PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851502

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851502

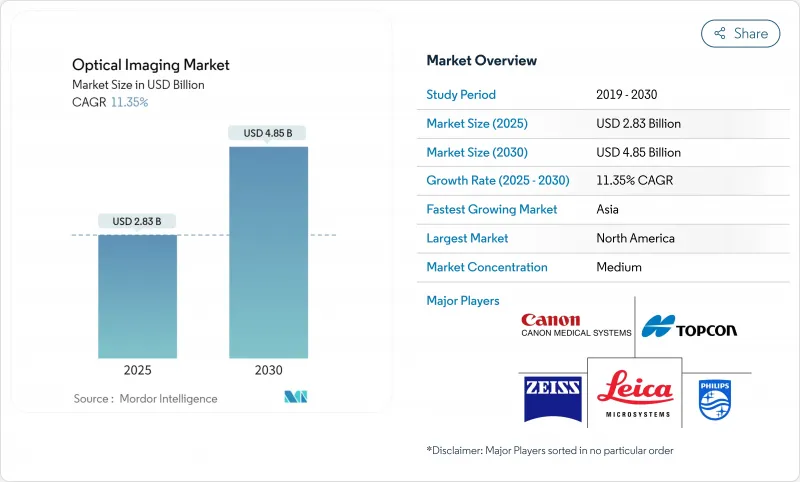

Optical Imaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The optical imaging market stands at USD 2.83 billion in 2025 and is on track to reach USD 4.85 billion by 2030, advancing at an 11.35% CAGR.

Growth is being propelled by steady breakthroughs in high-resolution imaging systems, the shift toward non-invasive diagnostics, and widening use in ophthalmology, cardiology, oncology, dermatology, and neurology. Integration with artificial intelligence is improving detection accuracy and workflow speed, while multi-modal platforms that merge optical coherence tomography (OCT) with photoacoustic or hyperspectral tools are expanding clinical value. Semiconductor shortages are nudging suppliers to redesign detectors and pursue vertical integration, yet the optical imaging market continues to benefit from resilient procurement budgets in hospitals, ambulatory surgery centers, and research labs. Asia-Pacific's rapid uptake of handheld OCT for diabetic eye screening and North America's favorable reimbursement for OCT-guided coronary interventions further reinforce the expansion path.

Global Optical Imaging Market Trends and Insights

Accelerated deployment of intra-operative optical imaging systems in ambulatory surgery centers

Ambulatory surgery centers (ASCs) performed more than 23 million procedures in the United States in 2024, a 15% year-on-year rise as payers reposition surgeries to outpatient settings. Compact intra-operative optical platforms, exemplified by UCLA Health's Dynamic Optical Contrast Imaging device, are gaining traction because they delineate tumor margins in real time and trim procedure time by 20%, boosting ASC throughput. Capital spending on these systems is justified by 35-50% cost savings relative to hospital surgeries and by growing insurer support for outpatient pathways. Reimbursement shifts are expected to drive ASC share of all surgeries to 68% by 2030, feeding demand for portable, network-ready optical rigs and widening the optical imaging market base.

Expanding reimbursement coverage for OCT-guided PCI in the United States & Japan

The OCCUPI trial reported a 4.9% composite event rate for OCT-guided PCI at one year compared with 9.5% for angiography alone, sparking policy changes that lift reimbursement by 12% in the United States and broaden coverage in Japan. Providers gain a 22% drop in repeat procedures, offsetting higher per-procedure costs and spurring adoption across high-risk coronary lesions. Utilization of OCT in coronary interventions is forecast to climb from 15% in 2024 to about 35% by 2028, embedding optical imaging deeper into interventional cardiology workflows.

Capital-intensive shift from benchtop to integrated operating-room imaging suites

Fully integrated optical suites bundling OCT, fluorescence, and navigation cost USD 1.5-2.5 million per theater, triple to quadruple benchtop setups, and require extensive infrastructure rewiring. Hospitals also carry 15-20% extra ownership costs over five years for service contracts and specialist training. Consequently, only 23% of eligible hospitals had completed full integration in 2024, with many deferring upgrades or phasing modules over multiple budget cycles. Emerging economies face sharper constraints, slowing penetration despite clear clinical benefits.

