PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851472

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851472

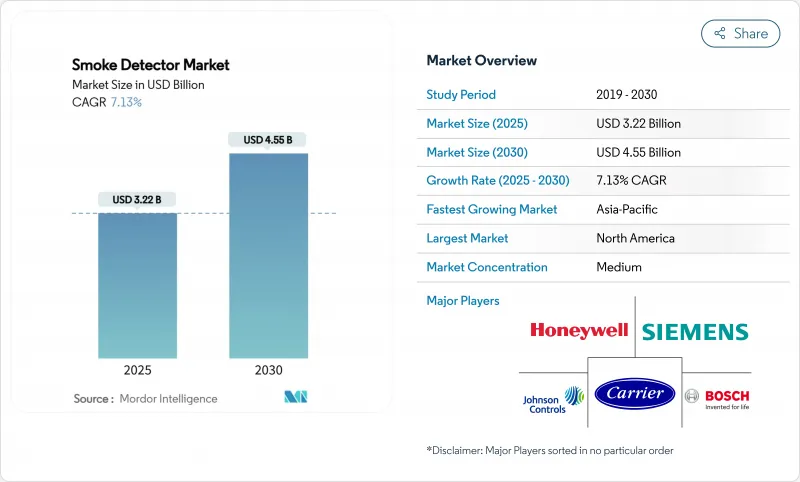

Smoke Detector - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The smoke detector market size is estimated at USD 3.22 billion in 2025 and is on track to register a 7.13% CAGR, lifting revenues to USD 4.55 billion by 2030.

Growth is propelled by stricter fire-safety codes, ongoing urban construction, and a rapid swing toward smart, insured-incentivized devices that cut false alarms and lower premiums. Construction rules in North America, the EN 54 framework in Europe, and China's GB 55037-2022 retrofit mandate continue to widen the installed base of interconnected alarms, while dual-sensor and aspirating technologies address the false-alarm problem in complex sites. Photoelectric products keep their lead in low-smolder risk dwellings, yet multi-sensor systems are winning big in offices, malls, and warehouses that now face both code and insurer scrutiny. Manufacturers concentrate on sealed lithium batteries and addressable IoT modules to reduce maintenance and deliver real-time data to building management platforms. The competitive field stays moderately fragmented as global leaders acquire niche innovators, while new entrants push low-cost, app-ready designs for emerging markets.

Global Smoke Detector Market Trends and Insights

Mandatory Interconnection of Residential Smoke Alarms in US & Canada

The 24 CFR § 3280.209 update obliges every new or replacement alarm in US manufactured housing to be hard-wired and interconnected, triggering all units when one senses smoke. The International Code Council's R314 clause mirrors this requirement for site-built dwellings, creating a large retrofit wave as owners replace aging stand-alone devices. Canada follows with similar rules in its National Fire Code, and Ontario's Fire Code enforces interconnection in both dwelling units and guest suites. As builders comply, shipment volumes of multi-linkable devices increase, and insurers lower premiums, further pushing adoption. Vendors respond with combo wired-wireless mesh solutions that simplify upgrades in existing housing stock.

EN 54-29 Multi-Sensor Requirement Accelerating Commercial Retrofits in Europe

EN 54-29 aligns smoke, heat, and CO sensing under one certified multi-sensor head, reducing nuisance triggers in busy commercial spaces. Germany and Belgium now demand EN 54-13 system-wide compatibility, compelling hotels, malls, and offices to swap legacy single-technology detectors for type-approved hybrids. Fire services treat validated multi-sensor signals as confirmed fires, trimming costly call-outs and underwriting risk, a perk amplified by some insurers offering premium credits. Systems integrators see higher project margins as they bundle detectors with addressable panels and cloud analytics. Retrofits gather pace in the UK, France, and Nordics where energy-efficient refurbishments are underway.

Am-241 Isotope Supply Constraints for Ionization Chambers

Los Alamos National Laboratory resumed domestic Am-241 production, yet volumes remain tight and ramp-up is complex. Geopolitical frictions limit Russian exports, the traditional fallback source. Manufacturers hedge by redesigning lines around photoelectric or dual-sensor heads, but cost-sensitive buyers still prefer ionization for fast-flame detection. Spot shortages lift component prices, pressuring margins and widening the price gap to photoelectric models across Latin America and Africa.

