PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851503

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851503

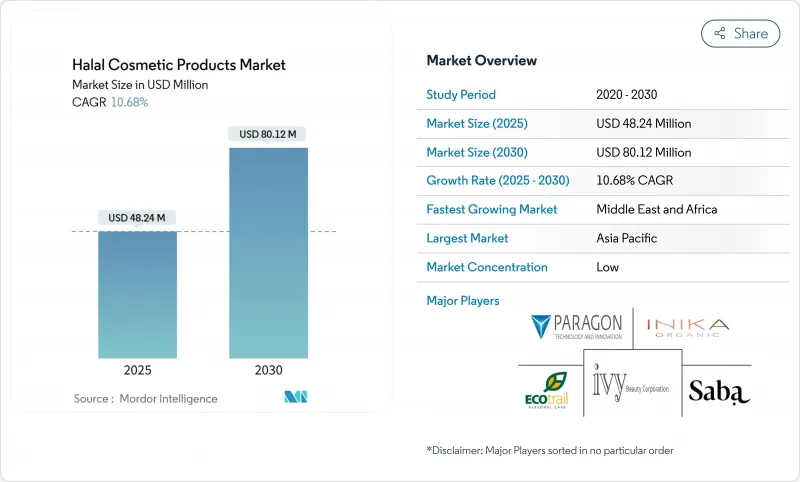

Halal Cosmetic Products - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The global halal cosmetics market is valued at USD 48.24 million in 2025 and is projected to reach USD 80.12 million by 2030, registering a CAGR of 10.68% during the forecast period.

This growth trajectory reflects the intersection of regulatory mandates, demographic shifts, and evolving consumer preferences toward ethical beauty products that comply with Islamic principles. The rise of social media influencers and digital marketing strategies has significantly impacted consumer purchasing behavior, particularly among younger demographics. This digital shift influences market competition, as demonstrated by Wardah's expansion from Southeast Asia through e-commerce platforms. Indonesia's implementation of Government Regulation No. 42 of 2024 has introduced additional requirements for halal supervision and certification documentation. The regulatory landscape continues to evolve across different regions, with standardization efforts aimed at ensuring product authenticity and compliance with Islamic principles.

Global Halal Cosmetic Products Market Trends and Insights

Stringent regulatory framework gains consumer's trust

The implementation of stricter halal certification standards is compelling cosmetics manufacturers to fundamentally rethink their formulation strategies. Indonesia's Law No. 33 mandates halal certification for all cosmetics by October 17, 2026, creating urgency for the 81% of registered cosmetics in the country that currently lack certification. This regulatory pressure extends beyond ingredient selection to production processes, where preventing cross-contamination has become a critical compliance challenge. Manufacturers must establish dedicated production lines and implement rigorous cleaning protocols between batches to maintain halal integrity. The certification process requires thorough facility audits and detailed documentation of ingredient sourcing and processing methods by certification bodies like LPPOM MUI in Indonesia and JAKIM in Malaysia. These requirements necessitate significant investments in facility upgrades, staff training, and quality control systems. Additionally, manufacturers must develop comprehensive documentation systems to track and verify the halal status of all ingredients throughout the supply chain.

Influence of social media platforms

In 2024, Saudi Arabia boasts a remarkable 99% internet penetration rate, as highlighted by the Communications, Space and Technology Commission. This digital landscape sees millennials and young adults actively engaging on social media, leading to heightened exposure to halal cosmetics. Beauty influencers on these platforms are not just promoting products; they're skillfully navigating the delicate balance between religious compliance and modern aesthetics. These influencers showcase application techniques that respect modesty principles while aligning with contemporary beauty standards, effectively bridging the gap between religious observance and self-expression. Furthermore, digital platforms empower consumers with knowledge about ingredient sourcing, certification processes, and brand values, often sidestepping traditional retailers who might not possess in-depth halal expertise. A surge in Google searches for "halal makeup" underscores a rising consumer awareness that transcends traditional Muslim-majority markets, hinting at a broader mainstream beauty audience that increasingly prioritizes ethical sourcing and ingredient transparency. Additionally, the integration of social commerce enables halal cosmetics brands to cultivate trust networks driven by community recommendations, a crucial strategy in an industry where authenticity is paramount.

Consumer inclination towards conventional product made with clean-label ingredients

Mainstream beauty consumers increasingly gravitate toward familiar clean-label products rather than halal-certified alternatives, creating market segmentation challenges that limit halal cosmetics' addressable market expansion beyond Muslim demographics. Clean beauty positioning often overlaps with halal principles regarding ingredient purity and ethical sourcing, yet lacks the certification rigor and religious compliance framework that defines halal cosmetics. This consumer preference reflects marketing sophistication gaps where established beauty brands successfully communicate clean ingredient benefits while halal cosmetics struggle with mainstream positioning beyond religious compliance. The fragmentation creates competitive disadvantages for halal cosmetics in premium segments where clean beauty brands command higher price points through sophisticated brand storytelling and influencer partnerships. Market education requirements increase customer acquisition costs for halal cosmetics brands seeking to expand beyond core Muslim consumer segments into broader ethical beauty markets.

Other drivers and restraints analyzed in the detailed report include:

- Growing concerns over the effects of synthetic products

- Growth in e-commerce and digital marketing

- Proliferation of counterfeit products

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

In 2024, skin care dominated the halal cosmetics market, accounting for 43.67% of its revenue. This highlights a daily reliance on moisturizers, serums, and cleansers, all steering clear of animal collagen and pork-derived emulsifiers. As Indonesia sets a certification deadline, even mainstream brands are being urged to reformulate, signaling a steady expansion for skin-focused halal items. Consumers increasingly link the absence of alcohol and harsh preservatives to safer, long-term use, leading to more frequent repeat purchases. While fragrance starts from a smaller base, it surges ahead of all other categories, boasting a 12.17% CAGR through 2030. This growth is fueled by the Middle East's appetite for oud-rich profiles, which navigate strict alcohol limits. The trend is further amplified by sensorial storytelling and travel-retail gifting bundles, boosting cross-border sales. Today's innovations spotlight water-based perfumes and encapsulated essential oils, ensuring scent longevity without ethanol. There's also a budding interest in probiotic skin fragrances, aiming to blend skin microbiome care with cultural scent preferences, enriching brand offerings.

Developing colour cosmetics and hair care poses a challenge, as their performance often hinges on polymer science, traditionally reliant on prohibited ingredients. However, with increasing investments in halal-certified pigments and plant-derived keratin, the performance gap is narrowing. Yet, the market still grapples with education. Brands adept at achieving colour payoff without carmine or standard silicones are seizing a first-mover edge in social media tutorials. Still, a complete shift across all SKUs may only materialize once more suppliers secure halal-compliant accreditation. To expedite this process, start-ups are forging partnerships with contract manufacturers already holding both Good Manufacturing Practice and halal certifications, significantly reducing their time-to-market.

The Halal Cosmetic Products Market Report is Segmented by Product Type (Skin Care, Hair Care, Color Cosmetics, Fragrances, and Others), Category (Mass and Premium), Distribution Channel (Supermarkets/Hypermarkets, Specialty Stores, Online Retail Stores, and Other Distribution Channels), and Geography (North America, Europe, Asia-Pacific, South America, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific holds 62.61% share of the halal cosmetics market in 2024, with Indonesia, the world's largest Muslim-majority nation, as the primary market. Indonesia's Government Regulation No. 42 of 2024, requiring halal certification for all cosmetics by October 2026, strengthens the region's market position. This regulation benefits local halal-certified brands and requires multinational companies to modify their production processes, as demonstrated by L'Oreal's investment in a halal-certified facility in Indonesia.

The Middle East and Africa region is expected to achieve a 13.61% CAGR from 2025-2030, despite its current smaller market share. This growth stems from its young population, digital connectivity, urbanization, and increasing disposable incomes. The market expansion aligns with a growing preference for Arabic beauty standards, creating demand for products that reflect local traditions.