Other drivers and restraints analyzed in the detailed report include:

- Rapid adoption of handheld OCT for diabetic retinopathy screening in primary care settings

- Integration of AI-based spectral algorithms in dermatology diagnostic workflows

- Limited reimbursement for dental optical imaging procedures in Europe

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Imaging Systems held 37% of revenue in 2024 on the strength of turnkey consoles used across ophthalmology, cardiology, and research settings. The optical imaging market size for this segment is forecast to expand steadily as vendors augment consoles with AI software and multi-modal add-ons. Rising demand for real-time guidance in minimally invasive surgery maintains hospital investment, even as procurement teams grapple with semiconductor shortages that inflate detector costs. Meanwhile, high-speed Cameras are redefining performance thresholds. Phantom High-Speed's S710 camera achieves 4,000 fps in holographic retinal blood-flow imaging, enabling precise Doppler calculations that enhance vascular diagnostics. This technical leap aligns with a projected 12.5% CAGR through 2030, the fastest within the product spectrum.

Next-generation illumination engines using narrow-band LEDs and super-continuum lasers sustain interest in the Illumination Systems segment as surgeons seek tissue-specific contrast. Software solutions, once peripheral, now anchor differentiation because AI algorithms deliver automated segmentation, vessel quantification, and anomaly flagging. Lenses remain indispensable: advances in aspheric and gradient-index optics boost depth penetration and reduce chromatic aberration, elevating image clarity. To mitigate chip shortages, TDK's Spin Photo Detector leverages magnetic elements to detect light at ultra-high speeds, opening a path to sidestep conventional semiconductor bottlenecks and stabilize component supply chains.

Ophthalmology retained the largest slice at 34.8% in 2024 due to entrenched OCT use for retinal disease management. Adaptive optics technologies are now revealing photoreceptor mosaics and choriocapillaris flow, allowing pre-symptomatic detection of macular disorders. In parallel, Oncology is gaining momentum with a 15.1% CAGR because optical imaging guides margin assessment during tumor resection and tracks vascular response during therapy. Photoacoustic contrast agents targeting hypoxic zones are enabling centimeter-deep visualization of tumor microenvironments in real time. Consequently, the optical imaging market share for oncology applications is set to rise as tertiary hospitals standardize intraoperative optical guidance.

Cardiology follows closely: OCT-guided percutaneous coronary intervention is proving superior to angiography alone in complex lesion management. The optical imaging market size for cardiology is projected to accelerate as more payers authorize coverage. Dermatology benefits from AI-enabled spectral scanners that cut biopsies and improve triage of suspicious lesions. Neurology and Dentistry niches are smaller yet innovative: intraoperative brain OCT tracks tissue mechanics, while dental OCT aids early caries detection without ionizing radiation. Pharmaceutical research groups employ label-free sectioning to visualize drug-cell interactions, shortening oncology drug discovery cycles.

The Optical Imaging Market Report is Segmented by Product (Imaging Systems, Cameras, Illumination Systems, Lenses, and Software), Application (Ophthalmology, Dentistry, Dermatology, Cardiology, Neurology, and Oncology), Technique (OCT, NIRS, Hyperspectral Imaging, and Photoacoustic Tomography), End-User (Hospitals, Diagnostic Centers, and Research Labs), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America held 40% share in 2024, anchored by strong reimbursement and an innovation ecosystem linking universities, startups, and large device makers. The FDA's green light for AI-assisted skin-cancer optical readers in 2024 accelerated cross-specialty adoption, while Duke University's handheld OCT prototypes advance point-of-care eye exams. The optical imaging market size in the region will keep growing as insurers widen coverage for AI-integrated diagnostics and as capital budgets target hybrid OR upgrades.

Asia-Pacific is the fastest-growing cluster, projected at a 12.4% CAGR. Governments in China, India, and Japan are funding domestic manufacturing, lowering import reliance, and subsidizing upgrades for rural clinics. Widespread use of handheld OCT in diabetic retinopathy screening is closing access gaps. Nevertheless, the lack of hyperspectral imaging specialists slows clinical trials, particularly in India and Southeast Asia. Cross-border training partnerships aim to build a talent pipeline that sustains longer-term adoption. Despite these hurdles, the optical imaging market in Asia-Pacific benefits from rising healthcare investment and high diabetes prevalence that drives retinal screening demand.

Europe maintains a sizeable base supported by robust research grants and academic hospital networks. German, French, and UK centers lead clinical validation in dermatology and neurology, yet dental applications suffer under fragmented reimbursement. Only 8% of dental practices use optical imaging because private pay models limit patient uptake. Eastern European health systems, meanwhile, seek lower-cost platforms to address unmet oncology imaging needs. The Middle East and Africa, while smaller, record steady uptake in specialist hospitals across the UAE and Saudi Arabia, buoyed by government-backed infrastructure spending and military interest in trauma imaging.

- Carl Zeiss AG

- Leica Microsystems (Danaher)

- Topcon Corporation

- Canon Medical Systems (Canon Inc.)