Other drivers and restraints analyzed in the detailed report include:

- China's 2024 GB50116 Code Upgrade for High-Rise Buildings

- 10-Year Sealed Lithium-Battery Retrofits Reducing Maintenance Costs in Europe

- Installation Skill Gap in ASEAN Code-Compliant Deployment

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Photoelectric models held 34% share of the smoke detector market in 2024, favored by codes targeting smoldering-fire risk in homes. Dual-sensor units, blending ionization and photoelectric principles, post the fastest 9.5% CAGR as commercial codes demand broader coverage. Ionization heads still sell into low-income housing but face Am-241 constraints, while beam detectors secure spots in atria and stadiums that require long-range line-of-sight. Aspirating systems occupy the premium tier, with Honeywell's FAAST FLEX gaining mindshare in dusty industrial zones where false alarms risk downtime.

The regulatory tilt toward multi-sensor adoption is reshaping R&D budgets. A Nature study proves capacitive particle analysis can recognize smoke versus steam at ppm levels, enabling smarter algorithms. EN 54 uniformity allows mixed-vendor sensors to plug into common panels, cutting integrator risk. Video smoke detection, already piloted in oil-gas plants, may disrupt point sensors by identifying smoke in seconds, though high bandwidth limits mainstream use until costs fall.

Battery-powered devices retained 44% share of the smoke detector market in 2024 because retrofits seldom add wiring. Yet hard-wired units with battery backup display the strongest 8.8% CAGR as codes insist alarms keep working during outages. Sealed 10-year lithium packs gain favor in Europe, saving annual maintenance and preventing user tampering. Solar-assisted heads and energy-harvesting micro-generators remain niche, restricted to remote mining or telecom shelters.

Total cost of ownership guides buyer choice more than sticker price. Denver Fire Department promotes lithium-battery alarms to reduce callouts for chirping low-battery alerts. OEM dashboards now flag battery health, letting property managers replace units proactively. Research projects explore energy-scavenging from building HVAC vibration, but commercial readiness is at least five years out.

The Smoke Detector Market Report is Segmented by Sensor Type (Photoelectric, Ionization, Dual-Sensor, Beam, and More), Power Source (Battery-Powered, Hard-Wired, and More), Connectivity (Stand-Alone/Conventional, Addressable, Smart/IoT-Enabled), End-User (Residential, Commercial, Industrial, and More), Distribution Channel, and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America contributed 40% of 2024 revenue for the smoke detector market, energized by tight building codes and widespread insurer incentives. US manufactured housing rules require hard-wired interconnected alarms, while Canada's Fire Code mirrors those clauses. State Farm's distribution of 2 million Ting sensors exemplifies the insurer-driven smart pivot, and Liberty Mutual offers tiered premiums for Google-branded detectors. Mexico's industrial corridors adopt aspirating systems to safeguard export warehouses serving near-shoring brands.

Asia Pacific records the fastest 8.4% CAGR for 2025-2030. China's GB 55037-2022 dictates detector networks in all high-rise residences and pushes IoT integration with property-management dashboards, lifting the smoke detector market size for the region dramatically through 2030. Japan adopts multi-sensor products to solve dense urban building challenges, while India's smart-city projects politely skip LoRaWAN owing to budget but favor addressable lines in metro stations. ASEAN nations struggle with installer shortages, delaying some projects despite rising awareness.

Europe maintains mid-single-digit growth as EN 54 harmonization underpins retrofits. Germany and Belgium enforce EN 54-13 compatibility proof, boosting demand for full-system upgrades. The UK's false-alarm charging adds an extra hurdle yet simultaneously pressures owners to invest in better technology once bedding-in risks pass. Nordic countries champion sealed lithium designs to cut maintenance. Southern Europe leans on hospitality builds, where tourism rebounds and owners replace 1990s-era ionization heads with dual-sensor units to meet new insurance clauses.

- Honeywell International Inc.

- Siemens AG

- Johnson Controls International plc

- Robert Bosch GmbH

- Hochiki Corporation

- ABB Ltd

- Carrier Global (Kidde)

- Resideo Technologies (First Alert/BRK)

- Google LLC (Nest Labs)

- Schneider Electric SE

- Panasonic Corporation

- Apollo Fire Detectors Ltd (Halma plc)

- X-Sense (Shenzhen Huidu)

- Hekatron Brandschutz

- Fike Corporation

- Nittan Co., Ltd.

