PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851469

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851469

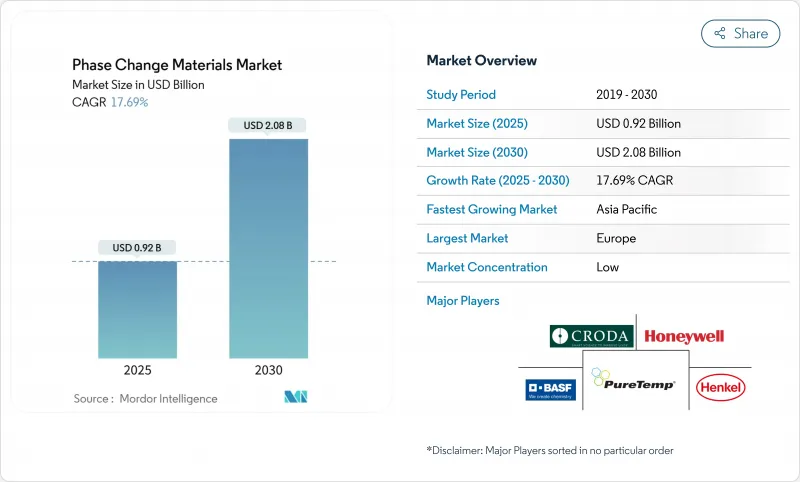

Phase Change Materials - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Phase Change Materials Market size is estimated at USD 0.92 billion in 2025, and is expected to reach USD 2.08 billion by 2030, at a CAGR of 17.69% during the forecast period (2025-2030).

Lengthening heat waves, net-zero construction goals, and rapid electrification in transport now place latent-heat storage at the center of commercial energy strategies. Mandatory building-energy codes in Europe and North America are accelerating integration, while cold-chain logistics and electric-vehicle battery packs expand the technology's reach into transportation, pharmaceuticals, and data-center cooling. Longly constrained by phase-separation and supercooling issues, salt hydrates are gaining traction after recent conductivity breakthroughs. At the same time, bio-based PCMs derived from agricultural residues have moved from laboratory curiosity to scalable commercial products, addressing fire safety and sustainability concerns without sacrificing thermal capacity. Regionally, Asia-Pacific is evolving into the fulcrum for capacity additions as manufacturers add local production lines to hedge supply-chain risk linked to high-purity salt hydrates.

Global Phase Change Materials Market Trends and Insights

Mandatory Building-Energy Codes Accelerating PCM Integration

Performance-based compliance criteria now allow architects to substitute rigid insulation with latent-heat storage layers, unlocking a 35-45% reduction in peak cooling loads within lightweight walls. Measured field results in Minnesota reported a 5.49 °C drop in peak indoor temperature plus a 77.8% load shift toward off-peak hours, providing regulators with real-world evidence of HVAC savings. Rising compliance thresholds for 2027 EU renovation targets are expected to place additional emphasis on PCM-infused gypsum boards and concrete blocks, thereby lifting procurement volumes across the Phase Change Material market.

Rapid Deployment of Cold-Chain Logistics Infrastructure

Vaccines, advanced biologics, and precision meats require temperature bands that often tolerate a +-0.5 °C deviation for less than three days. PCMs extend that holdover to 72 hours without external power, cutting diesel-generator reliance during airport or customs delays. Glycerol-water-NaCl blends slash carbon footprints 30-40% versus active cooling and lift pharmaceutical shelf life by 15-25%, feeding double-digit demand across the Phase Change Material market.

Hazardous Nature of Phase Change Materials

Paraffin waxes ignite at roughly 170 °C and require brominated flame retardants that add cost and can trigger health-labeling restrictions. Inorganic candidates such as LiNO3 present toxicity risks. Recent in-situ polymerized solid-solid PCMs eliminate leakage, passing UL94 V-0 flammability without halogens. Broader adoption hinges on scaling these encapsulation advances and harmonizing global chemical safety standards.

Other drivers and restraints analyzed in the detailed report include:

- Electrification of Vehicles Necessitating Advanced Thermal Battery Packs

- Government Incentives for Net-Zero Buildings Propelling Bio-Based PCM Adoption

- Supply-Chain Volatility of High-Purity Salt Hydrates

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Organic paraffin waxes remain the revenue anchor for the Phase Change Material market, accounting for 44.19% of global sales in 2024. Their dominance reflects mature supply chains, broad temperature coverage, and compatibility with macro-encapsulation slabs used in building panels. Yet the Phase Change Material market is witnessing a sharp pivot toward bio-derived oils, tallow, and fatty-acid blends as stakeholders chase lower life-cycle emissions. The emergent sub-segment is forecast to outpace all others at 19.21% CAGR to 2030, buoyed by LEED credits and municipal green-procurement mandates that explicitly endorse biogenic materials.

Paraffin-based formulations captured 41.49% of the Phase Change Material market revenue in 2024 due to their stable crystallization and ease of tailoring melting points across the 0-90 °C spectrum. Even so, salt hydrates are on course to disrupt that hierarchy, expanding at an 18.04% CAGR through 2030. High volumetric heat capacity (up to 350 kJ/L) and thermal conductivity improvements via carbon additives are allowing salt hydrates to shrink component size and weight. The resulting density advantage is especially attractive for electric-vehicle battery sleeves and compact data-center racks, where available footprint is constrained.

The Phase Change Material Market Report Segments the Industry by Product Type (Organic, Inorganic, and Bio-Based), Chemical Composition (Paraffin, Non-Paraffin Hydrocarbons, and More), Encapsulation Technology (Macro-Encapsulation, and More), End-User Industry (Building and Construction, Packaging, Textiles, Electronics, and More), and Geography (Asia-Pacific, North America, Europe, South America, and Middle-East and Africa).

Geography Analysis

Europe held 32.86% of global sales in 2024, underpinned by the EU's Energy Performance of Buildings Directive, which compels both new construction and deep-renovation projects to hit quasi-net-zero targets. Early adopters in Germany and the Nordics have shown 20-35% HVAC energy savings after embedding PCMs into external wall insulation systems. Regulatory clarity around carbon trading and green-bond eligibility continues to draw capital toward PCM-rich building materials, consolidating Europe's leadership position in the Phase Change Material market.

Asia-Pacific is the fastest-growing region, anticipated to expand 18.98% annually through 2030. China's aggressive heat-pump rollout complements PCM thermal storage by shaving peak electricity demand, a synergy encouraged under the "Future of Heat Pumps" roadmap.

North America combines stringent energy-code updates with an exploding electric-vehicle sector. Data-center operators in the United States, drawn by tax credits for on-site energy storage, pilot PCM-based thermal buffers to absorb server heat spikes and postpone chiller start-up.

- BASF

- Appvion, LLC.

- Climator

- Croda International Plc

- Cryopak

- DuPont

- Henkel AG & Co. KGaA

- Honeywell International Inc.

- Laird Technologies, Inc.

- Microtek

- National Gypsum Services Company

- Outlast Technologies GmbH

- Parker Hannifin Corp

- Phase Change Solutions

- Pluss Advanced Technologies

- PureTemp LLC

- Rubitherm Technologies GmbH

- Shenzhen Aochuan Technology Co.,Ltd.

- Shin-Etsu Chemical Co., Ltd.

- Sonoco Products Company

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Mandatory Building-Energy Codes in Europe and North America Accelerating PCM Integration

- 4.2.2 Rapid Deployment of Cold-Chain Logistics Infrastructure

- 4.2.3 Electrification of Vehicles Necessitating Advanced Thermal Battery Packs Using Salt-Hydrate PCMs

- 4.2.4 Government Incentives for Net-Zero Buildings Propelling Bio-based PCM Adoption

- 4.2.5 Expanding Global Trend Towards Energy Conservation and Sustainable Development

- 4.3 Market Restraints

- 4.3.1 Hazardous Nature of Phase Change Materials

- 4.3.2 Supply-Chain Volatility of High-Purity Salt Hydrates

- 4.3.3 Limited Awareness and Understanding

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

- 4.6 Raw-Material Analysis

- 4.7 Patent Analysis

5 Market Size and Growth Forecasts (Value)

- 5.1 By Product Type

- 5.1.1 Organic

- 5.1.2 Inorganic

- 5.1.3 Bio-based

- 5.2 By Chemical Composition

- 5.2.1 Paraffin

- 5.2.2 Non-Paraffin Hydrocarbons

- 5.2.3 Salt Hydrates

- 5.2.4 Eutectics

- 5.3 By Encapsulation Technology

- 5.3.1 Macro-encapsulation

- 5.3.2 Micro-encapsulation

- 5.3.3 Molecular Encapsulation

- 5.4 By End-user Industry

- 5.4.1 Building and Construction

- 5.4.2 Packaging

- 5.4.3 Textiles

- 5.4.4 Electronics

- 5.4.5 Transportation

- 5.4.6 Other Industries (Healthcare, Defense)

- 5.5 By Geography

- 5.5.1 Asia-Pacific

- 5.5.1.1 China

- 5.5.1.2 India

- 5.5.1.3 Japan

- 5.5.1.4 South Korea

- 5.5.1.5 Rest of Asia-Pacific

- 5.5.2 North America

- 5.5.2.1 United States

- 5.5.2.2 Canada

- 5.5.2.3 Mexico

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Rest of Europe

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Rest of South America

- 5.5.5 Middle-East and Africa

- 5.5.5.1 Saudi Arabia

- 5.5.5.2 South Africa

- 5.5.5.3 Rest of Middle-East and Africa

- 5.5.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves (Mergers and Acquistions, JV, Collaboration, Funding)

- 6.3 Market Share(%)/Ranking Analysis

- 6.4 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, and Recent Developments)}

- 6.4.1 BASF

- 6.4.2 Appvion, LLC.

- 6.4.3 Climator

- 6.4.4 Croda International Plc

- 6.4.5 Cryopak

- 6.4.6 DuPont

- 6.4.7 Henkel AG & Co. KGaA

- 6.4.8 Honeywell International Inc.

- 6.4.9 Laird Technologies, Inc.

- 6.4.10 Microtek

- 6.4.11 National Gypsum Services Company

- 6.4.12 Outlast Technologies GmbH

- 6.4.13 Parker Hannifin Corp

- 6.4.14 Phase Change Solutions

- 6.4.15 Pluss Advanced Technologies

- 6.4.16 PureTemp LLC

- 6.4.17 Rubitherm Technologies GmbH

- 6.4.18 Shenzhen Aochuan Technology Co.,Ltd.

- 6.4.19 Shin-Etsu Chemical Co., Ltd.

- 6.4.20 Sonoco Products Company

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment

- 7.2 Development of Phase Change Thermal Interface Material