PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851477

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851477

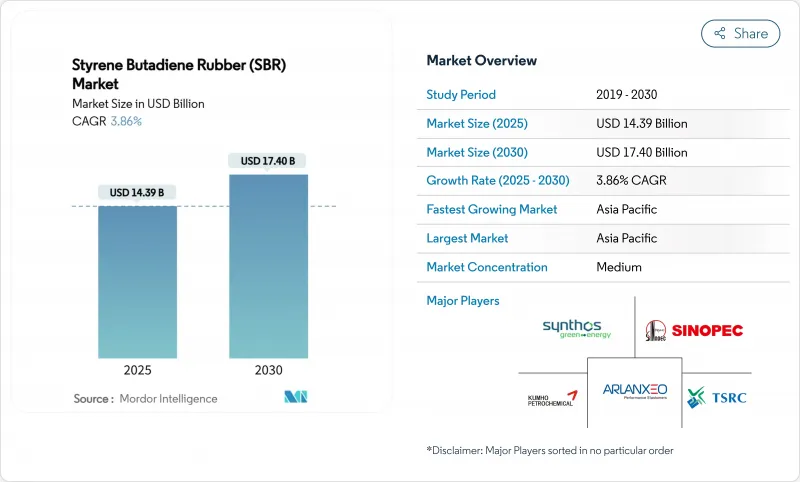

Styrene Butadiene Rubber (SBR) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Styrene Butadiene Rubber Market size is estimated at USD 14.39 billion in 2025, and is expected to reach USD 17.40 billion by 2030, at a CAGR of 3.86% during the forecast period (2025-2030).

Strong tire demand in emerging economies, sustained infrastructure investment, and mandatory sustainability regulations shape this moderate growth path. Investments in low-rolling-resistance tire technology, expanding adhesive usage in construction and packaging, and polymer-modified asphalt specifications all strengthen the consumption outlook. At the same time, crude-linked feedstock volatility, stricter carbon rules, and mounting competition from thermoplastic elastomers temper volume and pricing power. Asian manufacturing clusters reinforce global leadership by pairing large-scale capacity with proximity to automotive customers, whereas Western producers pursue divestitures and sustainable product pivots to protect margins.

Global Styrene Butadiene Rubber (SBR) Market Trends and Insights

Tire Replacement Demand Spike in Emerging Economies

Vehicle fleet expansion combined with improved road networks significantly raises tire wear rates, pushing Styrene Butadiene Rubber market demand for tire compounds. Replacement tires already contribute 60% of total tire consumption in India, and Bridgestone has responded by committing USD 85 million to expand local production capacity. Radial tire adoption multiplies SBR usage per unit, further escalating volumes. Replacement cycles remain less affected by economic slowdowns than OEM demand, providing downside protection during industry troughs. Emerging Asia and Latin America therefore deliver a reliable mid-term uplift to global sales.

Shift Toward Low-Rolling-Resistance Tires in EU & China

Regulations aimed at fleet fuel efficiency elevate demand for solution SBR grades that enable silica-filled tread compounds with lower hysteresis. EU consumer labeling has already shifted purchasing toward A-rated rolling-resistance products, with manufacturers recording 15-20% volume growth in these premium categories. China mirrors the trend in heavy-duty segments, translating to sizeable opportunities for suppliers capable of advanced functionalisation. The widening performance gap between emulsion and solution SBR reinforces price premiums for high-spec polymers while rewarding R&D-driven producers.

Crude-Linked Butadiene Price Volatility

Feedstock costs typically represent up to 70% of total SBR manufacturing expenses, leaving margins exposed when crude prices spike. Currency swings add a further layer of unpredictability for exporters. While natural rubber rallies in 2024 temporarily improved SBR's relative cost position, dual increases in crude derived butadiene quickly eroded that advantage. Long-term supplier contracts with fixed pricing clauses limit the industry's ability to pass on sudden feedstock hikes, forcing many firms to adopt hedging and inventory strategies that raise working capital requirements.

Other drivers and restraints analyzed in the detailed report include:

- Rapid Highway & Airport Construction Boosting Polymer-Modified Asphalt

- OEM Push for 10% Tread Weight Reduction via Functionalised S-SBR

- Growing TPE Substitutes in Footwear

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Solution SBR recorded the highest 4.34% CAGR through 2030, even though emulsion SBR controlled 71.13% of 2024 volumes. The Styrene Butadiene Rubber market size attributed to solution grades is projected to expand from USD 4.08 billion in 2025 to USD 5.06 billion in 2030, reflecting granular demand for high-performance tire treads. Functionalised solution polymers achieve tighter molecular weight distributions and superior filler compatibility, enabling tread weight reductions without compromising wet grip. ARLANXEO's recent capacity addition in Dormagen aligns with automaker requirements for low-rolling-resistance tires. As performance specifications tighten, solution SBR gains share, particularly in Europe, China, and premium replacement markets where consumer awareness is highest. Emulsion SBR remains indispensable in mass-market segments thanks to scale advantages, extensive installed reactor base, and wide compounding latitude. Yet its price-driven positioning leaves margins vulnerable to feedstock swings. Blended distribution strategies that pair low-cost emulsion platforms with premium solution offerings thus protect revenue streams across automotive cycles.

The Styrene Butadiene Rubber market share commanded by solution grades is likely to rise by 3 percentage points by 2030, supported by ongoing tire label regulation, electric vehicle proliferation, and OEM sustainability targets. Even in cost-sensitive emerging economies, policy-driven requirements for wet-grip and rolling-resistance performance accelerate migration to solution SBR. Producers investing in continuous processes, advanced catalyst systems, and in-line functionalisation can capture premium pricing while lowering variable costs via energy efficiency improvements and digitalised plant control.