- Koninklijke Philips NV

- PerkinElmer Inc.

- Nikon Metrology NV (Nikon Corp.)

- Olympus Corporation

- Teledyne Princeton Instruments

- Prior Scientific

- Thorlabs Inc.

- Abbott Laboratories

- Headwall Photonics Inc.

- Optovue Inc.

- Cytoviva Inc.

- Michelson Diagnostics Ltd.

- Damae Medical

- Wasatch Photonics Inc.

- Santec Corporation

- BaySpec Inc.

- Optovue Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Accelerated deployment of intra-operative optical imaging systems in ambulatory surgery centres (North America and EU)

- 4.2.2 Expanding reimbursement coverage for OCT-guided PCI in the United States and Japan

- 4.2.3 Rapid adoption of handheld OCT for diabetic retinopathy screening in primary-care settings (Asia)

- 4.2.4 Integration of AI-based spectral algorithms in dermatology diagnostic workflows (EU major clinics)

- 4.2.5 Surge in pharma demand for label-free optical sectioning to accelerate oncology drug discovery

- 4.2.6 Military funding for photoacoustic tomography in trauma triage (Middle-East and Israel)

- 4.3 Market Restraints

- 4.3.1 Capital-intensive shift from benchtop to integrated operating-room imaging suites

- 4.3.2 Limited reimbursement for dental optical imaging procedures in Europe

- 4.3.3 Scarcity of hyperspectral imaging experts slows clinical validation in emerging Asia

- 4.3.4 Phototoxicity concerns restricting repeat imaging in paediatric neurology

- 4.4 Regulatory Outlook

- 4.5 Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

5 Market Size and Growth Forecasts (Value)

- 5.1 By Product

- 5.1.1 Imaging Systems

- 5.1.1.1 Optical Imaging Systems

- 5.1.1.2 Spectral Imaging Systems

- 5.1.2 Cameras

- 5.1.3 Illumination Systems

- 5.1.4 Lenses

- 5.1.5 Software

- 5.1.1 Imaging Systems

- 5.2 By Application

- 5.2.1 Ophthalmology

- 5.2.2 Dentistry

- 5.2.3 Dermatology

- 5.2.4 Cardiology

- 5.2.5 Neurology

- 5.2.6 Oncology

- 5.2.7 Biotechnology and Research

- 5.2.8 Other Applications

- 5.3 By Technique

- 5.3.1 Optical Coherence Tomography

- 5.3.2 Near-Infrared Spectroscopy

- 5.3.3 Hyperspectral Imaging

- 5.3.4 Photoacoustic Tomography

- 5.4 By End-User

- 5.4.1 Hospitals and Clinics

- 5.4.2 Diagnostic Imaging Centres

- 5.4.3 Research and Diagnostic Laboratories

- 5.4.4 Other End-Users

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Chile

- 5.5.2.4 Peru

- 5.5.2.5 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 Japan

- 5.5.4.3 South Korea

- 5.5.4.4 India

- 5.5.4.5 Australia

- 5.5.4.6 New Zealand

- 5.5.4.7 Rest of Asia-Pacific

- 5.5.5 Middle East

- 5.5.5.1 United Arab Emirates

- 5.5.5.2 Saudi Arabia

- 5.5.5.3 Turkey

- 5.5.5.4 Rest of Middle East

- 5.5.6 Africa

- 5.5.6.1 South Africa

- 5.5.6.2 Rest of Africa

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Strategic Developments

- 6.2 Vendor Positioning Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Products and Services, and Recent Developments)

- 6.3.1 Carl Zeiss AG

- 6.3.2 Leica Microsystems (Danaher)

- 6.3.3 Topcon Corporation

- 6.3.4 Canon Medical Systems (Canon Inc.)

- 6.3.5 Koninklijke Philips NV

- 6.3.6 PerkinElmer Inc.

- 6.3.7 Nikon Metrology NV (Nikon Corp.)

- 6.3.8 Olympus Corporation

- 6.3.9 Teledyne Princeton Instruments

- 6.3.10 Prior Scientific

- 6.3.11 Thorlabs Inc.

- 6.3.12 Abbott Laboratories

- 6.3.13 Headwall Photonics Inc.

- 6.3.14 Optovue Inc.

- 6.3.15 Cytoviva Inc.

- 6.3.16 Michelson Diagnostics Ltd.

- 6.3.17 Damae Medical

- 6.3.18 Wasatch Photonics Inc.

- 6.3.19 Santec Corporation

- 6.3.20 BaySpec Inc.

- 6.3.21 Optovue Inc.

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment