research investment, therefore, centers on nucleating agents, block-copolymer design, and catalyst systems that lift the service temperature of TPE beyond 180 °C without eroding fatigue life. Such advances are expected to channel additional revenue into the Elastomers market while helping processors meet take-back mandates.

The Elastomers Report is Segmented by Product Type (Thermoplastic Elastomers and Thermoset Elastomers), End-User Industry (Automotive and Transportation, Electrical and Electronics, Medical and Healthcare, Industrial Machinery and Equipment, and More), and Geography (Asia-Pacific, North America, Europe, South America, and Middle-East and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia Pacific captures 42.34% of the Elastomers market and outpaces all other regions with a 6.56% CAGR. China remains the centerpiece, channeling elastomers into high-speed rail gaskets, appliance seals, and tire plants clustered along the Yangtze River Delta. India's state-sponsored industrial corridors likewise lift demand for vibration-dampening mounts used in capital equipment, while Southeast Asia's electronics clusters consume heat-resistant over-mold compounds for smartphones and tablets.

North America sustains the Elastomers market through its integrated supply chain for light vehicles, medical devices, and shale-gas infrastructure. Policy incentives for domestic EV battery plants intensify the procurement of flame-retardant TPE gaskets that seal cell enclosures. Europe pivots heavily toward sustainability, driving the adoption of bio-attributed EPDM and TPE blends verified under ISCC PLUS mass-balance systems.

South America, the Middle-East, and Africa post steady gains in infrastructure spending. Brazil's polyurethane output ranks fourth globally, while Gulf energy projects need sour-gas-resistant elastomer seals. Although smaller in absolute terms, these regions provide long-run upside as supply-chain localization continues.

- Ace Elastomer Co., Ltd.

- Arkema

- ARLANXEO

- Avient Corporation

- BASF

- Covestro AG

- DingZing Advanced Materials Co., Ltd.

- Dow

- Exxon Mobil Corporation

- Firestone Building Products Company

- HEXPOL AB

- Huntsman Corporation

- KRAIBURG TPE GmbH

- Kuraray Co., Ltd.

- Lion Elastomers Co., Ltd

- Mitsui Chemicals, Inc.

- Sirmax S.p.A

- Suzhou Austin Novel Materials Co., Ltd.

- Teknor Apex, Inc.

- Trinseo LLC

- UBE Corporation

- Wanhua Chemical Group Co., Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing demand for lightweighting and EV parts in automotive

- 4.2.2 Expansion of construction and infrastructure in Asia Pacific

- 4.2.3 Rapid penetration of Thermoplastic Elastomers (TPEs) in flexible consumer electronics

- 4.2.4 Surge in medical?grade PVC-free tubing applications

- 4.2.5 Emergence of recycling-compatible circular Thermoplastic Elastomers (TPE )grades

- 4.2.6 Additive manufacturing demand for elastomeric filaments

- 4.3 Market Restraints

- 4.3.1 Volatile crude oil and feedstock prices

- 4.3.2 Stricter micro-plastic and tire-wear regulations

- 4.3.3 Performance gap of bio-based elastomers at high-temperature

- 4.3.4 Supply-chain concentration of specialty monomers

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

5 Market Size and Growth Forecasts

- 5.1 By Product Type

- 5.1.1 Thermoplastic Elastomers

- 5.1.2 Thermoset Elastomers

- 5.2 By End-user Industry

- 5.2.1 Automotive and Transportation

- 5.2.2 Electrical and Electronics

- 5.2.3 Medical and Healthcare

- 5.2.4 Industrial Machinery and Equipment

- 5.2.5 Consumer Goods and Footwear

- 5.2.6 Adhesives, Sealants and Coatings

- 5.2.7 Others (Building and Construction, Aerospace and Defense, etc)

- 5.3 By Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Ace Elastomer Co., Ltd.

- 6.4.2 Arkema

- 6.4.3 ARLANXEO

- 6.4.4 Avient Corporation

- 6.4.5 BASF

- 6.4.6 Covestro AG

- 6.4.7 DingZing Advanced Materials Co., Ltd.

- 6.4.8 Dow

- 6.4.9 Exxon Mobil Corporation

- 6.4.10 Firestone Building Products Company

- 6.4.11 HEXPOL AB

- 6.4.12 Huntsman Corporation

- 6.4.13 KRAIBURG TPE GmbH

- 6.4.14 Kuraray Co., Ltd.

- 6.4.15 Lion Elastomers Co., Ltd

- 6.4.16 Mitsui Chemicals, Inc.

- 6.4.17 Sirmax S.p.A

- 6.4.18 Suzhou Austin Novel Materials Co., Ltd.

- 6.4.19 Teknor Apex, Inc.

- 6.4.20 Trinseo LLC

- 6.4.21 UBE Corporation

- 6.4.22 Wanhua Chemical Group Co., Ltd.

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-need Assessment

- 7.2 Shifting Focus toward the Development of Bio-based Products