The Styrene Butadiene Rubber Market Report is Segmented by Type (Emulsion SBR, Solution SBR), Application (Tyres, Adhesives, Footwear, Other Applications), and Geography (Asia-Pacific, North America, Europe, South America, Middle East and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific maintained 45.64% revenue share in 2024 and is projected to grow at 4.28% CAGR through 2030. China anchors regional dominance with extensive captive tire and synthetic rubber capacity, enabling fast scale-up for both emulsion and solution grades. Domestic demand receives a boost from rising car parc, infrastructure stimulus, and national recycling quotas that release capacity for export. India's market is propelled by a forecast doubling of tire industry revenue to USD 22 billion by 2032, spurring incremental capacities and backward integration investments. Thailand and Malaysia complement upstream supply via natural rubber output, affording compounders integrated sourcing advantages. However, carbon pricing, stricter air-emission norms, and water-pollution controls could trigger cost escalations or relocation of older SBR assets within the bloc.

North America delivers mature yet steady consumption underpinned by replacement tires, polymer-modified asphalt for highway rehabilitation, and adhesive uptake in e-commerce packaging. United States tire makers continue to emphasise performance niches such as light-truck and ultra-high-performance variants that lean heavily on functionalised solution SBR. Mexico's emergence as a near-shoring hub for motor vehicle assembly adds incremental demand for automotive rubber parts. Canadian mining and oil sands operations keep industrial SBR uses buoyant, particularly in conveyor belts and protective coatings. Overall, regional growth hovers close to the global average but skews toward higher value polymers.

Europe is constrained by a lower vehicle production trajectory but benefits from the EU's sustainability agenda that favours advanced and lower-carbon SBR. German, French, and Italian tire plants intensify adoption of eco-performance grades, amplifying imports of solution SBR from Korea and Singapore until European capacity expands. Eastern European highway and airport upgrades stimulate polymer-modified asphalt usage, partially offsetting automotive softness. The upcoming CBAM will likely curtail high-carbon imports and encourage local sourcing or renewable-energy upgrades in exporting countries. Scandinavian and Benelux markets lead on recycled SBR applications in flooring and sports surfaces, fostering niches that valorise circular solutions.

- ARLANXEO

- Asahi Kasei Corporation

- China Petrochemical Corporation (Sinopec)

- Dynasol Group

- ENEOS Corporation

- Eni S.p.A

- JSR Corporation

- Kemipex

- Kumho Petrochemical

- LANXESS

- LG Chem

- PETKIM

- SIBUR Holding PJSC

- Sumitomo Chemical Co. Ltd.

- Synthos

- The Goodyear Tire & Rubber Company

- Trinseo

- TSRC

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Tire replacement demand spike in emerging economies

- 4.2.2 Shift toward low-rolling-resistance tires in EU & China

- 4.2.3 Rapid highway & airport construction boosting polymer-modified asphalt

- 4.2.4 OEM push for 10% tread weight reduction via functionalised S-SBR

- 4.2.5 Mandatory wet-grip labelling in ASEAN spurring high-vinyl S-SBR uptake

- 4.3 Market Restraints

- 4.3.1 Crude-linked butadiene price volatility

- 4.3.2 Growing TPE substitutes in footwear

- 4.3.3 EU CBAM extending to synthetic rubber imports post-2027

- 4.3.4 Recycling quotas in China cutting virgin SBR demand for conveyor belts

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Competitive Rivalry

5 Market Size & Growth Forecasts (Value)

- 5.1 By Type

- 5.1.1 Emulsion SBR

- 5.1.2 Solution SBR

- 5.2 By Application

- 5.2.1 Tyres

- 5.2.2 Adhesives

- 5.2.3 Footwear

- 5.2.4 Other Applications

- 5.3 By Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 Japan

- 5.3.1.3 India

- 5.3.1.4 South Korea

- 5.3.1.5 Thailand

- 5.3.1.6 Malaysia

- 5.3.1.7 Vietnam

- 5.3.1.8 Indonesia

- 5.3.1.9 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 France

- 5.3.3.3 United Kingdom

- 5.3.3.4 Italy

- 5.3.3.5 Spain

- 5.3.3.6 Nordic

- 5.3.3.7 Turkey

- 5.3.3.8 Russia

- 5.3.3.9 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Colombia

- 5.3.4.4 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 United Arab Emirates

- 5.3.5.3 Qatar

- 5.3.5.4 Egypt

- 5.3.5.5 Nigeria

- 5.3.5.6 South Africa

- 5.3.5.7 Rest of Middle East and Africa

- 5.3.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)}

- 6.4.1 ARLANXEO

- 6.4.2 Asahi Kasei Corporation

- 6.4.3 China Petrochemical Corporation (Sinopec)

- 6.4.4 Dynasol Group

- 6.4.5 ENEOS Corporation

- 6.4.6 Eni S.p.A

- 6.4.7 JSR Corporation

- 6.4.8 Kemipex

- 6.4.9 Kumho Petrochemical

- 6.4.10 LANXESS

- 6.4.11 LG Chem

- 6.4.12 PETKIM

- 6.4.13 SIBUR Holding PJSC

- 6.4.14 Sumitomo Chemical Co. Ltd.

- 6.4.15 Synthos

- 6.4.16 The Goodyear Tire & Rubber Company

- 6.4.17 Trinseo

- 6.4.18 TSRC

7 Market Opportunities & Future Outlook

- 7.1 White-Space & Unmet-Need Assessment