Europe and North America represent developing markets for halal cosmetics, supported by Muslim diaspora populations and clean beauty trends among non-Muslim consumers. European regulations on ingredients complement halal requirements, enabling dual-certified products. In North America, regulatory frameworks like New Jersey's Halal Enforcement Unit, as reported by the New Jersey Division of Consumer Affairs in 2023, ensure product compliance, while organizations such as ISWA Halal Certification Department provide certification guidelines. South America shows growth potential, particularly in Brazil, where established cosmetics manufacturers can develop halal-certified products for domestic and international markets.

- PT Paragon Technology And Innovation

- INIKA Organic

- IVY Beauty Corporation

- Ecotrail Personal Care Private Limited

- Saba Personal Care SG

- Sampure Minerals

- Amara Halal Cosmetics

- INGLOT Cosmetics

- Flora & Noor

- Claudia Nour Cosmetics

- Klarity Skincare

- Talent Cosmetics

- Martha Tilaar Group

- Nurraysa Global Sdn Bhd

- Cosmoderm

- Tuesday in Love

- El-Hajj Skincare

- Momohime Halal Skincare

- Amsons Limited

- Alhalal Cosmetics

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing demand from Southeast Asian countries

- 4.2.2 Stringent regulatory framework gains consumer's trust

- 4.2.3 Influnce of Social Media Platforms

- 4.2.4 Growing concerns over the effects of synthetic products

- 4.2.5 Increased awareness about ethical and clean beauty

- 4.2.6 Growth in e-commerce and digital marketing

- 4.3 Market Restraints

- 4.3.1 Consumer inclination towards conventional product made with clean-lable ingredients

- 4.3.2 Proliferation of counterfeit products

- 4.3.3 High cost of halal certification and compliance

- 4.3.4 Complex supply chain issues

- 4.4 Consumer Behaviour Analysis

- 4.5 Regulatory Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitutes

- 4.6.5 Degree of Competition

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Product Type

- 5.1.1 Hair Care

- 5.1.2 Color Cosmetics

- 5.1.3 Fragrances

- 5.1.4 Skin Care

- 5.1.5 Others

- 5.2 By Category

- 5.2.1 Mass

- 5.2.2 Premium

- 5.3 By Distribution Channel

- 5.3.1 Supermarkets/Hypermarket

- 5.3.2 Specialty Stores

- 5.3.3 Online Retail Stores

- 5.3.4 Others Distribution Channel

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Rest of North America

- 5.4.2 South America

- 5.4.2.1 Brazil

- 5.4.2.2 Argentina

- 5.4.2.3 Rest of South America

- 5.4.3 Europe

- 5.4.3.1 United Kingdom

- 5.4.3.2 Germany

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Spain

- 5.4.3.6 Rest of Europe

- 5.4.4 Asia-Pacific

- 5.4.4.1 China

- 5.4.4.2 Japan

- 5.4.4.3 India

- 5.4.4.4 South Korea

- 5.4.4.5 Indonesia

- 5.4.4.6 Australia

- 5.4.4.7 Rest of Asia-Pacific

- 5.4.5 Middle East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle East and Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Ranking Analysis

- 6.4 Company Profiles (Includes Global-level Overview, Market-level Overview, Core Segments, Financials, Strategic Info, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 PT Paragon Technology And Innovation

- 6.4.2 INIKA Organic

- 6.4.3 IVY Beauty Corporation

- 6.4.4 Ecotrail Personal Care Private Limited

- 6.4.5 Saba Personal Care SG

- 6.4.6 Sampure Minerals

- 6.4.7 Amara Halal Cosmetics

- 6.4.8 INGLOT Cosmetics

- 6.4.9 Flora & Noor

- 6.4.10 Claudia Nour Cosmetics

- 6.4.11 Klarity Skincare

- 6.4.12 Talent Cosmetics

- 6.4.13 Martha Tilaar Group

- 6.4.14 Nurraysa Global Sdn Bhd

- 6.4.15 Cosmoderm

- 6.4.16 Tuesday in Love

- 6.4.17 El-Hajj Skincare

- 6.4.18 Momohime Halal Skincare

- 6.4.19 Amsons Limited

- 6.4.20 Alhalal Cosmetics

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK