PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851463

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851463

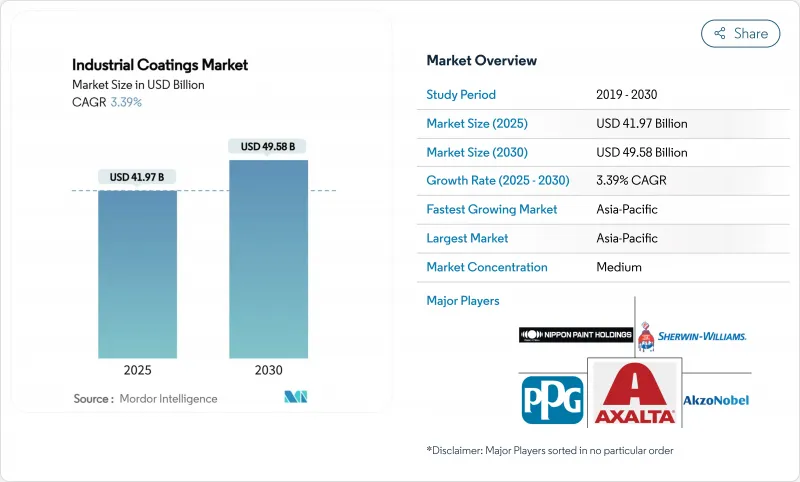

Industrial Coatings - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Industrial Coatings Market size is estimated at USD 41.97 billion in 2025, and is expected to reach USD 49.58 billion by 2030, at a CAGR of 3.39% during the forecast period (2025-2030).

The market's momentum is shaped by the accelerating adoption of nanotechnology, which improves coating performance while reducing material usage, and by a rapid substitution of solvent-borne products with sustainable water-borne and powder technologies. Asia-Pacific leads with a 51% share in 2024, powered by extensive infrastructure investments and manufacturing growth in China and India. Epoxy resins dominate with a 31% share, advancing at a 6% CAGR on account of their superior chemical resistance and adhesion properties, making them indispensable in high-performance applications across energy, infrastructure, and heavy industry. Regulatory mandates on volatile organic compounds (VOCs) are tightening globally, prompting manufacturers to accelerate innovation in low- and zero-VOC chemistries and thereby creating fresh opportunities for producers equipped with green technologies. Meanwhile, consolidation is accelerating as leading suppliers acquire specialized firms to bolster regional reach and technology depth, even as more than 20 sizable competitors maintain a fragmented landscape.

Global Industrial Coatings Market Trends and Insights

Rising Demand for Protective Coatings: Corrosion Mitigation Drives Innovation

Protective coatings have become pivotal as asset owners prioritize durability and lifecycle cost control. Products such as NEI Corporation's NANOMYTE TC-3001 offer up to 15 years of corrosion resistance with minimal maintenance, enabling operators to defer capital-intensive replacements. Downstream oil refineries, chemical plants, and offshore platforms increasingly specify multi-layer epoxy and zinc-rich systems that deliver both barrier and cathodic protection. The integration of embedded sensors within these coatings is shifting maintenance strategies from reactive inspections to predictive analytics, cutting unexpected downtime while preserving safety. Concurrently, governments are mandating longer service lives for public infrastructure, a requirement that boosts demand for next-generation solutions able to withstand coastal salinity, de-icing salts, and industrial pollutants. Collectively, these dynamics reinforce the industrial coatings market's focus on research that extends coating lifespan without increasing film thickness or curing time.

Increasing Applications in Oil and Gas Industry: Specialized Solutions for Extreme Conditions

Deep-water and high-temperature wells challenge conventional coatings, driving innovation toward hybrid chemistries that combine epoxy phenolics with ceramic or silicone components for enhanced resistance to hydrocarbons and temperatures exceeding 150 °C. PPG's purpose-built systems guard subsea pipelines from sour gas, while offering intumescent fire protection on topside structures in one integrated scheme. Coating designs are also evolving to tolerate high-pressure carbon dioxide streams expected in large-scale carbon capture and storage (CCS) projects. Localized suppliers in the Middle East are licensing these advanced technologies to meet rapidly expanding regional drilling programs, although stringent qualification protocols lengthen product adoption cycles. As the industry invests in digital twins for asset integrity, coatings compatible with remote condition-monitoring embedment stand to gain further traction, reinforcing the oil and gas sector's strategic importance to the industrial coatings market.

Harmful Environmental Impact of Solvent-borne Coating: Regulatory Pressure Accelerates Transition

Fresh limits on volatile organic compounds (VOC) in the United States and the European Economic Area have tightened allowable emissions for industrial paint shops, forcing operators to install abatement equipment or switch to low-solvent alternatives. Water-borne and powder varieties are therefore capturing incremental Industrial Coatings market size even when total painted surface area expands only modestly. Suppliers that retrofit existing dispersion lines instead of constructing new solvent facilities illustrate a calculated response to lifetime cost, signaling confidence that environmental compliance spending will tilt decisively toward alternative chemistries. As early movers win multi-year supply contracts on sustainability credentials, they reinforce a feedback loop that makes regulatory alignment a prerequisite for market entry rather than a competitive bonus.

Other drivers and restraints analyzed in the detailed report include:

- Infrastructure Development & Urbanization: Driving Demand for Durable Solutions

- Sustainability-Driven Shift Toward Low-VOC Technologies: Regulatory Pressure Accelerates Transition

- Fluctuating Raw Material Prices: Supply Chain Vulnerabilities Impact Market Dynamics

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Epoxy coatings represented 31% of the industrial coatings market in 2024, while polyurethane is projected to grow at a 5.02% CAGR, firmly outpacing the overall industry. Their leadership stems from exceptional adhesion, chemical resistance, and compatibility with a broad spectrum of substrates, enabling widespread adoption in refineries, wastewater plants, and fabrication workshops. Hybrid nano-silica-modified epoxies are emerging, delivering superior abrasion resistance while maintaining low VOC levels, which satisfies regulatory calls for greener solutions. In contrast, polyurethane resins are gradually taking share in exterior segments where UV stability and flexibility are critical, particularly in wind-turbine towers and railcars. Acrylics retain an important niche in light-duty equipment due to fast dry-to-touch times and low cost, and recent capital investments such as Lubrizol's USD 20 million expansion in North Carolina signal continued growth potential in water-borne acrylic emulsions.

Epoxy suppliers intensify R&D to shorten recoat windows and meet rapid project schedules, a top procurement criterion for contractors seeking to finish multiple passes in a single shift. Solvent-free novolac epoxies that tolerate moisture during cure are gaining momentum on offshore platforms, reducing weather-related delays. Meanwhile, halloysite-nanotube enhancements deliver double-digit improvements in salt-spray performance without altering formulation viscosity, attracting pipeline owners committed to 30-year service targets. Collectively, these advances strengthen the industrial coatings market's reliance on epoxy chemistries for critical-service duties, while opening incremental opportunities for polyurethane and acrylic innovators in less aggressive environments within the industrial coatings industry.

Solvent-borne coatings retained a 37% share of the industrial coatings market in 2024, while water-borne posting a resilient 4.89% CAGR thanks to their proven performance across diverse climatic zones. However, water-borne products now capture a growing share of maintenance repaints as contractors adapt to lower solvent levels, odor reduction, and safer handling requirements. The industrial coatings market share for water-borne technologies on heavy machinery is expected to rise by 2030 as phase-in periods for tightened VOC limits expire in Europe and North America. Powder coatings, free of solvents, remain the fastest-growing platform, adding capacity for agricultural equipment and appliance exteriors. Sherwin-Williams' Powdura ECO line integrates recycled polyethylene terephthalate (rPET) without sacrificing corrosion resistance, illustrating sustainable innovation that resonates with brand owners' circular-economy commitments.

UV-curable coatings, which provide instant throughput and slash oven-energy use by up to 95%, are penetrating wood flooring, electronics housings, and metal packaging segments. Nevertheless, their line-of-sight limitation and substrate temperature sensitivity restrain adoption in complex geometries. In the broader industrial coatings market, asset owners weigh total applied cost, performance, and regulatory compliance, leading many to adopt hybrid schemes that blend water-borne primers with solvent-borne or polyurethane topcoats for balanced properties. Over the forecast horizon, formulators are expected to refine amine-free accelerators and fast-dry alkyd emulsions to unlock further water-borne growth within the industrial coatings market.

The Industrial Coatings Market Report Segments the Industry by Resin Type (Epoxy, Polyurethane, and More), Technology (Solvent-Borne, Water-Borne, and More), End-Use Industry (General Industrial, and Protective Coatings), Substrate (Metal and Concrete), and Geography (Asia-Pacific, North America, Europe, South America, and Middle East and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific secured a 51% share of the industrial coatings market in 2024 and is poised to grow at a 4.31% CAGR through 2030. China commands heavy investment in petrochemical complexes and electric-vehicle manufacturing, while India's National Infrastructure Pipeline underwrites coatings demand for highways, airports, and railways. Multinational suppliers localize production to avoid tariffs and reduce lead times, evidenced by recent joint ventures in Vietnam and Thailand that integrate resin polymerization and finished-paint blending under one roof.

North America exhibits modest volume growth but strong value expansion as asset owners shift to premium, high-solids technologies. PPG's divestment of its U.S. and Canadian architectural coatings unit for USD 550 million allows management to redeploy capital toward its industrial coatings portfolio, including robotics-enabled powder lines. Infrastructure law outlays accelerate demand for bridge and pipeline coatings across the United States, while Canada's decarbonization roadmap incentivizes the adoption of low-VOC, renewable-electricity-based production.

Europe remains a technology leader, driven by strict VOC limits and ambitious climate-neutrality targets. BASF's decision to power key German and Dutch coating plants entirely with renewable electricity eliminates 11,000 tons of CO2 annually and strengthens its value-proposition for OEMs pursuing Scope 3 emission reductions. The region is also seeing early commercialization of bio-based alkyds sourced from non-food oil crops, though industrial customers demand rigorous durability validation before widespread adoption.

The Middle East & Africa, while owning a smaller share, records some of the highest growth rates as mega-projects such as Saudi Arabia's NEOM drive demand for advanced metal and concrete protective systems. Local formulators align with multinational technology partners to meet stringent fire- and corrosion-protection specifications required for high-salinity, high-UV desert environments. South America, led by Brazil, benefits from petrochemical investments and continued urbanization, though macroeconomic uncertainty tempers public-sector capital spending. Across these developing regions, knowledge transfer initiatives and localized training programs bolster applicator proficiency, a critical factor in realizing the full performance potential of modern industrial coatings.

- 3M

- AkzoNobel N.V.

- Arkema

- Asian Paints

- Axalta Coating Systems

- BASF SE

- Beckers Group

- Chugoku Marine Paints Ltd.

- Daikin Industries Ltd.

- Hempel A/S

- Henkel AG & Co. KGaA

- Jotun

- Kansai Paint Co., Ltd.

- Nippon Paint Holdings Co., Ltd.

- OC Oerlikon Management AG

- PPG Industries, Inc.

- RPM International Inc.

- Rust-Oleum Corporation

- Sika AG

- The Sherwin-Williams Company

- Tikkurila

- Wacker Chemie AG

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Demand for Protective Coatings

- 4.2.2 Increasing Applications in Oil and Gas Industry

- 4.2.3 Infrastructure Development and Urbanization

- 4.2.4 Growing Demand in Power and Marine Sectors

- 4.2.5 Rising Awareness of the Importance of Aesthetic Value

- 4.3 Market Restraints

- 4.3.1 Harmful Environmental Impact Of Solvent-borne Coating

- 4.3.2 Fluctuating Raw Material Prices

- 4.3.3 Availability of Alternative Coating Products

- 4.4 Value Chain Analysis

- 4.5 Regulatory Outlook

- 4.6 Porter's Five Forces

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitutes

- 4.6.5 Degree of Competition

5 Market Size and Growth Forecasts (Value)

- 5.1 By Resin Type

- 5.1.1 Epoxy

- 5.1.2 Polyurethane

- 5.1.3 Acrylic

- 5.1.4 Polyester

- 5.1.5 Other Resins (Alkyd, Fluoropolymer, Vinyl Ester)

- 5.2 By Technology

- 5.2.1 Solvent-borne

- 5.2.2 Water-borne

- 5.2.3 Powder

- 5.2.4 UV Technology

- 5.3 By End-use Industry

- 5.3.1 General Industrial

- 5.3.2 Protective Coatings

- 5.3.2.1 Oil and Gas

- 5.3.2.2 Mining

- 5.3.2.3 Power

- 5.3.2.4 Infrastructure

- 5.3.2.5 Other Protective Coatings

- 5.4 By Substrate

- 5.4.1 Metal

- 5.4.2 Concrete

- 5.5 By Geography

- 5.5.1 Asia-Pacific

- 5.5.1.1 China

- 5.5.1.2 India

- 5.5.1.3 Japan

- 5.5.1.4 South Korea

- 5.5.1.5 ASEAN

- 5.5.1.6 Australia

- 5.5.1.7 New Zealand

- 5.5.1.8 Rest of Asia-Pacific

- 5.5.2 North America

- 5.5.2.1 United States

- 5.5.2.2 Canada

- 5.5.2.3 Mexico

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Russia

- 5.5.3.6 Nordics

- 5.5.3.7 Rest of Europe

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Chile

- 5.5.4.4 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 Saudi Arabia

- 5.5.5.2 United Arab Emirates

- 5.5.5.3 Turkey

- 5.5.5.4 South Africa

- 5.5.5.5 Nigeria

- 5.5.5.6 Rest of Middle-East and Africa

- 5.5.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)}

- 6.4.1 3M

- 6.4.2 AkzoNobel N.V.

- 6.4.3 Arkema

- 6.4.4 Asian Paints

- 6.4.5 Axalta Coating Systems

- 6.4.6 BASF SE

- 6.4.7 Beckers Group

- 6.4.8 Chugoku Marine Paints Ltd.

- 6.4.9 Daikin Industries Ltd.

- 6.4.10 Hempel A/S

- 6.4.11 Henkel AG & Co. KGaA

- 6.4.12 Jotun

- 6.4.13 Kansai Paint Co., Ltd.

- 6.4.14 Nippon Paint Holdings Co., Ltd.

- 6.4.15 OC Oerlikon Management AG

- 6.4.16 PPG Industries, Inc.

- 6.4.17 RPM International Inc.

- 6.4.18 Rust-Oleum Corporation

- 6.4.19 Sika AG

- 6.4.20 The Sherwin-Williams Company

- 6.4.21 Tikkurila

- 6.4.22 Wacker Chemie AG

7 Market Opportunities and Future Outlook

- 7.1 Technological Advancements in Coating Formulations

- 7.2 White-space and Unmet-need Assessment