- Mircom Group of Companies

- Tyco (Johnson Controls Fire Protection)

- Ei Electronics

- Hochiki America

- Bosch Security Systems

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Mandatory Interconnection of Residential Smoke Alarms in US and Canada

- 4.2.2 EN 54-29 Multi-Sensor Requirement Accelerating Commercial Retrofits in Europe

- 4.2.3 China's 2024 GB50116 Code Upgrade for High-Rise Buildings

- 4.2.4 10-Year Sealed Lithium-Battery Retrofits Reducing Maintenance Costs in Europe

- 4.2.5 Insurance Premium Discounts for IoT-Connected Detectors

- 4.2.6 E-Commerce Warehousing Boom Driving Aspirating Detectors

- 4.3 Market Restraints

- 4.3.1 Am-241 Isotope Supply Constraints for Ionization Chambers

- 4.3.2 Installation Skill Gap in ASEAN Code-Compliant Deployment

- 4.3.3 False-Alarm Liability Slowing UK Multi-Sensor Adoption

- 4.3.4 High Up-Front Cost of LoRaWAN/BLE Smart Detectors in India and Brazil

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Outlook

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Sensor Type

- 5.1.1 Photoelectric

- 5.1.2 Ionization

- 5.1.3 Dual-Sensor (Ionization + Photoelectric)

- 5.1.4 Beam

- 5.1.5 Aspirating / Air-Sampling

- 5.2 By Power Source

- 5.2.1 Battery-Powered

- 5.2.2 Hard-Wired

- 5.2.3 Hard-Wired with Battery Backup

- 5.2.4 Solar and Energy-Harvesting

- 5.3 By Connectivity

- 5.3.1 Stand-Alone / Conventional

- 5.3.2 Addressable

- 5.3.3 Smart / IoT-Enabled

- 5.4 By End-User

- 5.4.1 Residential

- 5.4.2 Commercial

- 5.4.2.1 Corporate Offices

- 5.4.2.2 Hospitality and Leisure

- 5.4.2.3 Education Facilities

- 5.4.2.4 Healthcare Facilities

- 5.4.2.5 Retail and Malls

- 5.4.3 Industrial

- 5.4.3.1 Oil and Gas

- 5.4.3.2 Manufacturing Plants

- 5.4.3.3 Data Centers

- 5.4.4 Transportation and Logistics

- 5.4.4.1 Aviation

- 5.4.4.2 Marine

- 5.4.4.3 Rail and Metro

- 5.5 By Distribution Channel

- 5.5.1 Direct / System Integrators

- 5.5.2 Indirect

- 5.5.2.1 Offline Retail / Wholesale

- 5.5.2.2 Online (E-commerce)

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 Europe

- 5.6.2.1 United Kingdom

- 5.6.2.2 Germany

- 5.6.2.3 France

- 5.6.2.4 Italy

- 5.6.2.5 Rest of Europe

- 5.6.3 Asia-Pacific

- 5.6.3.1 China

- 5.6.3.2 Japan

- 5.6.3.3 India

- 5.6.3.4 South Korea

- 5.6.3.5 Rest of Asia-Pacific

- 5.6.4 Middle East

- 5.6.4.1 Israel

- 5.6.4.2 Saudi Arabia

- 5.6.4.3 United Arab Emirates

- 5.6.4.4 Turkey

- 5.6.4.5 Rest of Middle East

- 5.6.5 Africa

- 5.6.5.1 South Africa

- 5.6.5.2 Egypt

- 5.6.5.3 Rest of Africa

- 5.6.6 South America

- 5.6.6.1 Brazil

- 5.6.6.2 Argentina

- 5.6.6.3 Rest of South America

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Honeywell International Inc.

- 6.4.2 Siemens AG

- 6.4.3 Johnson Controls International plc

- 6.4.4 Robert Bosch GmbH

- 6.4.5 Hochiki Corporation

- 6.4.6 ABB Ltd

- 6.4.7 Carrier Global (Kidde)

- 6.4.8 Resideo Technologies (First Alert/BRK)

- 6.4.9 Google LLC (Nest Labs)

- 6.4.10 Schneider Electric SE

- 6.4.11 Panasonic Corporation

- 6.4.12 Apollo Fire Detectors Ltd (Halma plc)

- 6.4.13 X-Sense (Shenzhen Huidu)

- 6.4.14 Hekatron Brandschutz

- 6.4.15 Fike Corporation

- 6.4.16 Nittan Co., Ltd.

- 6.4.17 Mircom Group of Companies

- 6.4.18 Tyco (Johnson Controls Fire Protection)

- 6.4.19 Ei Electronics

- 6.4.20 Hochiki America

- 6.4.21 Bosch Security Systems

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-Space and Unmet-Need Assessment