PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851504

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851504

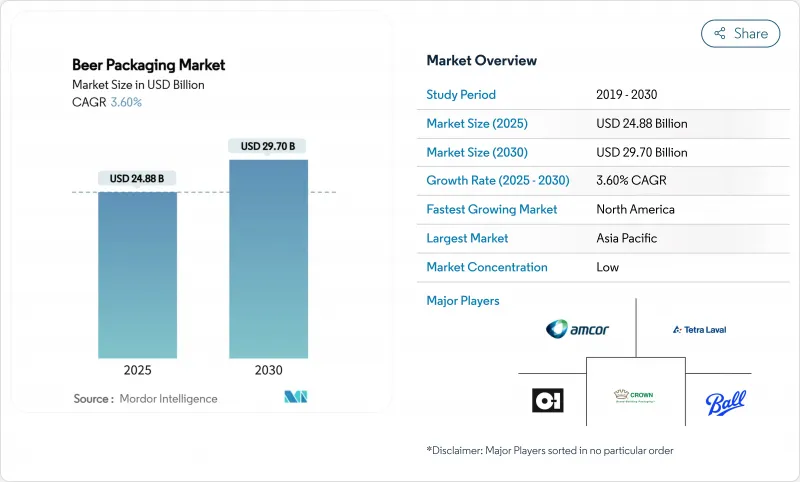

Beer Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Beer packaging market size stands at USD 24.88 billion in 2025 and is expected to reach USD 29.70 billion in 2030, advancing at a 3.60% CAGR over the forecast period.

This growth reflects rising demand for sustainable materials, the acceleration of premium formats, and ongoing shifts in consumption channels. Aluminum's share continues to expand as recyclability and logistics efficiency attract large and small brewers alike, while PET gains traction where cold-chain quality assurance is improving. Glass holds a clear lead in volume but now contends with cost pressures from energy-intensive production and heavier freight loads. Regional opportunities cluster in Asia-Pacific, where urbanization lifts packaged beer sales, and in North America, where craft breweries seek differentiated, eco-friendly formats that match retail shelf dynamics. Supply-side investments by leading can makers, glass producers, and flexible-pack specialists underline an industry pivot toward high-speed, low-waste technologies that cut material inputs and boost brand agility.

Global Beer Packaging Market Trends and Insights

Surge in Craft Breweries Driving Short-Run Can Designs in North America

Craft brewery growth reshapes packaging economics as digital printing such as Ball's Dynamark Advanced Pro lets multiple graphics run on one pallet, eliminating historic minimum-order barriers. Flexible can lines help brewers manage inventory, pilot new SKUs, and execute seasonal launches without excess glass bottle purchases. Though digital print premiums approach 300% over offset, the cost is offset by faster sell-through rates and stronger shelf appeal at more than 9,000 breweries across the region.

Rising Adoption of Lightweight Returnable Glass Bottles Backed by EU Deposit-Return Schemes

Mandated deposit systems achieve 98% return rates in Germany, prompting innovations like Vetropack's Echovai tempered bottle that is 30% lighter yet rugged across multiple cycles. France's rollout adds centralized washing hubs capable of 60 million bottles per year, shifting cost structures from one-way disposal toward circular asset management.

Legislative Bans on Single-Use Plastics Curtailing PET in Europe

The EU Packaging and Packaging Waste Regulation enforces 30% recycled content by 2030 and phases out targeted formats from 2025. Extended Producer Responsibility fees raise PET costs relative to infinitely recyclable aluminum, prompting portfolio shifts toward metal and lightweight returnable glass.

Other drivers and restraints analyzed in the detailed report include:

- Rapid Cold-Chain Expansion Enabling PET Penetration in Asian Beer

- Brand Premiumization Fueling Embossed Specialty Bottles Among German Breweries

- Tight U.S. Aluminum Slab Supply Elevating Can Costs for Craft Brewers

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Glass preserved an 80.98% share in 2024 due to sensory neutrality and entrenched consumer associations. Yet aluminum's recyclability edge and transportation savings peel away volume, aided by policy targets for 100% recyclable packaging by 2030. PET, advancing at 5.81% CAGR, draws on barrier-coated bottles that now satisfy beer's carbonation needs, while paper remains confined to secondary packs.

Rising energy costs and carbon levies widen aluminum's total-cost edge over furnace-fired glass. Meanwhile, innovations like bio-paraxylene PET from used cooking oil improve brand credentials and foreshadow broader polymer adoption. Brewers keep niche glass SKUs for premium variants, but the Beer packaging market increasingly redirects new capacity toward lighter substrates.

Bottles supplied 75.32% of global volume in 2024. Still, cans are accelerating at a 6.75% CAGR as dynamism in craft beer, convenience shopping, and outdoor consumption tips formats in favor of metal. Keg growth remains muted by cleaning-system cap-ex in emerging regions, and pouches stay marginal.

Digital printing lets small brewers match multinational packaging quality, increasing SKU churn without wasteful overruns. Investment in regional can lines, as seen in Brazil, further scales economies that shrink per-unit costs and enhance availability. Glass manufacturers counter with embossing and tapered profiles that lift perceived value on-premise.

The Beer Packaging Market Report is Segmented by Packaging Material (Glass, Metal, PET, Paper), Packaging Type (Bottle, Can, Keg, Pouches), Pack Size (Less Than Equal To 330 Ml, 331-650 Ml, More Than 650 Ml), Distribution Channel (Direct Sales, Indirect Sales), and Geography (North America, Europe, Asia-Pacific, Middle East and Africa, South America). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific led with 38.43% share in 2024, underpinned by population scale, climbing incomes, and rapid urbanization that favor packaged formats. Cold-chain expansion in Vietnam and Indonesia supports PET penetration, while China's craft segment grew to CNY 33.1 billion in 2024, fostering boutique can designs and gift-oriented glass bottles alike.

North America posts the fastest 6.43% CAGR through 2030. More than 9,000 craft breweries generate steady demand for short-run cans, though tariff and slab shortages inflate costs. Investments such as Ball's Florida acquisition streamline supply networks and add sustainable capacity, reinforcing aluminum's role as the region's growth engine.

Europe remains a premium stronghold but confronts flat per-capita beer intake. The EU's recyclability mandate triggers capital shifts into tempered, returnable glass and high-recycled-content cans. German breweries showcase premium packaging by installing embossed lines that hit industrial speeds while meeting circular-economy KPIs.

- Amcor Ltd.

- Ardagh Group SA

- Crown Holdings Inc.

- Ball Corporation

- Tetra Laval International SA

- O-I Glass Inc.

- Canpack Group

- Silgan Holdings Inc.

- Vidrala SA

- Allied Glass Containers Ltd.

- Plastipak Holdings Inc.

- Nampak Ltd.

- Orora Limited

- Graphic Packaging International

- Toyo Seikan Group Holdings Ltd.

- Envases Universales

- Berlin Packaging LLC

- Sidel (Sidel Group)

- Krones AG

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Surge in Craft Breweries Driving Short-Run Can Designs in North America

- 4.2.2 Rising Adoption of Lightweight Returnable Glass Bottles Backed by EU Deposit-Return Schemes

- 4.2.3 Rapid Cold-Chain Expansion Enabling PET Penetration in Asian Beer

- 4.2.4 Brand Premiumization Fueling Embossed Specialty Bottles Among German Breweries

- 4.2.5 Aluminum Tariff Cuts Triggering Can Conversions in South America

- 4.2.6 E-commerce Multipacks Accelerating Corrugated Secondary Packaging Demand in the UK

- 4.3 Market Restraints

- 4.3.1 Legislative Bans on Single-Use Plastics Curtailing PET in Europe

- 4.3.2 Tight U.S. Aluminum Slab Supply Elevating Can Costs for Craft Brewers

- 4.3.3 Consumer Shift to Hard Seltzers Reducing Glass Volumes in Australia

- 4.3.4 High Cap-Ex for Keg Refurbishment Limiting Returnability in Emerging Markets

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Packaging Material

- 5.1.1 Glass

- 5.1.2 Metal

- 5.1.3 PET

- 5.1.4 Paper

- 5.2 By Packaging Type

- 5.2.1 Bottle

- 5.2.2 Can

- 5.2.3 Keg

- 5.2.4 Pouches

- 5.3 By Pack Size

- 5.3.1 Less than 330 ml

- 5.3.2 331-650 ml

- 5.3.3 More than 650 ml

- 5.4 By Distribution Channel

- 5.4.1 Direct Sales

- 5.4.2 Indirect Sales

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Russia

- 5.5.2.7 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 India

- 5.5.3.3 Japan

- 5.5.3.4 South Korea

- 5.5.3.5 Australia and New Zealand

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 Middle East and Africa

- 5.5.4.1 Middle East

- 5.5.4.1.1 United Arab Emirates

- 5.5.4.1.2 Saudi Arabia

- 5.5.4.1.3 Turkey

- 5.5.4.1.4 Rest of Middle East

- 5.5.4.2 Africa

- 5.5.4.2.1 South Africa

- 5.5.4.2.2 Nigeria

- 5.5.4.2.3 Egypt

- 5.5.4.2.4 Rest of Africa

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Argentina

- 5.5.5.3 Rest of South America

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Amcor Ltd.

- 6.4.2 Ardagh Group SA

- 6.4.3 Crown Holdings Inc.

- 6.4.4 Ball Corporation

- 6.4.5 Tetra Laval International SA

- 6.4.6 O-I Glass Inc.

- 6.4.7 Canpack Group

- 6.4.8 Silgan Holdings Inc.

- 6.4.9 Vidrala SA

- 6.4.10 Allied Glass Containers Ltd.

- 6.4.11 Plastipak Holdings Inc.

- 6.4.12 Nampak Ltd.

- 6.4.13 Orora Limited

- 6.4.14 Graphic Packaging International

- 6.4.15 Toyo Seikan Group Holdings Ltd.

- 6.4.16 Envases Universales

- 6.4.17 Berlin Packaging LLC

- 6.4.18 Sidel (Sidel Group)

- 6.4.19 Krones AG

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment